A Quiet Close - REINZ stats December 2024

Wednesday, 22 January 2025

December Brought a Quiet Close to 2024

As December concluded 2024, the New Zealand property market experienced a relatively quiet month, as indicated by the latest figures from the Real Estate Institute of New Zealand (REINZ).

“December is usually a quiet month for the housing market. For New Zealand, sales count was down 27.4% compared to November 2024 and up 1.8% compared to last year. When we adjust the figures for seasonal effects, we see that both percentage movements are notably less than expected, confirming that December 2024 was a particularly quiet month for residential dwelling sales in New Zealand.” explains Chief Executive Jen Baird.

Sales increased by 1.8% nationwide compared to December 2023, rising from 5,420 to 5,518. In New Zealand, excluding Auckland, sales saw a year-on-year rise of 3.8%, from 3,838 to 3,984. Notable growth in sales was observed in Taranaki (+24.3%) and Waikato (+15.9%). The median price for New Zealand decreased slightly by 0.6% to $775,000 year-on-year. Month-on-month, the national median price fell 1.8% from $789,000. Excluding Auckland, the median price increased by $10,000 (1.4%) year-on-year, rising from $700,000 to $710,000.

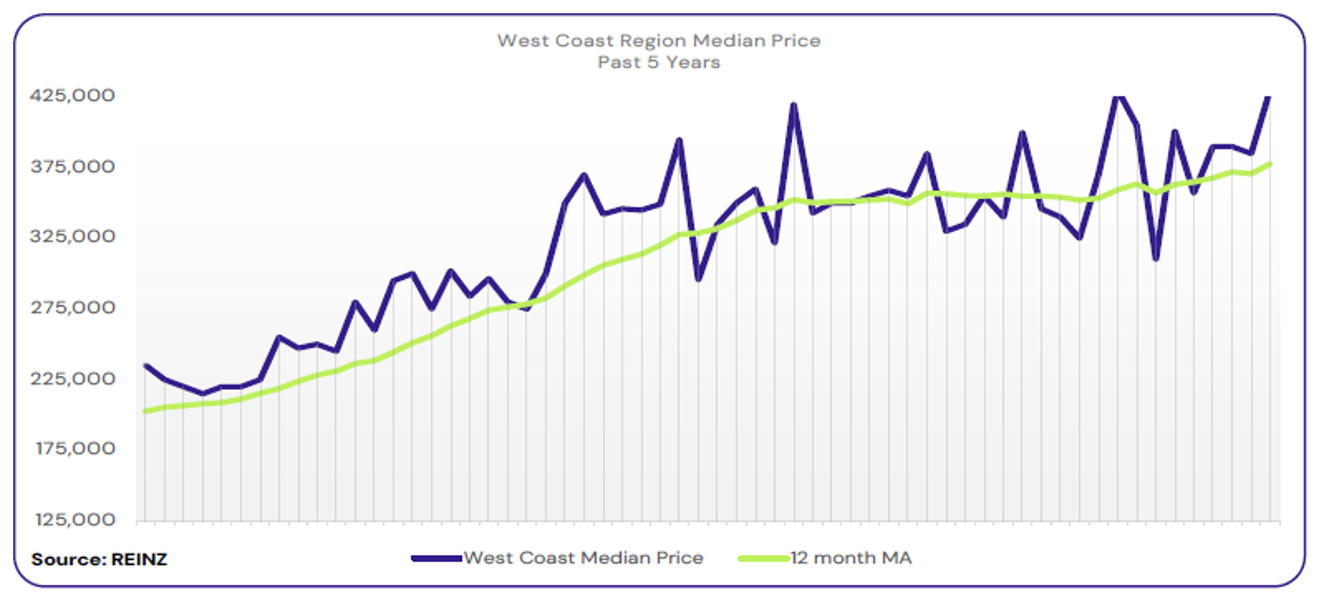

Eleven out of sixteen regions reported an increase in median prices compared to December 2023. The West Coast had the highest increase, up 24.3% from $346,000 to $430,000, followed by Nelson with a 10.6% increase from $710,000 to $785,000.

“Sales have risen year-on-year, though we saw a larger than usual drop off in sales this festive season. This suggests that December 2024 was impacted by the way the holidays fell, making it a shorter-than-usual December, with many people choosing to start their holidays early this year. Buyers had ample stock to choose from, and many expected further interest rate reductions, so there was limited urgency in the market in December. Local agents report that first-home buyers and owner-occupiers dominate the market, in some areas benefiting from lower property prices and improving affordability,” added Baird.

Overall, listings nationally decreased year-on-year by 1.3% from 4,828 to 4,767. Excluding Auckland, listings fell by 1.2% compared to December 2023, from 3,436 to 3,394. Seven out of fifteen regions reported increases in listings compared to last year; the most significant gains were reported in Gisborne (+36.8%), Nelson (+33.1%) and the West Coast (+32.1%).

National inventory levels have risen, increasing by 18.5% yearon- year to 29,478. However, inventory levels have decreased by 13.3% compared to the previous month, down from 33,984. Baird observes that while there was a slight year-on-year decline in new listings, several regions experienced significant increases.

“Listings dropped significantly compared to last month, showing a clear seasonal slowdown. Fewer new listings are entering the market, but overall inventory is still higher than last year. This means that stock is building up as demand changes.”

In December, there were 713 auctions nationally (12.9% of all sales), a decrease from 13.7% last year. The national median days to sell rose by six, to 42 days, compared to the previous year; excluding Auckland, it increased by six, to 42 days.

The House Price Index (HPI) for New Zealand is currently at 3,610, indicating a decrease of 1.1% year-on-year and 0.7% compared to November 2024. Over the past five years, the average annual growth rate of New Zealand’s HPI has been approximately 4.4%. However, it is currently 15.6% lower than its peak in 2021.

Regional highlights:

- Taranaki had the largest sales count percentage increase year-on-year, up by 24.3% year-on-year from 107 to 133.

- Seven out of fifteen regions reported increases in listings compared to last year. The regions with the most significant increases were seen in Gisborne (+36.8%), Nelson (+33.1%), and the West Coast (+32.1%).

- Eleven of the sixteen regions had a median price increase year-on-year. The West Coast led the way with an increase of 24.3% year-on-year with a median price of $430,000.

Regional Analysis - Northland

The median price for Northland increased 6.3% year-on-year to $670,000

“First home buyers and owner-occupiers were Northland’s most active buyer groups for December. Vendor expectations were realistic, with more open to lower offers for their property that they weren’t entertaining before. Attendance at open homes varied around the region, with some very popular for the first two weeks of the month.

Auction room activity also varied, with some recording good numbers, while other auction sessions had a majority passed in and low attendance. Lack of buyer urgency, fear of overpaying, buyer confidence, and job security concerns influenced market sentiment. Local agents predict that in the next few months, they could see a flurry of listings and buyers emerging to make transactions.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for December which is 42 days. There were 37 weeks of inventory in December 2024 which is the same as the same time last year.

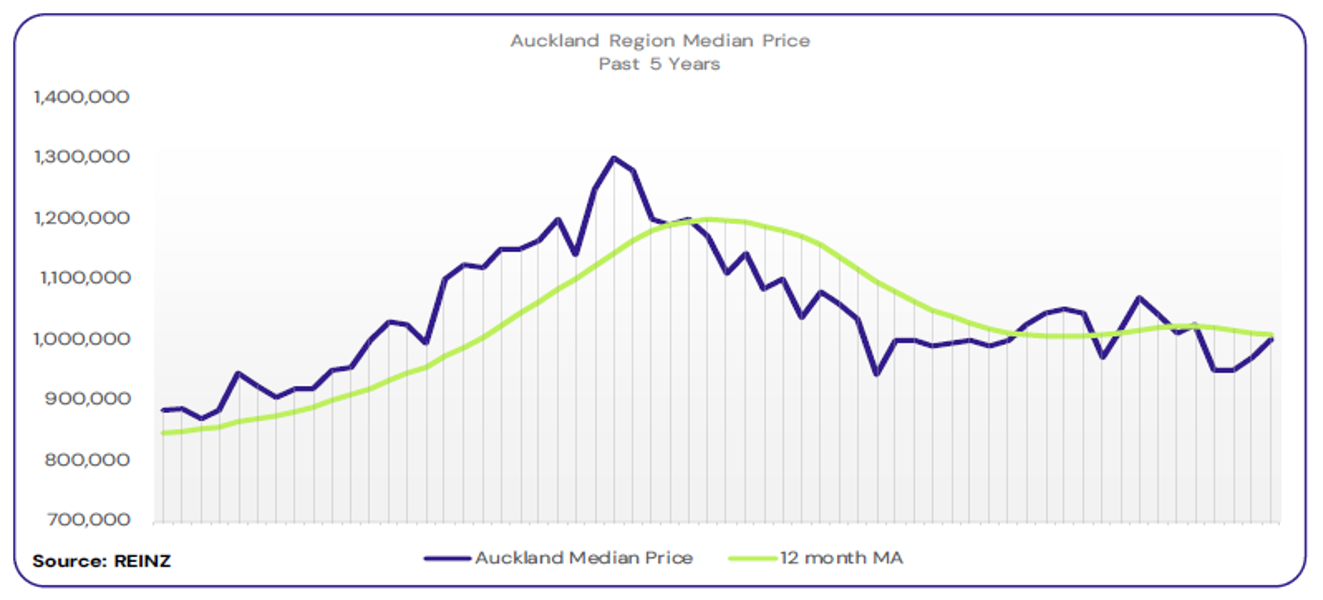

Regional Analysis - Auckland

The median price for Auckland decreased 4.3% year-on-year to $1,000,000

“Owner-occupiers, first home buyers, and investors were all active and showing interest, with developers focused on South Auckland. Overall, vendor pricing expectations were realistic, with some eager to sell as quickly as possible. Attendance at open homes varied; Central Auckland remained steady, while other areas were quieter. Due to the holiday season, December saw low auction room attendance and sales.

Market sentiment has remained stable, but some buyers were holding out on transacting because of the current economic environment. Local agents are cautiously optimistic that sales activity will gradually improve over the next few months.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for December which is 35 days. There were 27 weeks of inventory in December 2024 which is 3 weeks more than the same time last year.

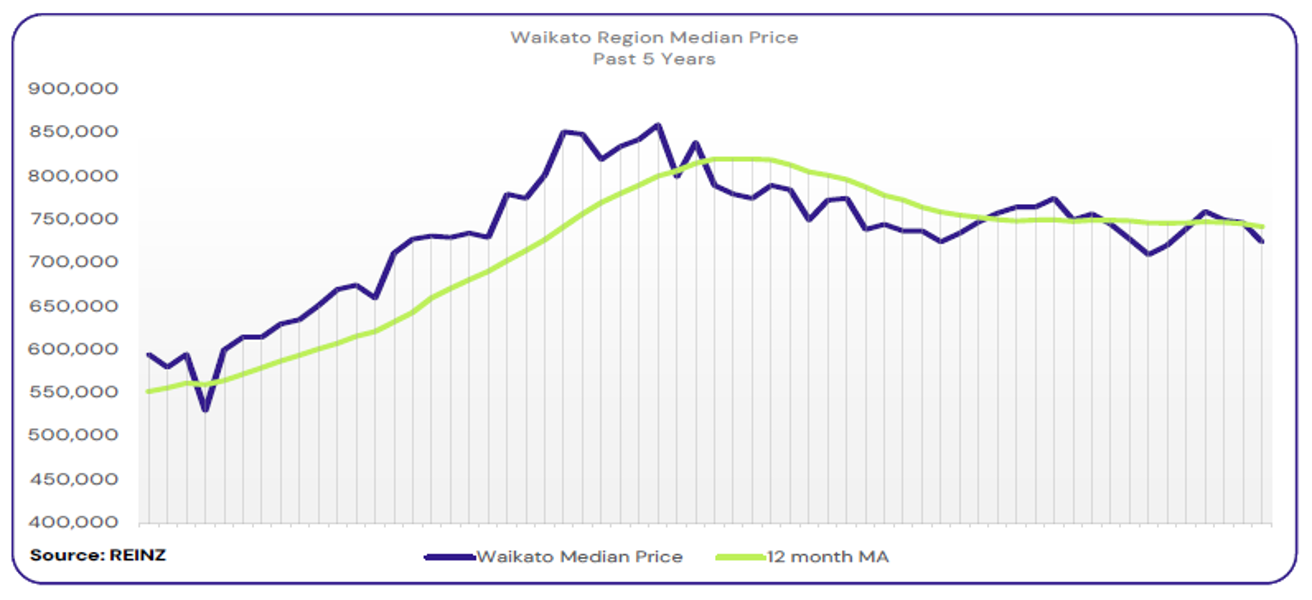

Regional Analysis - Waikato

Waikato’s median price decreased 5.2% year-onyear to $725,000

“Owner-occupiers, holiday home purchasers, first home buyers and investors were all active across the region, with an increase in developer enquiries in Hamilton. Fewer section buyers were reported in Taupo. Most vendors had realistic price expectations and were meeting market expectations, although others anticipated a significant market increase and held back on accepting offers or began to set higher expectations. Attendance at open homes remained steady, with holiday homes receiving higher attendee numbers.

In Hamilton and Taupo, local agents have observed a rise in the number of properties being auctioned, with increased attendance and a higher number of sales occurring at the auction. Market sentiment for December remained stable, showing improved positivity and confidence that resulted in consistent levels of enquiries. Although supply has increased, it has kept pace with the rising sales. Local salespeople are cautiously predicting a busier year with gradually increasing sales. They hope that further interest rate reductions will boost buyer confidence and encourage more market activity.” (REINZ)

The current median Days to Sell of 46 days is much more than the 10-year average for December which is 35 days. There were 26 weeks of inventory in December 2024 which is 2 weeks more than the same time last year.

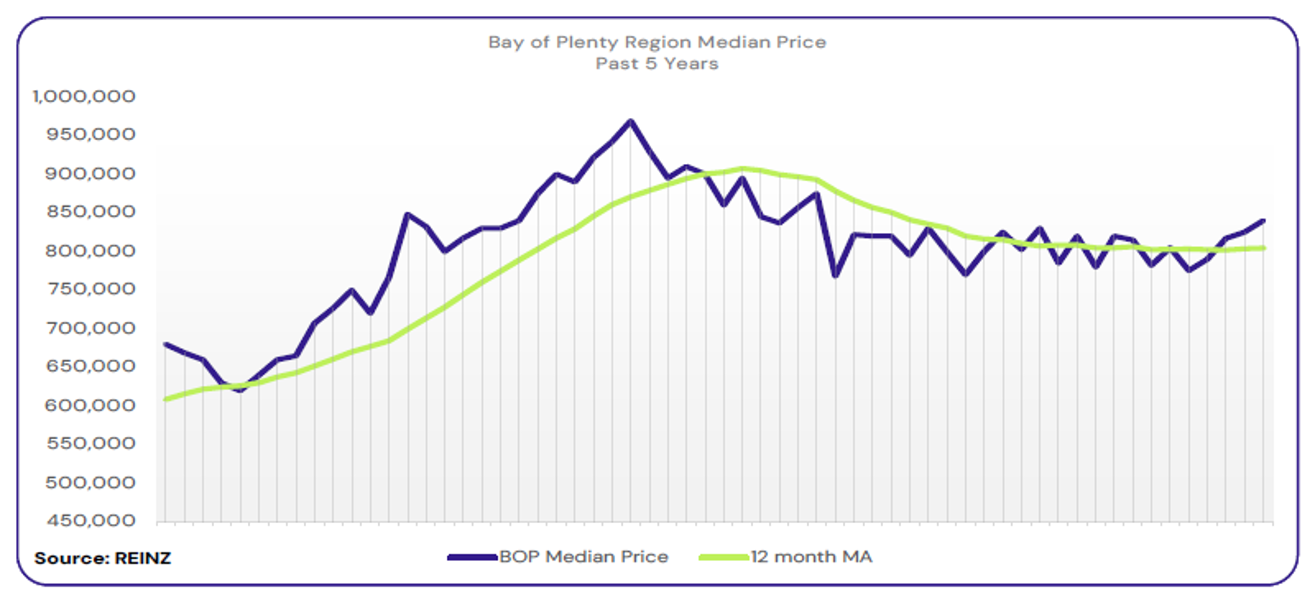

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased 1.2% year-on-year to $840,000

“Owner-occupiers and first home buyers were active, with investors noticeably more active than previous months. When vendor price expectations were realistic, their properties sold; when expectations weren’t realistic, their properties didn’t sell. Good factual information and media coverage cemented where the market is at, influencing vendor expectations. Attendance at open homes improved as more buyers started their journey with interest rates easing.

There was a steady improvement in auction clearance rates, with higher bidding numbers and auctions as a preferred method of sale. Local agents report that December was a busy month, considering it was interrupted by holidays. Market sentiment was positive, and local salespeople said there was a good demand for houses that needed work, suggesting buyers may think the market is at or near the bottom of the cycle.” (REINZ)

The current median Days to Sell of 46 days is more than the 10-year average for December which is 38 days. There were 23 weeks of inventory in December 2024 which is 2 weeks less than the same time last year.

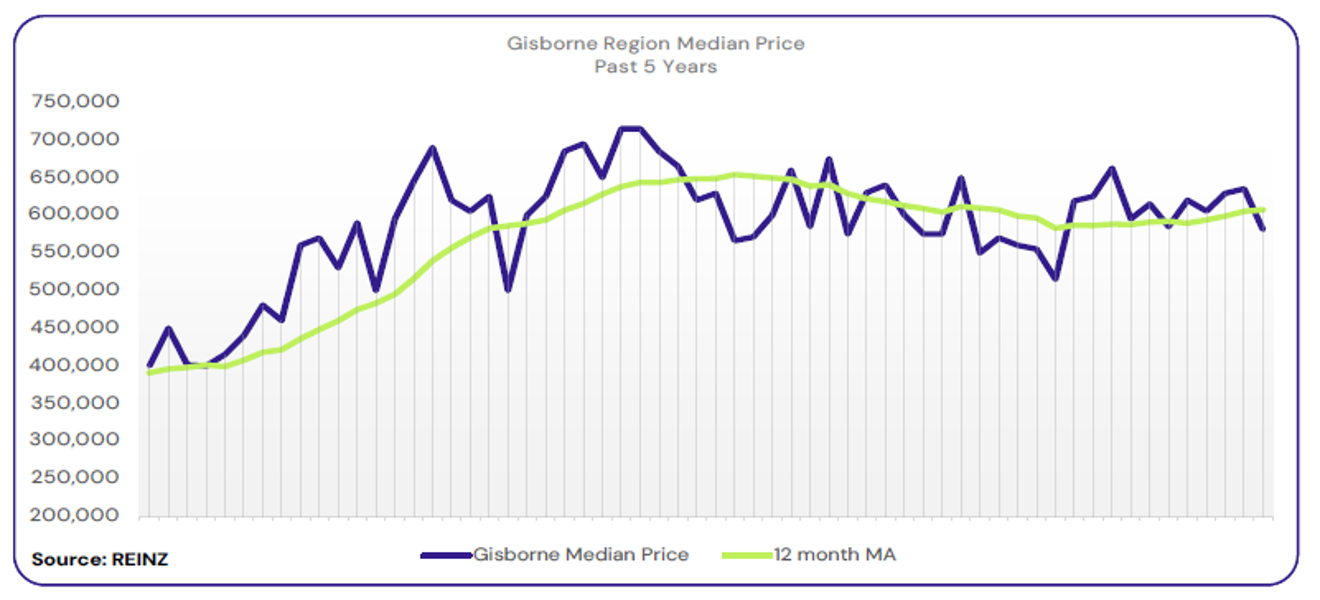

Regional Analysis - Gisborne

Gisborne’s median price increased 4.7% year-onyear to $581,000

“Investors were the most active buyer group in the region, with no particular buyer pool decline, just a general lack of mediumto- high-end buyers. Vendors were reportedly realistic regarding price expectations, as they received genuine market feedback from auctions and offers from buyers. Attendance at open homes was strong at the beginning of the month but tapered off as Christmas approached.

Local salespeople say Christmas and the economy influenced market sentiment much more than in previous years. However, the local agents are cautiously hopeful that the declining interest rates and plenty of new stock that will hit the market in the first few months of 2025 will interest buyers and those looking to sell in more favourable conditions.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for December which is 36 days. There are 11 weeks of inventory in December 2024 which is 3 weeks less than last year.

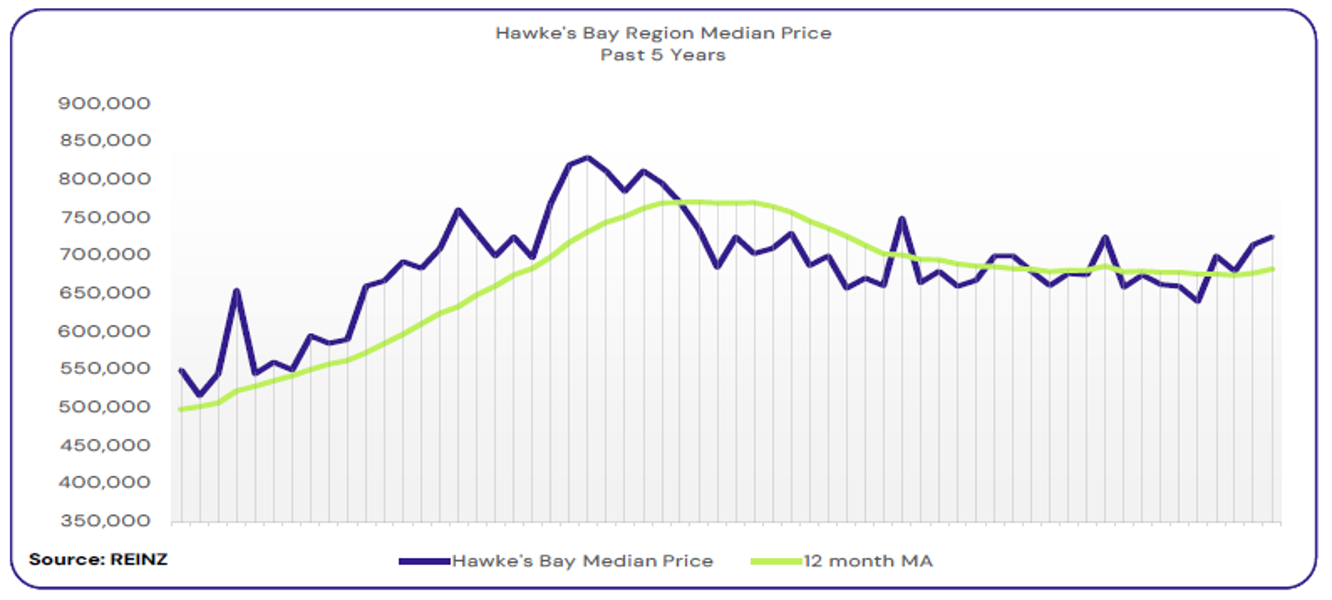

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased 9.7% year-on-year to $725,000

“Property owners looking to downsize and first-home buyers were the most active buyer groups, with no particular decline in other buyer pools. Vendor expectations were improving as 2024 drew to a close. Attendance at open homes was as expected for that time of year, with low numbers, but those who attended were serious buyers.

Market sentiment has shifted to bring more confidence in buying and selling. December brought improved urgency in all directions, though some properties needing extra work or complete renovations harder to sell. Even properties on the market for a while gained more interest. Local agents are cautiously hopeful that 2025 will bring further improvements to the market, including more sales and price increases.” (REINZ)

The current median Days to Sell of 50 days is much more than the 10-year average for December which is 34 days. There were 16 weeks of inventory in December 2024 which is 5 weeks less than the same time last year.

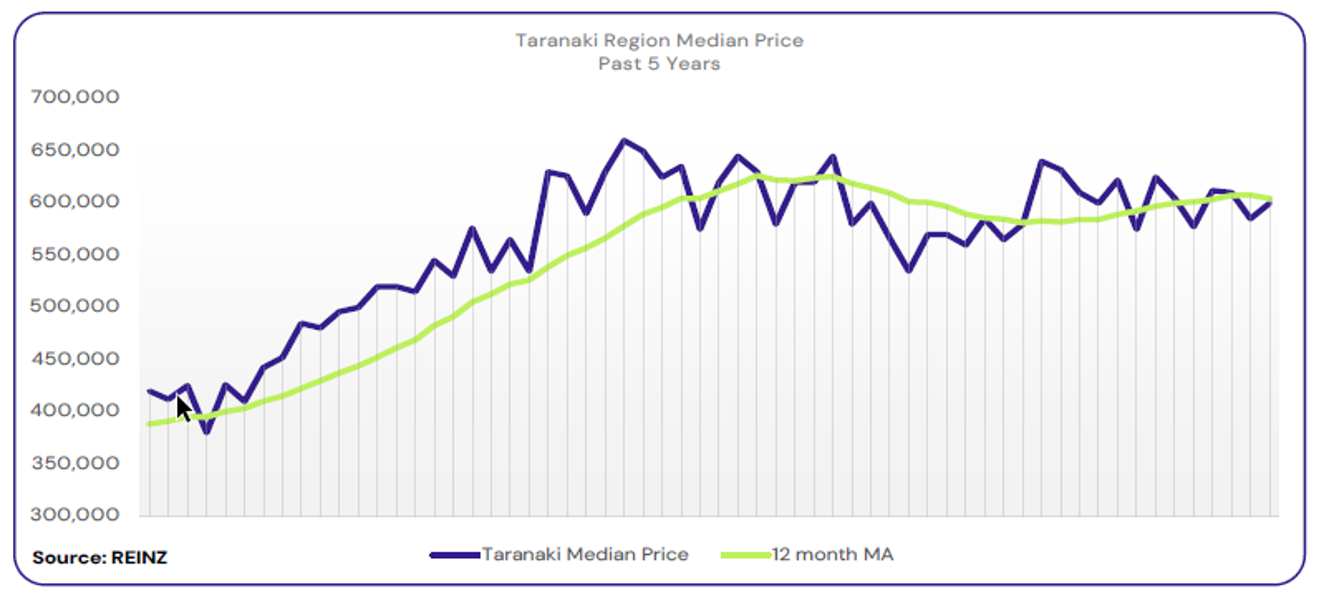

Regional Analysis - Taranaki

Taranaki’s median price decreased 6.3% yearon-year to $600,000

Out-of-region buyers continue to be active across the region, with owner-occupiers being the most active buyer group making transactions. Reports indicated that vendor price expectations rose slightly but remained relatively realistic. Media commentary about the market strengthening seemed to influence vendor expectations. Attendance at open homes was strong leading up to Christmas but dropped off for the last two weekends in December.

As interest rates continued to drop, more people came to the market, and multi-offers happened more frequently, which influenced market sentiment. Local agents report that the residential market appears to be strengthening monthly and are hopeful this trend will continue throughout 2025.” (REINZ)

The current median Days to Sell of 34 days is more than the 10-year average for December which is 30 days. There were 22 weeks of inventory in December 2024 which is 1 week less than the same time last year.

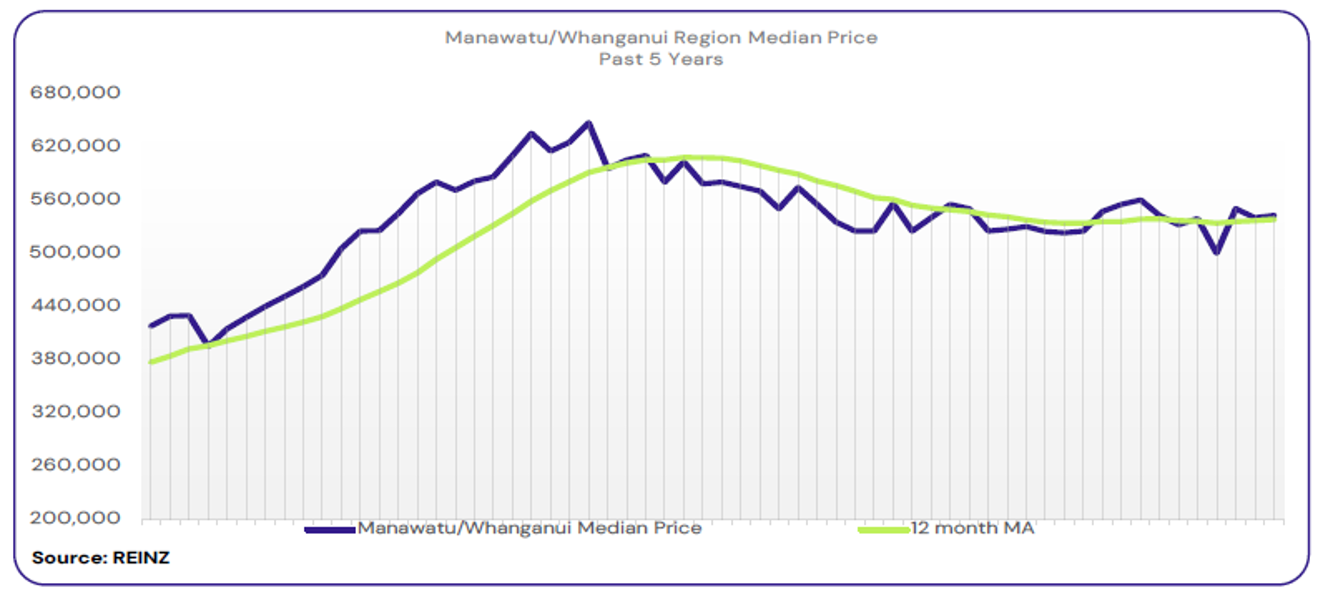

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased 3.4% year-on-year to $542,500

“Owner-occupiers and first-home buyers were the most active buyer groups. Investors are still largely absent from the market due to current house prices and interest rates. Many vendors have had to adjust their price to meet market conditions and achieve a sale. Attendance at open homes was reasonably quiet as the holiday period approached. There wasn’t much auction activity as some buyers struggled to get into a cash position to purchase at auction.

Local salespeople report that the local market has become more balanced, with more first-home buyers viewing properties. Decreasing interest rates have influenced market sentiment, job security, the current economic environment, and the predicted market outlook. They remain hopeful that the current balanced local market will continue into 2025. If the OCR and interest rates continue to fall, this could stimulate the market further.” (REINZ)

The current median Days to Sell of 38 days is more than the 10-year average for December which is 30 days. There were 20 weeks of inventory in December 2024 which is 2 weeks less than the same time last year.

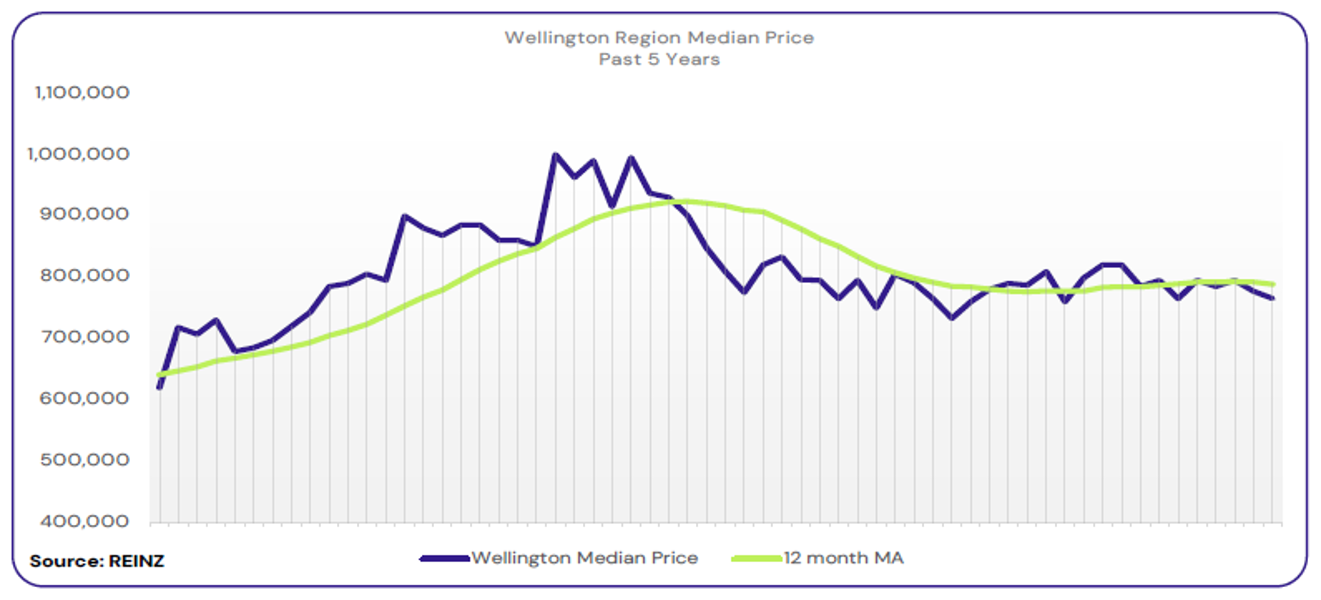

Regional Analysis - Wellington

Wellington’s median price decreased 5.4% year-on-year to $765,500

“First home buyers and investors were the most active buyer groups, with declining buyers of high-end properties throughout Hutt Valley. Vendor expectations regarding the asking price were realistic, with most needing to sell and not testing the market. Attendance at open homes was steady across the region, with few attending closer to Christmas.

There were reports of low auction room activity for December, as many buyers in attendance preferred a price indicator for the property. The market sentiment has changed, prompting many landlords to sell properties and resulting in more properties available on the market. Local agents predict a strong presence of first home buyers in 2025, as listings increase and interest rates stay steady.” (REINZ)

The current median Days to Sell of 42 days is much more than the 10-year average for December of 31 days. There were 12 weeks of inventory in December 2024 which is 2 weeks less than the same time last year.

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson increased 10.6% year-on-year to $785,000. The median price for Marlborough decreased 0.8% year-on-year to $630,000. The median price for Tasman increased 0.4% year-on-year to $823,000.

“Entry-level buyers and owner-occupiers looking for their second home were the most active buyer groups. The number of choices for buyers and lack of buyer urgency encouraged vendors to meet market expectations. Attendance at open homes varied leading up to the Christmas break.

Local agents report no change in buyer sentiment. The seasonal impact of the short month due to holidays and Christmas brings the usual lull in activity for the region. The forecast for the coming months indicates increased positivity and optimism, consistent sales and higher turnover. Local salespeople believe first home buyers have the opportunity to find properties within their price range.” (REINZ)

The current median Days to Sell of 34 days is more than the 10-year average for December which is 32 days. There were 31 weeks of inventory in December 2024 which is 7 weeks more than the same time last year.

Regional Analysis - West Coast

West Coast’s median price increased 24.3% year-on-year to $430,000

“First home buyers and owner-occupiers were the most active buyer group. Vendors were realistic about their price expectations and listed their properties within the appraisal range provided by the agent. Attendance at open homes was steady.

Market sentiment remained the same as last month, as nothing of note changed. Local agents report the local market was steady, with most expecting it to stay the same in the coming months as job opportunities arise. As the mining industry grows, agents expect sales and the buyer pool to strengthen as 2025 progresses.” (REINZ)

The current median Days to Sell of 61 days is much less than the 10-year average for December which is 74 days. There were 39 weeks of inventory in December 2024 which is the same as the same time last year.

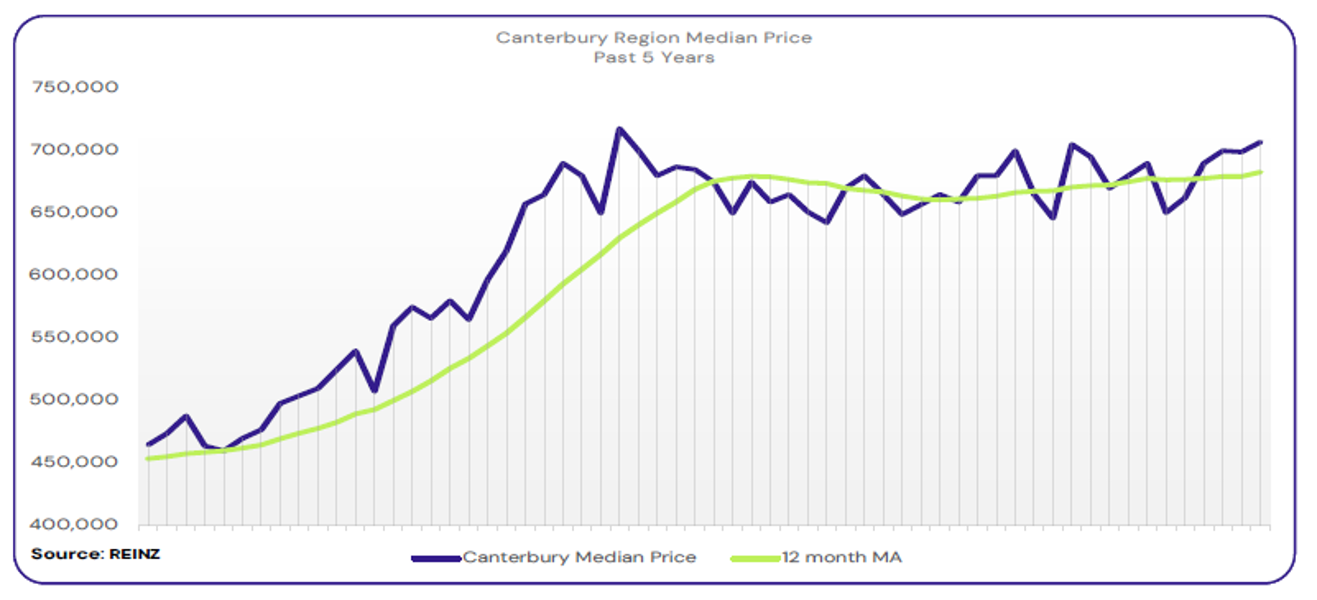

Regional Analysis - Canterbury

The median price for Canterbury increased 6.3% year-on-year to $707,000

“In December, the Canterbury region experienced a diverse mix of buyer types. In Timaru, investors and out-of-town buyers were the most active. In Christchurch, owner-occupiers and investors led activity. Meanwhile, Ashburton saw a variety of active buyers without any particular group standing out. Vendor expectations align with those of previous months. While some vendors were waiting for price increases, others adjusted to the competitive market. Attendance at open homes varied throughout the region; some locations saw high turnout, while others experienced more activity outside of these events.

Auction room activity in Christchurch had 1-2 bidders per property and generally good numbers in attendance. Lack of buyer urgency, increased investor enquiry, optimism for 2025 and the current economic climate influenced market sentiment. Local agents are cautiously optimistic that new listings will increase activity, although the challenge will be if the buyer pool can sustain this increase.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for December which is 32 days. There were 16 weeks of inventory in December 2024 which is 2 weeks more than the same time last year.

Regional Analysis - Otago

Dunedin’s median price decreased by 2.5% to $595,000

First home buyers were the most active, along with property owners who were downsizing. Investors were more evident this month but still not “active” in the market. Vendors were realistic about price expectations during December, which resulted in houses turning over quickly. Attendee levels at open homes were generally good during the month, although they dropped off entirely as Christmas approached. Auctions were increasingly attracting interest and have become a popular sale method.

Job security concerns, cost of living, and anticipation that interest rates will decline have influenced market sentiment. Local agents have reported unexpected busyness for the season and predict that house prices will likely stagnate in 2025.” (REINZ)

Queenstown Lakes

“Owner-occupiers and first-home buyers were the most active during December, with good momentum reported through the early weeks of that month. Vendor price expectations remained unchanged – local agents suggest there needs to be a positive shift in the market to warrant a price change. Attendance at open homes was slower during the month, with only those who were very motivated to purchase in attendance. Auction activity was slow as there are still plenty of properties for buyers to choose from.

Although there was no real shift in market sentiment, factors like high stock levels, interest rates, and a lack of buyer urgency continued to influence the market. Local agents cautiously expect that market conditions will improve from the first quarter to mid-2025.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for December which is 31 days. There were 19 weeks of inventory in December 2024 which is 2 weeks more than the same time last year.

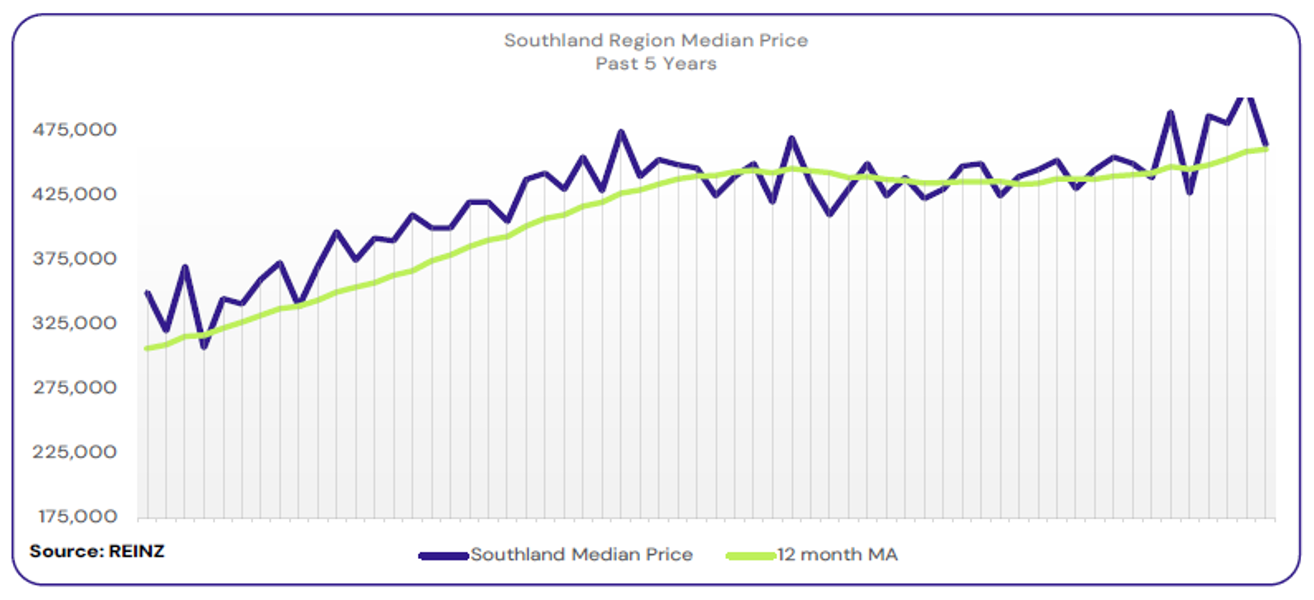

Regional Analysis - Southland

The median price for Southland increased by 4.5% year-on-year to $465,000

First home buyers and owner-occupiers were the most active buyer group in Southland, with reports of fewer investors in the market during December. Some vendors were realistic about price expectations, but others were ambitious at the higher end of the market. Attendance at open homes was good, particularly for properties priced in the $800K mark. Auction rooms saw 1-2 buyers in attendance, and typically, those were cash buyers.

The primary motivation for buyers was to make real estate decisions before Christmas. Local agents remain hopeful that the market will continue to improve and become positive with lower interest rates and stock availability.” (REINZ)

The current median Days to Sell of 41 days is much more than the 10-year average for December which is 30 days. There were 20 weeks of inventory in December 2024 which is 3 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.