Early signs of returning confidence as sales volumes rise in the regions - REINZ stats May 2023

Thursday, 15 June 2023

Early signs of returning confidence as sales volumes rise in the regions.

The Real Estate Institute of New Zealand (REINZ) reported that while some parts of the country experienced an increase in sales, others continued to face slower market conditions.

The easing of loan-to-value restrictions and stabilizing interest rates have brought about some positivity, particularly in the regions. However, high interest rates and economic uncertainties are still influencing buyer behavior, leading to cautiousness in the market. Median prices showed a slower rate of decline, and sales counts marginally decreased compared to the same period last year.

Several regions saw an increase in sales counts, indicating a returning market confidence. Nationally, the median price decreased year-on-year, while the median days to sell increased. Some districts, such as Nelson and the West Coast, witnessed median price increases, while Grey District and Waitomo District reached record median prices.

Inventory levels appeared to stabilize, with a slight increase in stock, potentially signaling a shift in the supply-demand balance.

Although the total number of properties sold decreased year-on-year, there was a significant increase in sales volumes compared to the previous month in several regions. REINZ also noted that sellers were generally meeting the market, but some were holding off on selling at higher prices.

The easing of loan-to-value restrictions and renewed confidence have motivated more first-time homebuyers to explore opportunities. Overall, the REINZ House Price Index indicated a decrease in residential property values nationwide.

Regional highlights

- Nelson saw increases in median sale price to $770,000.

- Auckland had a 10.4% decrease in the median sale price May April year-on-year and stayed under the $1m price point to $995,000.

- Seven regions had an increase in sales counts: Northland, Auckland, Waikato, Wellington and Tasman, Marlborough and Southland. Marlborough (-14) and Northland (-13) had a decrease in days to sell to 49 and 60 respectively month-on-month.

Regional Analysis - Northland

In Northland median prices decreased 2.1% year-on-year to $715,000.

“Local salespeople report more engagement from prospective purchasers trying to enter the market at the ‘right’ time to buy. Owner-occupiers remain the most active buyer pool, but the presence of first-home buyers is beginning to increase.

“Aligned with the past few months, vendors are aware of the market conditions and have been adjusting their price expectations accordingly — however, there are still a handful of vendors out there who are adamant the market will reach their price expectations succeeding the election.

“As interest rates stabilise, Northland agents predict an increase in confidence for those looking to enter the market.” (REINZ)

The current median days to sell of 60 days is more than the 10-year average for May which is 51 days. There were 47 weeks of inventory in May 2023 which is 18 weeks more than the same time last year.

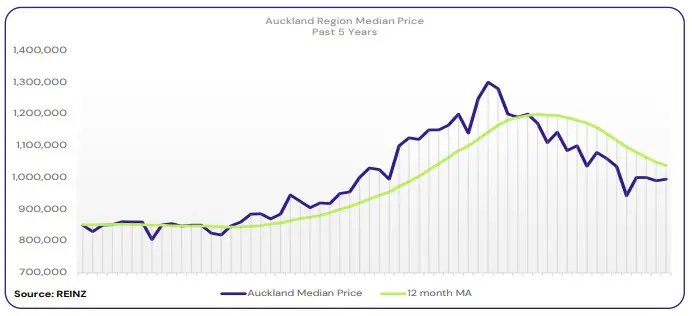

Regional Analysis - Auckland

Auckland’s median price eased by 10.4% annually to $995,000.

“Across Auckland, buyer activity has been light. Local salespeople say this is largely due to general economic conditions, the weather, and the anticipation of the upcoming election later in the year. In South Auckland, the number of first-home buyers increased due to the easing of loan-to-value restrictions, and assistance from Kainga Ora.

“Many vendors are still finding it difficult to adjust their price expectations and open homes have had an uptick in numbers in most parts of Auckland, weather permitting.

“Auckland salespeople stay hopeful that the recent changes to loan-to-value restrictions and stabilising interest rates will have a positive impact on market activity soon.” (REINZ)

The current median days to sell of 46 days is more than the 10-year average for May which is 40 days. There were 28 weeks of inventory in May 2023 which is 4 weeks more than the same time last year.

Regional Analysis - Waikato

The median price in the Waikato is down 7.5% year-on-year to $740,000. The Waitomo District reached a new record median of $655,000.

“While owner-occupiers were a dominant buyer pool, there was a notable increase of first home buyers showing interest. Open home attendance improved from last month in Hamilton and Taupo, but for the Coromandel, some roads are still not operational following Cyclone Gabrielle — impacting access to the region and the numbers at open homes.

“The market is still largely impacted by our economic climate, interest rates, and ongoing impacts of the weather, however, there are signs of improvement. In Taupo, local salespeople say there has been a higher level of certainty in the market. There is less fear of further rises to interest rates, buyers are more willing to engage and the imbalance between buyers and sellers is beginning to shift.” (REINZ)

The current median days to sell of 53 days is more than the 10-year average for May which is 44 days. There were 27 weeks of inventory in May 2023 which is 4 weeks more than the same time last year.

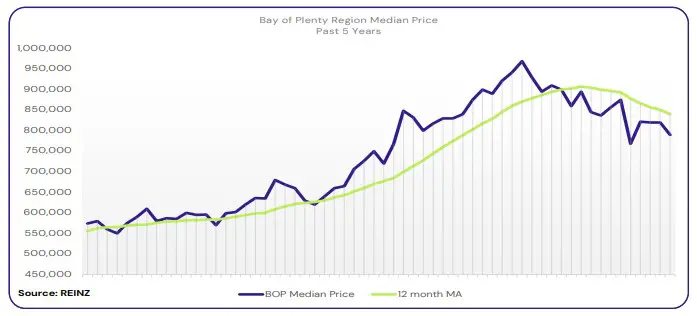

Regional Analysis - Bay of Plenty

The median price in the Bay of Plenty decreased 13.2% year-on-year to $790,000 in May.

“Across the region, buyers are reluctant to overpay and continue to feel uncertain about interest rates. Many buyers are tending to wait out their options until after the election.

“Vendors are taking their time to adjust to realistic price expectations, especially those that purchased their property in the peak of the market.” (REINZ)

The current median days to sell of 56 days is more than the 10-year average for May which is 48 days. There were 22 weeks of inventory in May 2023 which is 1 week less than the same time last year.

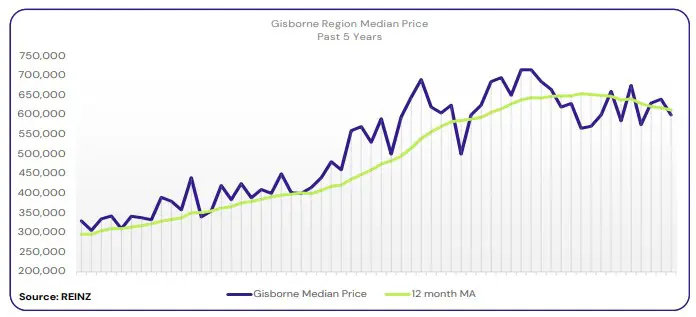

Regional Analysis - Gisborne

Gisborne’s median price decreased 9.8% annually to $600,000. Owner occupiers were the most active buyer pool, but across the region all buyer activity was light.

“Rising interest rates, cost of living and a fear of overpaying is continuing to impact Gisborne’s market. Sales counts were down 46.8% year-on-year — seeing only 25 sales take place in the region over May.” (REINZ)

The current median days to sell of 44 days is less than the 10-year average for May which is 45 days. There are 10 weeks of inventory in May 2023 which is 6 weeks less than last year.

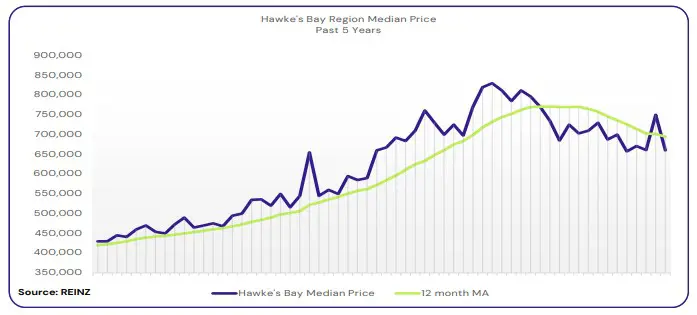

Regional Analysis - Hawke's Bay

The median price in Hawke’s Bay is down 10.2% on this time last year to $660,000.

“First home buyers were the most active buyer pool over May with many wanting to take advantage of refreshed opportunities. Open home attendance has been on the rise and vendors are more realistic in their price expectations.

“Local salespeople expect a higher volume of market activity after the election.” (REINZ)

The current median days to sell of 50 days is more than the 10-year average for May which is 43 days. There were 16 weeks of inventory in May 2023 which is 6 weeks less than the same time last year.

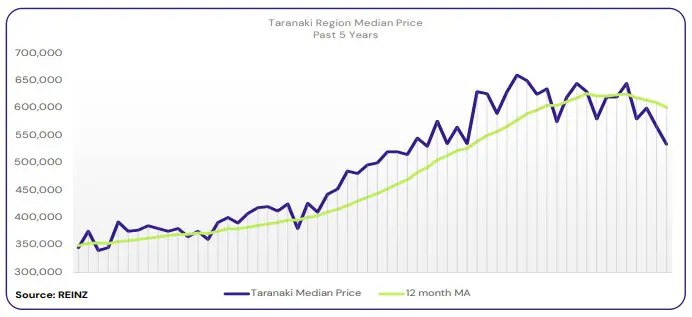

Regional Analysis - Taranaki

Median prices in Taranaki decreased 15.9% annually to $534,000.

“Owner-occupiers continue to be the most active buyers in Taranaki. There was an increase in open home viewings by first-home buyers towards the end of May following the Reserve Bank’s announcement of changing loan-to-value restrictions. However, this doesn’t appear to have influenced sales counts yet which are down 21.5% year-on-year.

“Buyers are not feeling any pressure to decide fast, and as a result, the median Days to Sell has increased by 17 days when compared to last May. Taranaki salespeople expect this slower market pace to continue throughout winter.” (REINZ)

The current median days to sell of 55 days is much more than the 10-year average for May which is 4 days. There were 21 weeks of inventory in May 2023 which is 8 weeks more than the same time last year.

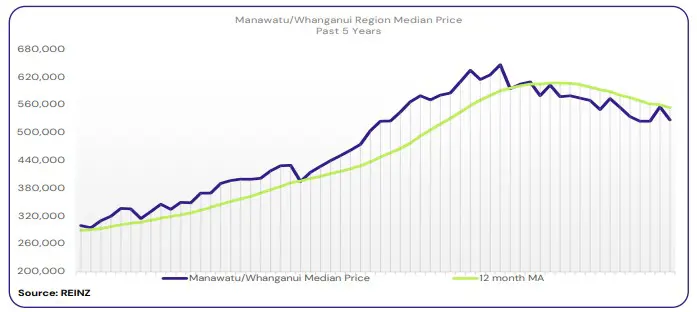

Regional Analysis - Manawatu/Whanganui

Manawatu/Whanganui’s median price decreased 12.4% when compared to May last year, to $528,000.

“First-home buyers have been looking for more opportunities whilst investors remain largely absent. Some vendors are still holding unattainable price expectations seeing some leave the market altogether.

“Properties that are priced to meet the current market are acquiring reasonable open home attendance, but properties that have been on the market for a while are not.

“Buyers are continuing to struggle with lending criteria, rising interest rates, the seasonal winter market, and cost of living. Local salespeople say there are quite a few hurdles to overcome yet.” (REINZ)

The current median days to sell of 54 days is much more than the 10-year average for May which is 43 days. There were 22 weeks of inventory in May 2023 which is the same as the same time last year.

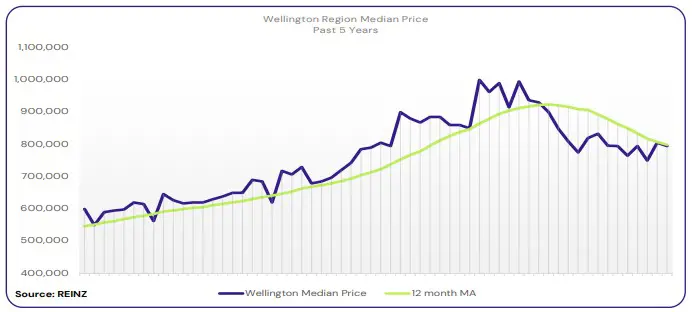

Regional Analysis - Wellington

Median prices in Wellington eased by 11.7% year-on-year to $795,000.

“Unlike in previous months, first-home buyers are actively back in the market seeking out opportunities. Investors are still sparse and attendance at open homes varied over May.

“The most significant impact on Wellington’s market has been uncertainty of prices and whether they will continue to ease. However, the capital did see a notable increase in its sales count year on year — up 24.6% on May 2022.

“Due to winter and anticipation of the election, Wellington salespeople expect the market to remain quiet for a while longer.” (REINZ)

The current median days to sell of 54 days is much more than the 10-year average for May of 40 days. There were 14 weeks of inventory in May 2023 which is 6 weeks less than the same time last year.

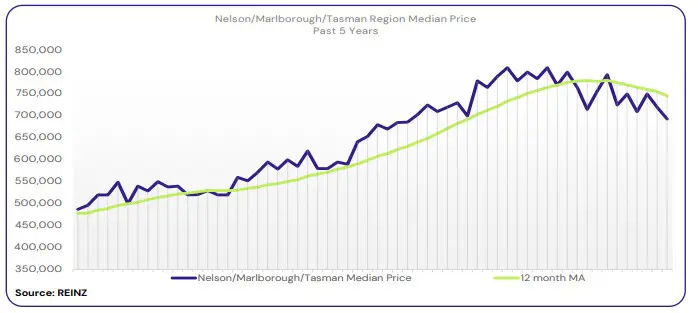

Regional Analysis - Nelson/Marlborough

Median prices in Nelson increased by 2.7% year-on-year to $770,000 in May — the only region to see an increase in its median price this month.

“In Marlborough and Tasman, median prices decreased by 6.8% and 12.9% to $635,000 and $745,000 respectively.

“Across all three regions, there was a mix of owner occupiers and first home buyers active in the market. Investors continue to shy away despite the recent announcement of tweaks to the loan-to-value criteria.

“Interest rates remain a concern of most buyers and vendors which has impacted confidence and ability to enter the market. Local salespeople say the market has remained static with some vendors still reluctant to come to market due to their price expectations above the threshold of what most buyers are willing to pay.” (REINZ)

The current median days to sell of 58 days is much more than the 10-year average for May which is 41 days. There were 23 weeks of inventory in May 2023 which is 8 weeks more than the same time last year.

Regional Analysis - West Coast

The median price in the West Coast was down 6.3% in May to $370,000.

“The cold and bleak weather conditions over May saw fewer people venture outside to open home viewings, but online enquiries continue to show there are a strong number of prospective buyers interested in entering the market.

“West Coast salespeople say the confirmation of a large new project at the Westland Milk Products factory in Hokitika bodes well for the southern part of the region in terms of employment opportunities and buyer interest. West Coast salespeople hope this increased level of confidence will flow through to the northern part of the region.” (REINZ)

The current median days to sell of 54 days is much less than the 10-year average for May which is 74 days. There were 31 weeks of inventory in May 2023 which is 6 weeks more than the same time last year.

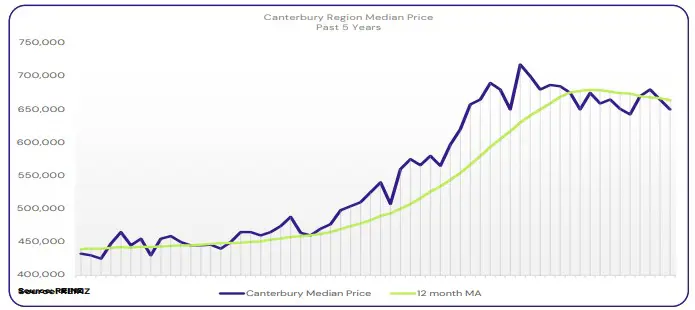

Regional Analysis - Canterbury

The median price in Canterbury decreased 5.4% to $650,000 in May.

“Across Ashburton and Christchurch, owner-occupiers were the most active buyer pool — particularly those upsizing or downsizing. In Timaru, first-home buyers were the leading buyer group — however, they are also the most cautious to commit.

“Economic uncertainty remains top of mind; although, Canterbury salespeople say they are seeing green shoots emerging: more appraisals, more vendors assessing their options, and more buyers deciding to just ‘get on with it.’ In Christchurch, there has been solid activity on properties that pass in at auction with buyer enquiry ensuing following the auction. A key concern of buyers is still paying too much.

“The arrival of winter tends to slow the market down further and coupled with a looming election, local agents expect this to just be the case.” (REINZ)

The current median days to sell of 43 days is more than the 10-year average for May which is 38 days. There were 17 weeks of inventory in May 2023 which is 4 weeks more than the same time last year.

Regional Analysis - Otago

Dunedin City: “Dunedin’s median price decreased 11.7% year-on-year to $565,000 in May. Owner occupiers are the most active buyer pool, but with loan-to-value restrictions now easing, first home buyers are beginning to show more interest.”

“Economic uncertainty and rising interest rates continue to remain a barrier to entering the market. As a result, sales counts decreased by 5.5% year-on-year this May. A quieter market cycle is anticipated to stick around for a while longer until after October’s election.” (REINZ)

Queenstown Lakes: “Most vendors are prepared to meet the market when they are committed and motivated to sell. There has been a recent upturn in buyer interest, mainly from the North Island.” (REINZ)

The current median days to sell of 57 days is much more than the 10-year average for May which is 40 days. There were 17 weeks of inventory in May2023 which is the same as the same time last year.

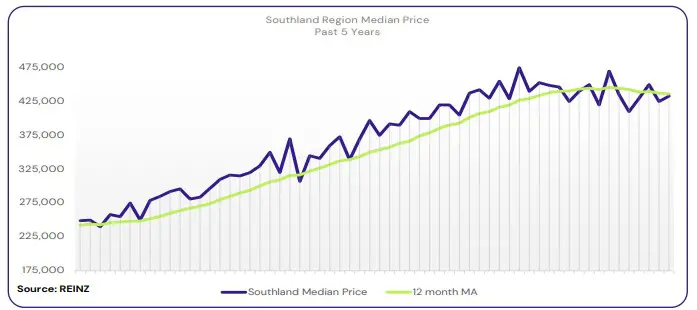

Regional Analysis - Southland

Southland’s median price decreased marginally by 3.6% year-on-year to $433,000.

“First-home buyers are making a comeback and there are early signs of investors edging their way back into the market too — partly due to the recently announced changes to the loan-to-value restrictions.

“Open home attendance is on the rise under the expectation that the market may have reached its low point. Vendors are tending to meet the market or are deciding to not list at all.” (REINZ)

The current median days to sell of 50 days is more than the 10-year average for May which is 41 days. There were 18 weeks of inventory in May 2023 which is 4 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.