NZ's fast-changing landscape of primary sector land use

Tuesday, 6 July 2021

By continuing, you agree to our terms of use and privacy policy

Instructions on how to reset your password will be sent to the email below.

Tuesday, 6 July 2021

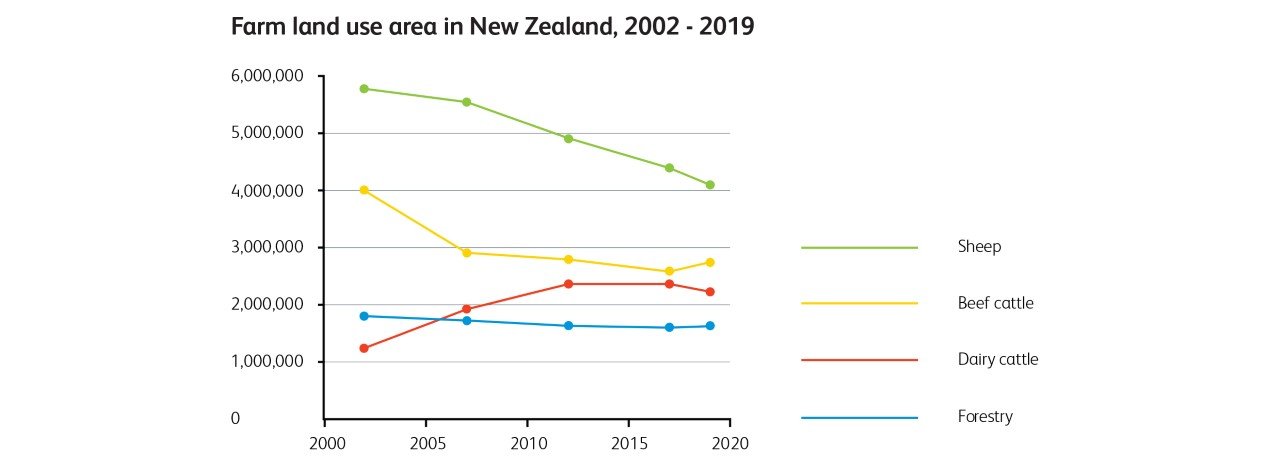

The data sourced from the Stats NZ agriculture production survey is quite confronting, particularly when you look at it in the context of the last 20 years and the implications out to 2030.

Some of the key findings over the last 20 years include:

The big question today, however, is what will be the impact of forestry land use over the next decade?

The survey data for 2020 is not available yet, but the consensus view is that forestry land use will show a significant upward shift in favour of new forest planting over the next 5 to 10 years.

Legislation has historically set the platform for rapid NZ land use change. Last June’s Climate Change Response (Emissions Trading Reform) Amendment Act 2020 could potentially have the same future impact as the 2001 Dairy Industry Restructuring Act on NZ. The DIRA change ultimately was the catalyst for 1 million new hectares in dairy production between 2000 – 2010; this happened very quickly in regions like Southland and Canterbury.

We are really only at the beginning of this ETS story. The change impact in favour of further NZ forestry production is gaining real momentum in both the North and South Island at this time. We have significantly more demand for land than we have listings.

Compounding this current change, the window for a straight carbon play and the notion of carbon sinks is a significant factor in the market. Any way you look at it, the carbon sink story is short-term thinking at best for NZ Inc.

While much is made of the downside of forestry land use change, the competition for land has underpinned value much like the 1990’s. In some east coast North Island coastal locations over the last 3-4 years, we have observed a two-fold increase in station valuations, where 3 years ago, there was little if any real demand for extensive more remote breeding properties with listings carried forward from one season to the next. This season has been particularly strong and notably, many properties have been purchased by proven farmers with forestry interests the under bidder.

If current predictions for the carbon price are truly set to double in the not-too-distant future, as has happened in Europe this year, our NZ farmer’s ability to grow and compete for post-1990 pastoral land will be severely tempered in future seasons.

The looming danger of large-scale land use change from sheep and beef country to forestry surfaces when a farm comes to market.

A large proportion of older rural landowners are looking to move off-farm and are searching for guidance around succession. The opportunity to maximise value with their farm exit has the potential to be without precedent over the next 5 to 10 years.

Good quality advice can be hard to come by. However, in a recent meeting with Forest360, their team outlined many land use opportunities that align with landowner succession goals and bottom lines.

They regularly see missed opportunities with the asset as it stands today, let alone strategic choices to improve wetlands, slope stabilisation or options for some production forestry on the various classes of land – all of which has the potential to create significant associated carbon revenues.

Forest360 is a full-service forestry company, offering services from land use planning and forest establishment to harvesting and marketing. They provide specialist advice about what existing forests could qualify for the ETS, what to plant and where and what it all means for the environment and your pocket. All of which can help you make informed decisions on the best land use options for you and your farm business.

Many of the Forest360 team have rural backgrounds and understand that ‘right species right place’ is essential, whether that be poplars on slipping slopes, pine or native trees on targeted areas of the farm.

The ETS is not always easy to navigate. However, in this fast-changing landscape of farms, timber, and carbon, it does not mean it should be ignored as an opportunity for diversification.

If the goal is to give the next generation a fighting chance to take the property forward, then having a plan for the farm around how to leverage the ETS will be an important hedge for the future.

The option to participate in the ETS could be as simple as making a phone call and getting an initial assessment from an appropriately qualified specialist.

It is hard to imagine a stronger combination of positive value factors for sheep and beef producers holding or leasing their assets long term, as underlying farm returns and productivity continue to improve and every year, there is less and less land in sheep production.

If the objective is to exit, there is no requirement to do anything other than not accept the first offer and get advice on creating a level playing field for farmers to participate in the sale process.

Our approach is to take all farms to the open market, ensuring the broadest level of coverage to build confidence in the marketing process. We are a service industry and our priority always is to give our vendor all the options, but at the end of the day, it’s their family views and wishes tied to their succession plans that drive the final choices.

Conrad Wilkshire,

GM Rural for Property Brokers Ltd

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.