Surging Sales and Rising Confidence - REINZ stats September 2023

Thursday, 12 October 2023

Sales counts up as we count down to the election.

In September 2023, New Zealand's property market witnessed a surge in sales, with a 5.1% year-on-year increase in sales counts and a 2.3% month-on-month rise in the median sale price. Multiple regions, including Marlborough and Auckland, saw significant growth. Inventory decreased year-on-year but increased month-on-month, and properties are now selling faster, as indicated by a reduction in median days to sell. The market also saw an uptick in auctions. The upcoming general election and an impending OCR announcement in November are expected to shape the market's future, but confidence and activity continue to grow post-winter, signaling a stronger market. The House Price Index increased slightly month-on-month but showed a 3.3% decline compared to the previous year.

Regional highlights

- Marlborough had the highest increase in the number of sales, up by 66.7% annually,

- Median sale prices have increased in all but three regions month on month with the West Coast (+16.4%), Marlborough (+13.8%) and Otago (+9.3%) leading the way.

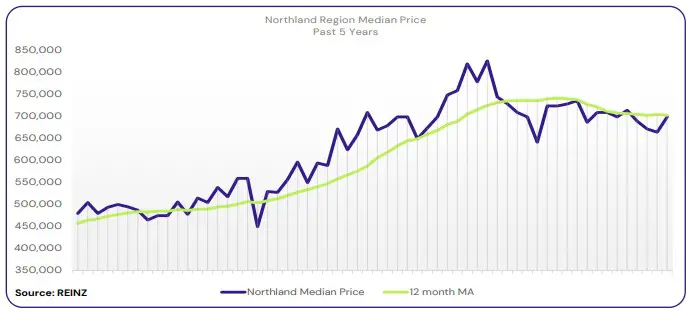

Regional Analysis - Northland

In Northland, median prices decreased by 3.4% year-on-year to $700,000.

“Owner-occupiers were the most active buyers across the region in September. Whangarei also saw activity from first home buyers. Most vendors are more attuned to current market prices; however, some are still hoping to achieve their initial asking price. Auction rooms in Whangarei continue to see an increase in sales and deals.

Open-home attendance has varied across the region. Whangarei saw increased attendance towards the back end of September, while Kerikeri saw a dip towards the end of the month. Whangarei saw continued activity in auction rooms.

Factors such as anticipation of the election and interest rates have influenced the market across the region, with market confidence growing. Local agents say that market activity will likely rise following the election.” (REINZ)

The current median Days to Sell of 80 days is much more than the 10-year average for September which is 52 days. There were 42 weeks of inventory in September 2023 which is 7 weeks more than the same time last year.

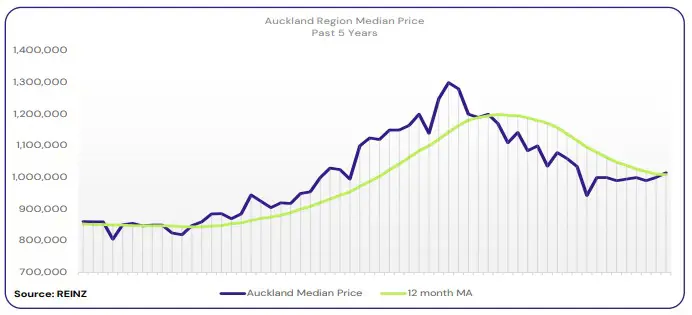

Regional Analysis - Auckland

Auckland’s median prices decreased by 2.0% year-on-year to $1,015,000.

“First-home buyers continued to be the most active group across Auckland. There was also some activity among homeowners and investors. Buyers in North Auckland seem to have adopted a wait-and-see attitude.

Most vendors are setting realistic expectations; however, some are still holding on to their initial prices. Open homes and auctions are seeing an increase in activity across the board, with some areas seeing more attendance at open homes than others.

Sales counts are rising slightly but have not reached expected levels for this time of year. Local agents report that the market is becoming steady, and some believe it is showing signs of picking up. Anticipation of the election and interest rates have influenced buyer and seller decisions.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for September which is 37 days. There were 23 weeks of inventory in September 2023 which is 12 weeks less than the same time last year.

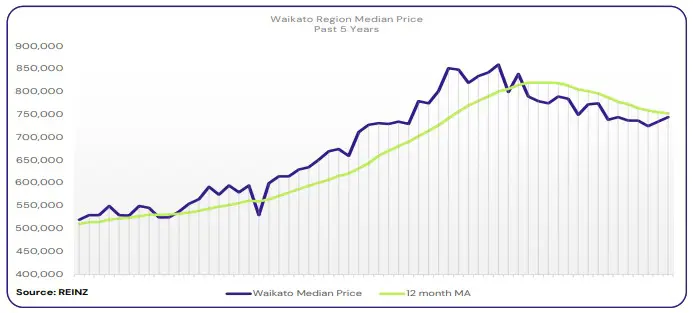

Regional Analysis - Waikato

In the Waikato, median prices decreased by 3.9% year-on-year to $745,000.

“Owner occupiers were the most active buyer group once again across Thames Coromandel and Hamilton. Hamilton and Taupo also saw some activity from first-home buyers and investors.

More vendors are showing realistic price expectations. However, some vendors in Thames-Coromandel are still holding on to their initial expectations.

Open-home activity in Coromandel is staying low, most likely due to the ongoing challenges with road access following Cyclone Gabrielle. Open homes and auction rooms saw an increase in activity in both Hamilton and Taupo, and Hamilton enjoyed a reasonable increase in sales counts this month.

Election anticipation, ongoing road infrastructure issues and economic conditions have influenced the market. Despite this, local agents across the region are expecting an increase in market activity in the time leading up to Christmas. Thames-Coromandel agents are also hopeful of market confidence returning with State Highway 25A (SH25A) being repaired.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for September which is 38 days. There were 23 weeks of inventory in September 2023 which is 9 weeks less than the same time last year.

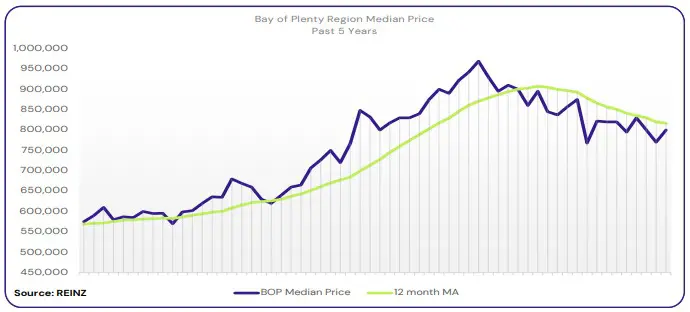

Regional Analysis - Bay of Plenty

Bay of Plenty’s median prices decreased by 5.3% year-on-year to $800,000.

“First-home buyers and owner-occupiers were the most active group across the region. There was more activity in the high-end sector in Tauranga this month.

Most vendors are adjusting their price expectations to meet the market, but some Tauranga vendors are still holding on for more favourable conditions.

Attendance in open homes and auctions was mixed in Rotorua but picked up in Tauranga this month.

Local agents report that there is more energy in the market. Anticipation of the election and economic conditions have impacted the market; however, agents believe they might see more activity soon.” (REINZ)

The current median Days to Sell of 56 days is much more than the 10-year average for September which is 44 days. There were 22 weeks of inventory in September 2023 which is 3 weeks less than the same time last year.

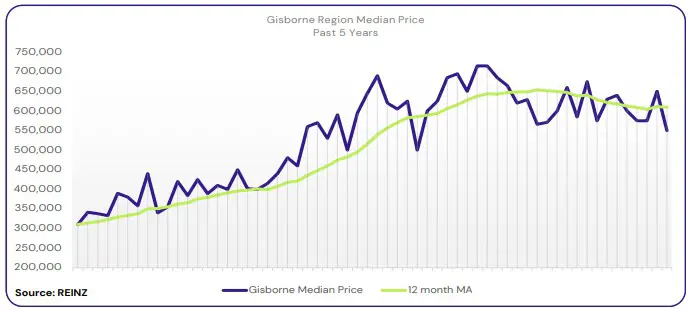

Regional Analysis - Gisborne

Median prices in Gisborne decreased by 3.7% year-on-year to $550,000.

“First-home buyers were the most active group in the region once again. Some vendors are aware of market conditions and are adjusting their expectations, while others are still waiting for more favourable conditions. Open homes and auction rooms saw some strong activity this month.

Anticipation of the election and low listings impacted the market for both buyers and sellers. Local agents report that uncertainty regarding weather conditions and property safety is also playing a role in market sentiment.” (REINZ)

The current median Days to Sell of 32 days is less than the 10-year average for September which is 34 days. There are 8 weeks of inventory in September 2023 which is 4 weeks less than last year.

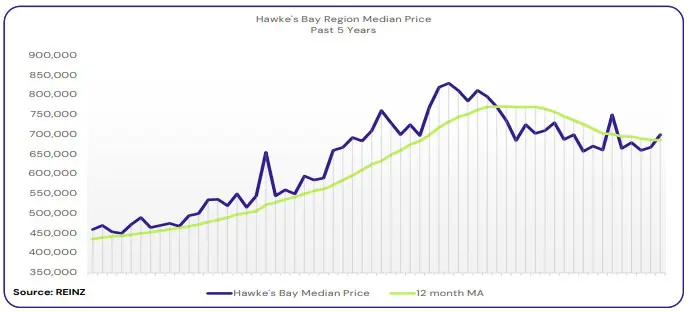

Regional Analysis - Hawke's Bay

In Hawke’s Bay, median prices decreased by 1.4% year-on-year to $700,000.

“First-home buyers continued to be the most active buyer pool in the region. Like the previous month, price expectations for most vendors were realistic, with some remaining firm to their initial expectations. Activity at open homes and auction rooms continued to rise this month.

Factors such as interest rates and anticipation of the election have affected the market. Local agents report a continued decrease in listing numbers. They are also expecting a slight upswing in market activity following the election but are unsure how long it will last.” (REINZ)

The current median Days to Sell of 42 days is more than the 10-year average for September which is 38 days. There were 16 weeks of inventory in September 2023 which is 2 weeks less than the same time last year.

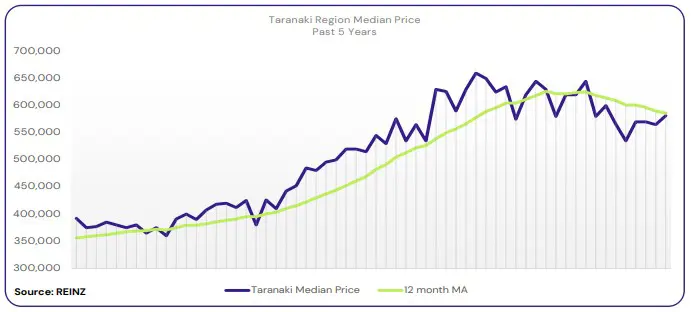

Regional Analysis - Taranaki

Taranaki’s median prices decreased by 7.7% year-on-year to $581,500.

“Owner-occupiers remain the most active buyers in Taranaki. Local agents also reported an increase in enquiries from investors. Most vendors continue to set realistic price expectations and are ready to meet the market.

Open-home attendance remained steady in September. Local agents report that sales numbers have picked up from August, however, most buyers are continuing with their ‘wait and see’ approach.

It is still a buyers’ market in Taranaki and local salespeople predict the current slow market will jump in activity after the election. Factors such as interest rates are also playing a role in market conditions.” (REINZ)

The current median Days to Sell of 49 days is much more than the 10-year average for September which is 37 days. There were 20 weeks of inventory in September 2023 which is 6 weeks more than the same time last year.

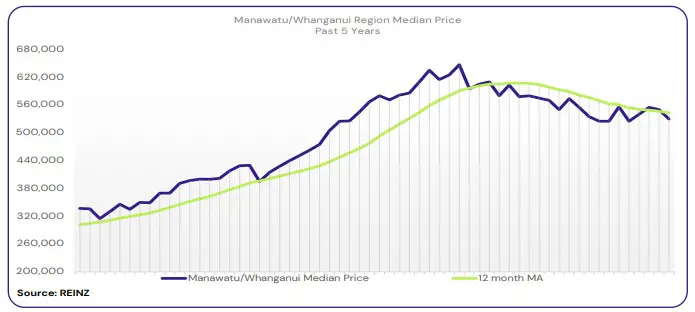

Regional Analysis - Manawatu/Whanganui

Median prices in Manawatu/Whanganui decreased by 7.0% year-on-year to $530,000.

“First-home buyers and owner-occupiers continue to be the most active buyer group in the region.

Vendors are adjusting their price expectations according to the market. Two factors have led to rising open-home attendance – new property listings and properties where the price has been adjusted. Auction rooms have seen an ongoing increase in activity.

Overall sales counts remain low as the market remains challenging, with low listings, interest rates, the current economic situation and anticipation of the election having influenced buyer and seller decisions. Most groups have adopted a wait-and-see attitude.” (REINZ)

The current median Days to Sell of 46 days is much more than the 10-year average for September which is 37 days. There were 19 weeks of inventory in September 2023 which is 7 weeks less than the same time last year.

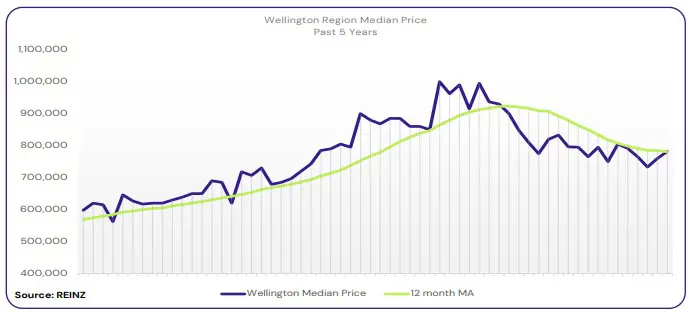

Regional Analysis - Wellington

Wellington’s median prices decreased by 4.6% year-on-year to $782,000.

“First-home buyers were the most active buyer group once again, with owner-occupiers showing activity as well. Investors continued to show some activity in the region, though not as much as the other buyer groups. Vendors continue to set their price expectations according to current market conditions, though they are hopeful for an increase in the future.

Attendance at open homes remains stable. The market is showing signs of steadying and local agents have said that the overall market sentiment is more positive this month. While factors such as property stock and anticipation of the election influenced the market, agents are optimistic that activity will begin to pick up soon.” (REINZ)

The current median Days to Sell of 34 days is less than the 10-year average for September of 35 days. There were 10 weeks of inventory in September 2023 which is 8 weeks less than the same time last year.

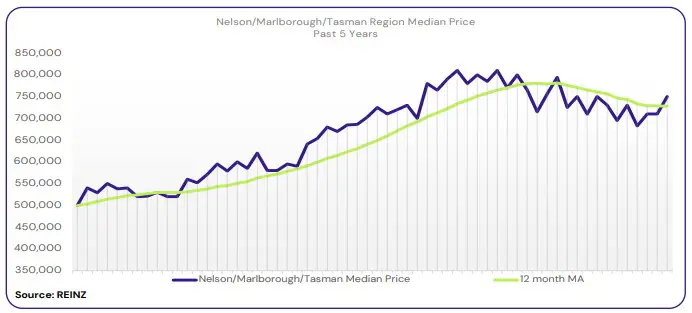

Regional Analysis - Nelson/Marlborough

Nelson’s median prices decreased by 2.7% year-on-year to $680,000. In Marlborough, median prices increased by 25.4% year-on-year to $740,000. In Tasman, median prices decreased by 5.8% year-on-year to $810,000.

“Owner-occupiers continued to be the most active buyer group in the region. Most vendors have kept their expectations high, particularly in Blenheim, where vendors are still receiving multiple offers.

Blenheim has seen a mix in open home attendance, with some weeks being busier than others. In Nelson, auction rooms have seen strong attendance for new listings.

Local agents report that they are seeing more deals that may be subject to sale or potentially lead to more deals. Factors such as cost of living, current economic conditions and anticipation of the election played a major role in market sentiment. Local agents are hopeful that the market will bounce back after the election.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for September which is 36 days. There were 22 weeks of inventory in September 2023 which is 1 week more than the same time last year.

Regional Analysis - West Coast

The West Coast’s median prices increased by 8.3% year-on-year to $390,000.

“Despite this, West Coast did see a decrease in overall sales, with sales counts decreasing by 17.1%. The region saw 29 properties sold this month, six less compared to last year. Of these, one property was sold in auction.

The median Days to Sell in the region was 59 days, a three day increase compared to last year. Factors such as anticipation of the election and recent weather conditions may be contributing to recent market activity in the area.” (REINZ)

The current median Days to Sell of 59 days is much less than the 10-year average for September which is 88 days. There were 41 weeks of inventory in September 2023 which is 9 weeks more than the same time last year.

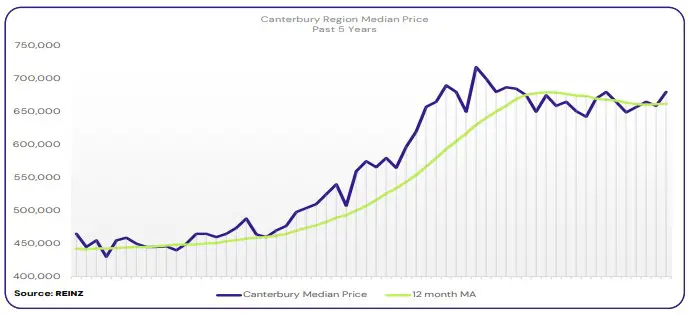

Regional Analysis - Canterbury

In Canterbury, median prices increased by 0.7% year-on-year to $680,000.

“There was a mix of active buyer groups across the region, with first-home buyers being the most active in Christchurch, owner occupiers in Ashburton, and investors in Timaru.

Price expectations remained the same for vendors in Christchurch, steady for vendors in Ashburton, and mixed in Timaru. Open-home attendance continued to rise for most of the region, but local agents say that attendance in Ashburton was very property-specific.

Auction room attendance continued to rise in Timaru and Christchurch but was low in Ashburton. Sales counts remained steady throughout Canterbury.

Overall market sentiment is leaning towards the positive side. While factors such as interest rates, inflation and anticipation of the election have affected the market, local agents are predicting an active market in the time leading up to Christmas and early next year.” (REINZ)

The current median Days to Sell of 34 days is the same as the 10-year average for September which is 34 days. There were 14 weeks of inventory in September 2023 which is 3 weeks less than the same time last year.

Regional Analysis - Otago

Dunedin City - The median sale price in Dunedin remained consistent with recent trends at $592,500.

“First home buyers remain active with competition arising for well-priced, low-to-mid value properties.

Factors such as interest rates, cost of living, economic conditions and anticipation of the election are continuing to influence activity of both buyers and sellers.” (REINZ)

Queenstown Lakes - “Owner occupiers and first-home buyers remained the most active buyer group.

Some vendors are becoming more aware of market conditions and others are staying firm with their asking prices. Buyers remain cautious about their spending.

Open-home attendance is steadily increasing, especially for high-end properties. Auctions remain the best option for buyers and vendors. Local agents report that sales counts are slowly increasing this month.

While factors such as interest rates and anticipation of the coming election have impacted choices, local agents believe that the region is going through a cycle change. As spring arrives, the market is showing signs of slow yet good improvement. Buyer and seller confidence is returning and is expected to grow following the election.” (REINZ)

The current median Days to Sell of 49 days is much more than the 10-year average for September which is 35 days. There were 15 weeks of inventory in September 2023 which is 1 week more than the same time last year.

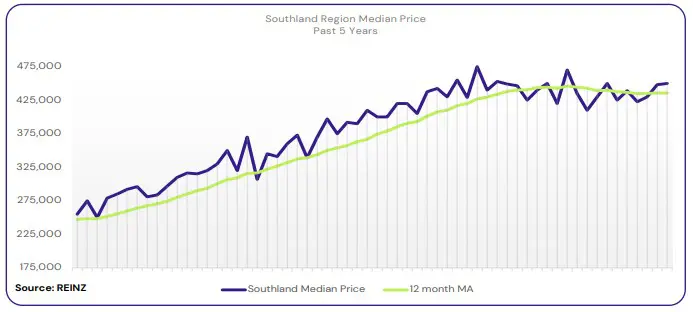

Regional Analysis - Southland

Southland’s median price remained the same as last year at $450,000.

“First-home buyer activity increased in September. Local agents report that vendor expectations have remained steady across the region, though vendor activity has decreased.

Open home attendance, auction room activity, and sales counts also remained steady across the board. Open homes saw more first-home buyers attending to see what is available.

Improving weather continues to influence the market, with steady improvement in market activity across the region during September. Anticipation of the coming election also played a role in the market.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for September which is 33 days. There were 17 weeks of inventory in September 2023 which is 4 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.