Spring sales surge around New Zealand - REINZ stats October 2024

Thursday, 14 November 2024

October proved to be a more positive month, with increases in sales and ever so slight increases in median prices.

According to REINZ Chief Executive Jen Baird, spring has officially arrived and has brought a wave of positivity and optimism to New Zealand’s property market. “There seems to be light at the end of the tunnel. Although challenges like the cost of living remain, positive signs are emerging. Falling interest rates, increased inventory in the market, and greater activity during open home events are all reflected in the data for October, ” explains Chief Executive Jen Baird.

On the sales front, total properties sold nationally increased by 20.0% compared to October 2023. Sales for New Zealand, excluding Auckland, rose 22.7% year-on-year, with notable increases in Nelson (+112.8%) and Marlborough (+29.5%).

“Salespeople are seeing more confidence among vendors and buyers now we’re into spring, and this shows signs of a busier market leading up to Christmas,” adds Baird.

The national median price increased by 0.7% year-on-year, from $789,500 to $795,000; month-on-month, it increased by 1.9%, from $780,000. Excluding Auckland, the median price rose 2.9% year-on-year from $690,000 to $710,000 and increased 2.2% from $695,000 compared to October 2024.

Regionally, ten out of sixteen areas reported an increase in median prices over the past year, with Marlborough leading at an impressive 18.3% increase to $769,000. The West Coast followed closely with a 14.7% rise year-on-year to $390,000. Month-on-month changes also revealed significant increases in Marlborough (10.6% from $695,000) and Manawatu-Whanganui (10.0% to $550,000).

“The New Zealand property market is experiencing a dynamic shift. While median prices are gradually catching up, local salespeople note that some buyers remain cautious about overpaying for properties due to relatively high interest rates. This environment encourages buyers to be more strategic in their approach, making them feel confident in negotiating with vendors to reach an agreeable price,” adds Baird.

New listings also surged, continuing the trend since the beginning of 2024, with every month this year showing a higher number of listings than the same month in 2023. Thirteen out of fifteen regions reported increases compared to last year. The two regions that didn’t were Southland and Northland, which both had a 0.0% change year-on-year. The regions that experienced the highest rise of listings were Gisborne (+103.6%), Canterbury (+40.6%), and West Coast (+40.0%).

Overall, listings nationally increased by 21.4% to 11,572, and New Zealand (excluding Auckland) increased by 22.2% year-on-year to 7,469. Inventory levels are also climbing; national inventory grew by 26.3% year-on-year and 7.7% month-on-month to reach 32,339 properties available for sale.

Baird notes that the increase in available properties provides buyers with the opportunity to explore a diverse range of options that better align with their individual needs and preferences, allowing them to take their time shopping around. In October, there were 1,191 auctions nationally (17.8% of all sales), an increase from 899 (16.1%). The national median days to sell rose by four to 42 days compared to last year; excluding

Auckland, it increased from 39 days in October 2023 to 43 days this month. The House Price Index (HPI) for New Zealand stood at 3,616—a decrease of 1.1% year-on-year but an increase of 0.5% month-on-month. Over the past five years, the average annual growth rate for New Zealand’s HPI has been approximately 4.8%, although it currently sits at 15.4% below its peak in 2021.

Regional highlights:

- Nelson had the largest sales percentage increase year-on-year, up 112.8% year-on-year from 39 to 83.

- Thirteen out of fifteen regions reported increases compared to last year. The regions that experienced the highest rise of listings were Gisborne (+103.6%), Canterbury (+40.6%), and West Coast (+40.0%).

- Ten of the sixteen regions had a median price increase year-on-year. Marlborough leading the way with a 18.3% increase compared to a year ago ($650,000 to $769,000).

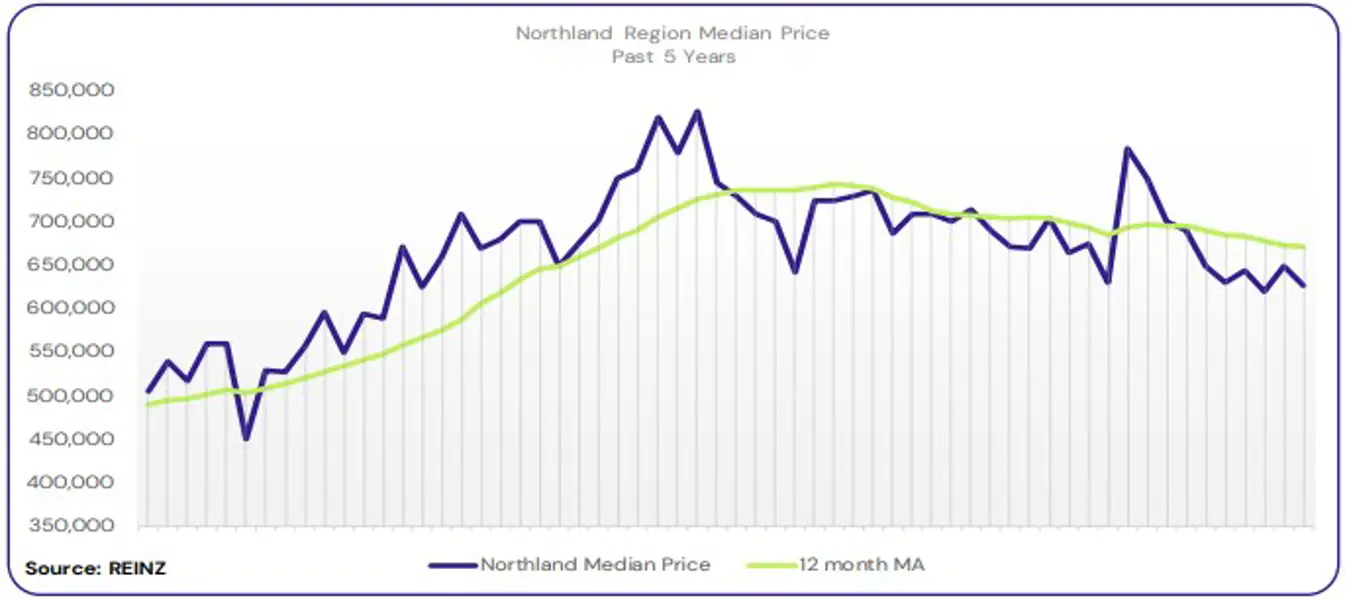

Regional Analysis - Northland

The median price for Northland decreased 5.8% year-on-year to $626,500.

“Owner-occupiers and first home buyers were the most active buyer groups, with increased investor activity in Whangarei.

Most genuine sellers serious about selling were realistic about price expectations; others expected immediate price increases and were not entertaining the lower offers presented.

Attendance at open homes increased for properties priced to meet current market conditions as more buyers saw an opportunity to get in the market while interest rates fell. Auction attendance was low, with properties mostly passed in. However, attendance increased, and more bidders were active in Whangarei.

Market sentiment was influenced by factors like interest rates, media coverage, and the slowed availability of new stock. Local agents report more confidence and signs of an improving market in October. Local salespeople predict increased activity as we move from spring to summer, and with increased appraisals, listing stock might rise before Christmas.” (REINZ).

The current median Days to Sell of 56 days is more than the 10-year average for October which is 47 days. There were 51 weeks of inventory in October 2024 which is 14 weeks more than the same time last year.

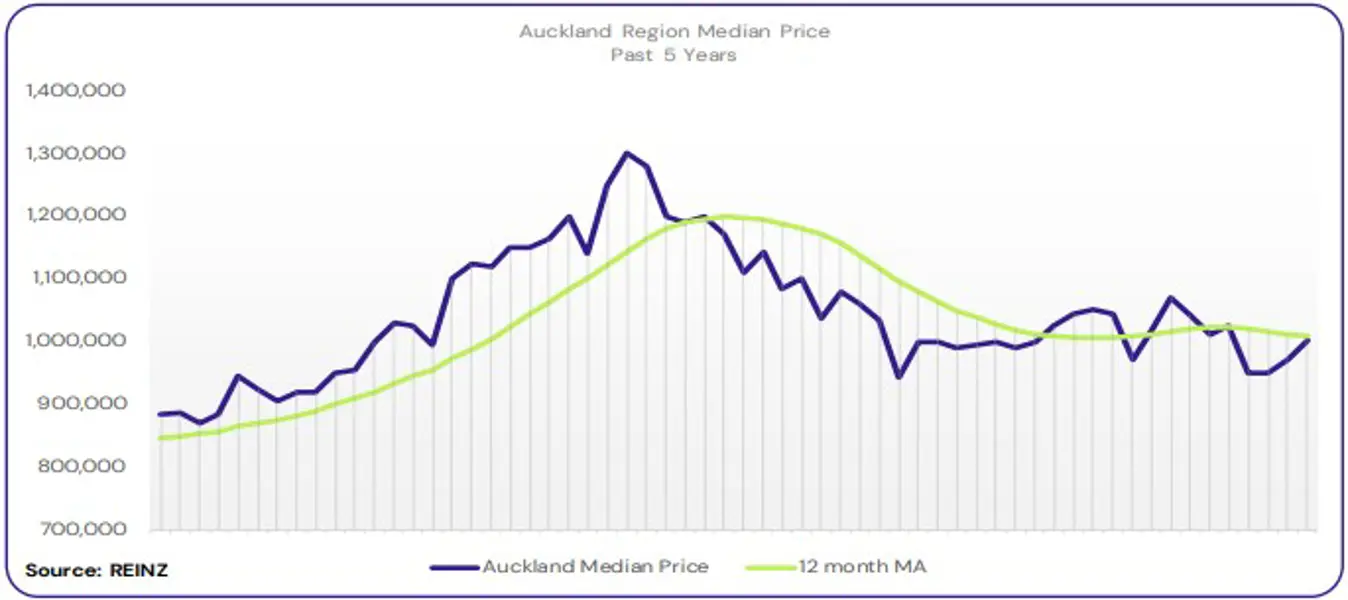

Regional Analysis - Auckland

The median price for Auckland decreased 4.3% year-on-year to $1,000,500.

“There was quite a mixture of buyers in the Auckland market in October, including owner-occupiers, first home buyers and investors.

Vendor expectations were still realistic, although some were still expecting price increases due to falling interest rates and the change in the OCR. Attendance at open homes varied, but new listings were still well-attended. Auction clearance rates and attendance were mixed, too.

Since the OCR announcement and further declines in interest rates, market sentiment has shifted to show signs of confidence and increasing activity from buyers. Local agents predict more activity and positivity in the coming months.” (REINZ).

The current median Days to Sell of 41 days is more than the 10-year average for October which is 37 days. There were 28 weeks of inventory in October 2024 which is 4 weeks more than the same time last year.

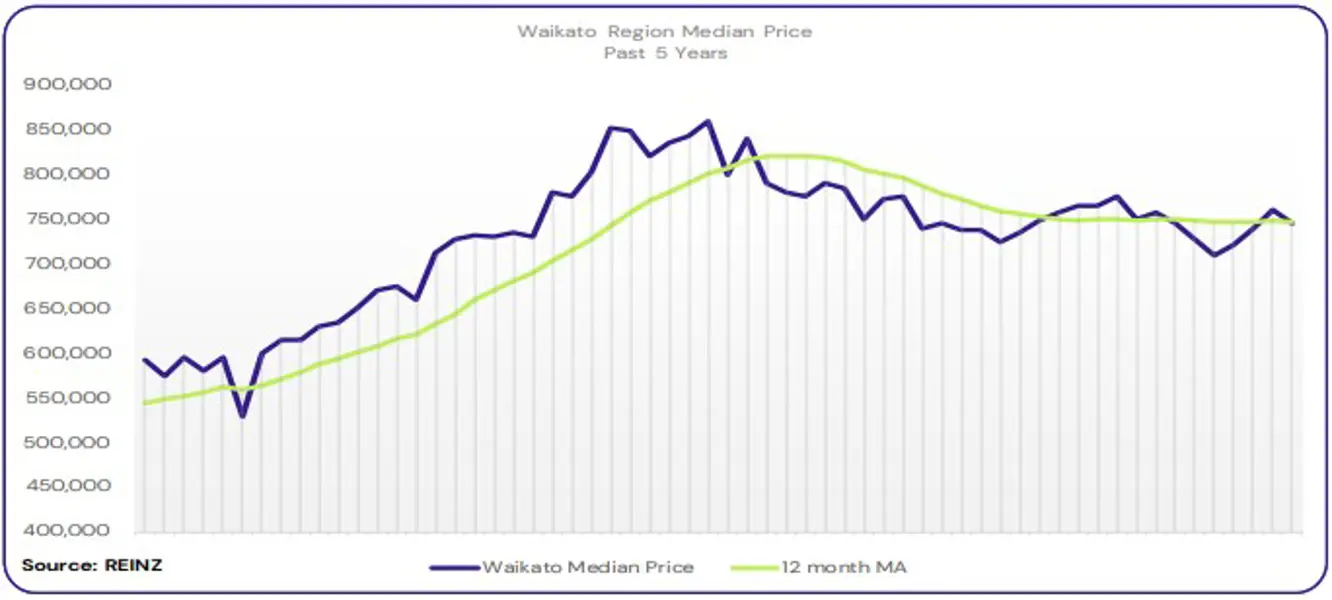

Regional Analysis - Waikato

Waikato’s median price decreased by 1.7% year-on-year to $745,000.

“Owner-occupiers, first home buyers and investors were Waikato’s most active buyer groups.

Most vendors remain realistic, although some believe that since the OCR announcement, prices should naturally “rise”, and so should their expectations. Attendance at open homes was encouraging for newer listings; properties that have been for longer weren’t getting as much traction.

The number of properties sold by auction has increased, and so have those in attendance. Clearance rates have improved as well, which may be because of more realistic seller and buyer scenarios. Factors like the OCR announcement, increased positivity, increased stock levels, decline in interest rates, the return of genuine buyers, and confident and active buyers have influenced market sentiment.

Local agents are hopeful the market will still respond positively leading up to the summer season, as we are entering the typical busy selling season and plenty of properties are for sale.” (REINZ).

The current median Days to Sell of 48 days is much more than the 10-year average for October which is 37 days. There were 26 weeks of inventory in October 2024 which is the same as the same time last year.

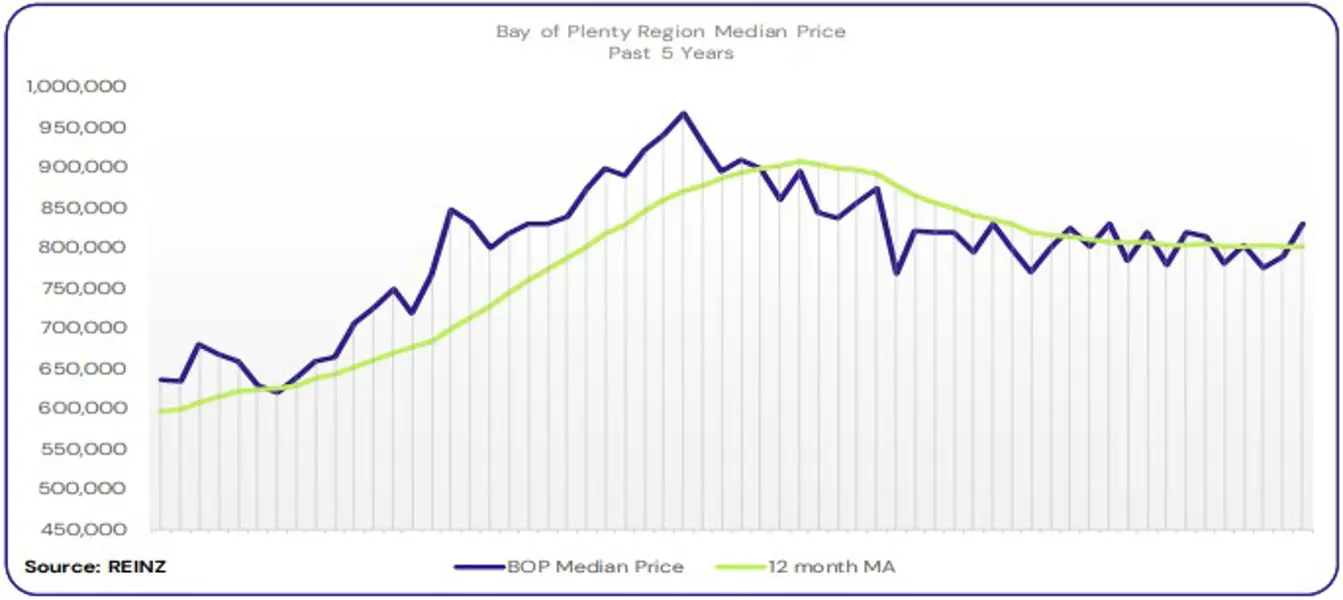

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased by 0.6% to $830,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with growing interest from investors as there was further market confidence since the declines in interest rates. Local agents report no declines in buyer pools; in

October, they only increased. Most vendors had realistic expectations regarding asking prices, and as they received genuine informed feedback, they saw the reality of where their property sits on the market. Attendance at open homes was fairly good, especially for new listings, but it still tended to drop after the first couple of weeks.

Auction room attendance levels increased weekly with active bidders, although properties sold well under the hammer if the price expectation was realistic. Factors like lower stock levels, a decline in interest rates, and further confidence in both buyers and sellers influenced the slight market sentiment shift. However, finance was still challenging to obtain.

Local agents cautiously predict that 2025 will be a good year, with greater turnover, further drops in interest rates and perhaps steady gains in prices and sales, too.” (REINZ).

The current median Days to Sell of 47 days is more than the 10-year average for October which is 40 days. There were 24 weeks of inventory in October 2024 which is the same as the same time last year.

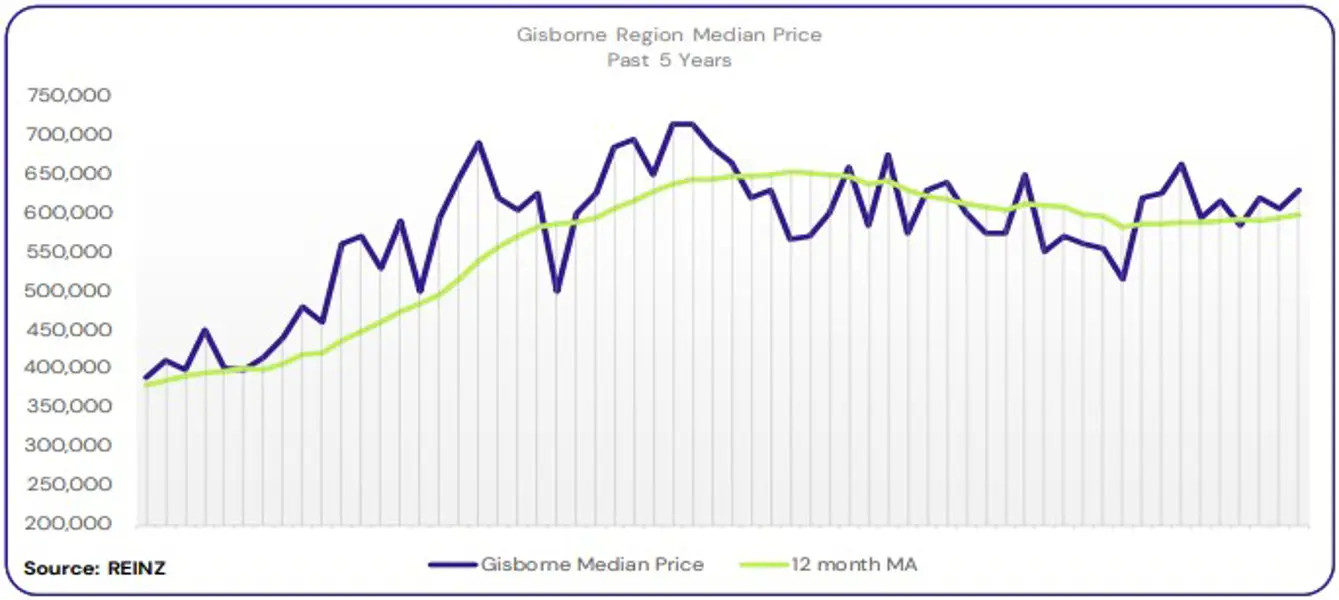

Regional Analysis - Gisborne

Gisborne’s median price increased by 10.4% year-on-year to $629,000.

“Investors and owner-occupiers were the two most active buyer groups in Gisborne this month. There was a slight decline in the mid-range buyer groups, resulting from longer bank approval timeframes.

Vendor expectations regarding asking price were increasingly realistic now that more transactions were happening. Attendance at open homes varied across the region, with some busier weeks than others. Auction room attendance was good as competition from buyers increased.

Market sentiment remains stable, with increased positivity and optimism leading up to Christmas and the New Year. Reduced interest rates, falling inflation and decreased OCR influenced market sentiment. After an influx of houses hitting the market, local agents don’t expect many more to be listed. Although, they do expect the New Year to be busy, with predicted price increases.” (REINZ).

The current median Days to Sell of 42 days is more than the 10-year average for October which is 37 days. There are 16 weeks of inventory in October 2024 which is 6 weeks more than last year.

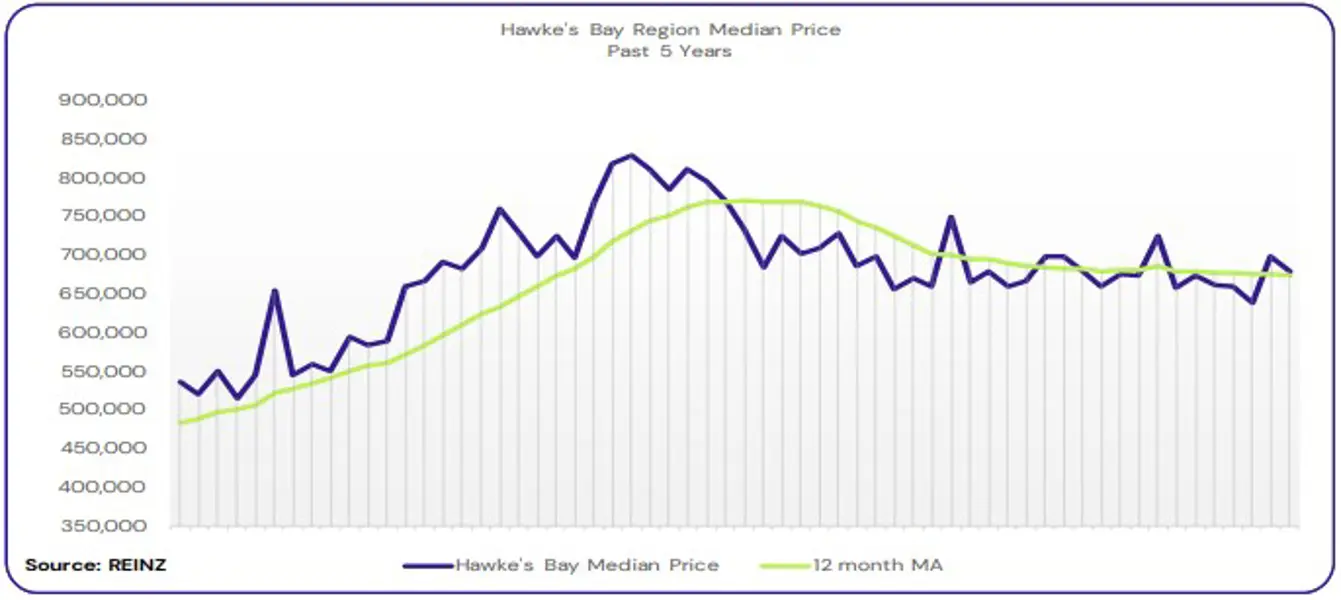

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price decreased by 2.9% year-on-year to $680,000.

“First home buyers, owner-occupiers and investors were the most active buyer groups. Vendor expectations were realistic, although some were firmer in response to the perception that buyers could afford more.

Attendance at open homes increased as the perception of values bottomed in Hawke’s Bay. Market sentiment has strengthened due to declining interest rates and increased activity with buyers and vendors. Local agents predict that as buyer activity continues to rise, listing numbers may stabilise, and as interest rates continue to fall, that will be a key driver of market activity.

Local salespeople suggest the biggest challenge may be keeping vendors’ expectations reasonable, as the benefits of interest rates dropping may take time to filter through the market.” (REINZ).

The current median Days to Sell of 45 days is more than the 10-year average for October which is 35 days. There were 18 weeks of inventory in October 2024 which is 1 week more than the same time last year.

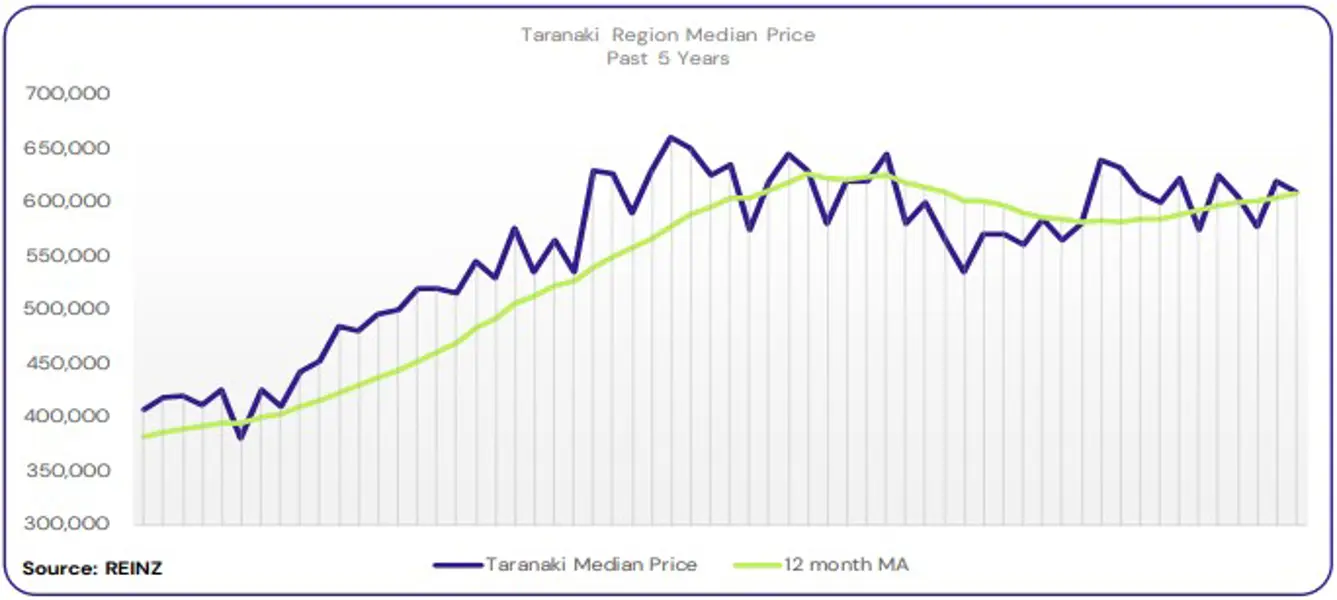

Regional Analysis - Taranaki

Taranaki’s median price increased by 8.0% year-on-year to $610,000.

“Owner-occupiers were the most active buyer group even though a wide range of buyers were active in October. There was no noticeable decline in the buyer pool. Although most vendors have realistic price expectations and meet market conditions, there has been an increase in vendors who explain how much more they should get for their property, making the price unrealistic for current conditions.

Attendance at open homes has increased steadily over the last three months. A popular method of viewing has been twilight viewings, which were well-attended.

This month, the decline in interest rates, more active buyers, and increased multi-offers influenced market sentiment. There seems to be a good mix of buyers in the market, most acting now as they believe sales prices may gradually increase. Local agents predict with caution that sales may increase this quarter, with an increase in higher-end sales last month being welcoming news for many.” (REINZ).

The current median Days to Sell of 40 days is more than the 10-year average for October which is 32 days. There were 22 weeks of inventory in October 2024 which is 2 weeks more than the same time last year.

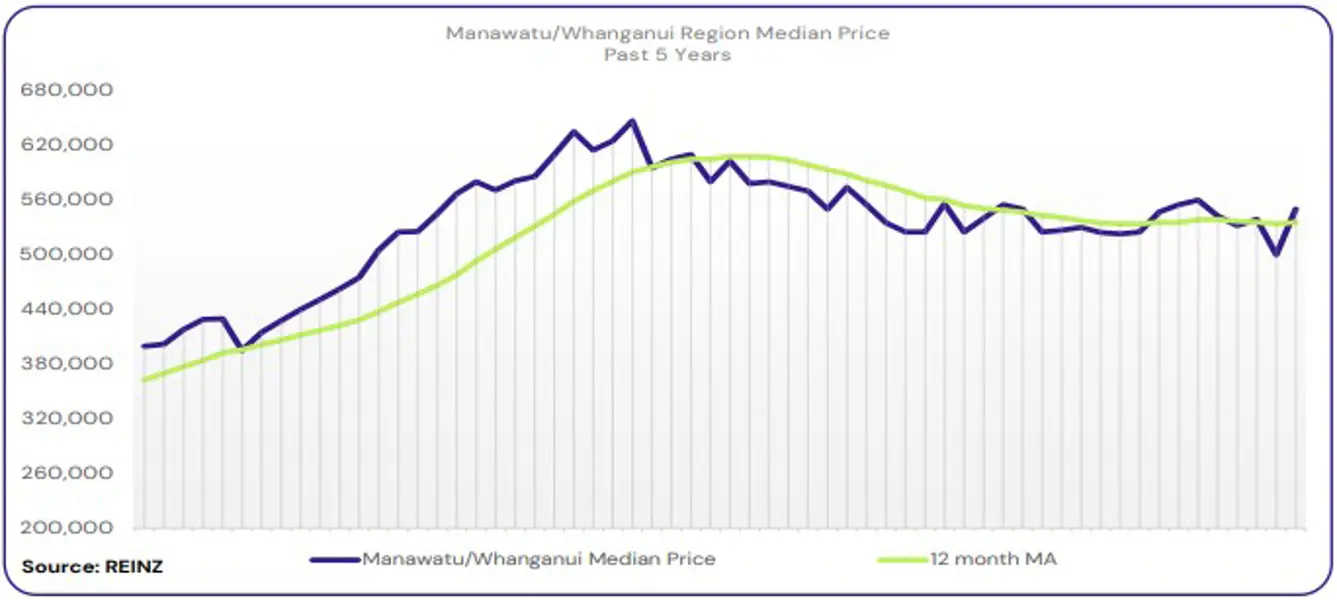

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased by 4.4% year-on-year to $550,000.

“Owner-occupiers were the most active buyer group, with a slight increase in queries from first home buyers, investors still absent.

Vendors seem more accepting of property values as they become educated on current market conditions, and those who want to sell are meeting the market. Overpriced properties remained on the market. Attendance at open homes varied; newer listings or properties priced to meet market expectations attract reasonable numbers. There were reports of increased activity in auction rooms and some successful sales under the hammer.

The OCR announcement increased confidence in buyers, and banks’ review of lending criteria created a positive market sentiment. Local agents cautiously predict the market will continue to grow slightly through November and dip slightly over Christmas and the New Year.” (REINZ).

The current median Days to Sell of 48 days is more than the 10-year average for October which is 34 days. There were 22 weeks of inventory in October 2024 which is 3 weeks more than the same time last year.

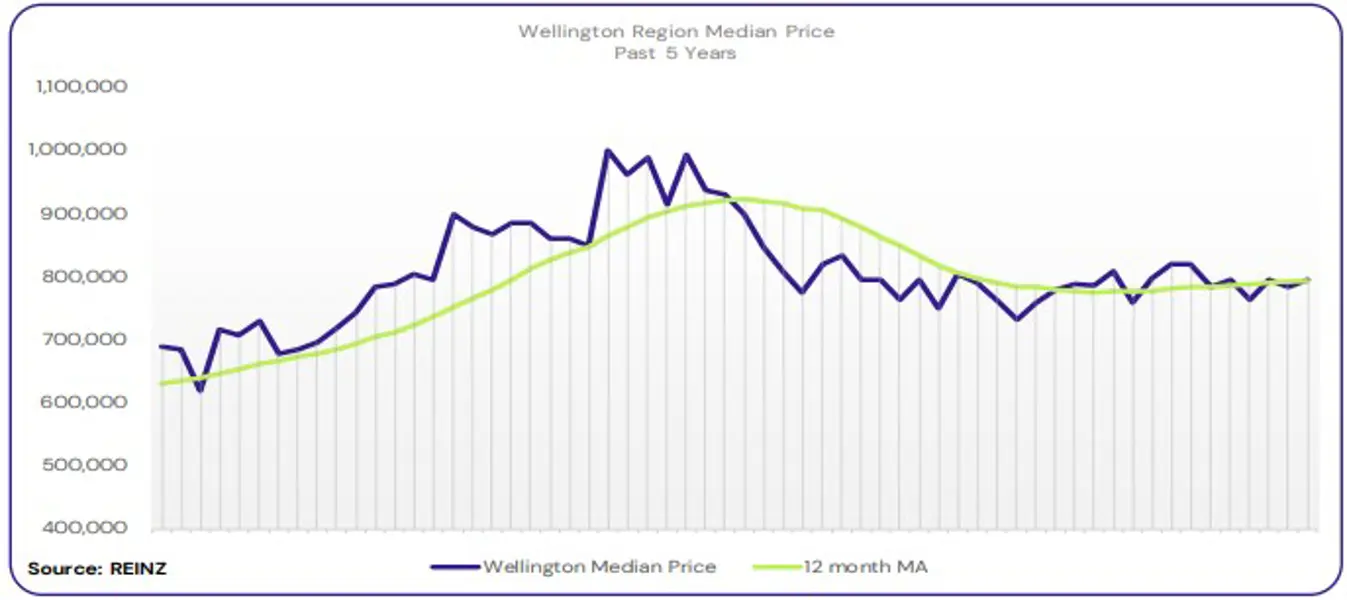

Regional Analysis - Wellington

Wellington’s median price increased by 0.6% year-on-year to $795,000.

“First-home buyers were the most active buyer group, although those looking to purchase a second home were active, too. Investors were still absent from the market.

Vendor expectations were still realistic, as most were conditioned to the current market and economic climate. However, some vendors have begun to question values after observing the media stating that prices might rise. Attendance at open homes were still low. The auction room attendance was also low, as not many properties were selling under the hammer.

If properties received little to no enquiry, some vendors chose to take their property off the market. This is reflected in market sentiment, as buyers lack confidence and are unsure of market conditions. Local agents are cautiously optimistic that we head into summer and after the New Year, where hopefully, there will be more listings and sales and further drops in interest rates.” (REINZ).

The current median Days to Sell of 41 days is more than the 10-year average for October of 33 days. There were 16 weeks of inventory in October 2024 which is 5 weeks more than the same time last year.

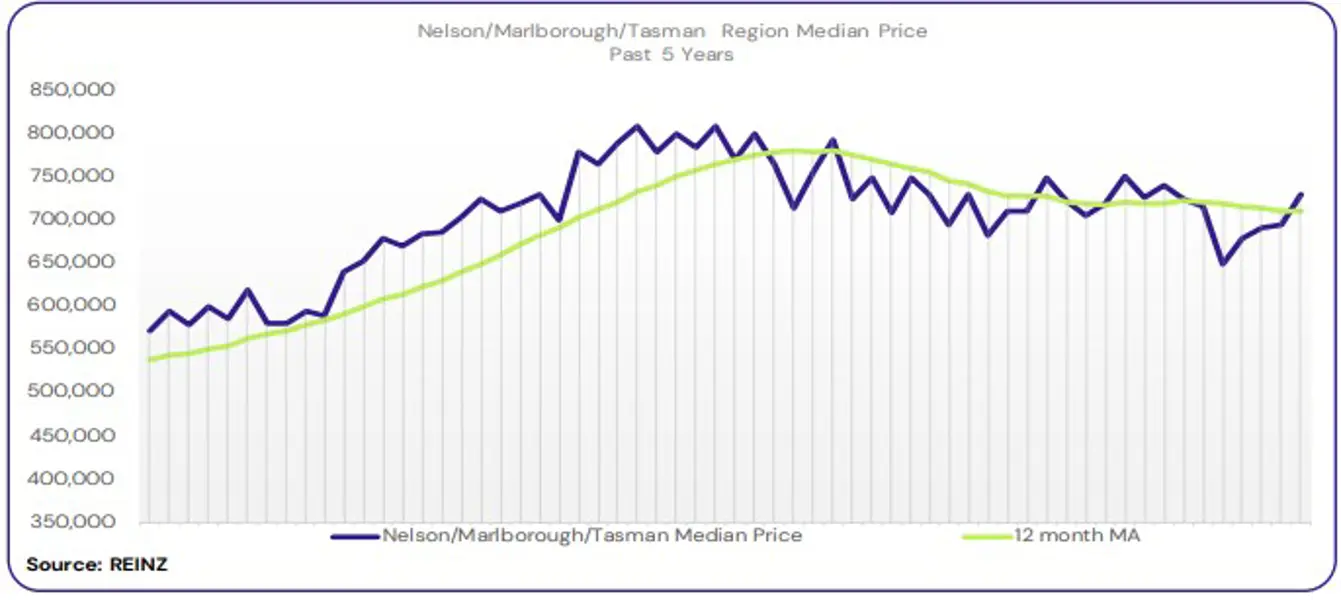

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased by 2.3% year-on-year to 655,000. The median price for Marlborough increased year-on-year by 18.3% to 769,000. The median price for Tasman decreased by 13.2% year-on-year to 744,000.

“All buyer pools were active in October, including owner-occupiers, investors and first home buyers. A decline in overseas and high-end buyers.

Vendors were aware of increased activity and were hoping for price increases, especially following recent media coverage around asking prices. Attendance at open homes was steady, with Nelson reporting strong increases in attendees.

Market sentiment was growing in confidence, although buyers remained active but selective and calculated due to the amount of stock available. Buyers are increasingly concerned about overpaying for a property. Local agents are cautiously optimistic that market activity will increase slightly in the pre-Christmas rush. They remain hopeful that this will bring more buyers in 2025.” (REINZ).

The current median Days to Sell of 46 days is much more than the 10-year average for October which is 35 days. There were 27 weeks of inventory in October 2024 which is 5 weeks more than the same time last year.

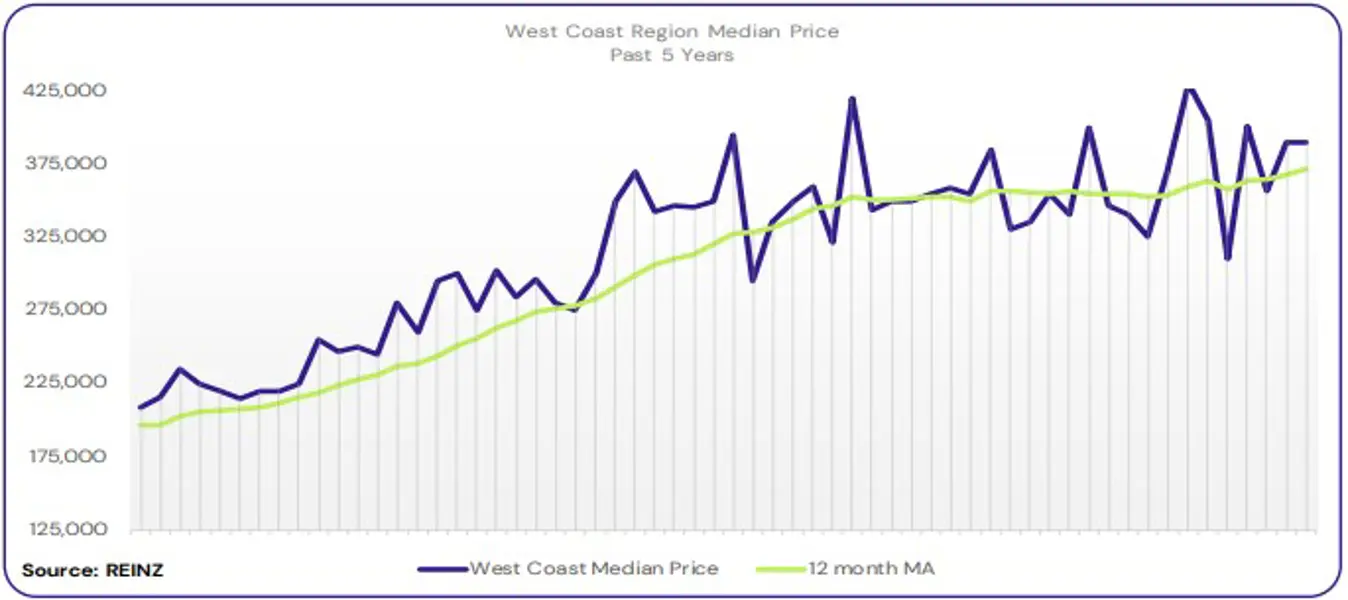

Regional Analysis - West Coast

West Coast’s median price increased by 14.7% year-on-year to $390,000.

“Owner-occupiers were the most active buyer group, with increased interest from all buyer pools over the month.

Many vendors strategically set prices for their properties but demonstrated a willingness to negotiate, creating a flexible selling atmosphere. Attendance at open homes was encouraging, with a steady stream of interested buyers exploring the houses each weekend, showcasing the appeal of multiple properties for sale.

Overall, market sentiment remained moderate. Local agents predict a growing market leading up to Christmas, with advertisements for mining jobs suggesting that this will bring more activity and positivity to the rental and housing market.” (REINZ).

The current median Days to Sell of 24 days is much less than the 10-year average for October which is 56 days. There were 58 weeks of inventory in October 2024 which is 16 weeks more than the same time last year.

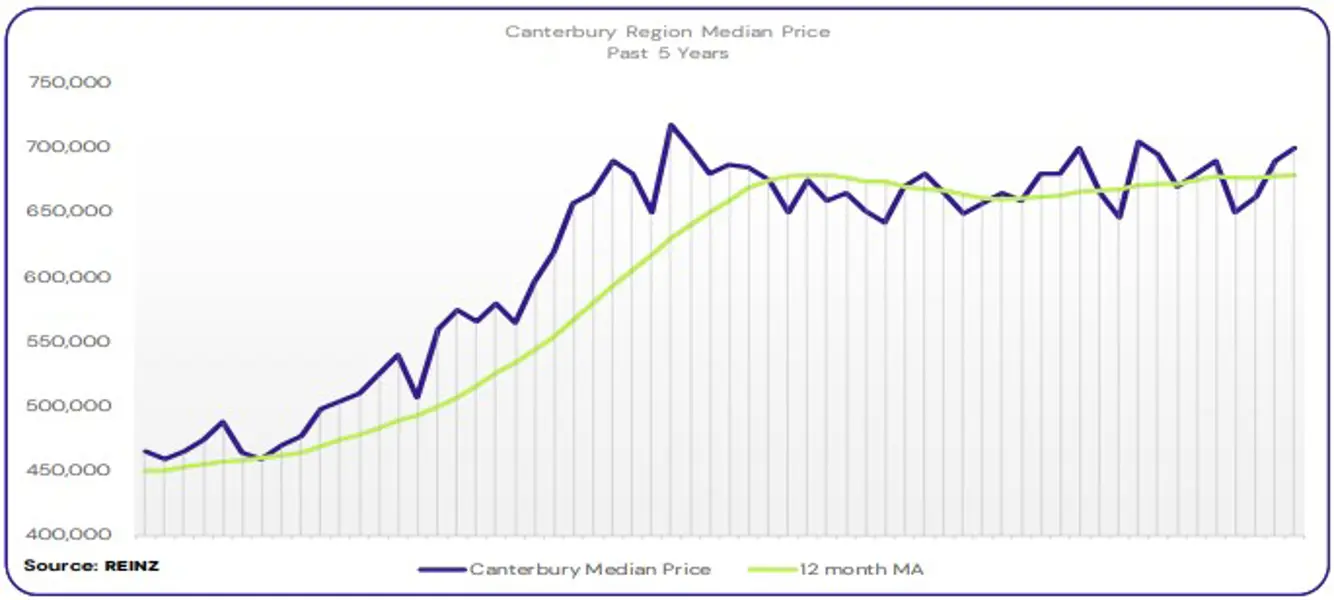

Regional Analysis - Canterbury

The median price for Canterbury increased by 2.9% year-on-year to $700,000.

“Owner-occupiers, first home buyers and investors were the most active buyer groups. Overseas buyers were absent. Most vendors were realistic and willing to meet market conditions, although others were hopeful that the decline in interest rates would increase prices. Attendance at open homes was steady; newer listings were more popular, and properties that needed work done were slow.

Auction room attendance was strong despite not having many cash buyers. Some vendors were hopeful prices would increase, so they held off on putting their property on the market. The buyer pool is light, but properties were selling.

The positive OCR announcement and the decline in interest rates created positive and confident market sentiment. Local agents remain hopeful that leading up to Christmas and into 2025, there will be an increase in listings, buyer activity, and possibly further interest rate decreases. However, they predict there won’t be price increases just yet.” (REINZ).

The current median Days to Sell of 38 days is more than the 10-year average for October which is 33 days. There were 17 weeks of inventory in October 2024 which is 3 weeks more than the same time last year.

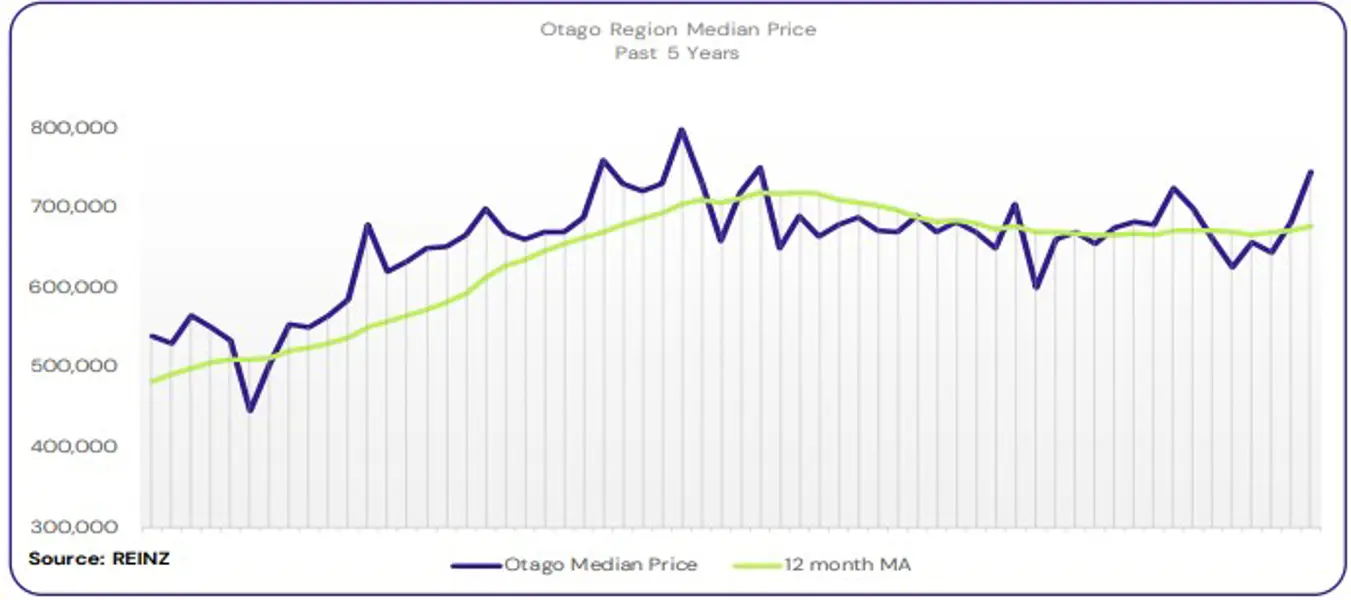

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price increased by 4.2% year-on-year to $620,000.

Buyers at the top-end and middle-end and first home buyers were the most active this month. Investors were still noticeably absent.

Vendors were aware of the increased activity and confused this for an increased asking price, which was not the case. Overall, attendance at open homes was good across different housing types and values. Clearance rates at auctions increased, although some buyers opted to wait and purchase post-auction.

Market sentiment was influenced by mortgage brokers’ statements, along with banks’ slightly loosening lending criteria and reducing interest rates, which created a confident market.

Local agents cautiously predict the market will improve and become stable just before Christmas.”

Queenstown Lakes

“Owner-occupiers and first home buyers were still the most active buyer groups for October. Local salespeople suggest that even though there was an OCR drop. Overseas buyers are slowly gaining momentum.

Some vendors feel that as interest rates fell, the market would’ve immediately responded to increased buyer demand and were less likely to negotiate. Attendance at open homes was growing, with the stock level and lower interest rates allowing buyers more choices.

Auction room clearance rates and attendance seemed lower than last month. Buyers have more options as stock numbers increase in the Central Lakes area and a combination of existing stock and new stock appears. Local agents suggest that there hasn’t been much of a shift in market sentiment. However, there has been more engagement through open homes and mortgage applications. These all suggest positive signs for market recovery through the summer, although local agents cautiously predict the second quarter of 2025 will be where significant changes may happen.” (REINZ).

The current median Days to Sell of 42 days is more than the 10-year average for October which is 34 days. There were 20 weeks of inventory in October 2024 which is 1 week more than the same time last year.

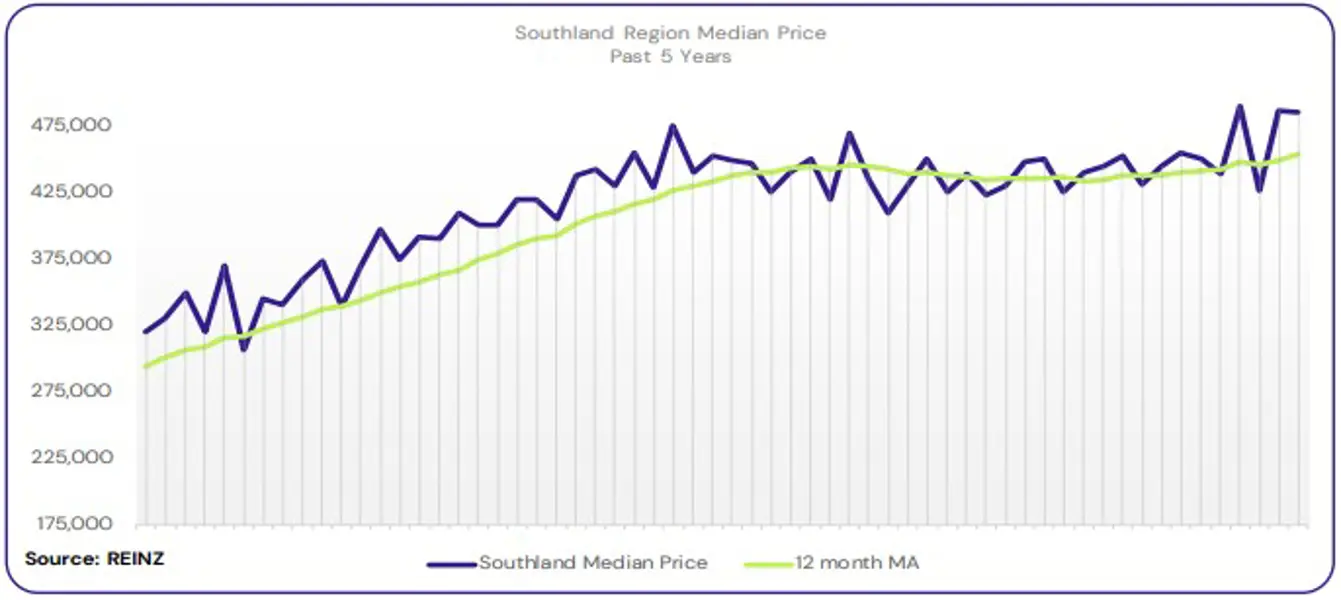

Regional Analysis - Southland

The median price for Southland increased by 14.1% year-on-year to 485,000.

“First-home buyers were Southland’s most active buyer group due to lower interest rates and more properties available.

Vendors listened to the market and what was happening in the economy. Local agents state they are working with the buyers in most cases. Attendance at open homes varied, with those under $600K receiving the most interest and aged stock receiving little to no traction.

Auction clearance rates have been good, with two to three bidders in attendance. Job security, increased stock, and the decline in interest rates influenced an upward lift in market sentiment. Local agents hope there will be further positive signs regarding interest rates and the economy leading up to and after Christmas.” (REINZ).

The current median Days to Sell of 44 days is much more than the 10-year average for October which is 32 days. There were 17 weeks of inventory in October 2024 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.