Seasonal Shift Brings Market Lift - REINZ stats March 2025

Tuesday, 15 April 2025

Seasonal Shift Brings Market Lift

The Real Estate Institute of New Zealand (REINZ) has released March figures, revealing promising trends in the national property market. Continuing the momentum from last month, year-on-year sales are rising across the country. “As we transition into the cooler months, the market remains vibrant rather than stagnant. There have been reports of increased attendance at open homes and auctions. Even in cases where properties don’t sell at auction, there’s plenty of post-auction interest, indicating a resilient and engaged buyer community,” says Acting Chief Executive Rowan Dixon

National sales counts have increased compared to March 2024, rising 12.8% (from 6,774 to 7,640). This suggests a positive shift in the property market, likely influenced by the combination of lowering interest rates and still relatively low house prices. For New Zealand, excluding Auckland, sales saw a 14.2% year-on-year rise, from 4,622 to 5,278. At a regional level, notable year-on-year growth in sales was observed in Tasman (+48.6%) and the West Coast (+23.6%). “This growth suggests that lowering interest rates and low house prices encourage more people to buy homes. Additionally, the strong performance in New Zealand (excluding Auckland) with a 14.2% year-on-year rise, highlights that regions outside Auckland are also experiencing significant demand,” says Dixon.

The median price for New Zealand declined by $30,000 (1.4%) to $1,040,000 year-on-year. Excluding Auckland, the median price fell by 2.1% from $715,000 to $700,000 compared to March 2024. Six out of sixteen regions reported an increase in median prices compared to last year. The West Coast region experienced the highest increase, rising by 11.5% from $370,000 to $412,500. Two regions had no change from March 2024: Canterbury at $695,000 and Taranaki at $600,000. Nelson’s median price significantly declined year-on-year from $722,000 to $640,000 (11.4%). “March saw a year-on-year increase in sales, but median prices continue to lag behind. New Zealand’s property market remains the same: high listings result in decreased buyer urgency. If a buyer misses out on a property, they can easily find a similar one for sale,” says Dixon.

More properties hit the market than in March 2024, with an increase of 5.0% nationally, from 11,455 to 12,029 listings. Excluding Auckland, listings increased by only 2.6%, from 7,326 to 7,513, compared to last year. National inventory levels increased by 10.9% year-on-year to 36,870 and 3.2% compared to the previous month. “As interest rates continue to fall and the OCR drops once again, local salespeople around the country are anticipating stability in the market over the coming months, bringing renewed energy and hope for many navigating these changing economic tides,” Dixon concludes.

There were 1,204 auctions across the country in March, which amounted to 15.8% of all sales, a slight decline from March 2024 and last month. The national median days to sell rose by 3 days, to 41 days year-on-year, which was the same for New Zealand, excluding Auckland. The House Price Index (HPI) for New Zealand is currently at 3,632, indicating a decrease of 0.7% year-on-year and a 0.6% decline compared to February 2025. Over the past five years, the average annual growth rate of New Zealand’s HPI has been approximately 3.7%. Southland remains the highest-ranking region for HPI movement, having taken the top place for nine consecutive months.

Regional highlights:

- Tasman had the largest sales count percentage increase year-on-year, up by 48.6% year-on-year from 70 to 104 sales, which was followed by Canterbury, up 23.6% compared to March 2024, from 1,080 to 1,335.

- 12 regions reported increases in listings compared to last year. The region with the most significant growth was Gisborne (+23.8%).

- Six regions had a median price increase year-on-year. The West Coast led the way with a rise of 11.5% year-onyear with a median price of $412,500. Two regions saw no change year-on-year: Taranaki ($600,000) and Canterbury ($695,000).

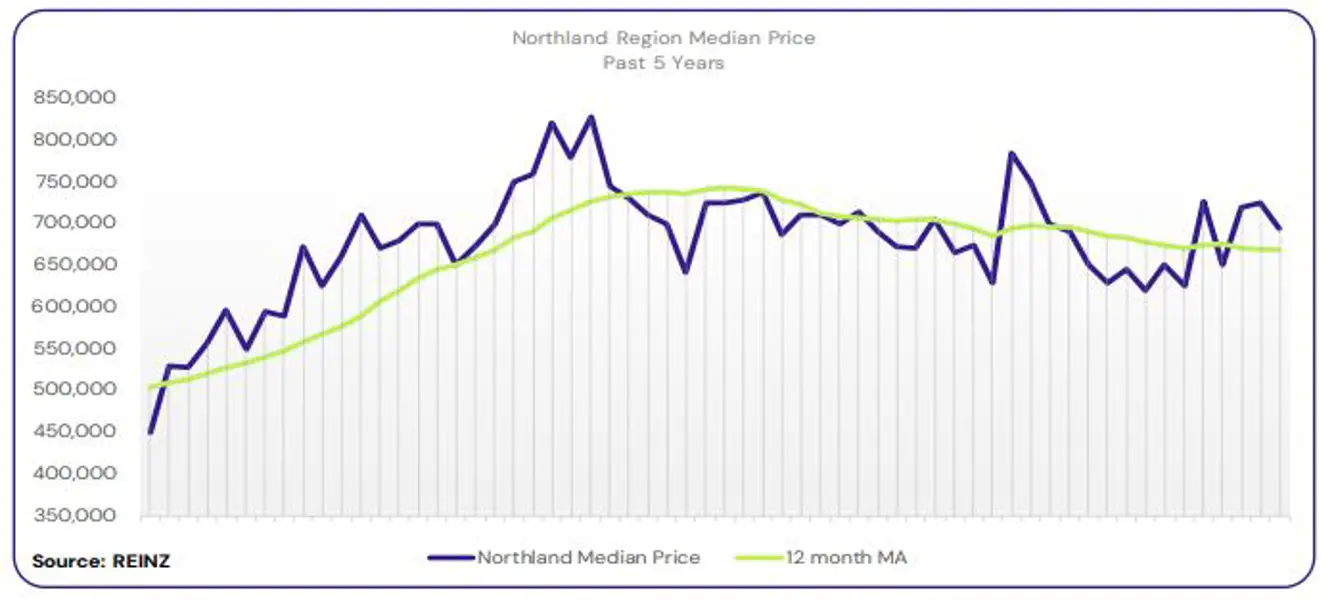

Regional Analysis - Northland

The median price for Northland decreased by 0.7% year-on-year to $695,000

“Owner-occupiers and first-home buyers were the most active in the market, with good enquiry levels from investors in Whangarei. Most vendors were realistic regarding their price expectations, but some buyers and sellers still harboured optimism and false expectations. Good numbers through new listing open homes, while buyers in Kerikeri opt for private appointments. Auction room attendee levels improve week by week, with few instances of post-auction negotiations.

Market sentiment has shifted as the market appears steady, and buyers were eager to engage and motivated. Local salespeople in Whangarei report large pools of conditional buyers seeking problem-free properties, making it easier to obtain finance and insurance. Local salespeople predict Northland will follow suit once Auckland’s property market picks up. However, they state there won’t be any price shift, as increased choice equals less pressure on buyers.” (REINZ)

The current median Days to Sell of 59 days is more than the 10-year average for March which is 49 days. There were 42 weeks of inventory in March 2025 which is 3 weeks less than the same time last year.

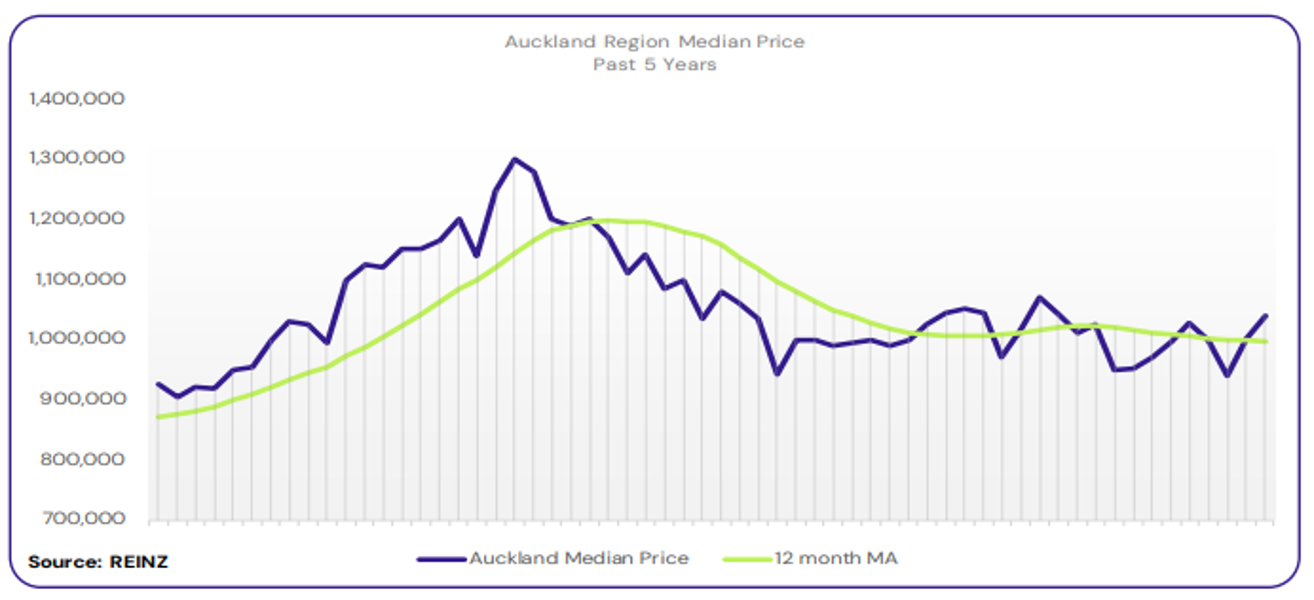

Regional Analysis - Auckland

The median price for Auckland decreased by 2.8% year-on-year to $1,040,000

“First-home buyers, investors, and owner-occupiers were the most active. Some vendors were realistic regarding the asking price, motivated to sell, and met market expectations, while others expected to obtain a price they thought was right, which was always on the higher end of the scale. Attendance at open homes varied across the region; while some may have numerous walk-throughs, others may have none – particularly with existing stock.

Auction room attendance varied across the region as well. Economic conditions, lending criteria and buyer confidence influenced market sentiment. Local agents are cautiously optimistic that the market will improve in a gradual, incremental manner.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for March which is 37 days. There were 27 weeks of inventory in March 2025 which is 2 weeks more than the same time last year.

Regional Analysis - Waikato

Waikato’s median price decreased by 1.6% year-on-year to $745,000

“All buyer groups were active in the Waikato region, with notable increases in investors and developers in Hamilton. Most vendors met market expectations regarding the asking price, and depending on their motivation, some continued to turn down strong offers in the hope of receiving a better one. Attendance at open homes varied around the region, with very low attendance in Thames, while Hamilton and Taupo saw steady numbers, especially on newer listings.

Improving activity was noted in auction rooms, with more properties opting for this sales method. Attendance at auctions also increased. Market sentiment is becoming increasingly positive, with growing confidence among active buyers. Local salespeople predict that the property market will continue to track steadily over the next few months. However, the early winter may bring a seasonal dip or decline in activity.” (REINZ)

The current median Days to Sell of 44 days is more than the 10-year average for March which is 36 days. There were 25 weeks of inventory in March 2025 which is 5 weeks less than the same time last year.

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased by 0.3% year-on-year to $782,500

“Owner-occupiers and first-home buyers were the most active buyer groups, with a notable number of retirees also considering village options in Tauranga. Overall, vendor expectations were realistic; others were hoping to recover what they paid at the peak of the market. Attendance at open homes was lower than in previous months and declined significantly after the first few weeks, although the quality of attendees was generally good.

Auction rooms have seen an increase in the number of attendees and remain a preferred sales method. Factors such as stock levels, economic conditions, job uncertainty, difficulty obtaining finance, lower interest rates, and slow sales activity influenced market sentiment. Local salespeople predict the market will continue to be slow and steady, with no significant change in either direction. However, external factors like economic conditions will likely influence the local property market.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for March which is 40 days. There were 23 weeks of inventory in March 2025 which is 2 weeks less than the same time last year.

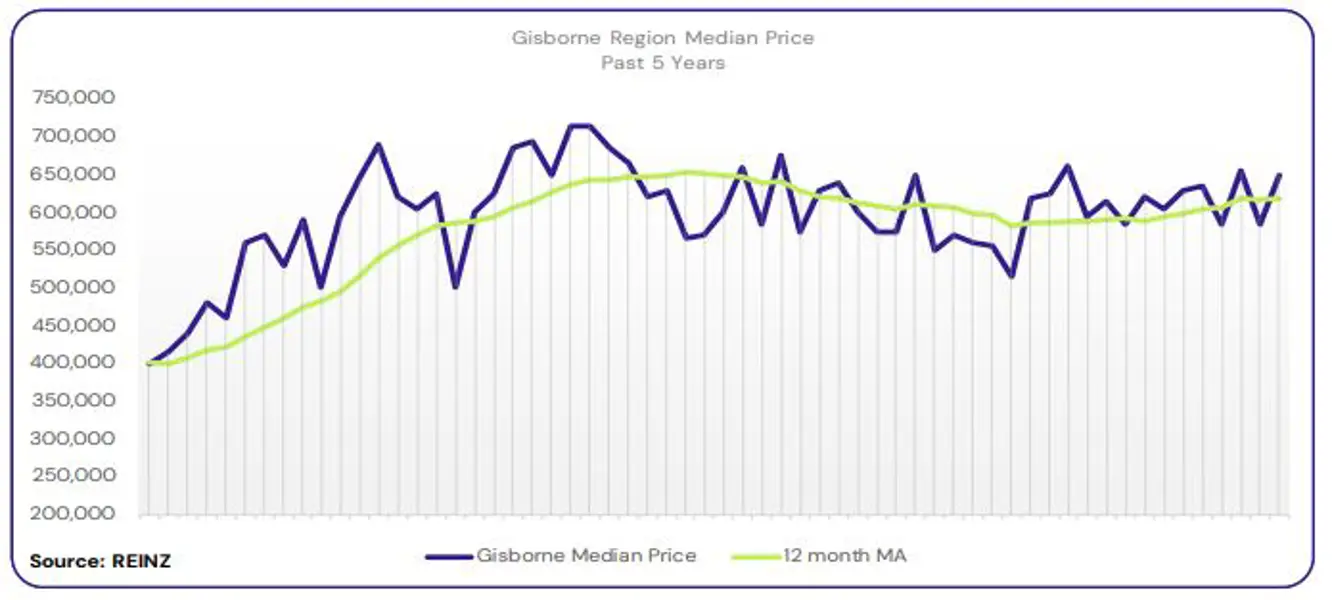

Regional Analysis - Gisborne

Gisborne’s median price increased by 4.0% yearon-year to $650,000

“Owner-occupiers were the most active buyer group, as lower interest rates meant more were looking to upgrade their property and move up the property ladder. Vendor expectations regarding price were realistic, as the competition in the market meant they had to be reasonable or risk their property losing traction. Attendance at open homes remained steady throughout the month, with higher numbers through the doors in the first month on the market.

Auction room attendance levels have bounced back in the region. Market sentiment has remained stable despite the increase in the number of properties on the market. Local salespeople cautiously predict a slightly improving market over the next few months, anticipating fewer new listings over winter.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for March which is 41 days. There are 13 weeks of inventory in March 2025 which is 6 weeks more than last year.

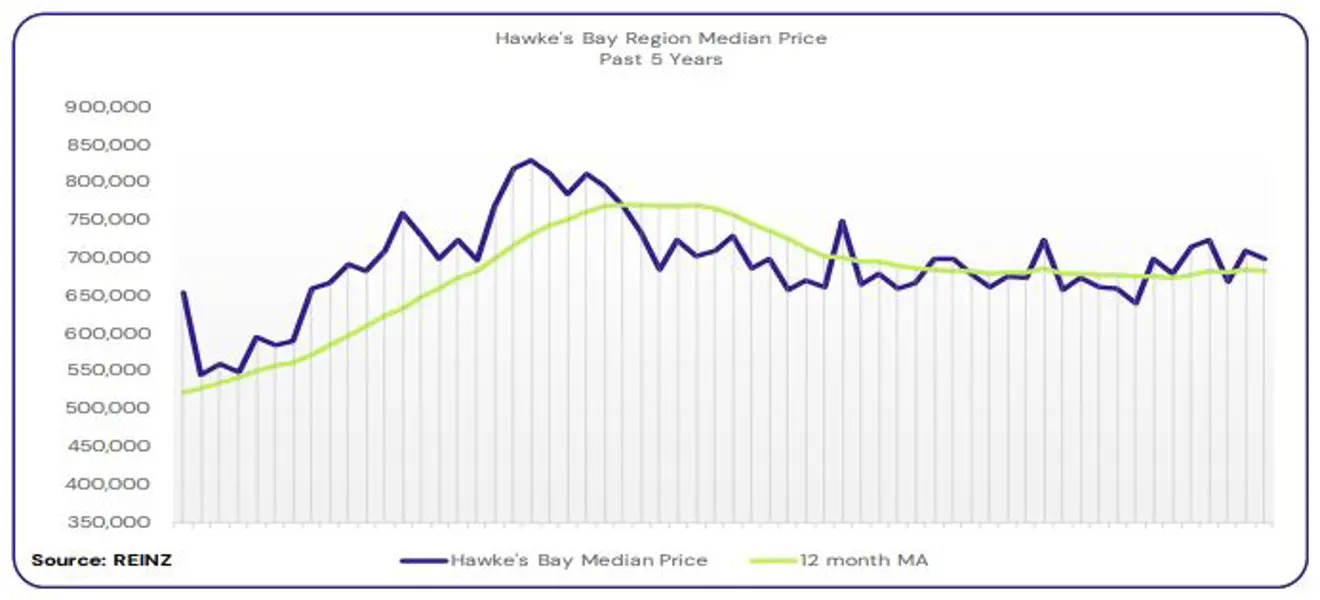

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price decreased by 3.4% year-on-year to $700,000

“First-home buyers and owner-occupiers were the most active in the market, with no decline in a particular buyer pool. Most vendor expectations regarding price were reasonably realistic, and attendance at open homes across the region increased compared to the previous month. This improved attendance also extends to the auction room, with increased sales under the hammer compared to last year.

Market sentiment was reported to be more positive despite the local market remaining uneven in March. Local salespeople cautiously predict a slight improvement in interest rates in the coming months, which is expected to have a positive impact on the property market.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for March which is 36 days. There were 17 weeks of inventory in March 2025 which is 2 weeks less than the same time last year.

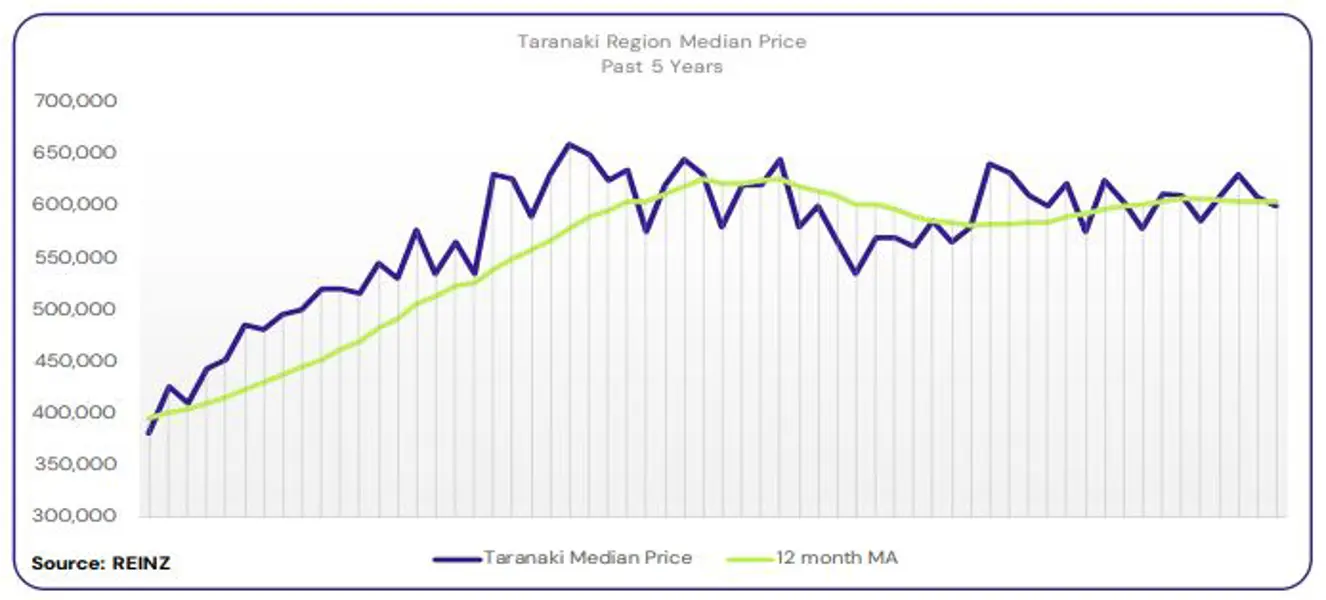

Regional Analysis - Taranaki

Taranaki’s median price had no change year-on-year, staying at $600,000

“All buyer types were active in the Taranaki residential market, with owner-occupiers being the most active. Local agents report that many vendors have increased their price expectations due to media-driven factors. Most seem to understand that achieving a premium price will take longer. Attendance at open homes was well-attended, and good numbers were reported across all price brackets.

Factors such as the increase in multiple offers, growing confidence, rising listings, and competition among buyers influenced market sentiment. Local agents cautiously predict sales volumes will remain strong for the next few months and are hopeful for further OCR reductions.” (REINZ)

The current median Days to Sell of 37 days is more than the 10-year average for March which is 33 days. There were 19 weeks of inventory in March 2025 which is 4 weeks less than the same time last year.

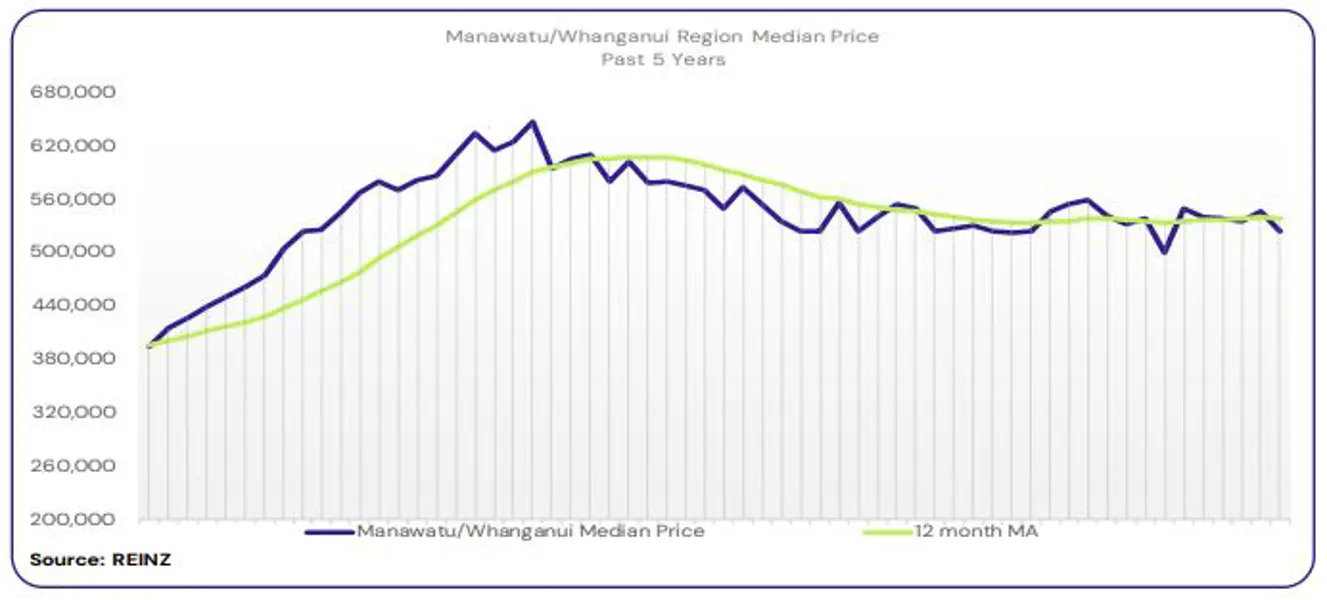

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased by 4.0% year-on-year to $525,000

“Owner-occupiers were the most active buyers, followed by first-home buyers and investors. Some vendor expectations regarding price were still too high and needed to meet the local market expectations to achieve a sale. Attendance at open homes was sporadic, with the newer listings attracting reasonable numbers. Auction room attendance and activity were very low.

Market sentiment was influenced by factors such as job security, house prices, the cost of living, and current economic conditions. Local agents predict that it will be a more balanced market over the next few months, but to be aware of the current market sentiment influences.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for March which is 33 days. There were 21 weeks of inventory in March 2025 which is 2 weeks less than the same time last year.

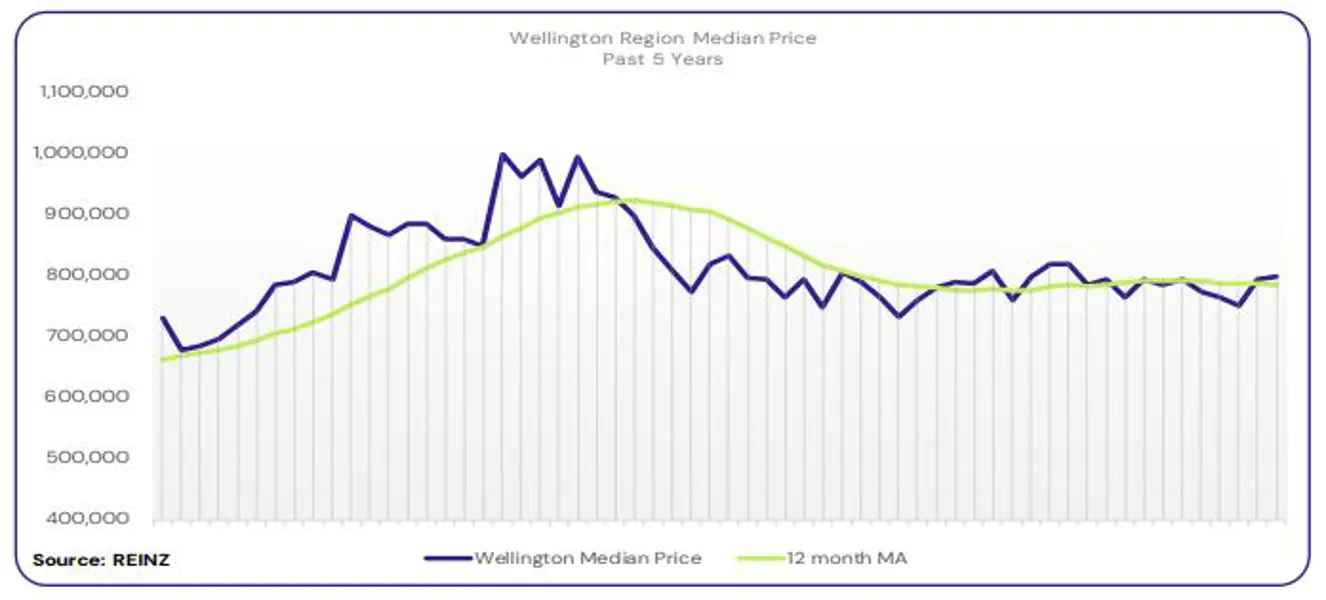

Regional Analysis - Wellington

Wellington’s median price decreased by 2.4% year-on-year to $800,000

“First home buyers remained the most active buyer group in March, with owner-occupiers present but more selective. Investor and out-of-town buyer activity was limited. Vendor expectations were generally more realistic, though some still anchored to peak market values. Open home attendance was steady, particularly in well-priced, entry-level suburbs.

Market sentiment was cautious but improving, supported by easing mortgage rates and increased listings. Buyers were value-focused and deliberate, reflecting ongoing affordability pressures and broader economic uncertainty. Local agents expect this steady, measured activity to continue into autumn.” (REINZ)

The current median Days to Sell of 36 days is more than the 10-year average for March of 33 days. There were 16 weeks of inventory in March 2025 which is 3 weeks more than the same time last year.

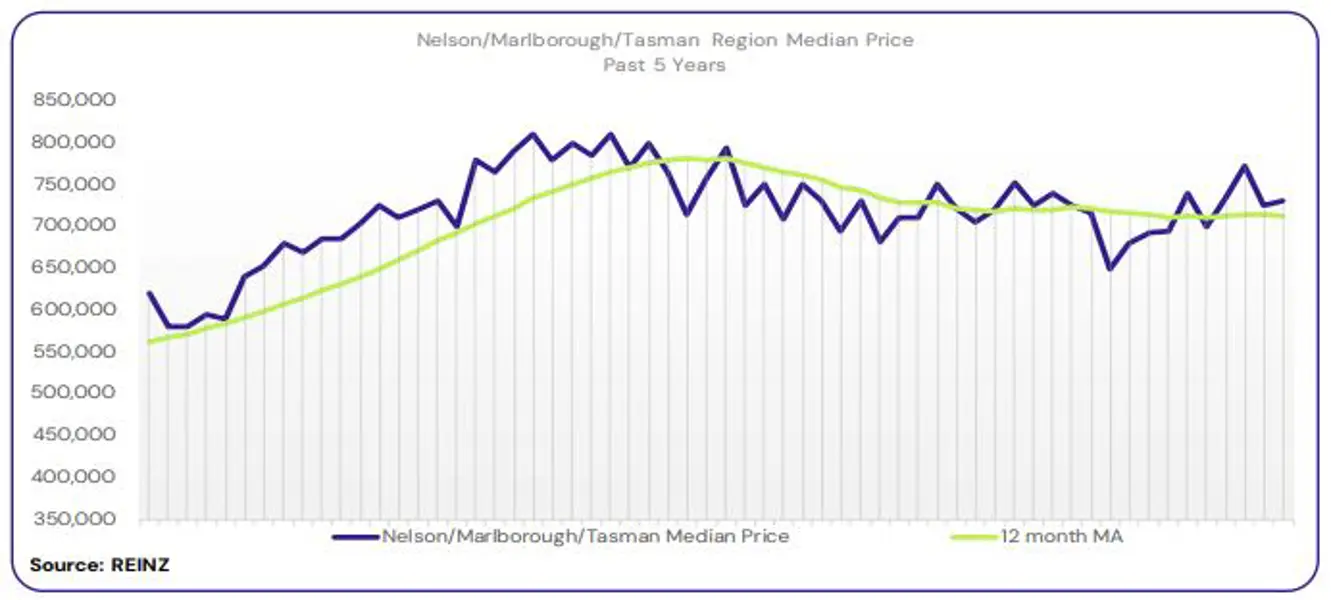

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased by 11.4% year-on-year to $640,000. The median price for Marlborough increased by 1.1% year-on-year to $655,000. The median price for Tasman increased by 4.2% year-on-year to $865,000.

“Owner-occupiers and first-home buyers were the most active buyer groups across the region. Some vendors continue to hold out for higher prices, but those who were willing to meet the market often received multiple offers, although they weren’t always quick to commit. Attendance at open homes remained active for newer listings but declined after the first few weeks due to high stock levels.

Auction rooms across the region experienced higher attendance and increased clearance rates. Market sentiment was overall more positive in March due to declining interest rates, a lack of buyer urgency, increased stock on the market, and the local market’s transition from a buyer-driven to a more balanced market. Local salespeople cautiously anticipate the market will remain relatively stable and are optimistic about a positive outlook that will carry them through the winter months.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for March which is 34 days. There were 21 weeks of inventory in March 2025 which is 1 week more than the same time last year.

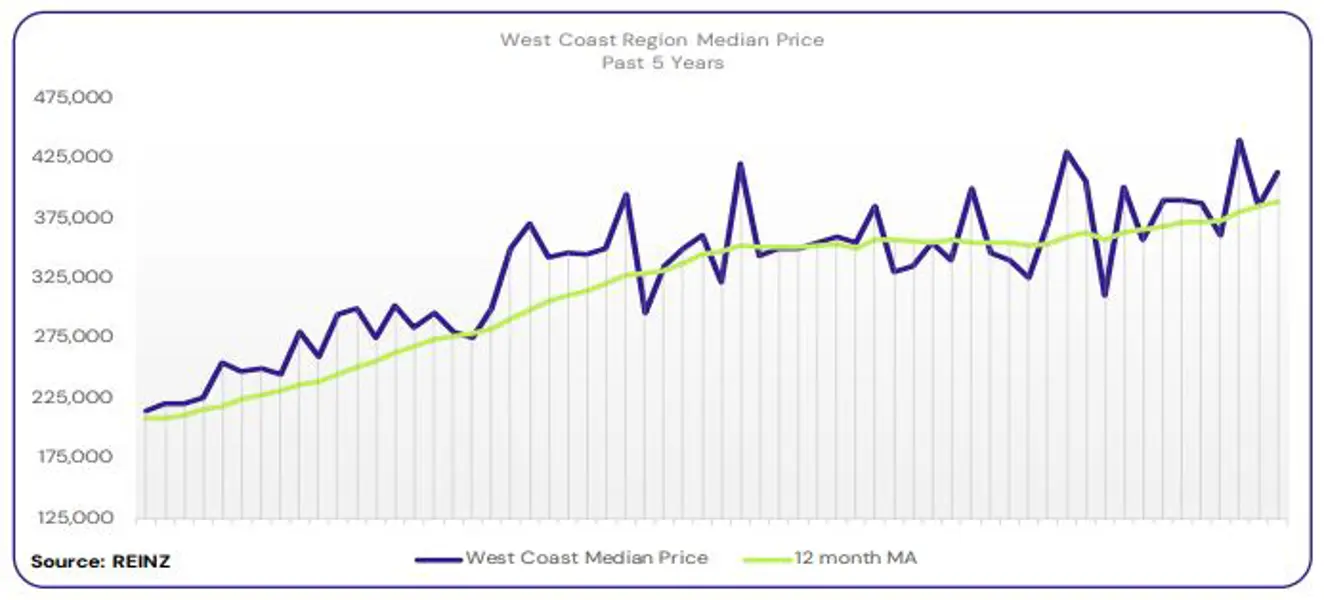

Regional Analysis - West Coast

West Coast’s median price increased by 11.5% year-on-year to $412,500

“First-home buyers and owner-occupiers were the most active groups. Some vendor expectations regarding the asking price were realistic, while others were influenced by media coverage surrounding price increases. Attendance at open homes was relatively low, which is typical for the region.

Factors such as increased listings and the rise of active buyers in the area influenced market sentiment. Local salespeople predict that the West Coast market will continue at its steady pace, as opportunities in the mining sector remain at the forefront of journalists, which provides hope to locals.” (REINZ)

The current median Days to Sell of 39 days is much less than the 10-year average for March which is 54 days. There were 38 weeks of inventory in March 2025 which is 4 weeks less than the same time last year.

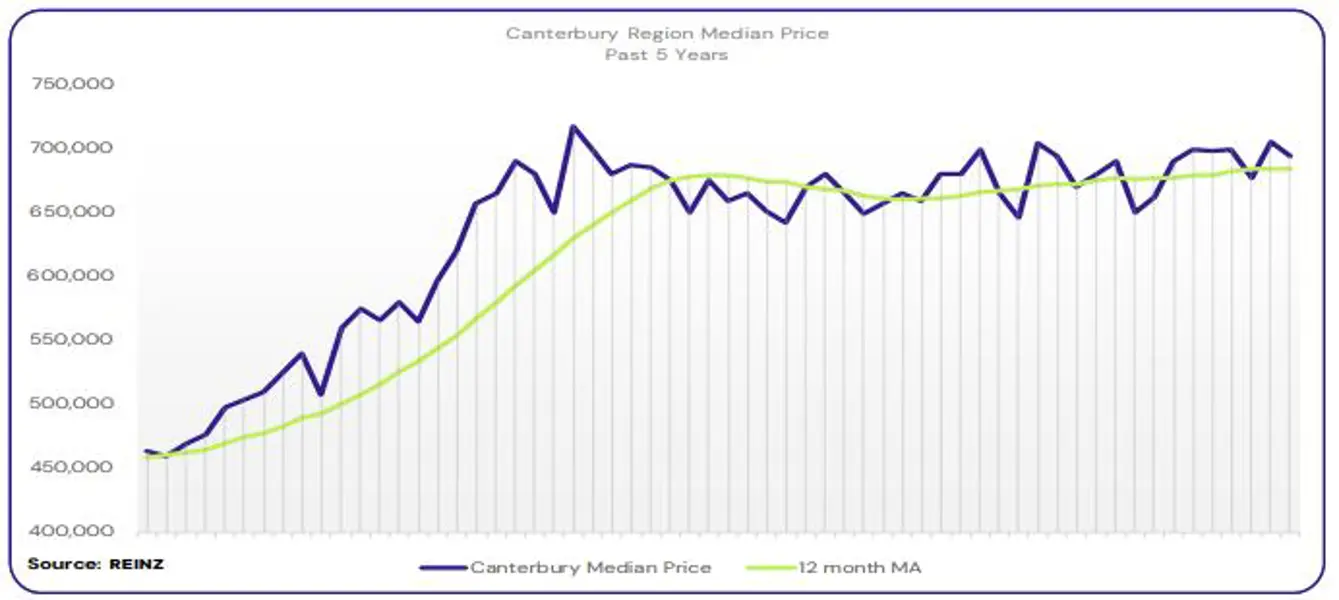

Regional Analysis - Canterbury

The median price for Canterbury had no change year-on-year, staying at $695,000

“First-home buyers and owner-occupiers were the most active, with the Ashburton region reporting an increase in investor activity, while Timaru local agents reported fewer local investors. Most vendors were realistic regarding the asking price. Attendance at open homes was steady, with many reporting good numbers and new listings on the market. Auction activity was mixed around the region, with most reporting reasonable clearance rates and increased attendance.

Market sentiment was influenced by interest rate reductions, increased confidence, job uncertainty, as well as the growing number of individuals looking to purchase. Local agents predict that the market will remain stable as more listings enter the market and more potential buyers looking to transact.” (REINZ)

The current median Days to Sell of 36 days is more than the 10-year average for March which is 32 days. There were 16 weeks of inventory in March 2025 which is the same as the same time last year.

Regional Analysis - Otago

“Dunedin’s median price increased by 0.8% year-on-year to $600,000

All buyer groups were active in Dunedin, although there were still relatively few overseas buyers. Most vendor expectations were too high as stock levels continued to increase. Attendance at open homes was good for new stock; however, the longer the property remains on the market, the fewer buyers opt to attend. Some agencies that conduct auctions report some success under the hammer, but there have also been notable post-auction successes, as many buyers don’t yet have finance approval.

Factors such as increased stock levels, interest rates, cost of living, and lack of buyer urgency influenced market sentiment. Local agents report that buyers often have the time to look around, and some fear that a better home, more suited to their needs, may come on the market, so they hold off on purchasing. Local salespeople predict that house prices may not increase over the winter.” (REINZ)

Queenstown Lakes

“Owner-occupiers were the most active, but as interest rates fall, it’s attracting first-home buyers and investors to the market. The gap between vendor price expectations and buyers’ expectations remained a problem, as current market conditions favour the buyers. Attendance at open homes was steady across Central Lakes. Auction activity varied as buyers had plenty of choice if they didn’t secure the sale.

Interest rates, lending criteria, increased stock levels, the OCR and lack of buyer urgency influenced market sentiment. Local agents cautiously predict that the market will improve by mid-2025 when there could be positive growth once interest rates stabilise.” (REINZ)

The current median Days to Sell of 44 days is much more than the 10-year average for March which is 33 days. There were 21 weeks of inventory in March 2025 which is 7 weeks more than the same time last year

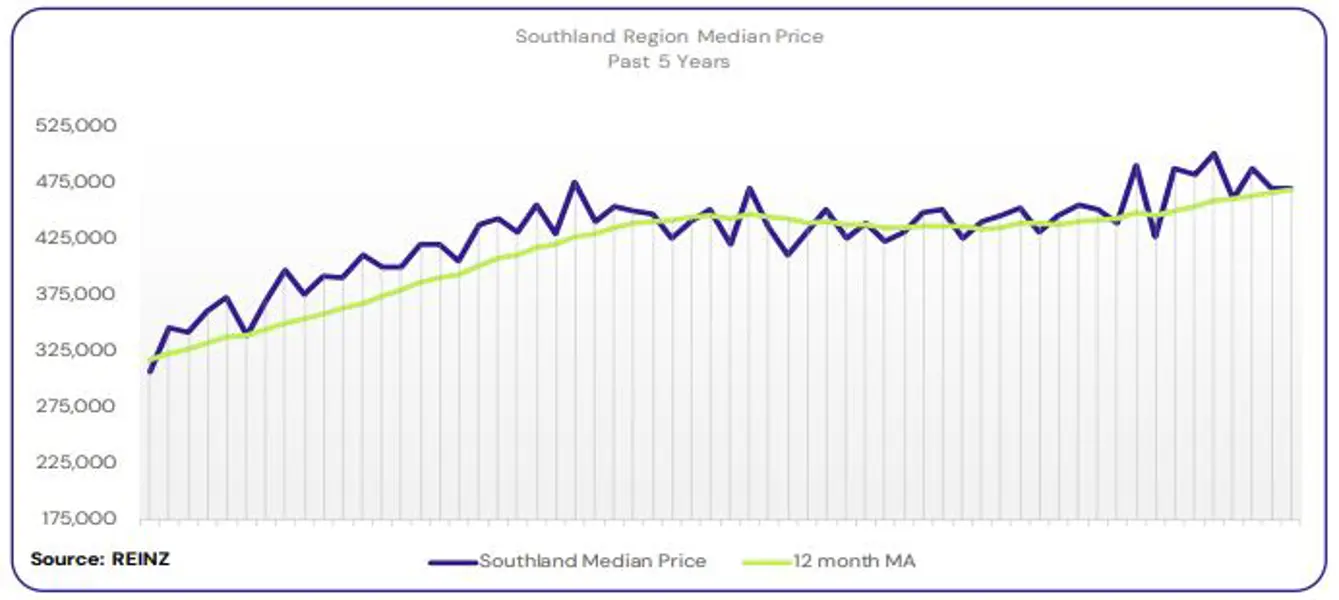

Regional Analysis - Southland

The median price for Southland increased by 5.6% year-on-year to $470,000

“Owner-occupiers and first-home buyers were the most active, which local agents attribute to lower interest rates, affordable housing and tax benefits. There was a decline in buyers looking at the top end of the market. Most vendors were realistic regarding asking prices due to their motivation to sell and increased market competition. Attendance at open homes was patchy across the region, with newer listings attracting the highest numbers. Some auction rooms achieved good results. Market sentiment shifted as there was good supply and demand. Local salespeople cautiously predict that the local market will remain steady as we head into winter.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for March which is 32 days. There were 15 weeks of inventory in March 2025 which is 3 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.