Growing Confidence Fuels Market Momentum - REINZ stats February 2025

Monday, 17 March 2025

February showed some positive signs across the NZ property Market

The latest figures from the Real Estate Institute of New Zealand (REINZ) for February showed some positive signs across the New Zealand property market, with increases in sales counts and auction activity. REINZ Acting Chief Executive Rowan Dixon says the data released today indicates growing stability in the market. As New Zealand transitions from the holiday period and returns to normal routines, the market looks optimistic.“ Sales have increased nationally year-on-year, and activity is ramping up as we move out of summer. Attendance at open homes remains strong, and auction numbers are comparable to those in February 2024. These are encouraging signs for a positive and confident market ahead, ” Dixon comments.

Sales returned to a relatively stable level nationwide, rising 3.4% (from 6,080 to 6,287) year-on-year and increasing 59.5% (from 3,941 to 6,287) compared to January 2025. For New Zealand, excluding Auckland, sales experienced a 5.6% year-on-year rise, from 4,252 to 4,491. Compared to February 2024, notable growth in sales was observed on the West Coast (+22.2%) and Taranaki (+20.6%). All regions reported an increase in sales month-on-month, as expected. “Sales in New Zealand generally rise from January to February, though the exact shift becomes clearer once seasonal trends are accounted for. For instance, New Zealand experienced a 59.5% increase in sales, but when adjusting for seasonality, that is 12% higher than anticipated,” Dixon says.

The median price for New Zealand declined by 2.4%, from $791,000 to $772,000, year-on-year. Excluding Auckland, the median price fell by only $10,000 (1.4%) from $710,000 to $700,000 compared to February 2024. Six out of sixteen regions reported an increase in median prices compared to February 2024. The West Coast region experienced the highest increase, rising 16.3% from $325,000 to $377,500. Southland noted a 9.2% increase year-on-year, from $430,600 to $470,000. “February saw a rise in sales, but median prices lagged, with only six regions recording an increase. High number of listings can give buyers less urgency—if they miss out on one property, plenty of similar options are still available,” says Dixon. Overall, listings nationally declined 3.6% year-on-year, from 11,788 to 11,363. Excluding Auckland, listings declined slightly by 0.3%, from 7,269 to 7,249, compared to February 2024. The most significant gains in listings were observed by Gisborne (+79.4%) and Southland (+24.1%).

National inventory levels increased by 13.6% year-on-year to 35,712 and 10.2% compared to last month. “Reports show a positive outlook with most vendors setting realistic prices and aligning to market conditions,” Dixon concludes. February saw 1,163 auctions across the country (18.5% of all sales), a slight increase from February 2024 and a notable increase from last month. The national median days to sell rose by 3 days, to 54 days year-on-year; excluding Auckland, it increased by two, to 54 days. The House Price Index (HPI) for New Zealand is currently at 3,655, indicating a decrease of 1.2% year-on-year and an increase of 1.4% compared to January 2025. Over the past five years, the average annual growth rate of New Zealand’s HPI has been approximately 4.0%. However, it sits at 10.6% below its peak in 2021.

Regional highlights:

- West Coast had the largest sales count percentage increase year-on-year, up by 22.2% year-on-year from 36 to 44.

- Four regions reported increases in listings compared to last year. The region with the most significant increase was Gisborne (+79.4%).

- Six regions had a median price increase year-on-year. The West Coast led the way with a rise of 16.2% year-on-year with a median price of $377,500.

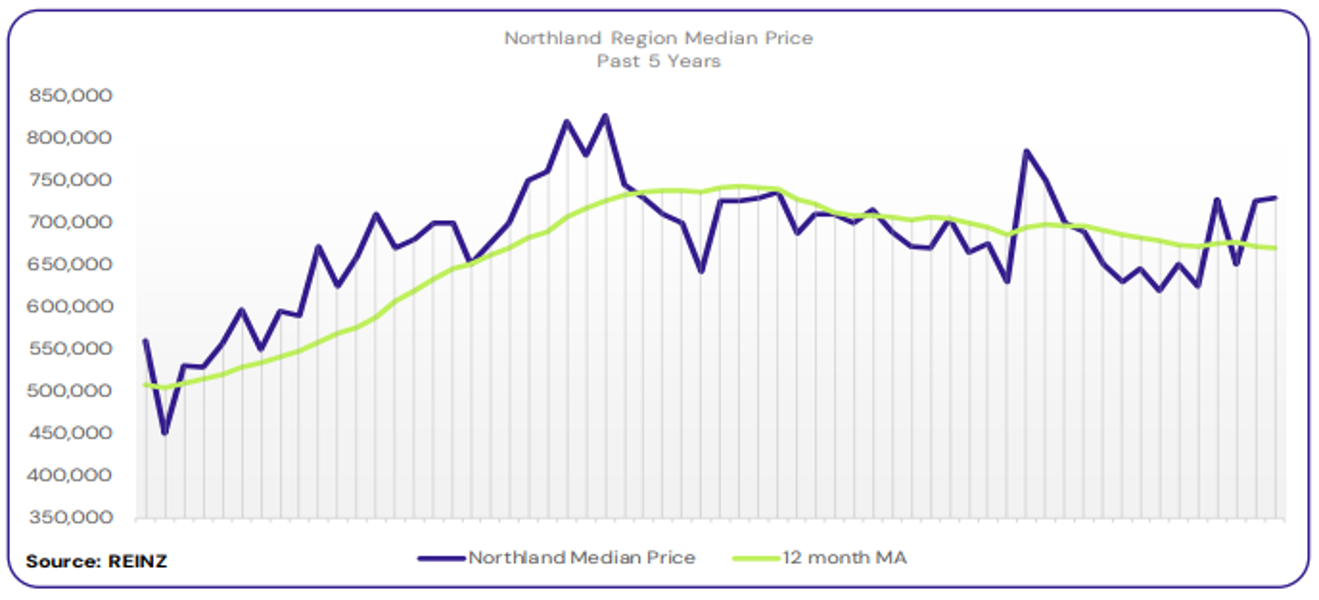

Regional Analysis - Northland

The median price for Northland decreased by 2.7% year-on-year to $730,000

“Owner-occupiers, first home buyers and investors were the most active buyers in Whangarei, with only first home buyers the most active in Kerikeri. Vendor expectations were relatively realistic as they came to the market prepared with current prices.

Open home attendance varied across the region. Low numbers were reported in Kerikeri, but in contrast, attendance increased towards the end of the month in Whangarei. Auction attendance also increased, but most of the properties were passed in. Market sentiment was influenced by more stock available, vendors under pressure due to increased competition, and more choices for buyers, meaning less urgency to commit.” (REINZ)

The current median Days to Sell of 70 days is more than the 10-year average for February which is 61 days. There were 42 weeks of inventory in February 2025 which is 4 weeks less than the same time last year.

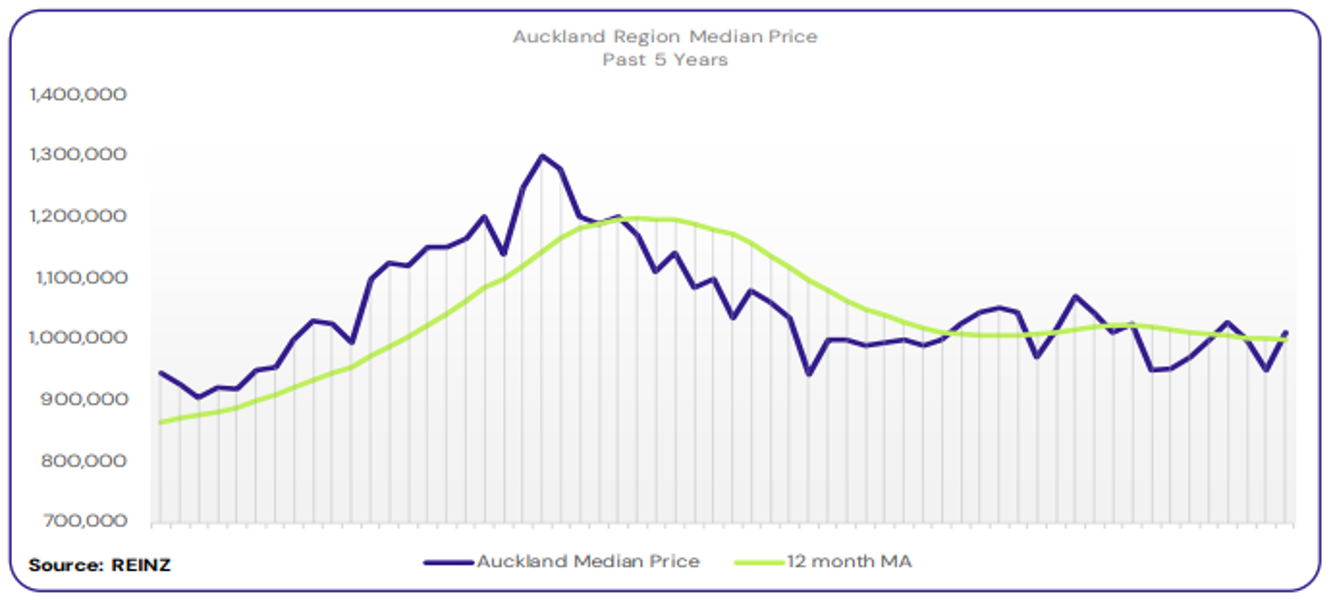

Regional Analysis - Auckland

The median price for Auckland decreased by 0.5% year-on-year to $1,010,000

“Owner-occupiers, first home buyers and investors were active this month. Developers were absent from the market. Some vendors were meeting market expectations and being realistic regarding asking price, while others had begun to expect a higher price. Attendance at open homes was good for the first few weeks of the campaign.

Auction activity varied. Attendance levels were average at best, although there were increases in pre-auction offers. Increased confidence, job security concerns, DTI restrictions, and easing interest rates influenced market sentiment. Local agents hope there will be a steady improvement in sales counts, selling price and continued positive sentiment.” (REINZ)

The current median Days to Sell of 55 days is more than the 10-year average for February which is 47 days. There were 31 weeks of inventory in February 2025 which is 1 week more than the same time last year.

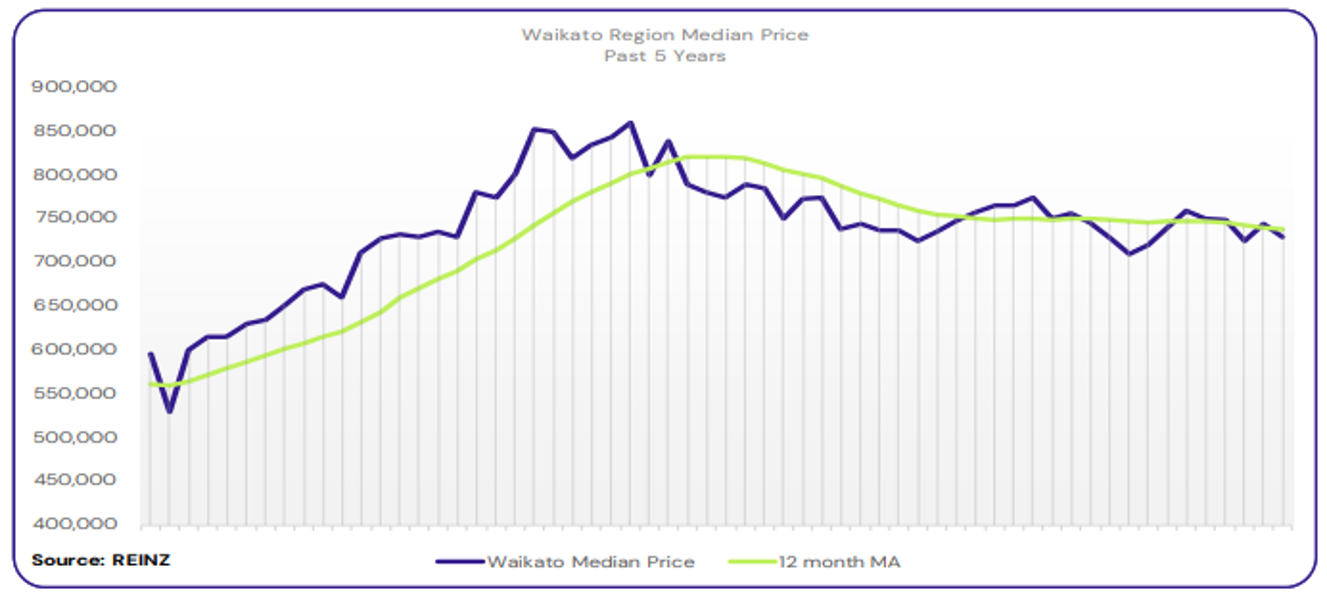

Regional Analysis - Waikato

Waikato’s median price decreased by 2.7% year-on-year to $730,000

“Owner-occupiers, particularly those looking for a holiday home and to upsize, and first home buyers. Investors were notably present, and developer enquiries increased. Most vendor expectations met market expectations for newer listings, while there was a gap in some cases. Those who met market expectations realise the number of listings available and the competitive market to secure a sale. Open home attendance was steady, but it all came down to price point and property type.

Auction activity remained steady across the region. There was an increase in listings opting for auction as their sales method. Attendance and activity in the auction room also increased, especially for well-priced properties performing well under the hammer. Interest rates, insurance costs, affordability, cost-of-living pressures, lending criteria, the OCR announcement, and high levels of stock available influenced market sentiment. Local salespeople are cautiously optimistic that the market will stabilise over the next few months. Hopefully, as the economy settles, this may encourage those who held back from purchasing to commit.” (REINZ)

The current median Days to Sell of 61 days is much more than the 10-year average for February which is 45 days. There were 23 weeks of inventory in February 2025 which is 4 weeks less than the same time last year.

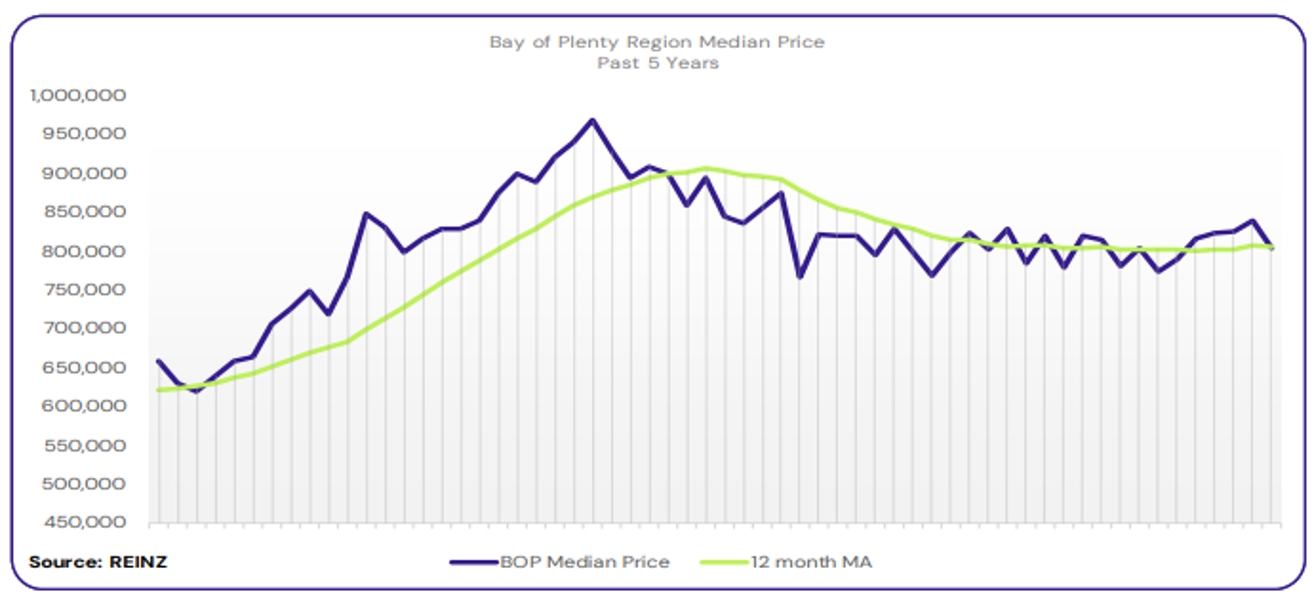

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty decreased by 1.8% year-on-year to $805,000

“There was good activity across all buyer groups in February, with no buyer group absent. Most vendors had realistic expectations regarding the asking price, while others were not accepting the current market conditions. Open home attendance was steady, with those who attended being good-quality buyers.

Auction room activity was good, with more sales under the hammer and many negotiations to get the sale across ,the line. Sales counts increased for the region and were consistent with last year, if not slightly higher. Factors like increased buyer confidence, easing interest rates, lending conditions, and economic and employment uncertainty influenced market sentiment. Local salespeople expect market activity to continue rising but are aware prices may remain flat.”

The current median Days to Sell of 61 days is more than the 10-year average for February which is 51 days. There were 22 weeks of inventory in February 2025 which is 3 weeks less than the same time last year.

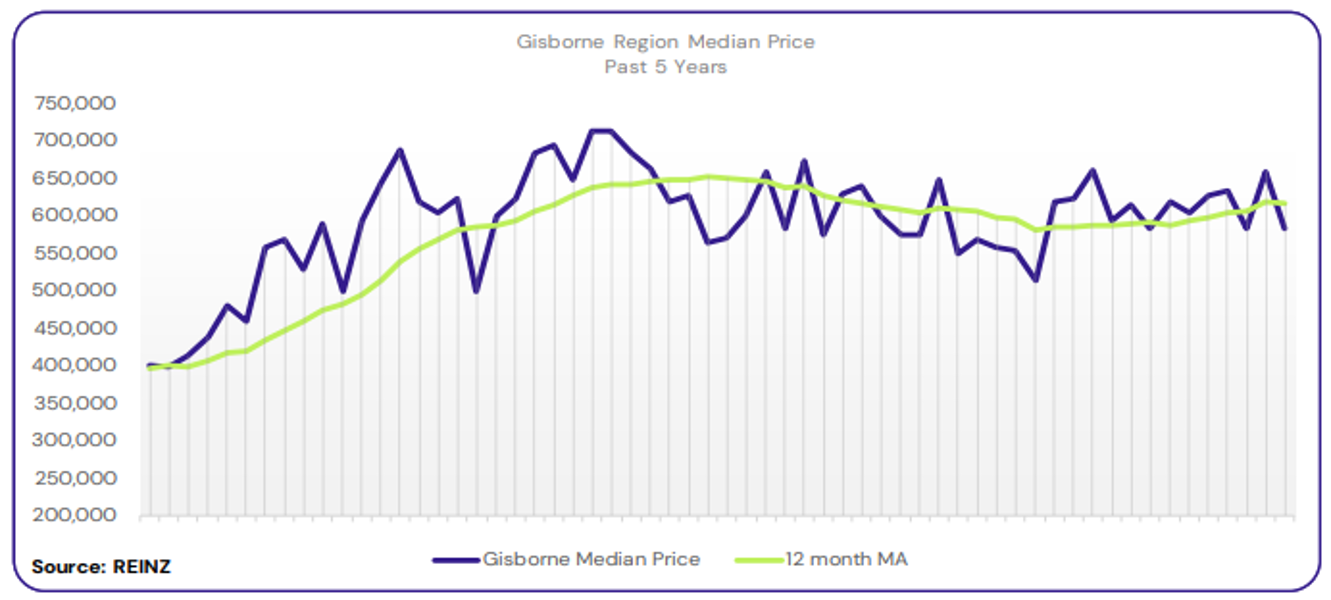

Regional Analysis - Gisborne

Gisborne’s median price decreased by 5.5% year-on-year to $585,000

“Owner-occupiers and investors were the most active buyer groups. Vendor expectations grew increasingly optimistic as local salespeople began to recognise the motivation for vendors to secure a sale in order to purchase another property. Attendance at open homes continued to rise.

Outcomes from auctions yielded mixed results, but overall, clearance rates improved, and average bidder numbers followed suit. Market sentiment was influenced by the rise in listings and the easing of interest rates, which generated more urgency among buyer pools. Local salespeople cautiously predict that the market will remain relatively stable over the next few months as sales numbers hopefully increase. They also encourage agents to focus diligently on their current listings rather than pursuing newer stock.”

The current median Days to Sell of 58 days is more than the 10-year average for February which is 48 days. There are 15 weeks of inventory in February 2025 which is 4 weeks more than last year.

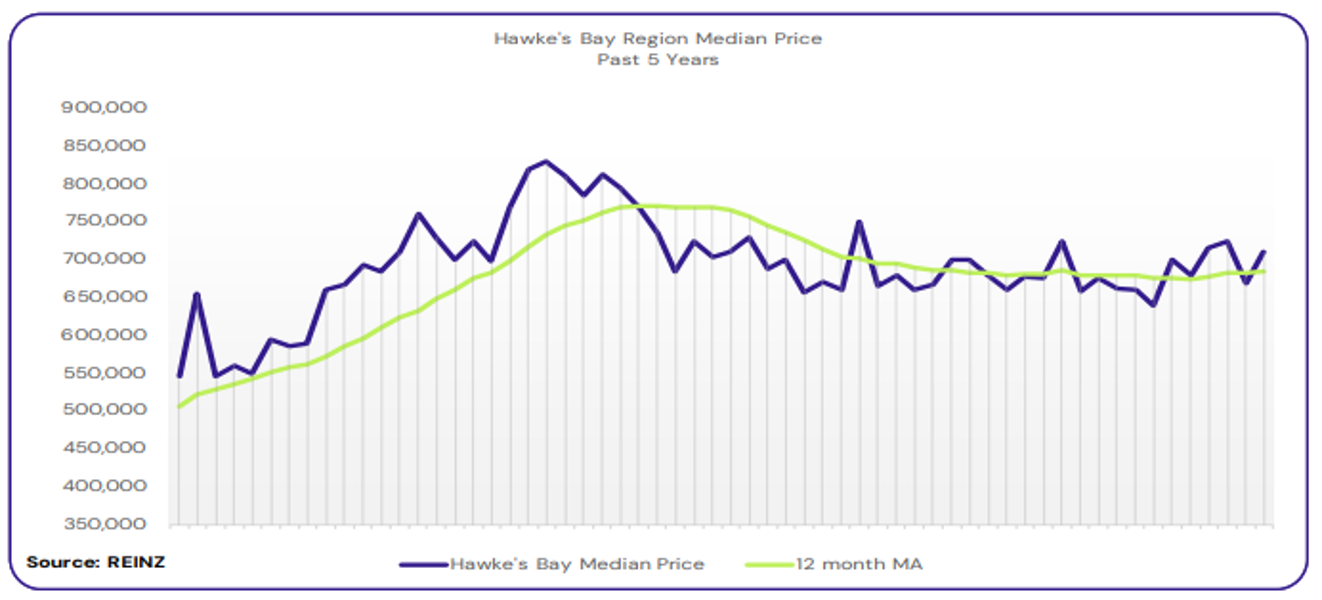

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 5.2% year-on-year to $710,000

“First home buyers and owner-occupiers were the most active buyer group. There’s been a general uptick across all buyers as conditions become favourable for purchases regarding finance. Vendor expectations continued to be steadily realistic, meeting market expectations. Attendance at open homes was good, although there was slow traffic through properties where buyers saw no initial value.

Auction activity was good, especially in properties that had good improvement potential. The OCR announcement influenced market sentiment positively, resulting in increased sales and buyer activity, although still at off–peak values. Local salespeople are cautiously optimistic that as interest rates continue to ease, buyer affordability will improve, expecting increases in sales and further activity from investors.” (REINZ)

The current median Days to Sell of 58 days is much more than the 10-year average for February which is 42 days. There were 18 weeks of inventory in February 2025 which is 2 weeks less than the same time last year.

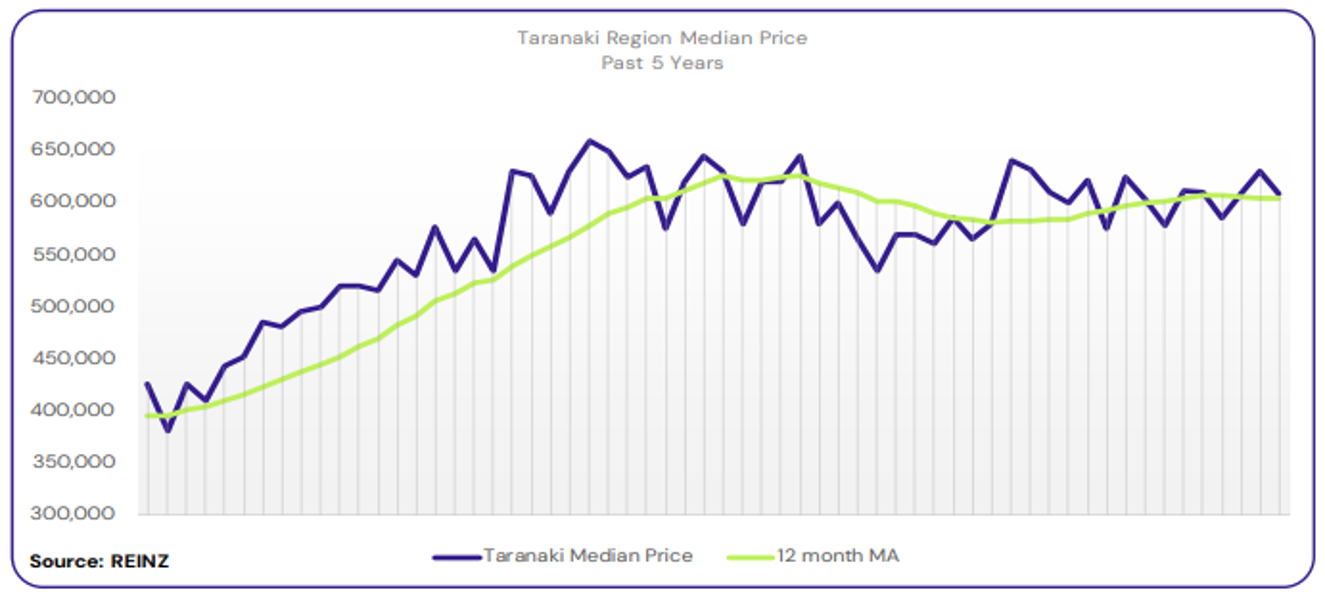

Regional Analysis - Taranaki

Taranaki’s median price decreased by 0.3% year-on-year to $608,000

“All buyer types were active in Taranaki, but owneroccupiers were the most active out of the group. Investor activity continues to rise. Some vendors have increased their expectations, but most understand that higher prices can take longer in this market. Open homes were well attended, with some agents opting for twilight mid-week open homes, which were popular.

Multi-offers were popular, and buyers begun to feel the heat from the competition, which influenced market sentiment. Interest rates easing, OCR reduction, increased listings, and buyer positivity also influenced market sentiment. Local agents predict that there will be more activity across all buyer groups over the next three months.” (REINZ)

The current median Days to Sell of 40 days is less than the 10-year average for February which is 41 days. There were 20 weeks of inventory in February 2025 which is 1 week less than the same time last year.

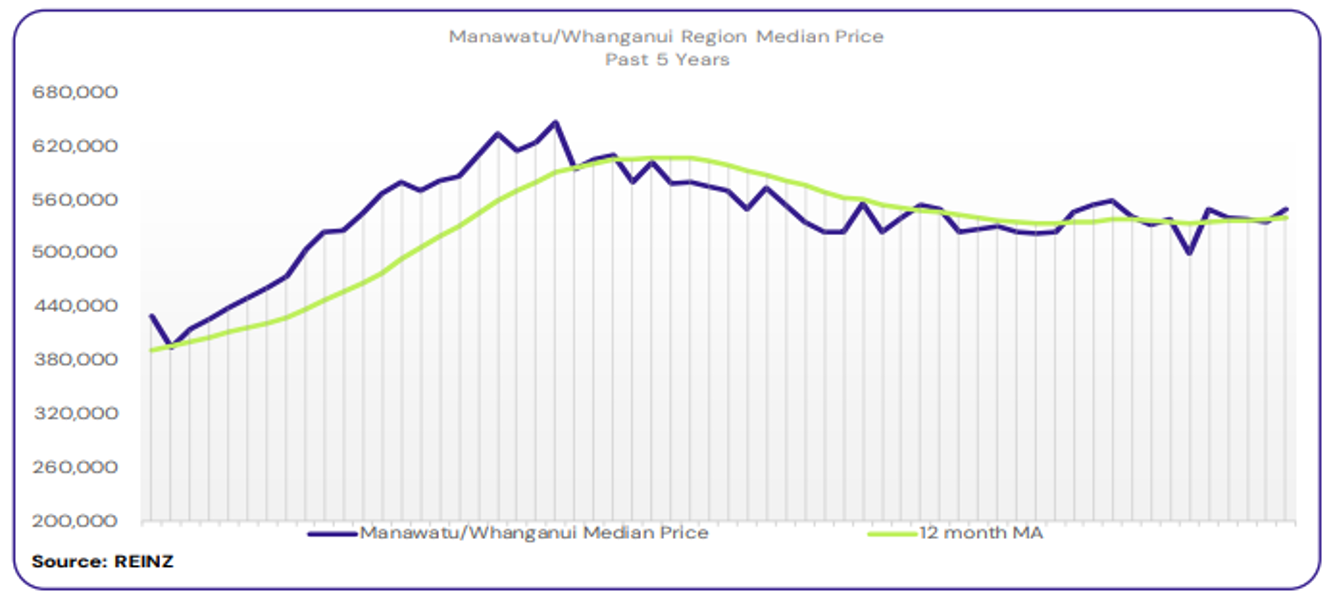

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased by 4.8% year-on-year to $550,000

“Owner-occupiers were the most active buyer group, with increased activity from first home buyers and investors. Overseas buyers were non-existent in the local market. Some vendors were still reluctant to meet market expectations. While new properties that hit the market initially attract good attendance, listings that have been on the market a while have fewer viewers.

There were reports of auction success stories, although buyers were reluctant to attend auctions in general. Sales counts increased and there were certainly signs of green shoots. Increased optimism, easing interest rates, job security concerns, the cost of living, and the country’s current economic state impacted market sentiment. Local agents report that their local market is transitioning to a more balanced market, but this may take a while to show.” (REINZ)

The current median Days to Sell of 57 days is less than the 10-year average for February which is 42 days. There were 21 weeks of inventory in February 2025 which is 1 week less than the same time last year

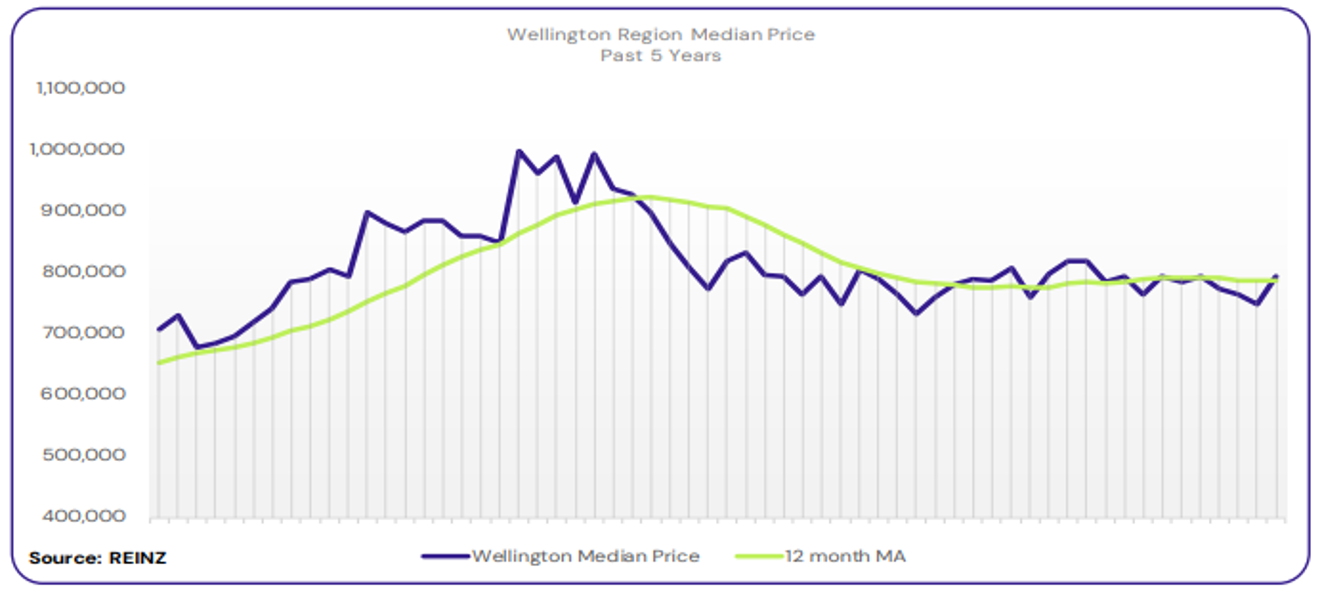

Regional Analysis - Wellington

Wellington’s median price decreased by 0.5% year-on-year to $795,000

“First home buyers were the most active in Wellington, with investors selling their investment properties due to local rate increases. Most vendors believed that as interest rates had eased, their property values would increase, which wasn’t the case. Attendance at open homes were average around the region, most were seeking private viewings.

Market sentiment was influenced by investor activity, interest rate easing and vendors holding off on putting their property on the market. Local salespeople predict there may still be many more investors selling their properties in the coming months due to the high supply of new builds and the drop in rent prices, which is all competition pushing them to sell.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for February of 39 days. There were 15 weeks of inventory in February 2025 which is 2 weeks more than the same time last year.

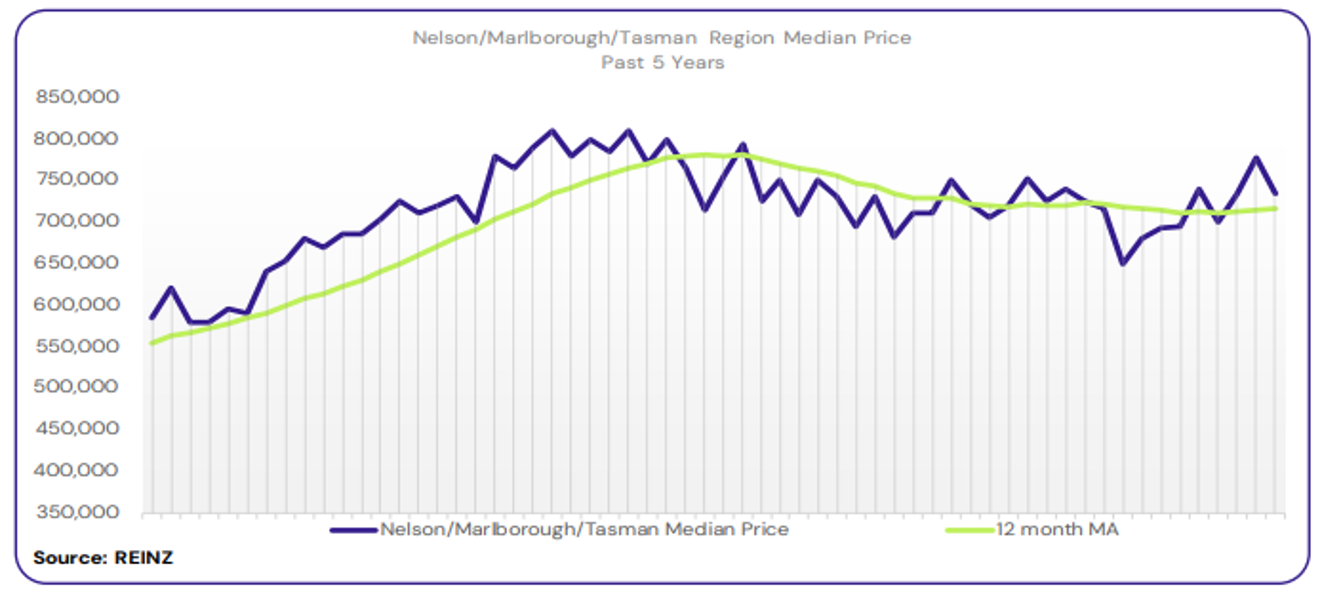

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased by 2.4% year-on-year to $715,000. The median price for Marlborough decreased by 4.4% year-on-year to $650,000. The median price for Tasman increased by 4.6% year-on-year to $795,000.

“Owner-occupiers and first home buyers were the most active in the market. Most vendors knew they had to be realistic to secure a sale, but it depends on individual reasons for selling. Attendance at open homes was slowly increasing over the month. There has been more auction presence across the region, and the vendors meeting market levels were selling under the hammer.

Factors like increased stock levels, employment concerns, and interest rates influenced market sentiment. However, local agents report that the local market is slowly becoming more balanced and cautiously predict this will continue over the next few months.” (REINZ)

The current median Days to Sell of 50 days is more than the 10-year average for February which is 43 days. There were 24 weeks of inventory in February 2025 which is 6 weeks less than the same time last year.

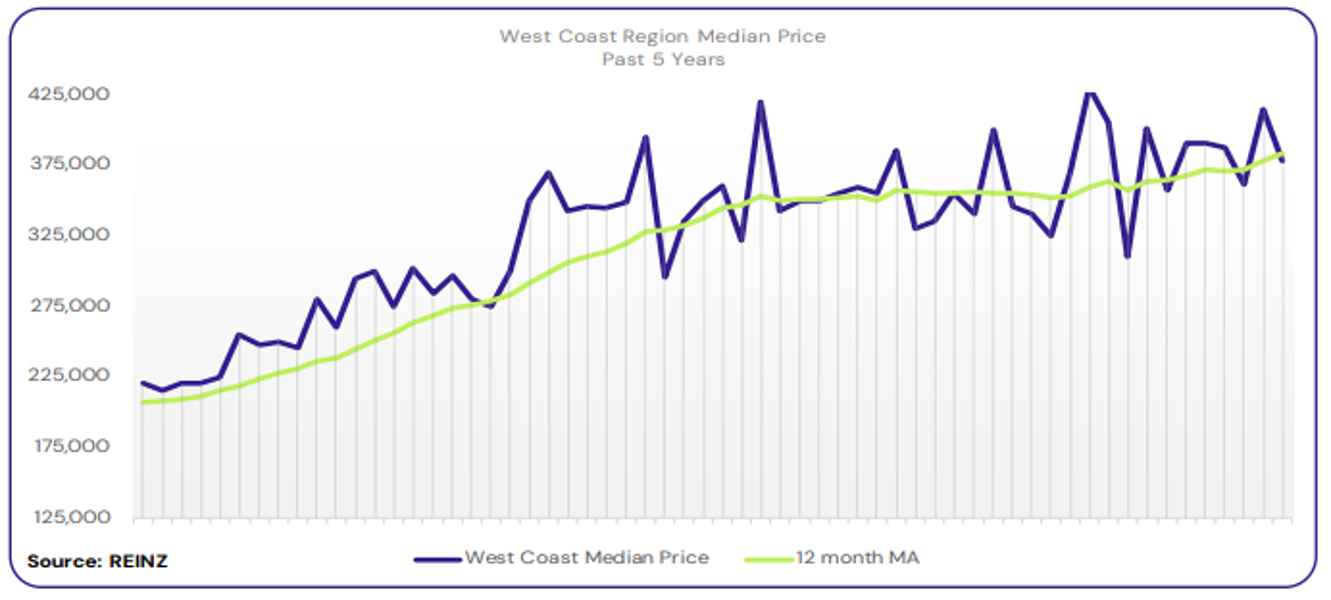

Regional Analysis - West Coast

West Coast’s median price increased by 16.2% year-on-year to $377,500

“Owner-occupiers and first home buyers were most active. Vendor expectations were realistic, as there was an increase in new properties on the market. Attendance at open homes was steady, the same as in previous months. The West Coast market remained positive, with interest rates easing, more listings, and buyers taking advantage of the influx of listings, all of which have influenced market sentiment.

Local agents are cautiously optimistic that the market will remain much of the same in the region over the next few months. With several key mining projects getting the green light, local salespeople say this will give much needed confidence to buyers and investors alike.” (REINZ)

The current median Days to Sell of 55 days is much less than the 10-year average for February which is 66 days. There were 42 weeks of inventory in February 2025 which is 11 weeks less than the same time last year

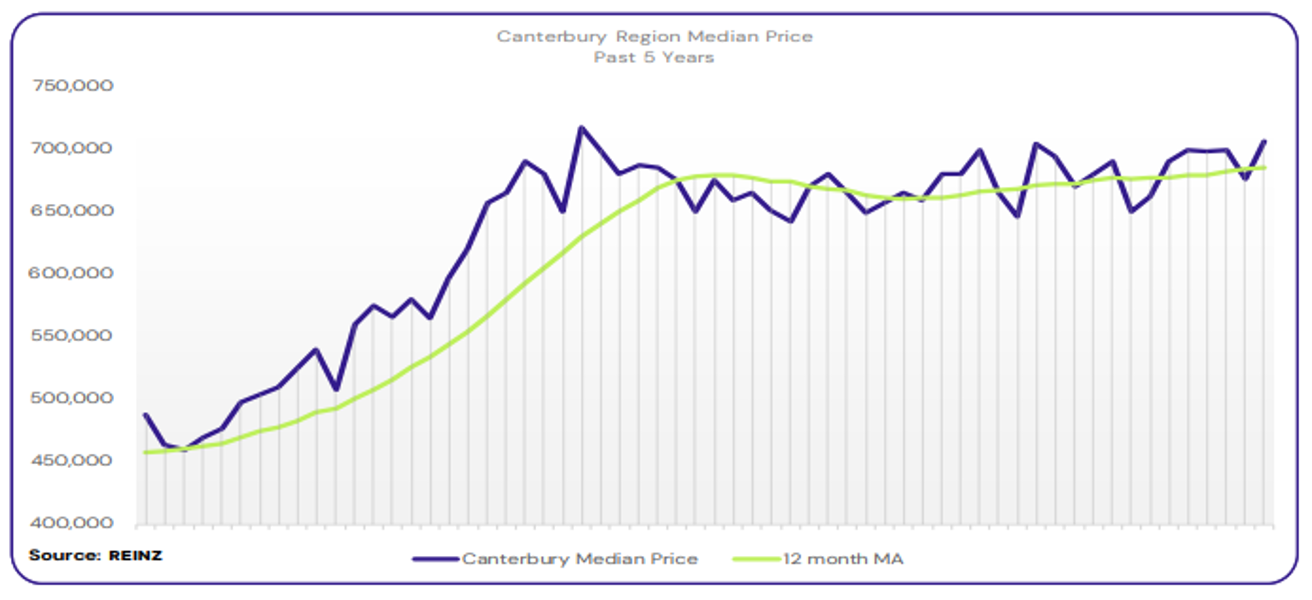

Regional Analysis - Canterbury

The median price for Canterbury increased by 0.3% year-on-year to 707,000

“All buyer types were active across the region. Some vendors hoped to see price increases, but most were realistic about price expectations and were not far off market conditions. Attendance at open homes varied across the region, with patchy numbers depending on the property in Ashburton, but everywhere else saw substantial attendee numbers.

Factors such as easing interest rates, heightened optimism, and increased activity have impacted market sentiment. Local salespeople cautiously anticipate in the coming months that there will be a larger pool of buyers, thanks to easing interest rates, to help move many properties for sale.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for February which is 43 days. There were 17 weeks of inventory in February 2025 which is the same as the same time last year.

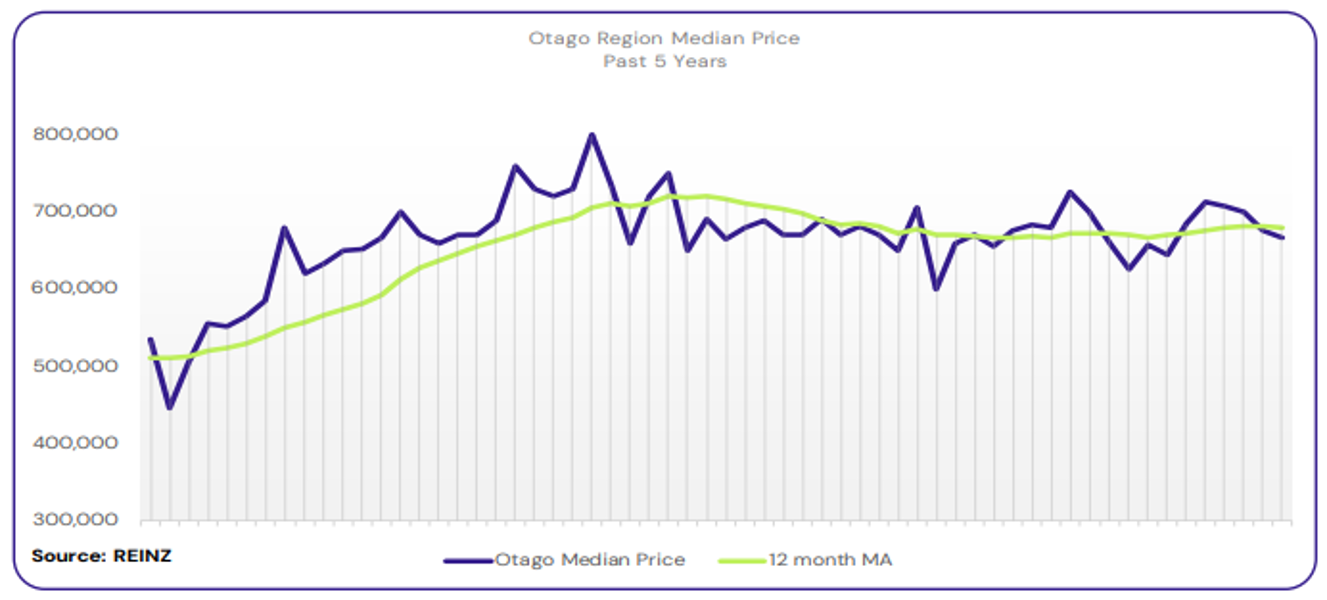

Regional Analysis - Otago

“Dunedin’s median price increased by 3.7% year-on-year to $617,000

All buyer types were active. However, they weren’t as active as in previous months. While prices have adjusted recently, some vendor expectations continue to vary from optimistic to meeting the market. Attendance at open homes around the region was fantastic. Auctions were not a popular sales method due to the lack of unconditional buyers—most who attended signed post-auction contracts with conditions.

Factors like increased stock, increased days to sell, the cost of living, inflation, declining property prices, and buyer affordability influenced market sentiment. Local salespeople predict a drop in the market before it balances in late autumn.” (REINZ)

Queenstown Lakes

“First home buyers still dominate the Central Lakes market. Vendor expectations were similar to last month; vendors were willing to negotiate but started with higher expectations, not realising that their first offer is usually the best. Open homes were well attended for properties around the $1-2 million mark. Bridging the gap between vendors and buyers at auctions is still tricky and proves to be a challenge. Buyers have choices and are generally happy to move onto another property if their first choice isn’t a success.

Affordability, lack of confidence, cost of land and cost of building influenced market sentiment. Local salespeople state that a changing market is always challenging; as buyers chase the best deal from the bank, they’re also chasing the best deal in the market. They hope the market conditions will improve over the next few months.” (REINZ)

The current median Days to Sell of 51 days is much more than the 10-year average for February which is 41 days. There were 20 weeks of inventory in February 2025 which is 4 weeks more than the same time last year.

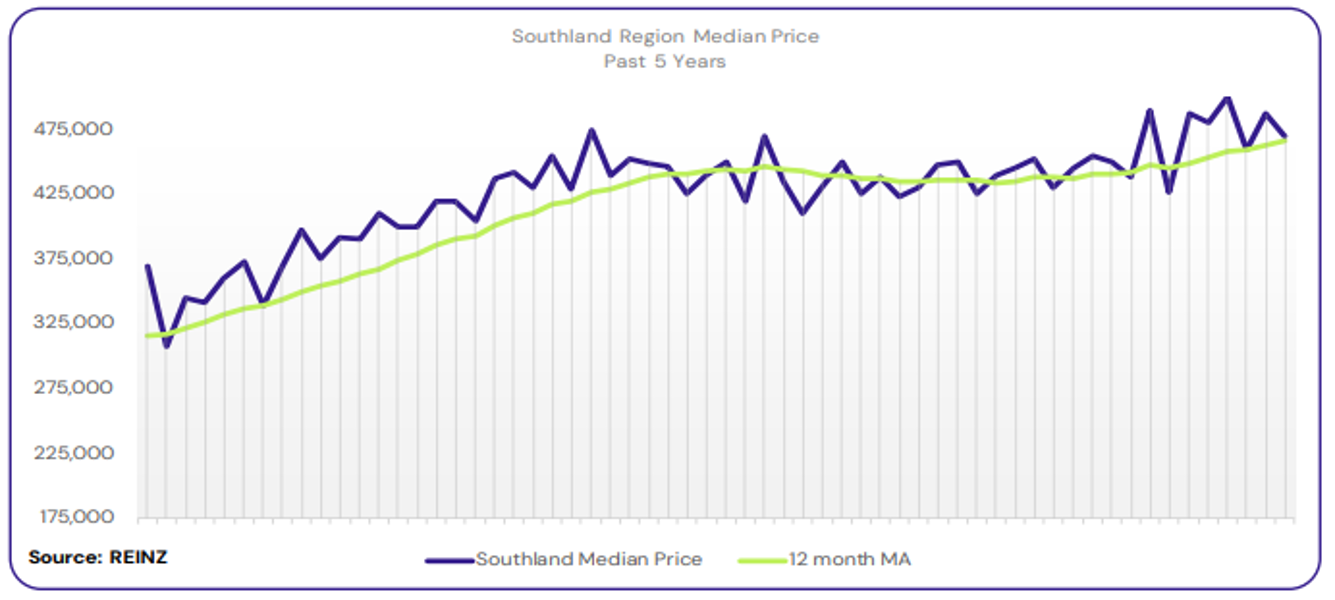

Regional Analysis - Southland

The median price for Southland increased by 9.2% year-on-year to $470,000

“First-home buyers and investors were the most active buyers. With an increase in the number of properties for sale, vendors were aware that buyers have choices and understand that they need to meet the market. New properties on the market had great attendance numbers at open homes, especially for homes under $550K.

Steady results were reported for properties sold under the hammer, with vendors more motivated to achieve results during the marketing campaign. Factors like stock levels, the local economy, and affordability influenced market sentiment. Local salespeople predict the suggested interest rate outlook and their local market conditions; they cautiously anticipate a favourable demand for properties.”

The current median Days to Sell of 42 days is more than the 10-year average for February which is 38 days. There were 17 weeks of inventory in February 2025 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.