Sales up, amidst a national and regional increase in listings - REINZ stats May 2024

Tuesday, 18 June 2024

The May 2024 data shows a national and regional increase in listings and sales counts while median sales prices stabilise.

REINZ Chief Executive Jen Baird says the market shows a general theme of more this month with higher sales counts, increased stock levels, more listings, and properties selling more quickly than a year ago. These annual increases contrast with current challenges in securing finance, changes in the job market, and the wait on OCR and interest rate changes.

The total number of properties sold in New Zealand increased by 8.0% compared to April 2024, from 5,834 to 6,303, and by 6.8% year-on-year, from 5,903 to 6,303. Gisborne had the highest increase, up by +112% year-on-year, and 11 of the 16 regions had increases in sales count month-on-month and year-on-year. " The seasonally adjusted figure is an important indicator of the underlying market trends. By seasonally adjusting the data we can see whether the change in sales is part of a normal change we would expect, or something else is happening." says Baird.

“Nationally, seasonally adjusted figures show a 5.2% increase, indicating that year-on-year sales counts performed slightly above expectations – an encouraging sign despite the current economic challenges.”

Listings increased nationally by 25.4% year-on-year from 7,359 to 9,225, continuing a trend since the start of 2024. Twelve of the sixteen regions have increased in new listings year-on-year with notable increases in Wellington (+103.3%), Hawke’s Bay (+34.3%), Marlborough (+33.3%), Auckland (+30.0%), Otago (+31.4%) and Waikato (+20.7%).

Stock levels for May 2024 increased 22% (+5,913) from 26,685 to 32,598 year-on-year and decreased 3.6% from 33,815 month-on-month. For New Zealand ex Auckland, stock levels increased 18.9% (+3,215) up from 17,015 to 20,230. “With a continued flow of new options coming to the market adding to a large level of stock this does provide a lot of choice for buyers and a sense that they can take their time to make decisions," adds Baird.

The national median sale price decreased slightly by 1.3% year-on-year, from $780,000 to $770,000, and decreased by 2.5% compared with April 2024, from $790,000 to $770,000. “The seasonally adjusted figures show a 1.2% decrease, showing prices performed slightly below the change usual for May. The volume of listings and choice can affect prices as well as vendor price points adjusting to buyer demands.”

Ten of 16 regions had year-on-year price increases with West Coast leading the way with a 14.1% increase, from $355,000 to $405,000. Compared to April 2024, only three additional regions had median sale price increases (Hawke’s Bay +2.3% to $675,000; Manawatu-Whanganui +0.9% to $560,000; Canterbury +1.5% to $680,000).

Nationally, median Days to Sell decreased by 5 days, from 49 to 44 days, compared to a year ago. For New Zealand, excluding Auckland, median Days to Sell decreased by 8 days year-on-year, from 51 to 43 days. In 10 of the 16 regions, median Days to Sell were lower compared with May 2023. Northland had the highest days to sell at 71 days compared to 56 last month and 60 compared to May 2023.

“There’s solid buyer interest and activity, and more listings are coming to a well-stocked market. While some buyers are taking their time, others are snapping up properties at attractive prices before the expected slowing during the winter months and the potential reemergence of investors mid-year. It might be a few months yet before the residual impact of readjustments post the government’s 100-day plan and budget are felt. Indeed, there are cool economic breezes being felt but there are signs of more positive activity ahead,” adds Baird.

Regional highlights

- Gisborne had the highest increase in sales count, up by +112% year-on-year, and 11 of the 16 regions had increases in sales count month-on-month and year-on-year.

- Twelve of the sixteen regions have increased in new listings year-on-year with notable increases in Wellington at +103.3%.

- Ten of the sixteen regions had price increases, with West Coast topping the charts with a 14.1% increase year-on-year from $355,000 to $405,000.

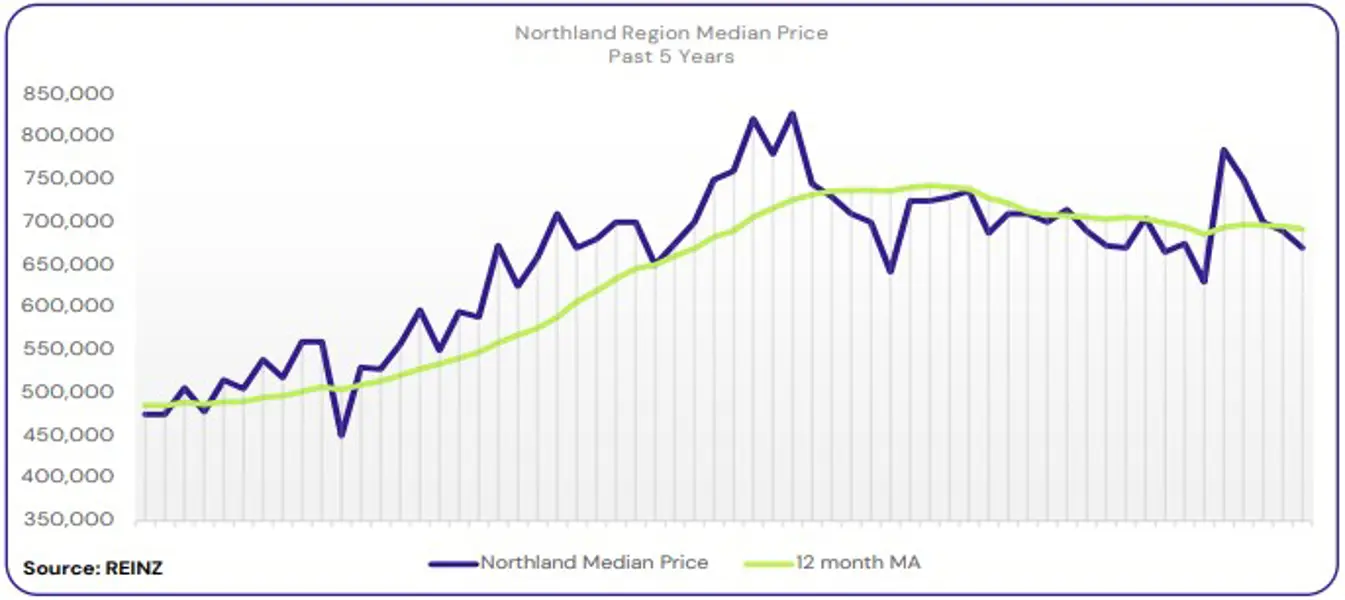

Regional Analysis - Northland

The median price for Northland decreased 6.3% year-on-year to $670,000.

“First-home buyers and buyers looking for a family home were the most active groups, with investor activity reported in Whangarei. Most vendors know market expectations but are hesitant to adjust their prices. Open home attendance varied across the region, with good attendance recorded at newly listed properties.

Auction attendance levels lifted, with people bidding in the auction room, but conditional sales were made outside the auction room. Interest rates, the removal of the First Home Grant, bright-line property rule changes, and economic uncertainty influenced market sentiment. Local agents are hopeful activity may lift once investors return and if interest rates drop.” (REINZ)

The current median Days to Sell of 71 days is much more than the 10-year average for May which is 52 days. There were 45 weeks of inventory in May 2024 which is 2 weeks less than the same time last year.

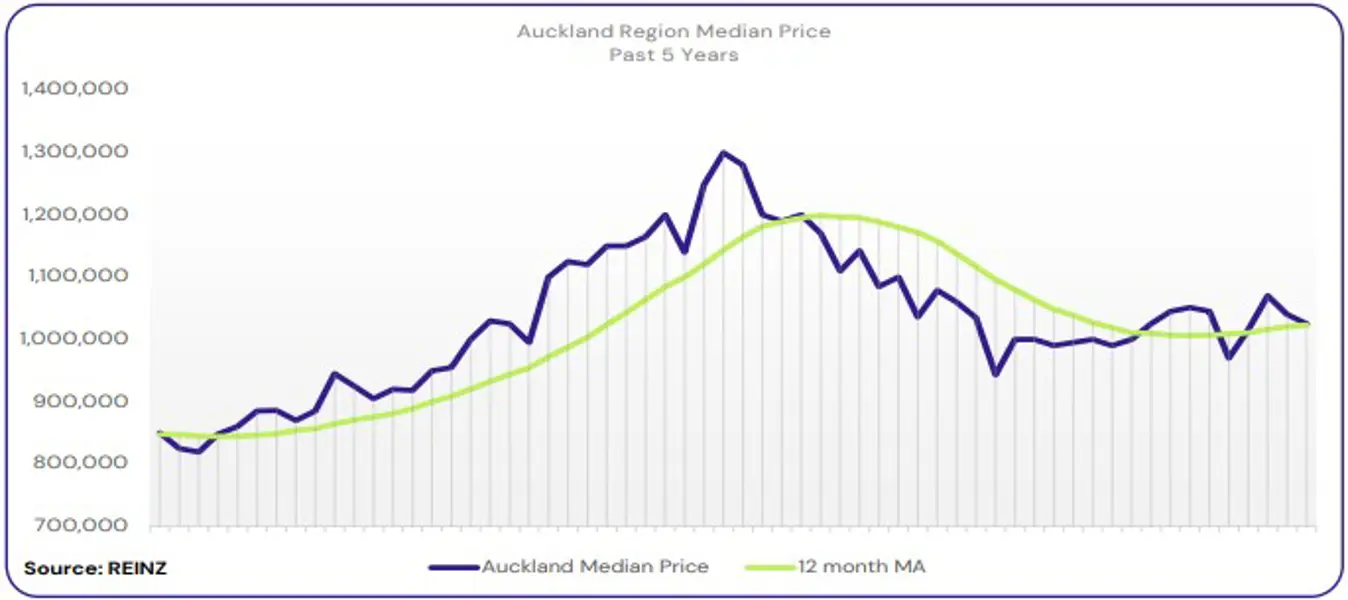

Regional Analysis - Auckland

In Auckland, the median price increased 3.0% year-on-year to $1,025,000.

“First-home buyers and owner occupiers remained the most active buyer groups across the region, with investor enquiries increasing in South Auckland.

Local agents report that most vendors hold firm to their original price expectations. Open home attendance varies, with newer listings attracting higher numbers. Auction activity remains light. Interest rates, mortgage serviceability, bank lending criteria and vendor expectations influenced market sentiment.

Local agents remain hopeful that activity might increase once investors return and borrowing conditions are reduced.” (REINZ)

The current median Days to Sell of 46 days is more than the 10-year average for May which is 42 days. There were 27 weeks of inventory in May 2024 which is 1 week less than the same time last year.

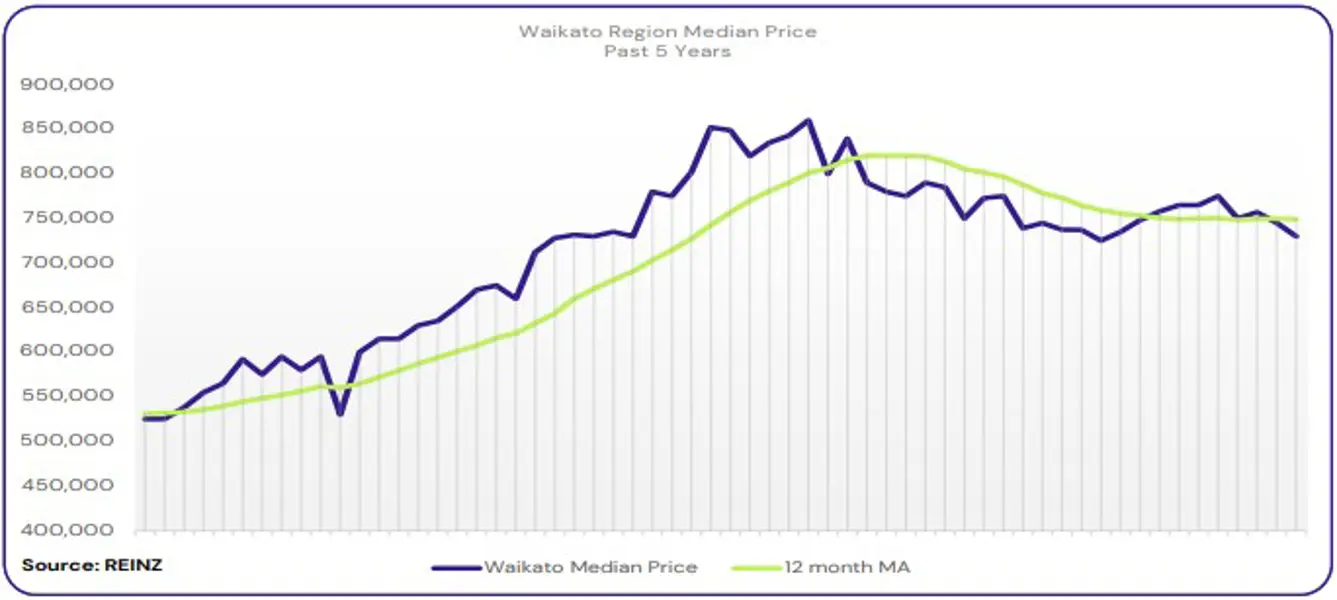

Regional Analysis - Waikato

The median price in Waikato decreased 1.0% year-on-year to $730,000.

“Owner occupiers and first-home buyers were the most active buyer groups across the region. Holiday home buyers were also active in Taupo.

Most vendors are adjusting their prices to meet market expectations. Open home attendance varied across the region. Auction attendance was steady in Taupo and Thames / Coromandel, with some properties selling after the auction rather than in the auction room.

Factors like mortgage serviceability, interest rates and high stock levels influenced market sentiment. With high stock levels creating a lack of buyer urgency, local agents remain cautiously optimistic that sales numbers might increase once investors return.” (REINZ)

The current median Days to Sell of 54 days is more than the 10-year average for May which is 44 days. There were 27 weeks of inventory in May 2024 which is the same as the same time last year.

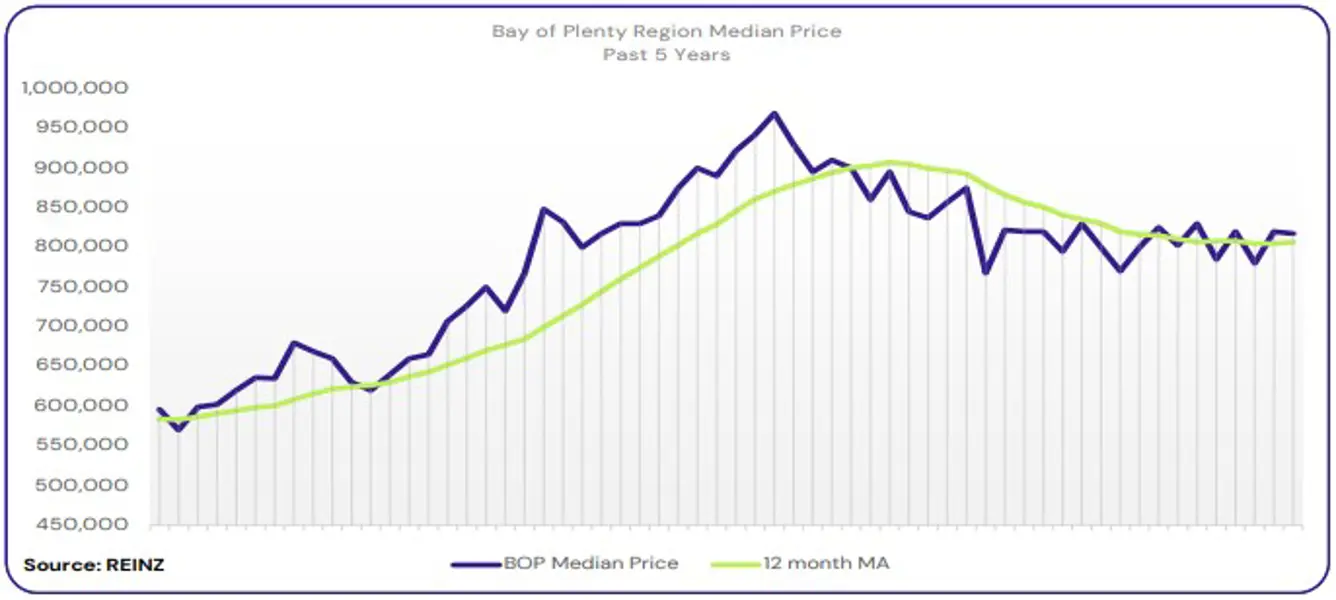

Regional Analysis - Bay of Plenty

The median price for Bay of Plenty increased 2.8% year-on-year to $817,500.

“Owner occupiers and first-home buyers were the most predominant buyer groups, with some investor activity in Rotorua.

Most vendors meet market price expectations, while some are taking time to negotiate a sale price. Open home attendance holds steady, with newer listings seeing higher numbers. Auction attendance in Tauranga remains steady, but with few active bidders. Factors such as economic confusion, market uncertainty, high stock levels, the cost of living and upcoming Government policy changes are impacting market sentiment.

Local agents remain hopeful the housing market will stabilise as we progress through the year and if interest rates drop.” (REINZ)

The current median Days to Sell of 50 days is more than the 10-year average for May which is 46 days. There were 25 weeks of inventory in May 2024 which is 3 weeks more than the same time last year.

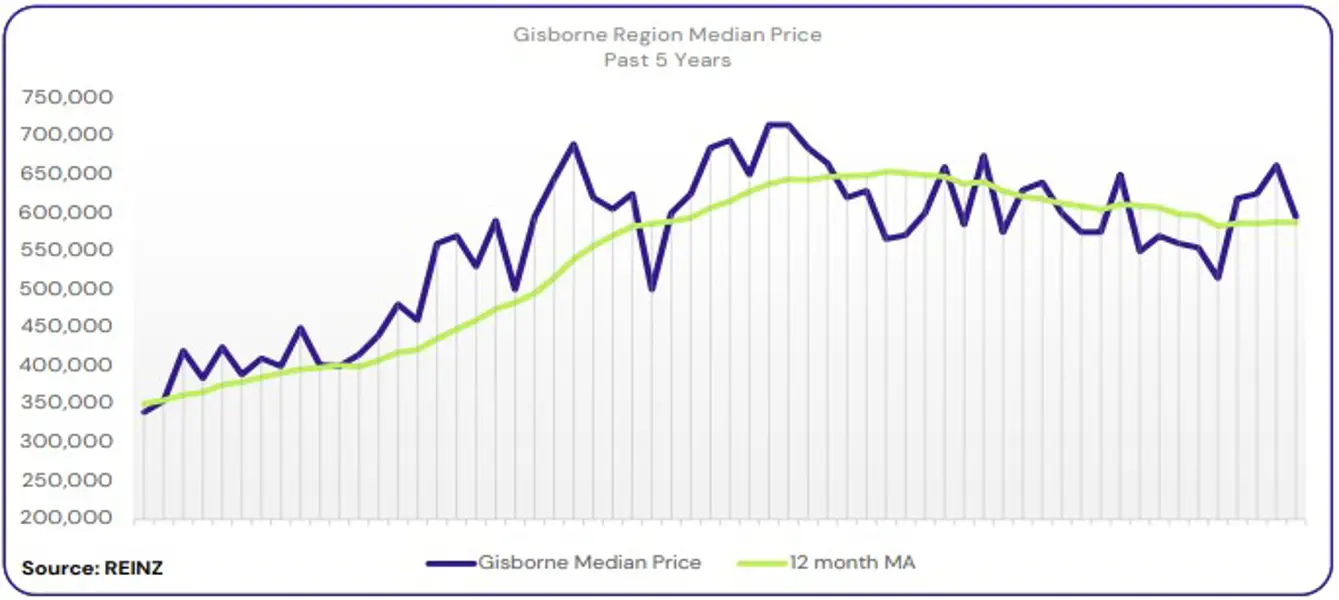

Regional Analysis - Gisborne

Gisborne’s median price has decreased 0.8% year-on-year to $595,000.

“The region saw a 112% increase in sales counts year-on-year (from 25 to 53). Gisborne also saw a 25% increase in average listings year-on-year (from 24 to 30).

The region’s average inventory was 81 in May 2024, a 3.3% decrease year-on-year. Days to sell in May 2024 increased 2.3% year-on-year (from 44 to 45 days).” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for May which is 43 days. There are 8 weeks of inventory in May 2024 which is 2 weeks less than last year.

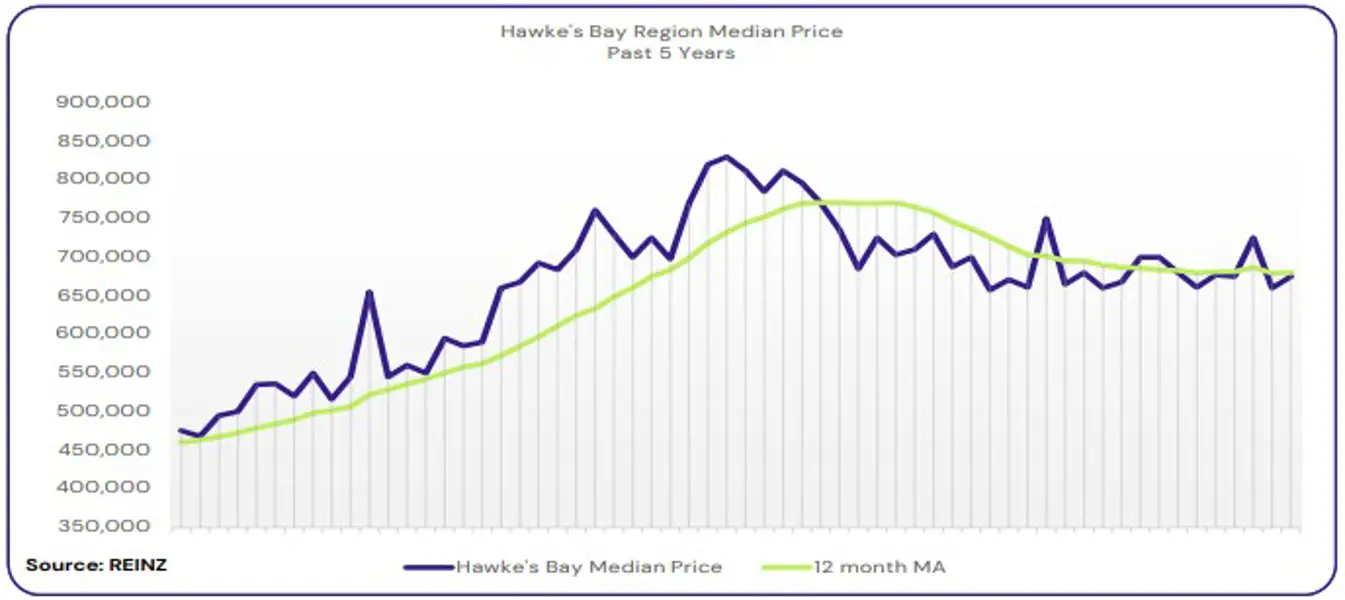

Regional Analysis - Hawke's Bay

The median price for Hawke's Bay increased 1.5% year-on-year to $675,000.

“First-home buyers and owner occupiers remain the most active buyer groups. Most vendors’ expectations are too high, and they hesitate to adjust prices. As average days on the market remain high, some vendors opt to withdraw their properties rather than adjust prices.

Open home attendance remained steady for new listings. Factors like interest rates and general economic conditions impacted market sentiment.

Local agents report some buyers are adopting a ‘wait and see’ approach and predict that may continue in the cooler months.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for May which is 42 days. There were 17 weeks of inventory in May 2024 which is 1 week more than the same time last year.

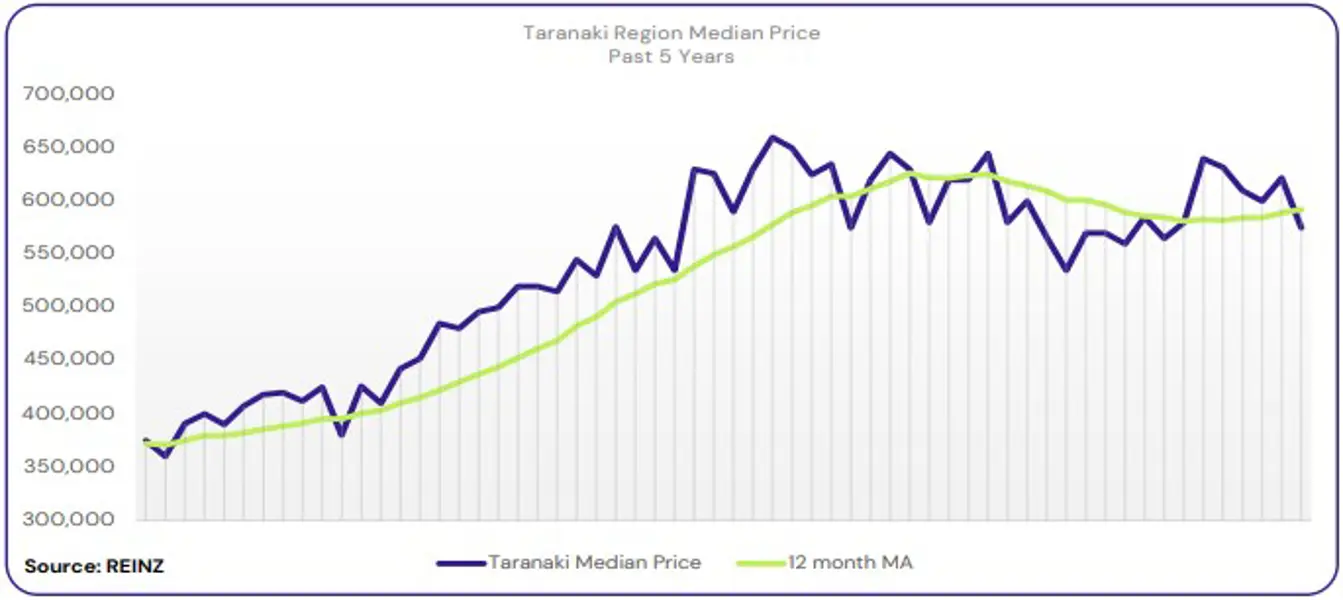

Regional Analysis - Taranaki

The median price for Taranaki increased 7.5% year-on-year to $575,000.

“Owner occupiers and first-home buyers were the most active buyer groups across the region, with investor activity increasing in some areas. Some vendors are coming to the market well-prepared to meet market expectations. New listings are attracting high numbers at open homes, but attendance drops for properties several weeks into a campaign.

Interest rates and the lack of buyer urgency due to increased stock levels influenced market sentiment. Local agents remain cautiously hopeful that once interest rates drop, sales volumes might increase.” (REINZ)

The current median Days to Sell of 42 days is the same as the 10-year average for May which is 42 days. There were 19 weeks of inventory in May 2024 which is 2 weeks less than the same time last year.

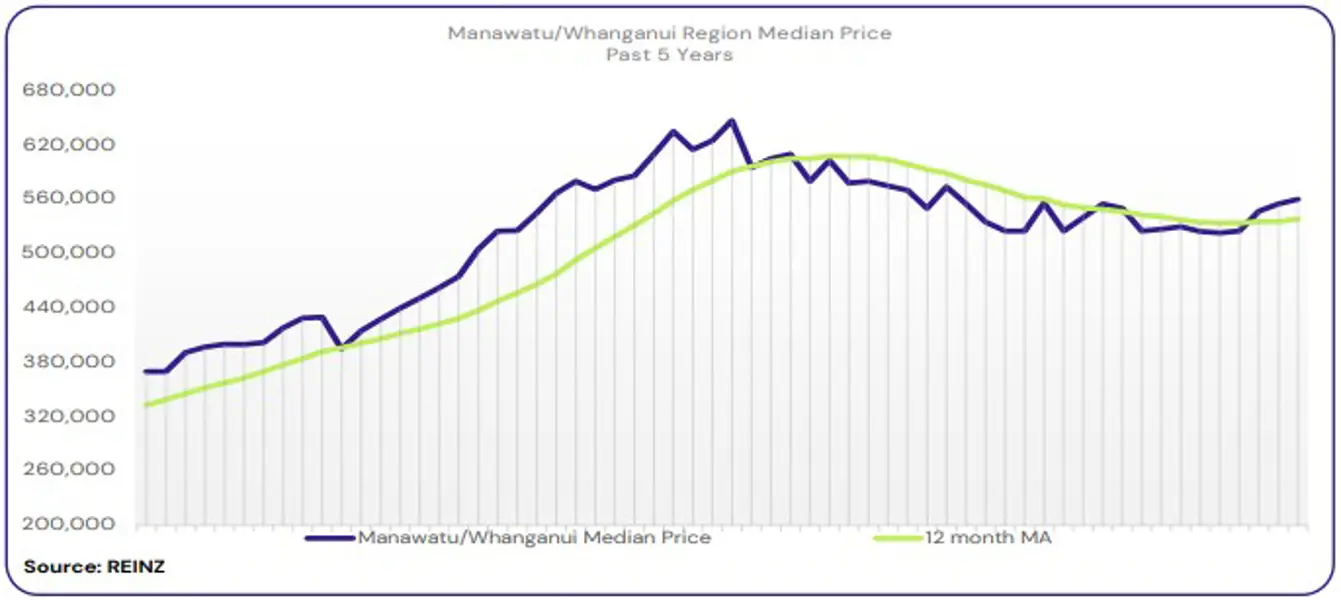

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased 6.7% year-on-year to $560,000.

“Owner occupiers were the predominant buyer group in May, with some enquiries from first-home buyers. Vendors are adjusting their prices to meet market expectations. Open home numbers for new listings have attracted good attendance, while attendance decreased significantly for properties on the market for several weeks or longer.

Interest rates, job security, cost of living, bank lending criteria, vendor expectations and economic confusion remain a concern for most buyers. Local salespeople predict with no major changes eventuating in the coming months, the market will remain steady.” (REINZ)

The current median Days to Sell of 46 days is the same as the 10-year average for May which is 41 days. There were 24 weeks of inventory in May 2024 which is 2 weeks more than the same time last year.

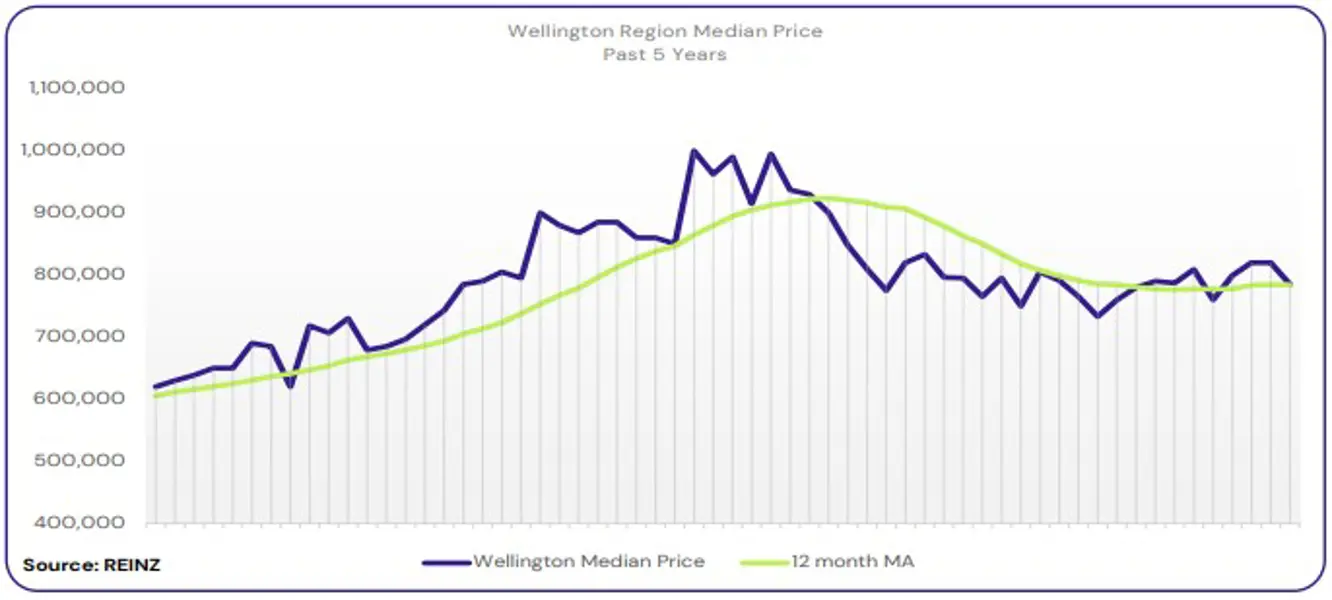

Regional Analysis - Wellington

The median price for Wellington decreased 0.8% year-on-year to $785,000.

“First-home buyers were the most active buyer group in Wellington for May, although local salespeople report a decline in buyers of higher-priced properties. Vendors are adjusting to realistic prices to meet market expectations. Open home attendance has been quiet, with many opting for viewing by appointment only. Auction activity saw low conversion rates under the hammer, with many selling after the auction rather than in the auction room.

Local agents report that seasonal changes and interest rates have influenced market sentiment.” (REINZ)

The current median Days to Sell of 39 days is less than the 10-year average for May of 40 days. There were 14 weeks of inventory in May 2024 which is the same as the same time last year.

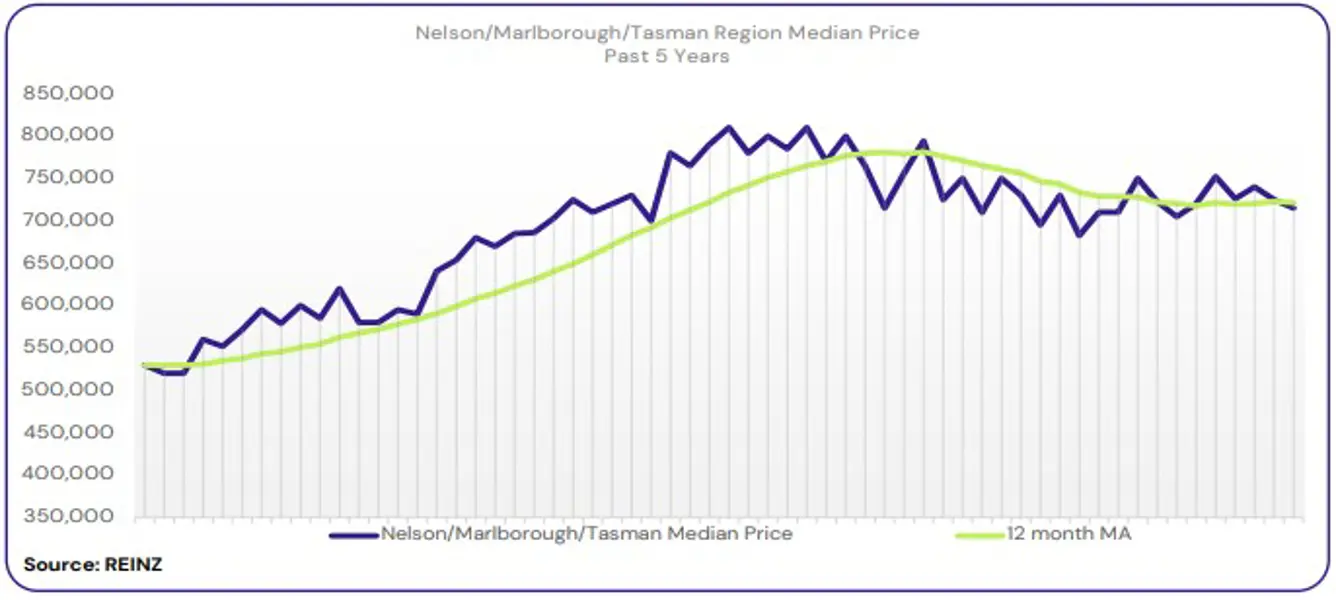

Regional Analysis - Nelson/Tasman/Marlborough

In Nelson, the median price has decreased 13.0% year-on-year to $670,000. In Marlborough, the median price increased 5.4% year-on-year to $685,000. In Tasman, the median price increased 3.9% year-on-year to $774,000.

“First-home buyers and owner occupiers were the most predominant across the region. Most vendors listen to buyer feedback and adjust their prices to meet market expectations. Local salespeople note vendors prefer to price their property over other sale methods. As a result, auction activity across the regions declined.

New listings attract higher attendance at open homes, and high stock levels contribute to a lack of urgency among buyers. Factors like job security and interest rates influenced market sentiment. Local agents remain hopeful that as people choose to relocate to the region, it might provide a stable market as we move into the cooler months.” (REINZ)

The current median Days to Sell of 50 days is more than the 10-year average for May which is 41 days. There were 21 weeks of inventory in May 2024 which is 3 weeks less than the same time last year.

Regional Analysis - West Coast

West Coast’s median price has increased 14.1% year-on-year to $405,000.

“Owner occupiers and downsizers were the most active buyers in May. Most vendors adjust their prices to meet the appraisal range, which attracted steady numbers at open homes across the region.

Factors such as the cost of living, job uncertainty and the decline in properties for sale influence market sentiment. Local agents suggest that the usual seasonal shift and fewer houses for sale have made it a buyer’s market. As the mining sector sees positivity, local salespeople are hopeful for an uplift in regional market confidence.” (REINZ)

The current median Days to Sell of 61 days is less than the 10-year average for May which is 66 days. There were 28 weeks of inventory in May 2024 which is 3 weeks less than the same time last year.

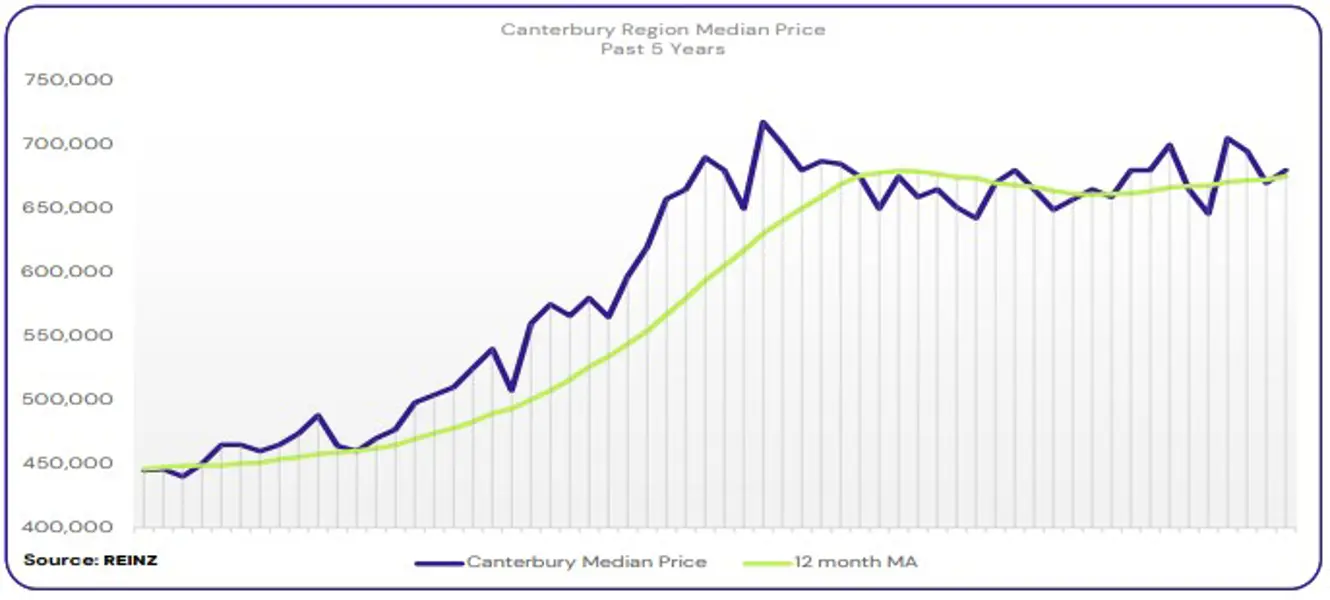

Regional Analysis - Canterbury

The median price for Canterbury increased 4.8% year-on-year to $680,000.

“First-home buyers were the most active buyer group in Christchurch and Timaru, with the same regions reporting a decline in owner-occupier transactions. Local agents in Ashburton report that few investors returned to the market. Most vendors have accepted the current market, adjusting their prices to meet market expectations and listening to feedback. Open home attendance remains steady across the region, with new listings attracting higher numbers.

Interest rates, increased stock levels and lack of buyer urgency influenced market sentiment. Local agents are hopeful for further positivity in the coming months when interest rates may ease.” (REINZ)

The current median Days to Sell of 35 days is less than the 10-year average for May which is 38 days. There were 15 weeks of inventory in May 2024 which is 2 weeks less than the same time last year.

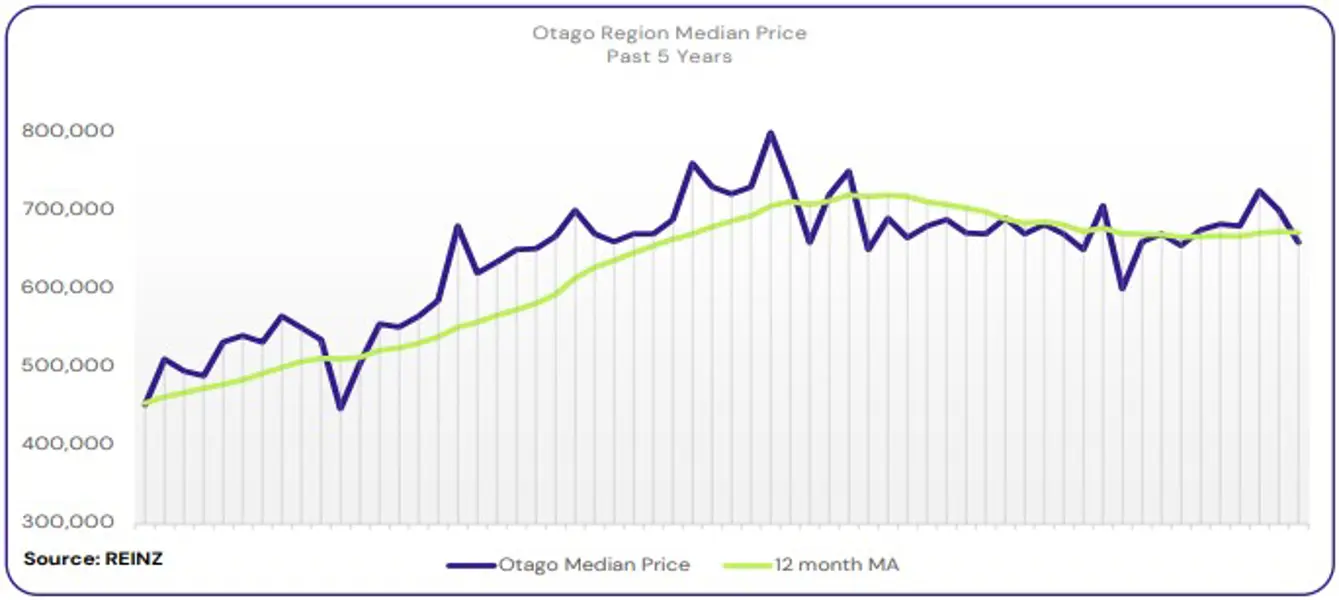

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price has decreased 5.7% year-on-year to $640,000.

First-home buyers and owner occupiers were May’s most active buyer group in Dunedin.

Most vendors are altering their prices to meet market expectations. Open home attendance saw good numbers across new listings and properties marketed for first-home buyers. Market sentiment was influenced by factors such as interest rates, lack of buyer urgency, job uncertainty and economic confusion. Local agents predict that activities will remain unchanged until economic conditions and market confidence improve.”

Queenstown Lakes

“First-home buyers and owner occupiers remained the most active buyer group in the region. While most vendors are willing to adjust their prices, some who have recently listed are hopeful of achieving a higher price. Auction numbers have been steady, with multiple bidders for the right properties.

Factors like interest rates, lack of vendor and buyer urgency and high stock levels influence market sentiment. Local agents remain hopeful that once interest rates drop and bright-line property rule changes come into effect, it might increase market confidence.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for May which is 40 days. There were 16 weeks of inventory in May 2024 which is 1 week less than the same time last year.

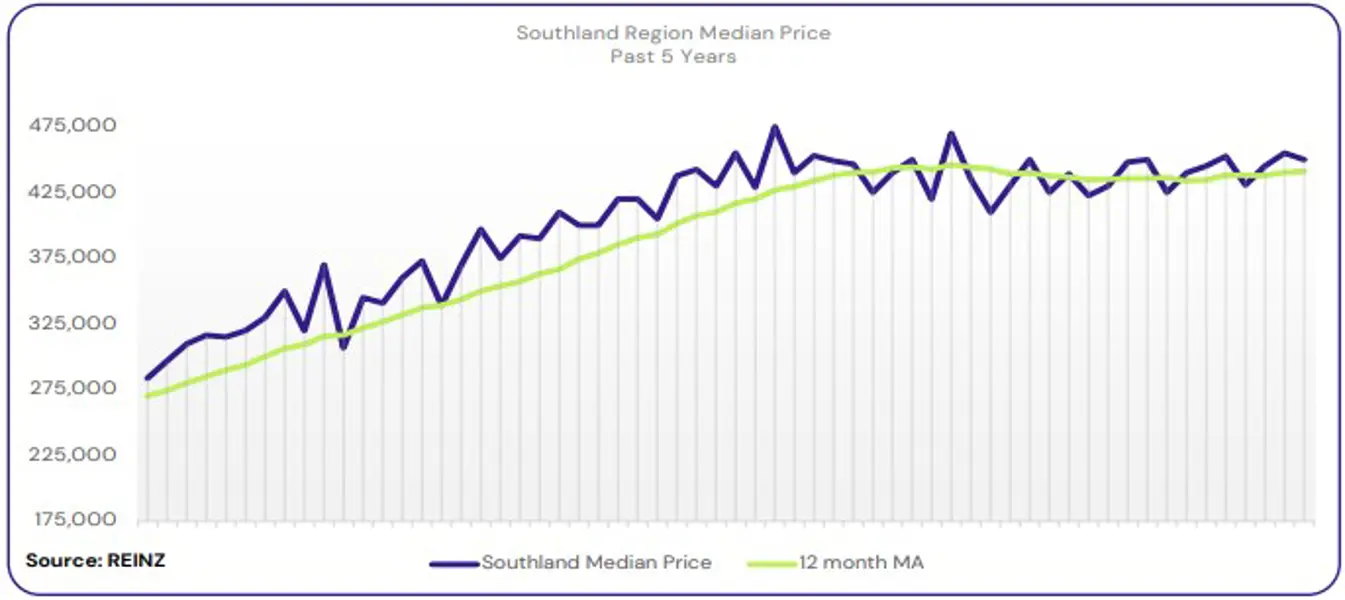

Regional Analysis - Southland

The median price for Southland increased 2.5% year-on-year to $450,000.

Attendance at open homes varied, with new listings attracting higher numbers than listings that have been on the market for longer. Auction activity remains steady, with some properties selling after the auction instead of in the auction room. Factors like job security and economic challenges influence market sentiment.

According to local agents, the aluminium smelter’s announcement of a 20-year deal could bring more buyers to the area. They are cautiously optimistic that investors will return to the market once bright-line property rule changes occur.” (REINZ)

The current median Days to Sell of 34 days is less than the 10-year average for May which is 40 days. There were 17 weeks of inventory in May 2024 which is 1 week less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.