Positive Growth in New Zealand Real Estate Market - REINZ stats June 2023

Monday, 17 July 2023

Buyer activity and sales up, new listings still lag.

The real estate market in New Zealand is showing positive signs of increased buyer activity and sales, even though new listings are currently lagging. In June 2023, there was a notable rise in sales, with a 14.6% increase in the total number of properties sold nationwide compared to June 2022. Sales counts in New Zealand, excluding Auckland, saw an even higher increase of 17.4% year-on-year.

Despite June traditionally being a slower month for the property market, this year's sales exceeded expectations when compared to May 2023, thanks to the seasonal adjustment applied to the sales count figures. Furthermore, there is increased first home buyer activity at open homes, driven by the easing of LVR restrictions in June 2023.

While the number of new listings has decreased compared to last year, the market is still seeing sales happening as people make choices about where and how they want to live, resulting in property transactions. The market is facing some challenges, including interest rates, a pending election, and cost-of-living concerns, but the positive activity remains strong.

Although the median price in June 2023 decreased by 8.2% year-on-year, some regions, like the West Coast and Tasman, have seen annual increases in median prices. Despite a 9.0% annual decrease in the REINZ House Price Index (HPI) for New Zealand, the market is still showing resilience and adapting to the current economic climate.

Overall, the real estate market in New Zealand is experiencing a renewed level of activity, with increased sales and buyer interest, even as new listings remain lower than desired. The market is navigating through challenges, but the positive signs indicate that people are still making decisions about their living arrangements, contributing to ongoing property transactions.

Regional highlights

- Whilst prices continue to ease annually in most regions, West Coast saw an increase in median sale price, increasing 35.4% from $295,500 to $400,000.

- Auckland increased 0.8% month-on-month in the median sale price, reaching the $1m price point, but decreased 12.5% year on year.

- Two regions (Hawke’s Bay and Southland) had a decrease in the median days to sell.

- West Coast had the highest annual increase in median days (+28 days).

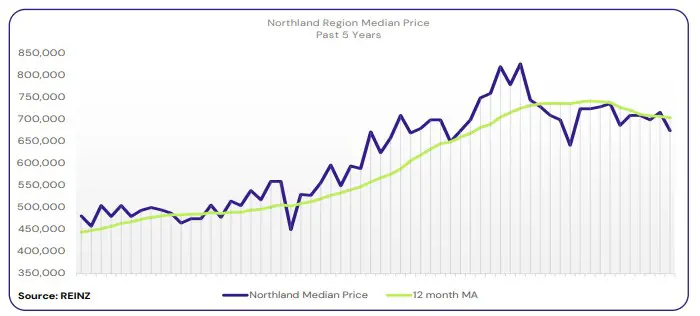

Regional Analysis - Northland

In Northland, median prices decreased by 4.9% year-on-year to $675,000.

“Local salespeople report that first home buyers, owner occupiers, and investors were all active over June, and buyers appear more confident.

Interest rates remain a concern for first-home buyers, and some investors are being cautious ahead of October’s election.

In keeping with the last few months, vendors are more aware of market conditions, and some are adjusting their price expectations, while others are holding firm with their original price expectations. Listings for Northland were 19.0% higher compared with the previous year – the only region to see a year-on-year increase.

Economic uncertainty, the cost of living, and fear of paying too much continue to be buyer concerns, although Northland agents are cautiously optimistic that the market may slowly improve in the coming months.” (REINZ)

The current median Days to Sell of 61 days is more than the 10-year average for June which is 56 days. There were 46 weeks of inventory in June 2023 which is 16 weeks more than the same time last year.

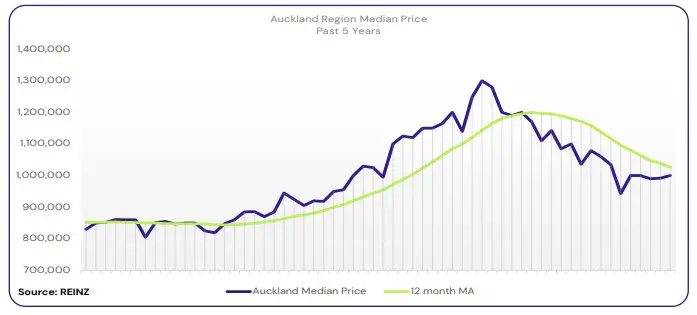

Regional Analysis - Auckland

In Auckland, the median price decreased by 12.5% year-on-year to $1,000,000.

“Local salespeople reported increased sales in South Auckland, particularly with first-home buyers, due to the easing of loanto-value restrictions. In North Auckland, sales were low, with local agents citing lending criteria, interest rates, ongoing bad weather, and anticipation of the election as contributing factors. North Auckland agents predict that the market will improve once the factors described above stabilise.

Many vendors are preferring to wait in the hope of achieving their price expectations, although some are meeting the market and adjusting their price. Listings were 23.7% lower year-on-year.

Buyers are continuing to look, with attendance at open homes and auctions increasing slightly in central and south Auckland; local agents are seeing signs of slight increases in confidence.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for June which is 40 days. There were 27 weeks of inventory in June 2023 which is 1 week less than the same time last year.

Regional Analysis - Waikato

In the Waikato, median prices eased by 12.2% year-on-year to $737,300.

“There was a notable increase in numbers of first home buyers in Hamilton and investors are starting to make enquiries there again. The most active buyer pool in Thames-Coromandel were owner occupiers and holiday home purchasers, while in Taupo, owner occupiers and first home buyers were the most active.

Open home attendance picked up in Hamilton and Taupo compared with last month, but in the Coromandel, challenges with road access due to Cyclone Gabrielle damage impacted the numbers at open homes. Listings in the Waikato were 23.5% lower.

Local salespeople report signs of improving confidence, with an increase in buyers coming back to the market and showing a renewed appetite for purchasing. Local agents predict that the market will slowly improve, as demand increases.” (REINZ)

The current median Days to Sell of 53 days is more than the 10-year average for June which is 44 days. There were 25 weeks of inventory in June 2023 which is 0 weeks less than the same time last year.

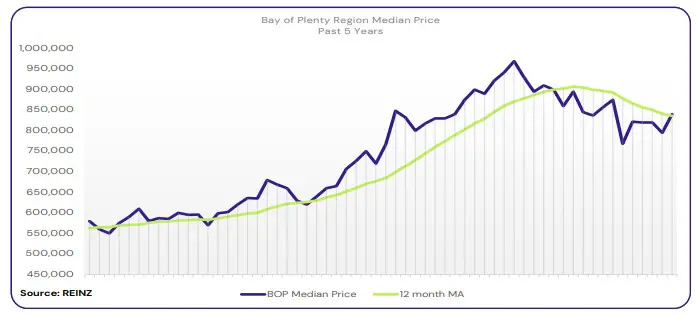

Regional Analysis - Bay of Plenty

The median price in Bay of Plenty decreased by 6.7% year-on-year to $840,000.

“Local salespeople report a steady improvement in sales, with first home buyers and owner occupiers being the most active buyer pools. Open home attendance increased over the month.

Most vendors accept the impacts of interest rates, the economic climate, lending restrictions, and are adjusting their price expectations accordingly. A small number of vendors are continuing to aim for their original price expectations. Listings were lower, with 27.9% fewer listings compared with a year ago.

There’s been a positive shift in market sentiment, and local agents are seeing motivated buyers, and more offers being made. Bay of Plenty salespeople predict that the market will slowly improve.” (REINZ)

The current median Days to Sell of 57 days is more than the 10-year average for June which is 48 days. There were 23 weeks of inventory in June 2023 which is 3 weeks less than the same time last year.

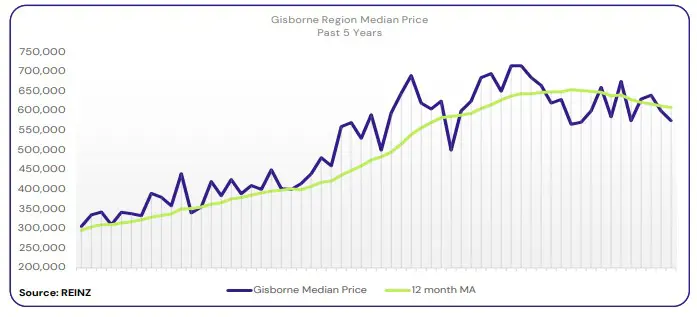

Regional Analysis - Gisborne

In Gisborne, the median price decreased by 7.3% year-on-year to $575,000.

“The number of days to sell was higher compared with a year ago, reflecting buyer anticipation of the election and concerns about interest rates and the economic climate, alongside ongoing impacts of severe weather events.

Listings were 48.9% lower in Gisborne compared with the previous year – the most significant year-on-year drop in listings across the regions.” (REINZ)

The current median Days to Sell of 51 days is more than the 10-year average for June which is 41 days. There are 17 weeks of inventory in June 2023 which is 1 week more than last year.

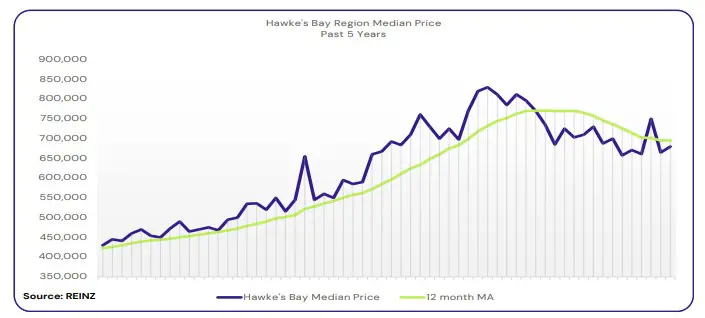

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price eased slightly to $680,000, down by 0.7% compared with the previous year.

“First-home buyers were the most active buyer pool and attendance at open homes and auctions increased compared with the previous month.

Most vendors have adjusted their price expectations in light of the impacts of rising interest rates and the economic climate, as well as the ongoing impacts of severe weather events. However, some vendors with high-end homes are opting to wait until their price expectations are met. There were 29.8% fewer listings in June, compared with the previous year.” (REINZ)

The current median Days to Sell of 58 days is much more than the 10-year average for June which is 41 days. There were 17 weeks of inventory in June 2023 which is 2 weeks less than the same time last year.

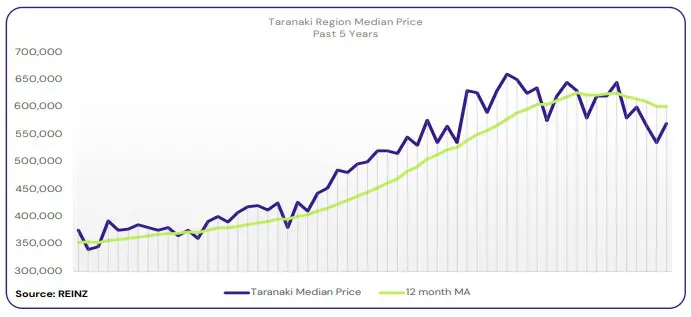

Regional Analysis - Taranaki

Median prices in Taranaki decreased by 0.9% year-on-year to $570,000.

“Owner-occupiers continued to be the most active buyers in the region, but there was more activity from first-home buyers compared with the previous month.

Most vendors are realistic about their asking price and are aware that properties are, on average, taking longer to sell. It continues to be a buyers’ market in Taranaki, but local agents report signs of a shift in market sentiment, as some buyers believe the market has reached its low point. Appraisal activity was noticeably higher in June, although many vendors are not looking to market their home until later in the year, which could lead to a lot of sales activity over summer.” (REINZ)

The current median Days to Sell of 52 days is more than the 10-year average for June which is 42 days. There were 25 weeks of inventory in June 2023which is 11 weeks more than the same time last year.

Regional Analysis - Manawatu/Whanganui

Manawatu/Whanganui’s median price decreased by 6.6% to $540,000 when compared to June last year.

“Owner-occupiers continue to be the most active group, but local salespeople have noted that more first-home buyers are returning to the market. Open-home attendance increased compared with the previous month.

Year-on-year, there were 14.3% fewer listings in Manawatu/ Wanganui.

The market continues to be challenging as buyers are impacted by interest rates and property prices. Local salespeople predict these challenges to continue for some time yet, though there may be some light at the end of the tunnel.” (REINZ)

The current median Days to Sell of 56 days is more than the 10-year average for June which is 43 days. There were 23 weeks of inventory in June 2023 which is 2 weeks more than the same time last year

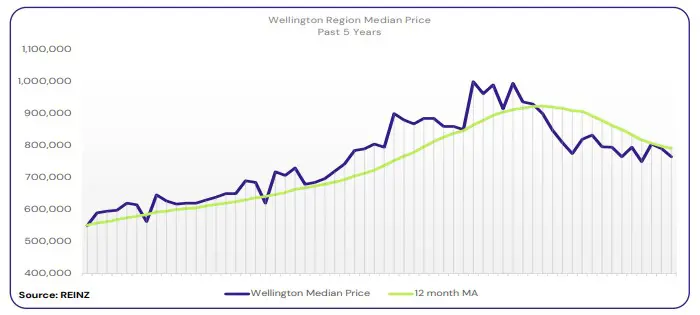

Regional Analysis - Wellington

Median prices in Wellington eased by 9.8% year-on-year to $765,000.

“Local salespeople report that first-home buyers were the most active group, and there were more attendees at open homes this month, compared with the previous month. Vendors have adjusted their price expectations considering the current market environment.

Due to anticipation of the election and buyer concerns about interest rates, Wellington salespeople predict that the market will continue to be quieter than usual for the next few months.” (REINZ)

The current median Days to Sell of 51 days is much more than the 10-year average for June of 39 days. There were 10 weeks of inventory in June 2023 which is 10 weeks less than the same time last year.

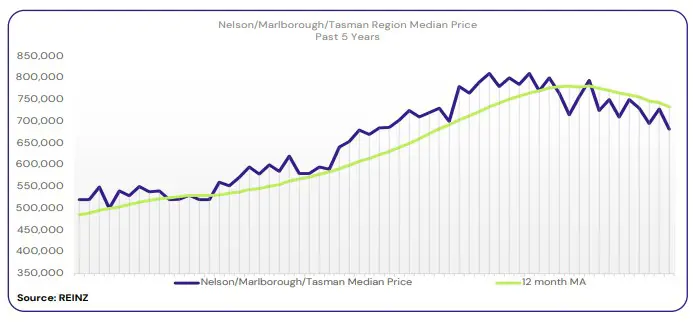

Regional Analysis - Nelson/Marlborough

Median prices in Nelson decreased by 17.2% year-on-year to $650,000.

“In Marlborough and Tasman, median prices fell by 10.4% and 7.5% year-on-year to $645,000 and 800,000 respectively.

All types of buyers were active in the market, with owner occupiers being the biggest buyer pool. Some vendors have changed their pricing expectations in line with the market, but others continue to hold out in the hopes of achieving their original sales price.

Interest rates and the economic climate continue to be a concern for buyers, and anticipation about the election is also leading to some caution about purchasing. Local agents expect market sentiment to remain the same for the next few months.” (REINZ)

The current median Days to Sell of 58 days is much more than the 10-year average for June which is 39 days. There were 20 weeks of inventory in June 2023 which is 2 weeks more than the same time last year.

Regional Analysis - West Coast

The median price in the West Coast increased by 35.4% to $400,000 when compared to June last year.

“Despite a mixed bag weather-wise, real estate activity on the coast continued to buck nationwide trends, with good numbers of contracts being written across the board. Listings were on par with expectations, dropping by 15.5% year-on-year.

Prices remained strong and there were multiple signs of interest in all parts of the market. Potential buyers in the middle to early retirement bracket – who tend to have fewer financial constraints on their buying potential – are the group showing the most interest.

West Coast salespeople report a boost in confidence due to the Westland Milk Products factory expansion in Hokitika getting underway. The possibility of a new gold boom in Reefton has also generated interest and salespeople hope this will flow through to increased confidence levels.” (REINZ)

The current median Days to Sell of 56 days is much less than the 10-year average for June which is 67 days. There were 41 weeks of inventory in June 2023 which is 8 weeks more than the same time last year.

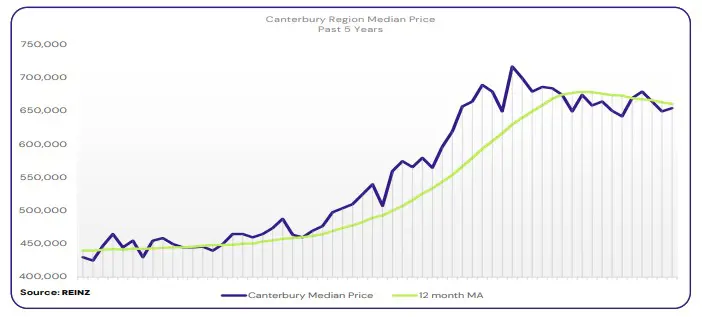

Regional Analysis - Canterbury

Canterbury’s median price eased by 4.4% year-on-year to $655,000.

“Across Timaru and Ashburton, owner occupiers and first home buyers were equally active buyer pools, while in Christchurch, owner occupiers were the leading buyer group.

Interest rates, the cost of living, and the risk of paying too much continue to be concerns for buyers. However, local salespeople report signs of confidence growing. Although listings decreased by 14.1%, open home attendance and private viewings increased, and local salespeople noted increased sales of new townhouses and sections in Christchurch, after being quiet for some time.

The market tends to be slower during winter, and this is compounded by the upcoming election. However local agents predict positive changes in market sentiment in spring.” (REINZ)

The current median Days to Sell of 38 days is more than the 10-year average for June which is 37 days. There were 16 weeks of inventory in June 2023 which is 1 week more than the same time last year.

Regional Analysis - Otago

Dunedin City - The median price in Dunedin was $585,000, a modest increase on recent months and in line with the general trend of a price plateau.

“First-home buyers were the most active buyer pool, with loan-to-value restrictions having eased, and open-home attendance was strong over the month.

A range of factors such as interest rates, inflation, economic uncertainty, and anticipation of the election continue to impact market sentiment, with some vendors choosing to wait before placing their property on the market. With the dropping stock levels, buyer competition is stronger than it has been for some time.” (REINZ)

Queenstown Lakes - Owner-occupiers and first-home buyers were the most active buyer pools in the Queenstown Lakes District.

“Some vendors are open to reviewing their price expectations if they have urgency. Open-home attendance numbers were in line with this time of year.

Investors are by and large waiting to see if legislation around tenancy rights, expense deductibility, and the Brightline Test, will be altered and if so, when.” (REINZ)

The current median Days to Sell of 57 days is much more than the 10-year average for June which is 40 days. There were 15 weeks of inventory in June 2023 which is 1 week less than the same time last year.

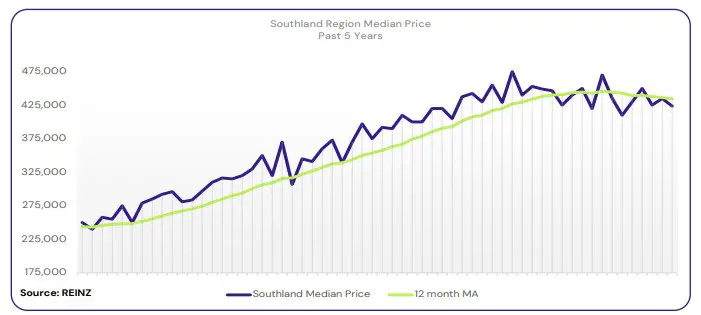

Regional Analysis - Southland

Southland’s median price decreased by 5.2% year-on-year to $423,500.

“First-home buyers and investors were the most active, particularly with houses priced at the lower end of the market. Sales were up by 31.1% compared with June the previous year.

Listings decreased 23.3% in Southland. Local salespeople reported a decrease in buyers for houses priced at the middle and high end of the market, as concerns continued over the economic climate and interest rates. Agents predict a quieter market cycle to stick around for a while longer, at least until after October’s election.” (REINZ)

The current median Days to Sell of 36 days is less than the 10-year average for June which is 37 days. There were 16 weeks of inventory in June 2023 which is 3 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.