Activity Heats Up While Prices Remain Cool - REINZ stats November 2024

Tuesday, 17 December 2024

As we dive into Summer, market activity rises as the New Zealand property market experiences a wave of confidence.

Buyers are showing increased interest, spurred by the recent reduction in the Official Cash Rate (OCR), prompting more transactions nationwide. At the same time, fewer sellers are bringing their property to market, which is reflected in the nationwide decline in property listings.

"There’s been a shift in market sentiment nationwide in November. After a challenging year, recent data indicates promising signs of increased activity, which we hope will continue into 2025. This is a good time to make transactions, as prices remain stable, and interest rates decrease.” says Baird. Nationwide, sales rose by 10.8% compared to November 2023. In New Zealand, excluding Auckland, sales increased by 12.9% year-on-year, with notable gains in Gisborne (+55.6%), Hawke’s Bay (+34.4%), and Wellington (+32.3%).

Median prices in New Zealand remained unchanged yea on-year and month-on-month, holding steady at $795,000. Excluding Auckland, the median price saw a slight year-on-year increase of $5,000, rising from $700,000 to $705,000 while remaining stable month-on-month. Nine out of sixteen areas reported an increase in median prices over the past year, with Southland leading the way with a 17.7% from $440,000 to $518,000, a record high for the region and the first time it has recorded a median price over $500K. Gisborne followed with a 13.4% rise year-on-year to $635,000.

“November saw more life in the property market. Buyers are benefiting from steady prices and increasing options, while sellers in many areas are seeing stronger interest,” adds Baird.

Overall, listings nationally increased year-on-year by 3.9% from 10,712 to 11,129, and New Zealand (excluding Auckland) increased by 7.8% from 6,901 to 7,437 compared to November 2023. Eleven out of fifteen regions reported increases in listings compared to last year. The regions with the most significant increases were Southland (+14.5%), the Bay of Plenty (+14.1%), and the West Coast (+13.6%).

For the first time this year, the number of listings in the market decreased compared to the previous month, with a nationwide decline of 3.8% compared to October 2024. Additionally, listings across New Zealand, excluding Auckland, decreased by 0.4% month-on-month.

Inventory levels are rising, with a national increase of 21.3% year-on-year and a 5.1% increase month-on-month, totalling 33,984.

Baird notes, “November marks the first month in a while that we have seen an increase in demand and a slight reduction in new property coming to market. We expect the summer months to bring the usual upswing in sales activity across the market, this year with both buyers and sellers feeling a little more confident”.

In November, there were 1,209 auctions nationally (16.7% of all sales), a decrease from 20.3% in November 2023. The national median days to sell rose by four to 42 days compared to last year; excluding Auckland, it increased by three to 42 days this month.

The House Price Index (HPI) for New Zealand is currently at 3,638, reflecting a year-on-year decrease of 1.4% but a month on-month increase of 0.6%. Over the past five years, the average annual growth rate of New Zealand’s HPI has been approximately 4.6%. However, it is currently 14.9% lower than its peak in 2021. In November 2024, Southland reported the highest HPI movement, reaching an index level of 4,652, which marks a new high for the region.

Regional highlights:

- Gisborne had the largest sales count percentage increase year-on-year, up 55.6% year-on-year from 36 to 56.

- Eleven out of fifteen regions reported increases in listings compared to last year. The regions with the most significant increases were seen in Southland (+14.5%), the Bay of Plenty (+14.1%), and the West Coast (+13.6%).

- Nine of the sixteen regions had a median price increase year-on-year. Southland led the way with a 17.7% increase, reaching a record high of $518,000. This is the first time the region has reached a median price of over $500K.

Regional Analysis - Northland

The median price for Northland increased by 8.1% year-on-year to $730,000

“First home buyers and owner-occupiers were the most active buyer group, with a slight absence of investors in the market as first home buyers were purchasing lower-priced properties. Vendor expectations regarding property prices were aware of current market expectations and adjusted accordingly. However, some vendors expected slightly elevated property prices after the recent OCR decline. Improved attendance at open homes was observed over November, as increased stock and settled weather positively influenced numbers, especially for well-presented new listings.

Auction room attendees increased, and reserve adjustments during auctions assisted in higher sales numbers. Market sentiment was influenced by an increase in buyers, a lift in stock numbers, increased confidence, lower interest rates and buyers and vendors feeling the slow shift toward a favourable vendor market. Local agents feel the market will stay steady, with inquiries and listings to stay strong over the summer. They anticipate a buoyant market into early 2025. (REINZ).

The current median Days to Sell of 57 days is much more than the 10-year average for November which is 47 days. There were 38 weeks of inventory in November 2024 which is 2 weeks less than the same time last year.

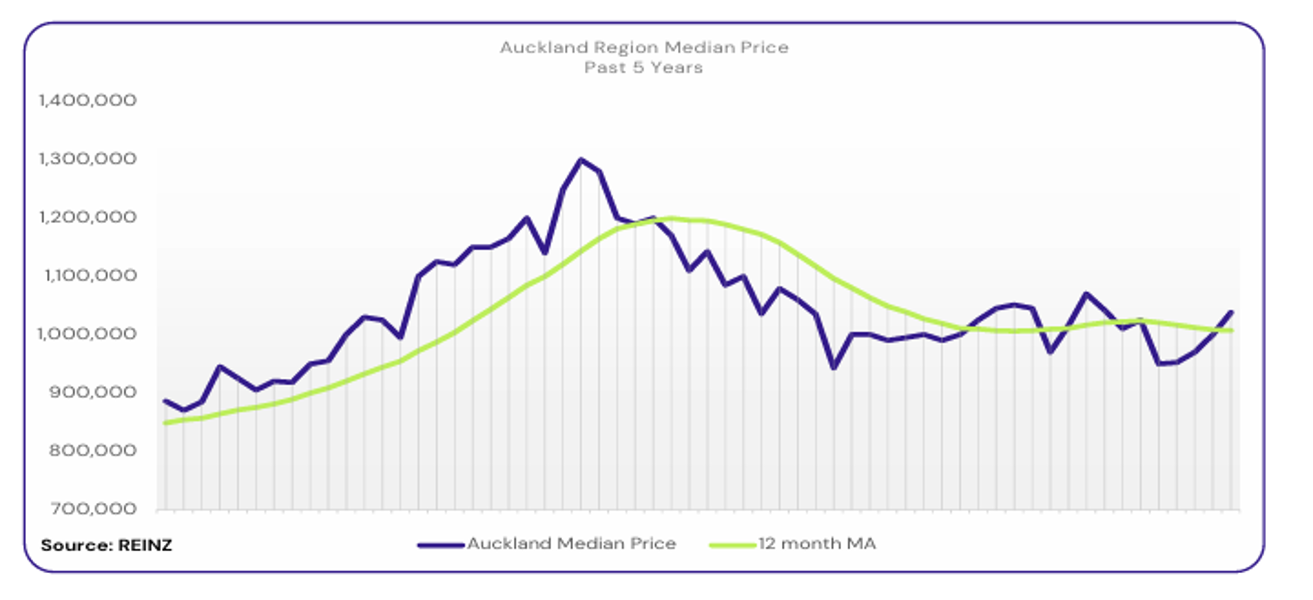

Regional Analysis - Auckland

The median price for Auckland decreased by 1.2% year-on-year to $1,038,000.

“First home buyers and owner-occupiers were the most active in November, with more queries reported from overseas buyers. South Auckland saw a decline in developers. Vendor expectations regarding the asking price were generally realistic, with some vendors wanting a higher price.

Attendance at open homes varied around the region. Auction room attendance and sales under the hammer increased, along with pre-auction offers. Factors like interest rates, bank lending policies, OCR cuts, and increased stock influenced market sentiment. Local agents report the overall market is shifting to be more positive and slowly seeing activity increases. However, they predict a static market over the holiday period.” (REINZ).

The current median Days to Sell of 40 days is more than the 10-year average for November which is 35 days. There were 26 weeks of inventory in November 2024 which is 1 week more than the same time last year.

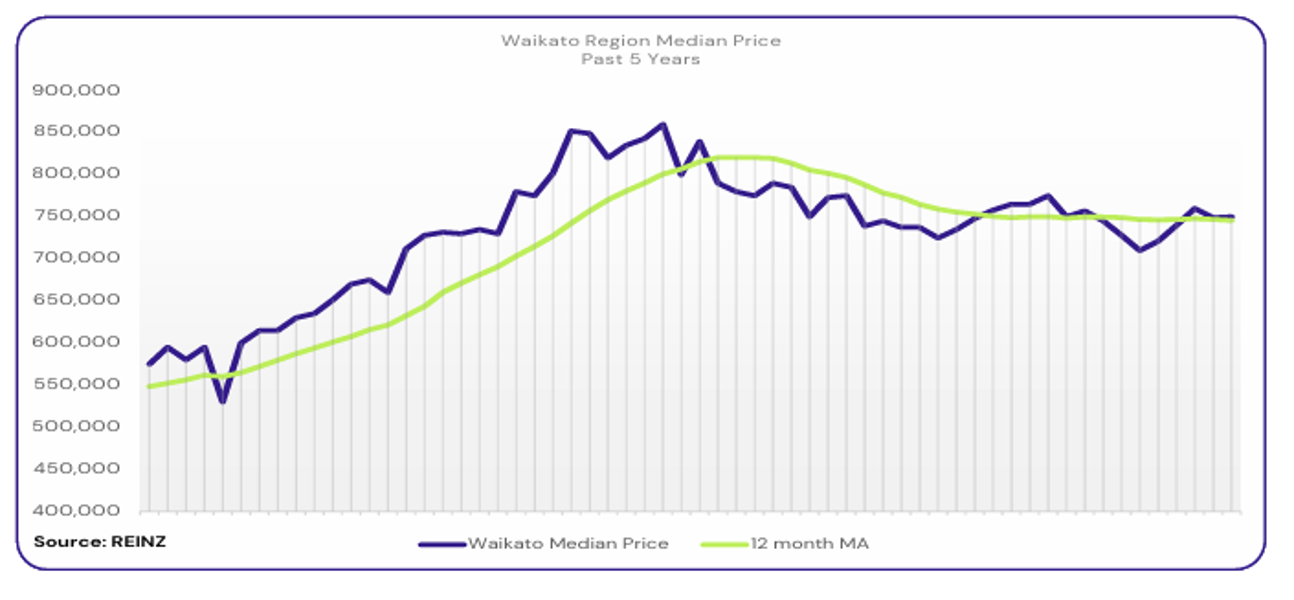

Regional Analysis - Waikato

Waikato’s median price decreased by 2.0% year-on-year to $750,000

“First home buyers and owner-occupiers were the most active buyer groups, with increases from investors coming through. A slight decrease in demand for lifestyle properties was noted in Taupo. Most vendors were realistic in terms of asking price. Due to increased activity, the comparison sales data was good. Other vendors saw the decline in interest rates as a sign that prices would trend upward quickly.

Attendance at open homes varied regionally but generally saw 1-4 groups each week. Auction attendance levels remained consistent throughout the month, and clearance rates increased as more properties were listed by auction. Factors like the OCR drop, lower interest rates and increased sales activity influenced market sentiment. Local agents report that the market will likely quieten throughout December, although they are hopeful that January and February will bring increased open home numbers, higher enquiries, and high sales activity for the region.” (REINZ).

The current median Days to Sell of 45 days is more than the 10-year average for November which is 37 days. There were 23 weeks of inventory in November 2024 which is 1 week less than the same time last year.

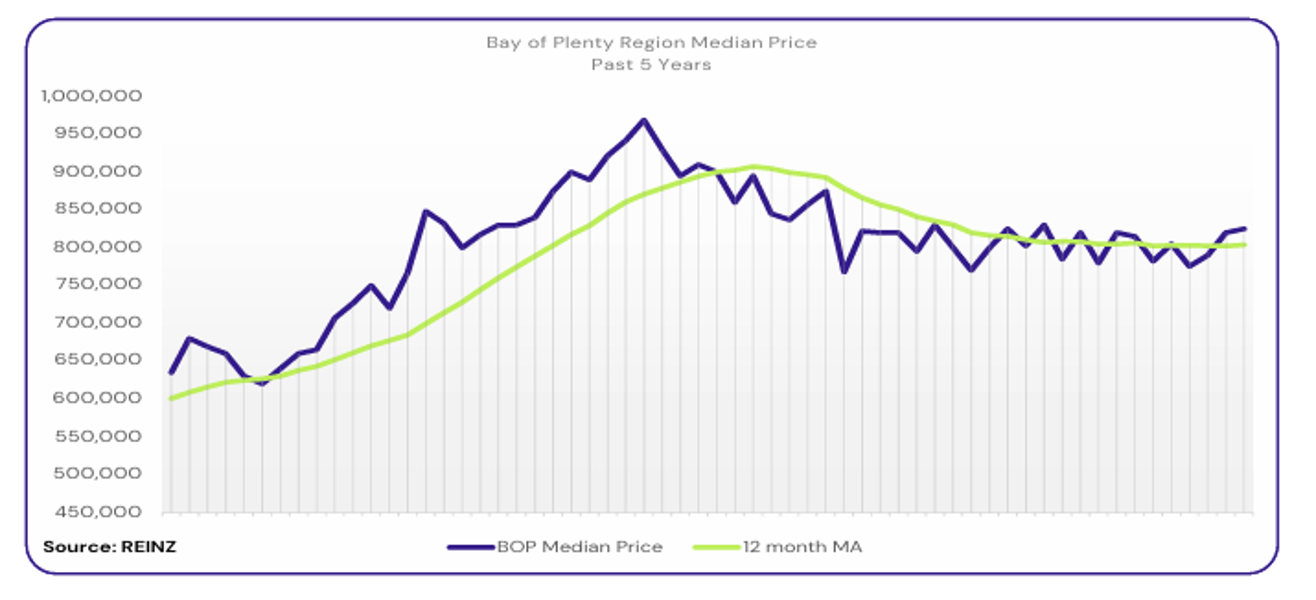

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased by 2.8% to $825,000

“First home buyers, owner-occupiers and investors were the most active buyer groups across the region. Vendors had realistic expectations regarding their asking prices, while those with unrealistic expectations saw properties selling around them and wondered why their own property wasn’t selling. This generally led to a price correction.

Attendance at open homes increased due to lower interest rates and the warmer season. Auction room attendance increased retrospectively, with many properties sold under the hammer, too. Market sentiment was influenced by increased buyer activity, increased stock, and investors’ return to the market. However, vendors receiving early offers in their campaign were concerned they missed out on better opportunities.

Local agents describe their local market as “positive without panic.” Recent interest rate drops gave many a renewed sense of confidence. Local salespeople predict increased market activity will be in February and March 2025.” (REINZ).

The current median Days to Sell of 47 days is more than the 10-year average for November which is 39 days. There were 24 weeks of inventory in November 2024 which is 1 week less than the same time last year.

Regional Analysis - Gisborne

Gisborne’s median price increased by 13.4% year-on-year to $635,000

“Investors and owner-occupiers were the most active buyer groups in November, with a notable absence from the midrange buyer group. Vendors were still realistic with their price expectations for their property; an increase in sales count backs this. Attendance at open homes varied across the region. Buyers were keenly watching what the banks do with interest rates.

The auction sales method was still popular, with an increased number of auctions brought forward. Local salespeople report increased sales count, which they say has been due to the shift in interest rates and still a good amount of stock available. Local agents reported that their market was looking positive, with some seeing pre-auction offers within the first 24 hours of the property hitting the market. However, they predict December numbers will be quite light, as usual, but heading into 2025, there are indicators that it will be a busy summer season ahead.” (REINZ).

The current median Days to Sell of 45 days is more than the 10-year average for November which is 37 days. There are 13 weeks of inventory in November 2024 which is 2 weeks more than last year.

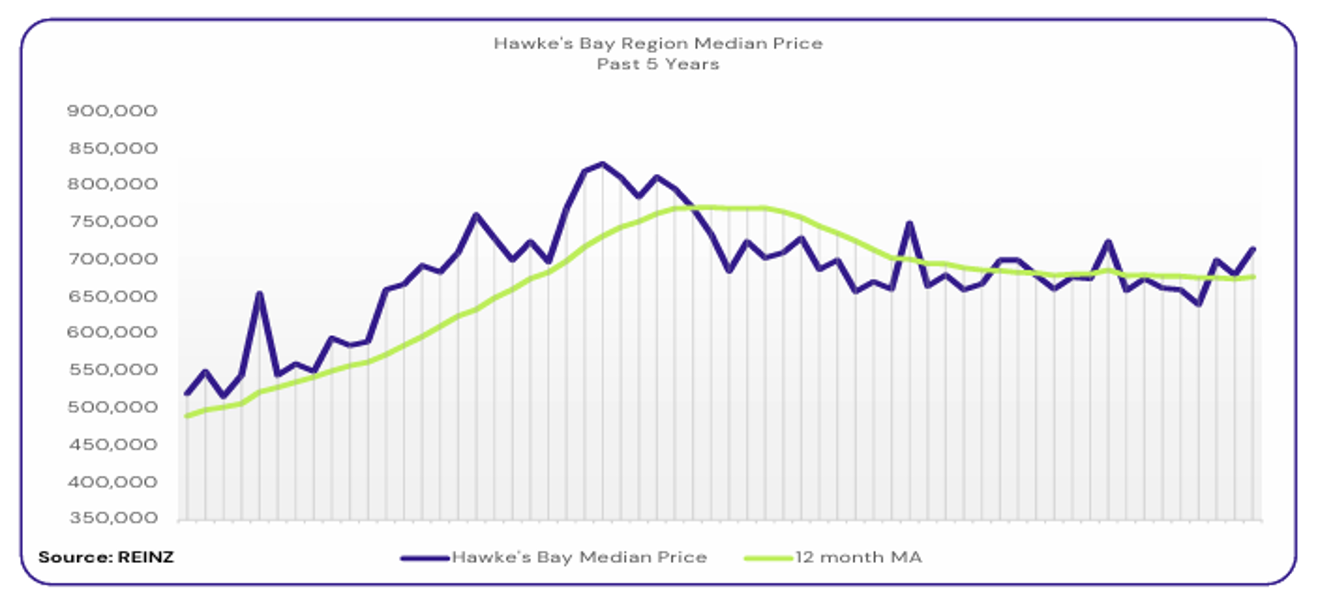

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 5.1% year-on-year to $715,000

“The most active buyer group in November was the mid-range group, with no decline in a particular buyer group. Vendor price expectations for their properties were realistic and in line with market conditions. Attendance at open homes varied around the regions – new listings presented well were very popular. There was little attendance at auctions, but early signs of activity were present as sales under the hammer increased. Market sentiment was influenced by factors such as the cost of living, increased council and insurance rates, and the decline in interest rates.

Local agents suggest that the coming months will bring much of the same, with slightly elevated activity than what has been evident in this region. The biggest challenge for local agents is prospecting properties for the future; getting appraisals seems trying.” (REINZ).

The current median Days to Sell of 44 days is more than the 10-year average for November which is 35 days. There were 18 weeks of inventory in November 2024 which is 1 week more than the same time last year.

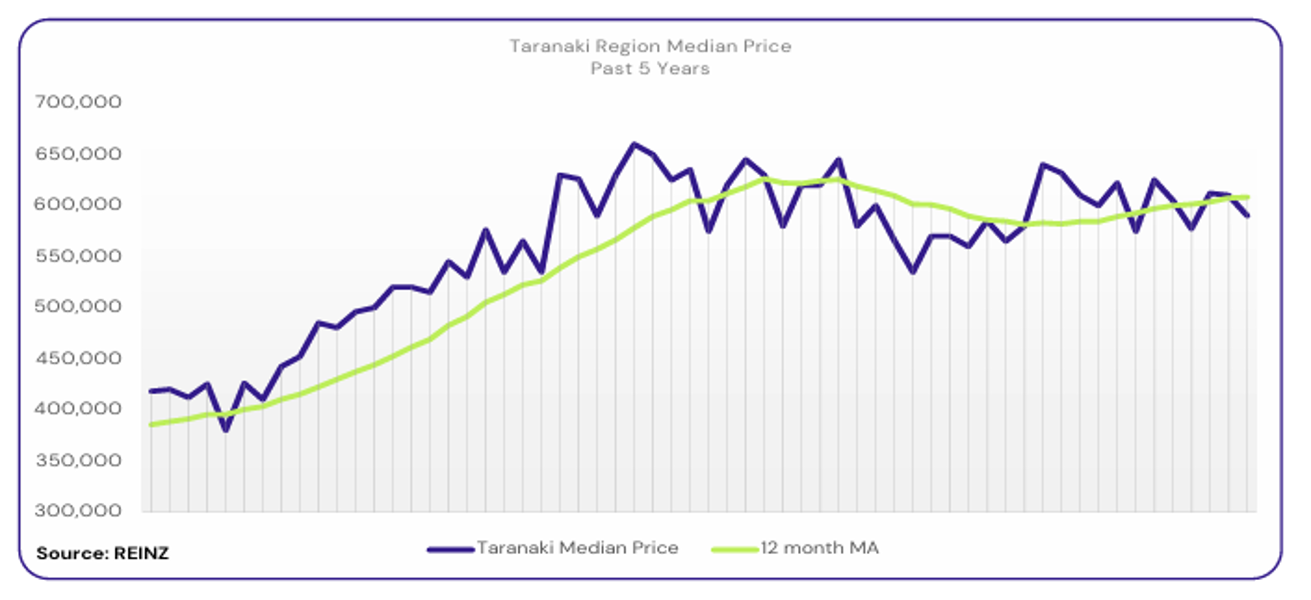

Regional Analysis - Taranaki

Taranaki’s median price increased by 1.7% year on-year to $590,000

“Owner-occupiers, along with a noticeable increase of out-of town buyers, were the most active buyer groups. Most vendors have been realistic with their price expectations. However, there has been an increased number of vendors with unrealistic expectations. This seems to be following recent media articles and the reduced interest rates. Attendance at open homes continues to increase, as it has done so steadily over the past few months.

As interest rates continue to fall, local agents have seen more buyers come to the market, and multi-offers have happened more frequently. Local agents are cautiously predicting sale volumes will increase through the summer months. However, they know they must manage vendor expectations as the market changes.” (REINZ).

The current median Days to Sell of 45 days is much more than the 10-year average for November which is 33 days. There were 23 weeks of inventory in November 2024 which is 3 weeks more than the same time last year.

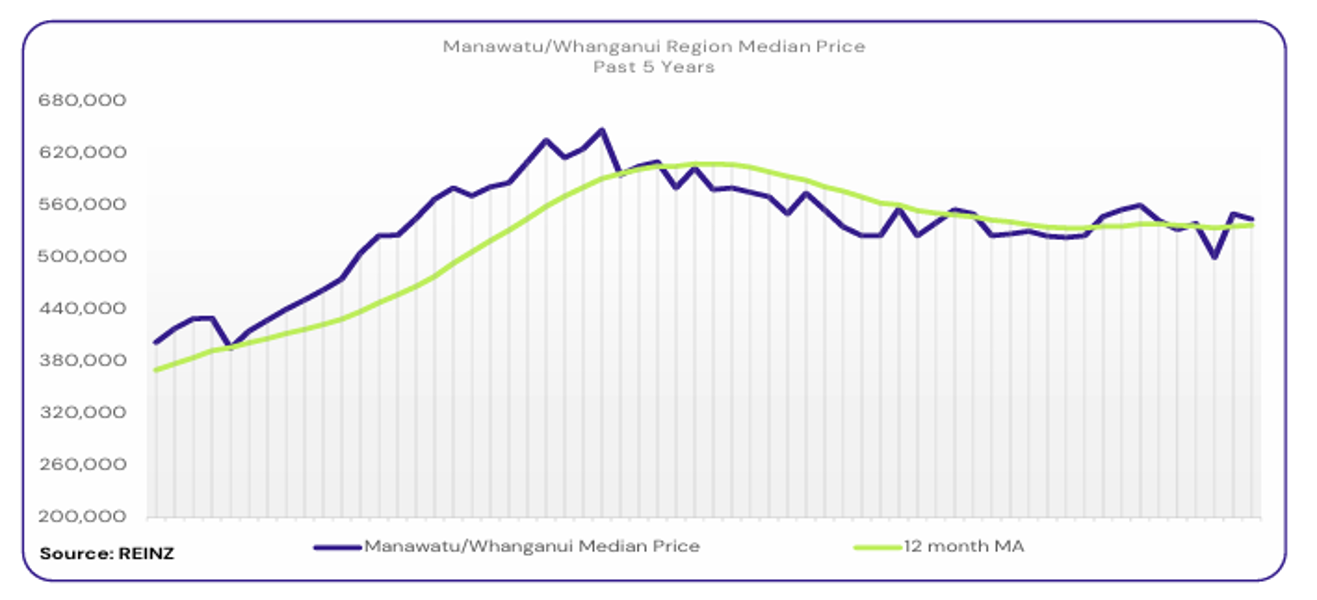

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased by 2.6% year-on-year to $544,000

“Owner-occupiers were the most active buyer group, but there were reports of increased enquiries from first-home buyers. Investors were absent from the market. Vendors were open to considering lower offers on their properties, and attendance at open homes declined, which was expected during November. Auctions were not the preferred method of sale, resulting in little activity.

Factors like recent reductions in OCR, interest rates, job security and increased stock influenced market sentiment. Local agents suggest that the market is moving from a buyers’ market to a more balanced market with increased activity in February 2025.” (REINZ).

The current median Days to Sell of 41 days is much more than the 10-year average for November which is 33 days. There were 22 weeks of inventory in November 2024 which is 2 weeks less than the same time last year.

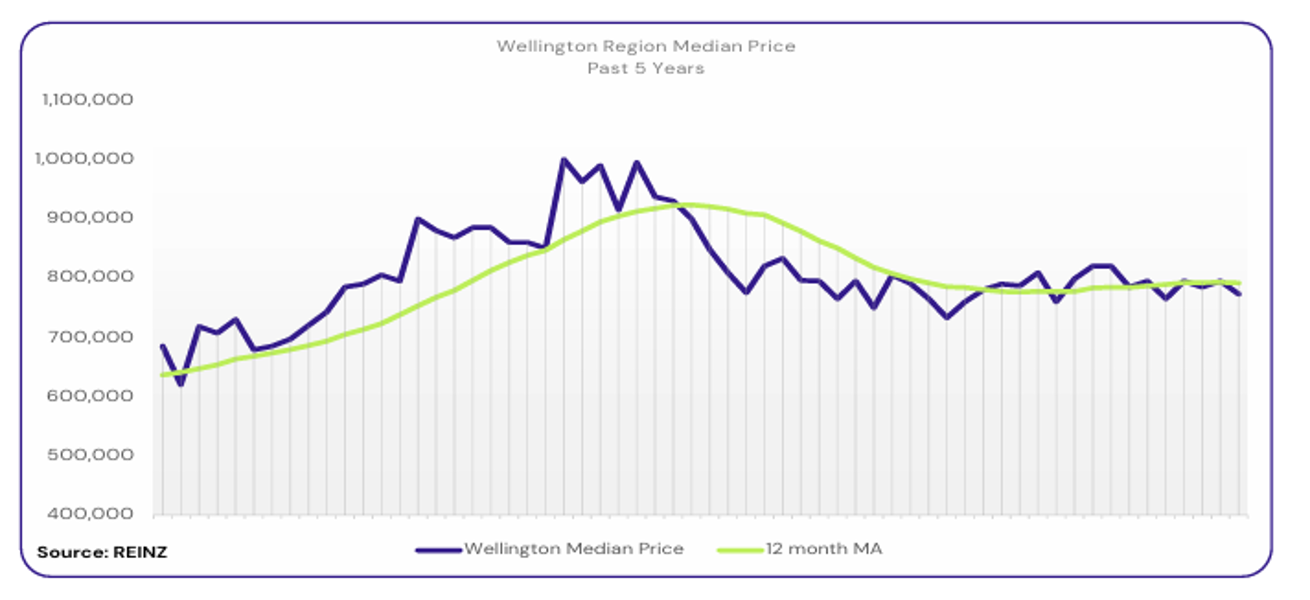

Regional Analysis - Wellington

Wellington’s median price decreased by 1.8% year-on-year to $773,000

“Every buyer group was active in Wellington, with no standout buyer group. Although there was no particular decline, there weren’t many investors around. Most vendors had high expectations, while others were realistic about their price expectations and understood current market performances. Local agents reported that attendance at open homes was the best the Wellington market has seen in a long time. Selling properties by auction was not a favourable sales method.

Market sentiment was seen as more positive by buyers, which was also reflected in media reporting; however, some vendors were divided on whether to sell now or wait. Local agents report that most are waiting for the New Year to sell their property. They predict there may be high stock levels to start 2025, paired with excited buyers ready to make a move.” (REINZ).

The current median Days to Sell of 42 days is more than the 10-year average for November of 32 days. There were 13 weeks of inventory in November 2024 which is the same as the same time last year

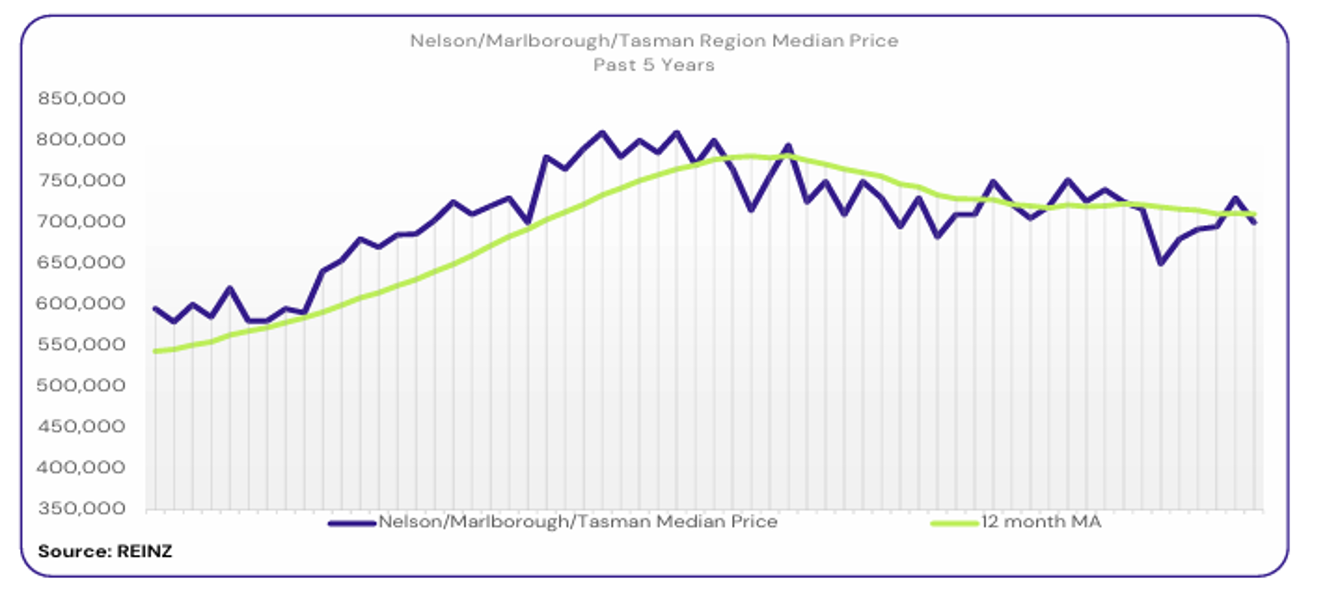

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson increased by 1.2% year-on-year to $657,500. The median price for Marlborough decreased year-on-year by 3.0% to $650,000. The median price for Tasman was the same as in November 2023, at $835,000

“There was no significant active buyer group in November, but local agents are hopeful buyer activity will grow in 2025.Vendors knew that the market changed to be positive, but this has yet to be reflected in the price. Attendance at open homes saw the first few weeks of open homes being well-attended, but dropped off shortly after.

Local salespeople report that they believe the coming months will have more sales activity than the year before. As they waited for the sentiment to reflect in activity, market sentiment was more positive after the reduction of interest rates and the OCR announcement. For the prediction of the coming months, local salespeople suggest that the market will remain buoyant as the increase in new listings continues to grow, with stagnant sales activity expected over the Christmas and New Year period.” (REINZ).

The current median Days to Sell of 40 days is more than the 10-year average for November which is 33 days. There were 22 weeks of inventory in November 2024 which is 10 weeks less than the same time last year.

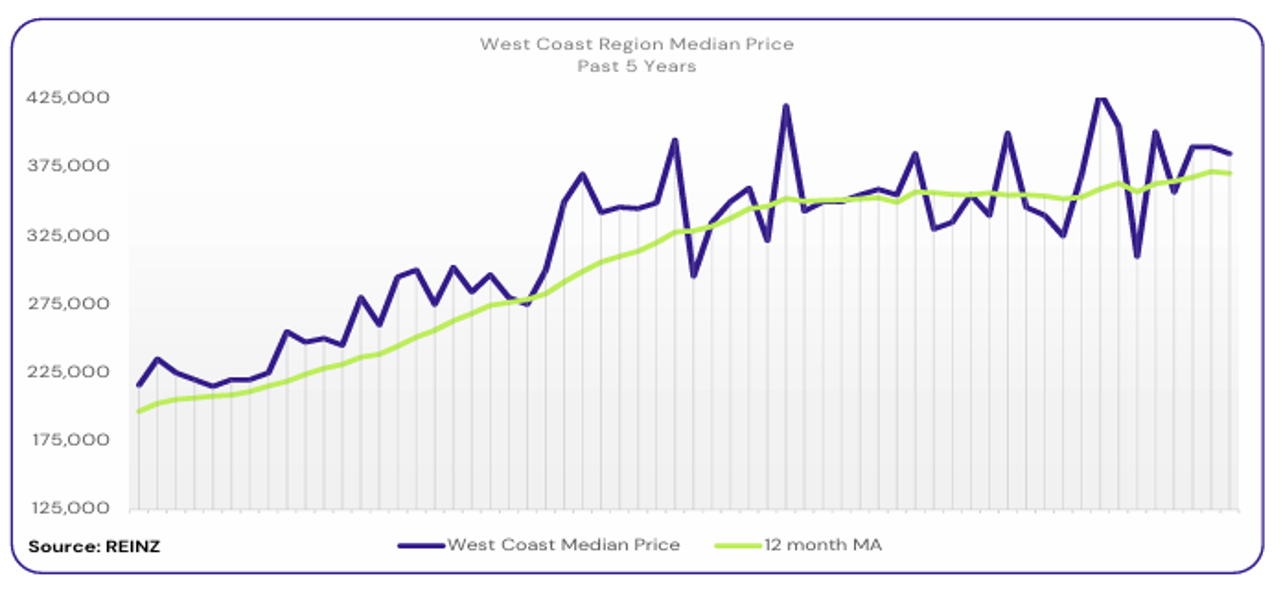

Regional Analysis - West Coast

West Coast’s median price decreased by 3.8% year-on-year to $385,000

“Owner-occupiers up-sizing were the most active buyer group, with no decline in buyer pool. Vendors asking price expectations were realistic but have shifted to increasing their expectations due to media influence. Attendance at open homes was steady across most properties. Auctions were not a popular sales method in this region.

As interest rates continued to fall, confidence and positivity increased, influencing market sentiment. Local agents suggest that next year, with the release of more jobs in the mining industry, they view this as positive as it may increase sales price and rent.” (REINZ).

The current median Days to Sell of 31 days is much less than the 10-year average for November which is 58 days. There were 48 weeks of inventory in November 2024 which is 15 weeks more than the same time last year.

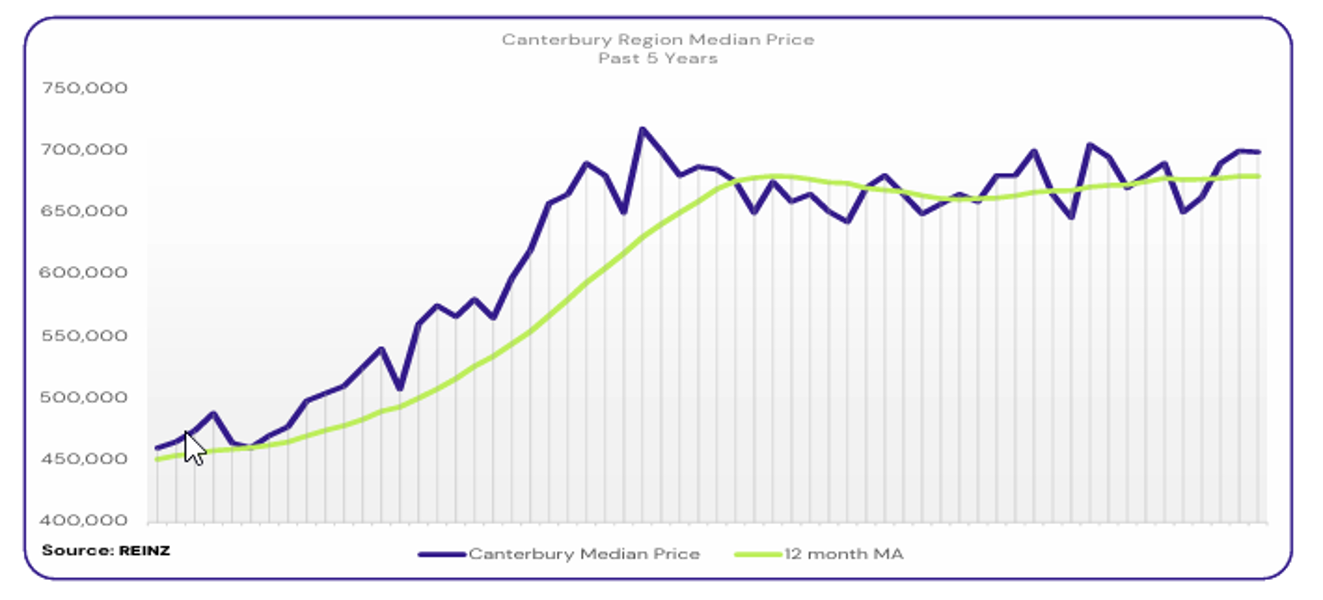

Regional Analysis - Canterbury

The median price for Canterbury decreased by 0.1% year-on-year to $699,000

“Owner-occupiers and families moving for schooling were the most active buyer groups across Canterbury. First-home buyers were prevalent in Christchurch.Most vendors were ready to meet market expectations. However, other vendors expected price increases as interest rates dropped along with OCR rates. Attendance at open homes increased for new listings and those in school zones but varied week-by-week elsewhere. Auction room rates were steady and generally very well attended, even though there were fewer cash buyers.

Market sentiment shifted to reflect a more motivated and confident market due to the recent OCR review and the lower interest rates. Local agents report the property market in Canterbury as ticking along steadily and predict the holiday period will cause market activity to slow down. They are excited to see what the 2025 year will bring.” (REINZ).

The current median Days to Sell of 37 days is more than the 10-year average for November which is 32 days. There were 15 weeks of inventory in November 2024 which is the same as the same time last year.

Regional Analysis - Otago

Dunedin City - Dunedin’s median price increased by 1.8% year-on-year to $607,500.

First-home buyers were the most active buyer group, with slow activity from investors reported. Vendors’ price expectations were realistic and in line with market expectations. However, with decreasing interest rates, there might be a change as buyers could be expected to pay more, possibly next year. Attendance at open homes was good for properties priced and presented correctly. Activity at auctions increased week by week.

Factors like lower interest rates, the lead-up to Christmas, and no issues obtaining finance for some buyers influenced market sentiment, which local salespeople say has been relatively active considering the cost of living. Local agents are cautiously optimistic that their market will continue to be busy up until Christmas and gain further momentum in January. The summer months may bring positivity, and as interest rates drop further, it may bring increased activity.” (REINZ).

Queenstown Lakes

“Owner-occupiers and first home buyers were the most active in the market, with local agents hopeful more investors will enter the market as the OCR reductions continue. Vendors still want the best price for their property, and there was an evident gap between both parties. However, as the stock increases around Central Lakes, vendors will most likely accept the best on the day. Attendance at open homes remained steady as more buyers entered the market. Auction room attendance and sales rates followed a similar trend to last month. However, buyers were more interested in unique properties or properties for sale in areas with little stock.

Local salespeople note that market sentiment didn’t change much in November. Lenders and mortgage brokers were all very busy with new and existing applications as people chose to reapply after recent interest rates deductions. Local agents also suggest that it’s leading up to be the perfect buyer and investor market approaching in early 2025.” (REINZ).

The current median Days to Sell of 45 days is much more than the 10-year average for November which is 32 days. There were 21 weeks of inventory in November 2024 which is 5 weeks more than the same time last year.

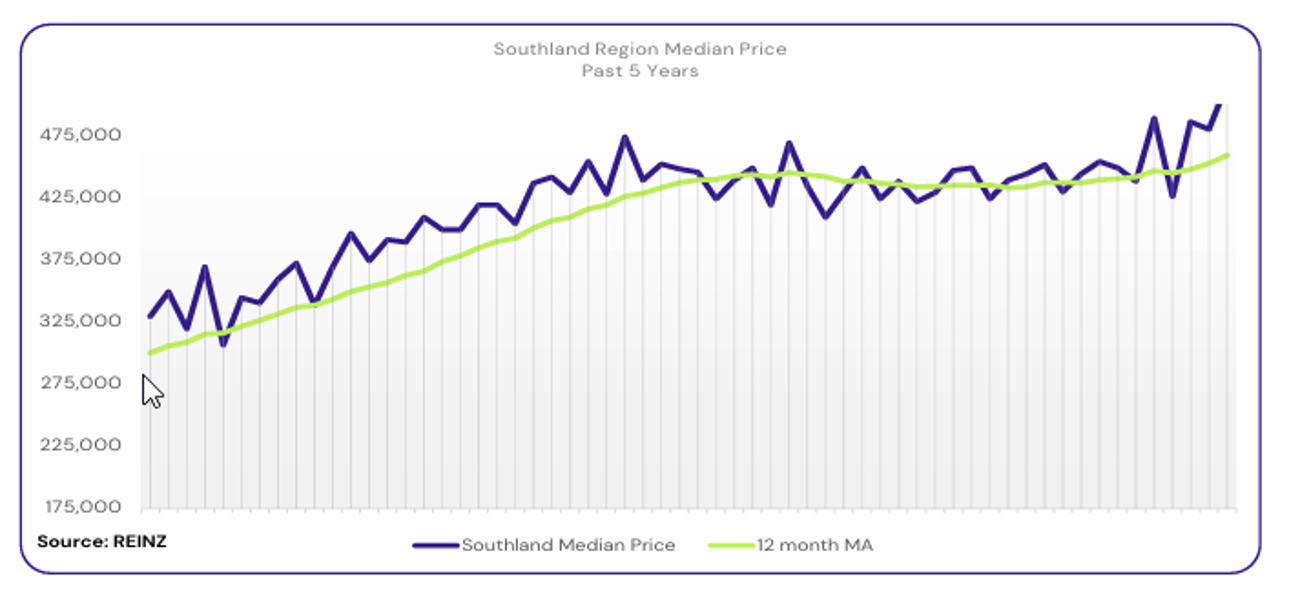

Regional Analysis - Southland

The median price for Southland increased by 17.7% year-on-year to $518,000 – a record-high median price for the region.

“In Southland, the most active buyer groups were first home buyers and owner-occupiers, with a decline of investors reported. Vendor expectations regarding price were realistic. However, more choices were available for buyers, so vendors were negotiating with buyers carefully. Attendance at open homes was good, especially for new listings. Older listings were getting attention if prices were reduced. Auction room attendance saw 1 to 2 bidders for each auction.

Market sentiment had a positive outlook with interest rates declining and plenty of stock available; it has been an honest market. Local salespeople predict that over the coming months, into 2025, there will be increased positivity as rates continue to reduce, bringing more buyers willing to transact.” (REINZ).

The current median Days to Sell of 41 days is much more than the 10-year average for November which is 29 days. There were 18 weeks of inventory in November 2024 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.