Property market stable as sentiment improves - REINZ stats August 2024

Tuesday, 17 September 2024

August provided a sense of confidence and positivity to the property market.

REINZ Chief Executive Jen Baird said August provided a sense of confidence and positivity to the property market. “August data shows a level of stability in the market. Despite a marginal 0.6% (or $5,000) decrease in national median prices year-on-year, we’re seeing prices hold steady with a 1.3% increase month-on-month,” says Baird.

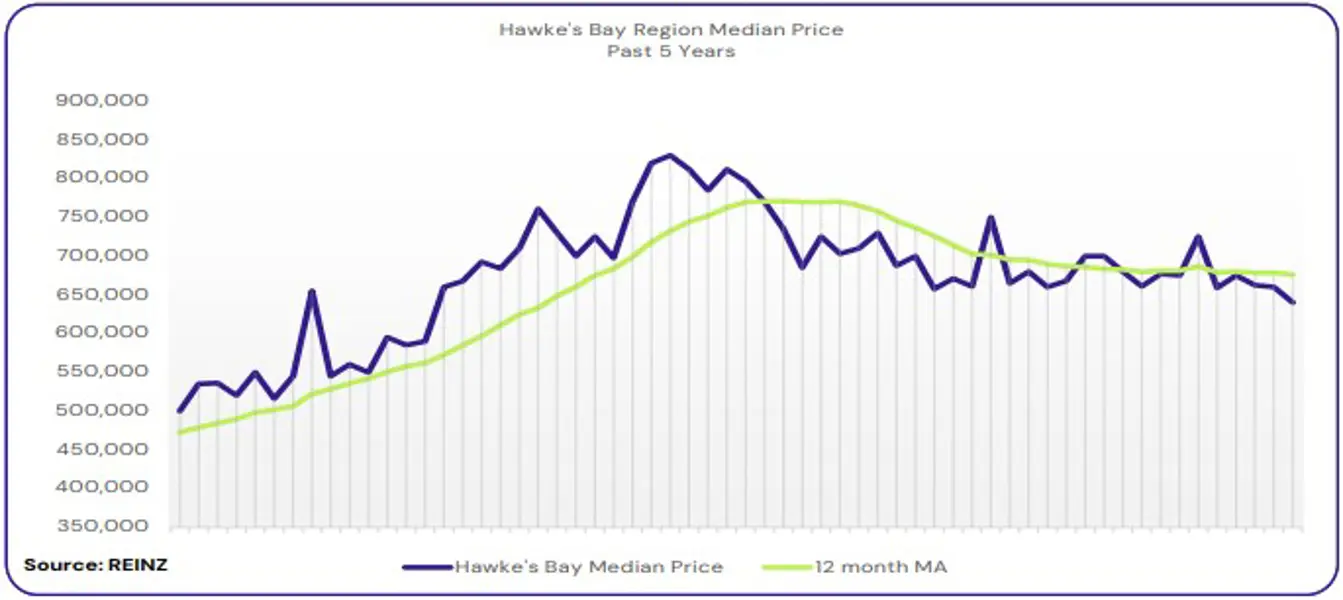

Compared to August 2023, the total number of properties sold nationally decreased by 0.7% (just 40 properties), from 5,725 to 5,685, and decreased by 5.1% month-on-month, from 5,992 to 5,685. In the regions, eight regions saw an increase in sales in August 2024, and the most significant increases were in Northland (+22.7%), Hawke’s Bay (+21.6%) and Bay of Plenty (+16.2%). Compared to July 2024, five regions saw an increase in sales volume.

The national median price decreased by 0.6% year-on-year, from $770,000 to $765,000, and increased by 1.3% month-on-month. For New Zealand, excluding Auckland, the median price increased 1.6% year-on-year from $670,000 to $681,000. Month-on-month, the median price increased by 1.8%.

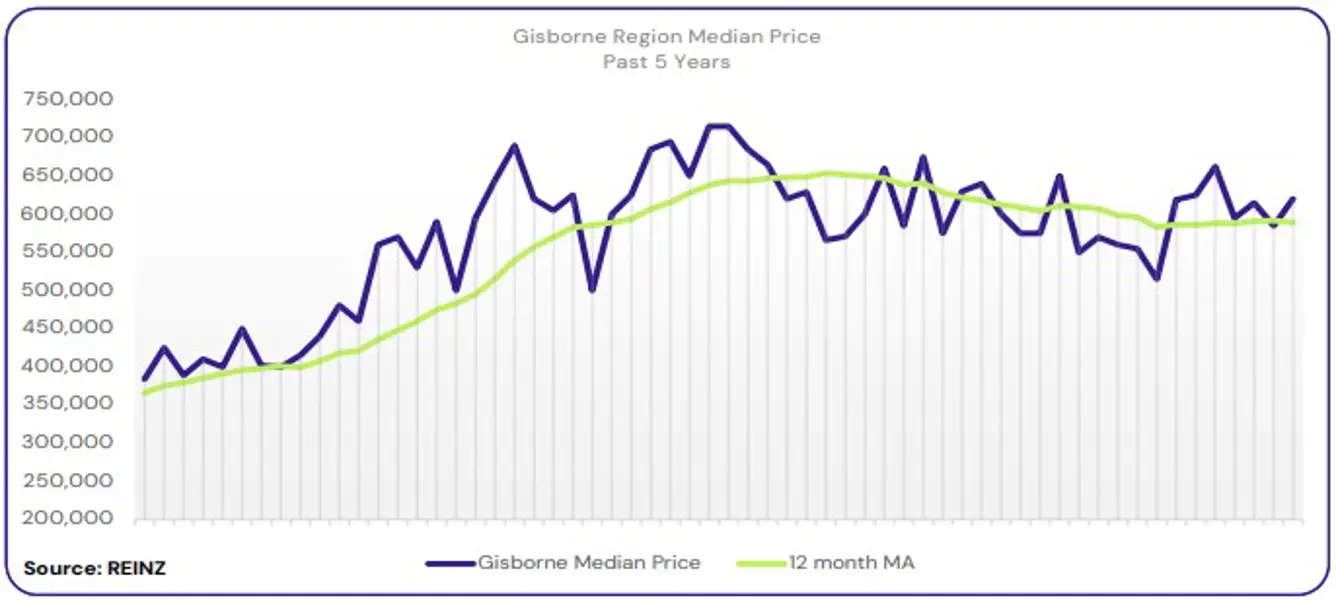

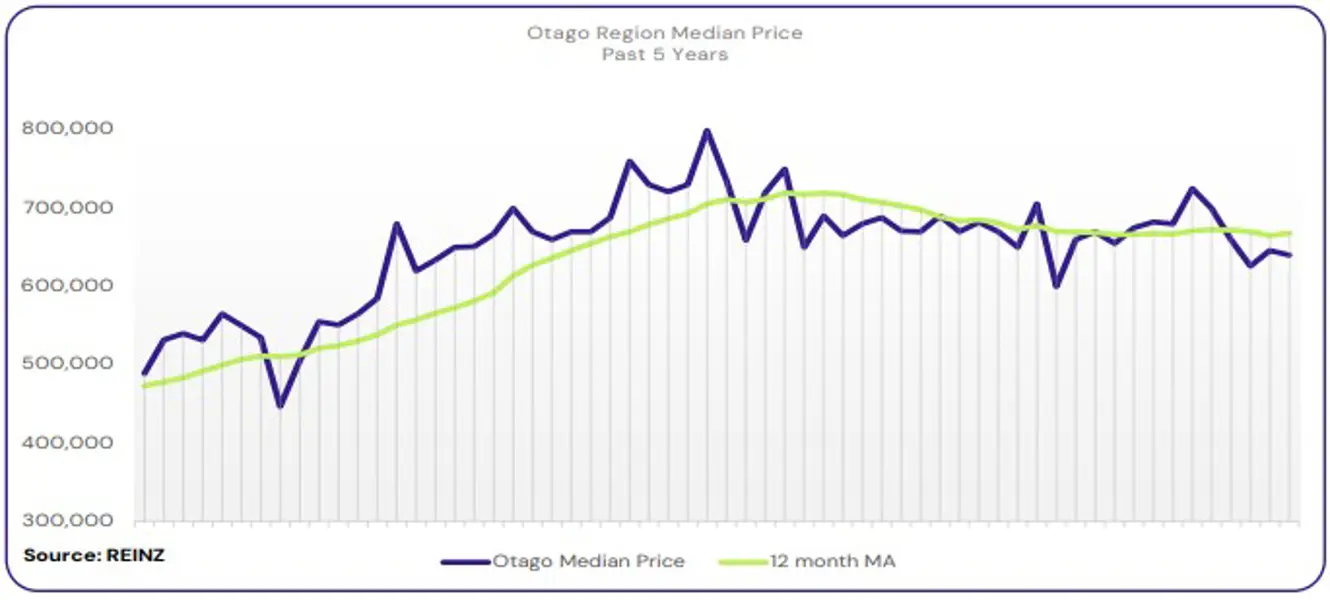

Six of the sixteen regions had a median price increase year-on-year, with Otago leading the way with a 6.7% increase to $640,000, followed closely by the West Coast with a 6.6% increase to $357,000. Eight regions increased month-on-month, with the most notable changes observed in Marlborough (+7.8% to $625,000) and Gisborne (+6.0% to $620,000).

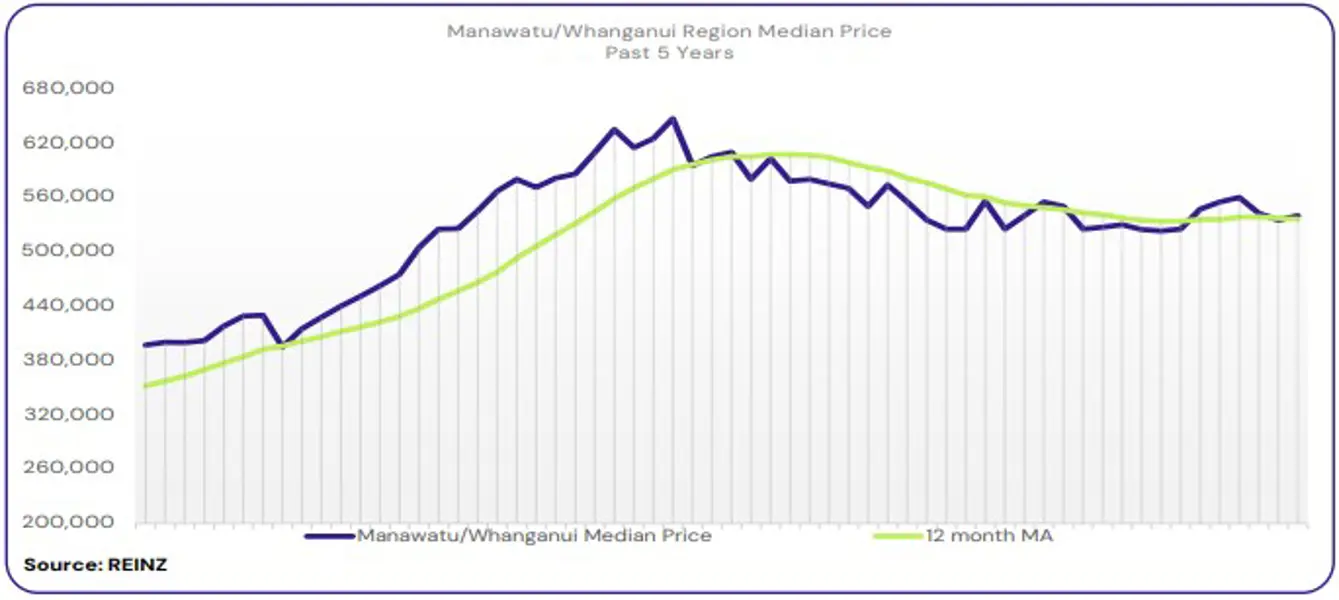

Staying in the regions, thirteen of the fifteen have seen a rise in new listings year-on-year, with the most notable increases recorded in Gisborne (+69.2%), Marlborough (+40.8%) and Manawatu-Whanganui (+39.8%). Two regions saw a decrease in new listings year-on-year: Nelson (-18.1%) and Northland (-11.1%). Nationally, there was an 8.1% increase in new listings compared to August 2023.

“This month, we saw further signs of a change in market sentiment, with local agents reporting increased confidence in vendors and purchasers, the return of investors, and increased activity, particularly at open homes over the last two weeks of August. They attribute this change to the decline in interest rates. However, it would be an overstatement to say that we are at a turning point in the market – we merely have our indicators on. While there is a rise in optimism and confidence, we are hopeful that better times are still ahead,” adds Baird.

The national inventory level increased by 30.0% (+6,830) in August, from 22,750 to 29,579 year-on-year and decreased by 3.2% (-977) from 30,556 month-on-month. For New Zealand ex Auckland, inventory levels increased 30.8% (+4,348) year-on-year from 14,099 to 18,447 and decreased 2.4% (-460) compared to June 2024.

Compared to August 2023, the median days to sell increased by eight days, from 42 to 50 days nationally. For New Zealand, excluding Auckland, median days to sell increased by six days, from 43 to 49 year-on-year. Five regions had fewer days to sell in August 2024 than in August 2023. Northland had the highest median days to sell at 71 days, an increase of 10 days year-on-year.

“We continue to see an increase in the average number of properties listed. Although the inventory is down slightly compared to last month, the volume of properties for sale continues to provide a lot of choice for buyers,” adds Baird.

There were 656 auctions nationally in August 2024 (11.5% of all sales), compared to 799 (10.9% of all sales) in August 2023. The Auckland region called 335 auctions in August 2024 (18.6% of all sales), compared to 492 auctions or 25.5% of all sales in August 2023.

“There is an expectation that rates will fall further towards the end of this year, providing the much-needed relief to property owners and those in the position to buy, which may increase sales volumes nationwide,” comments Baird.

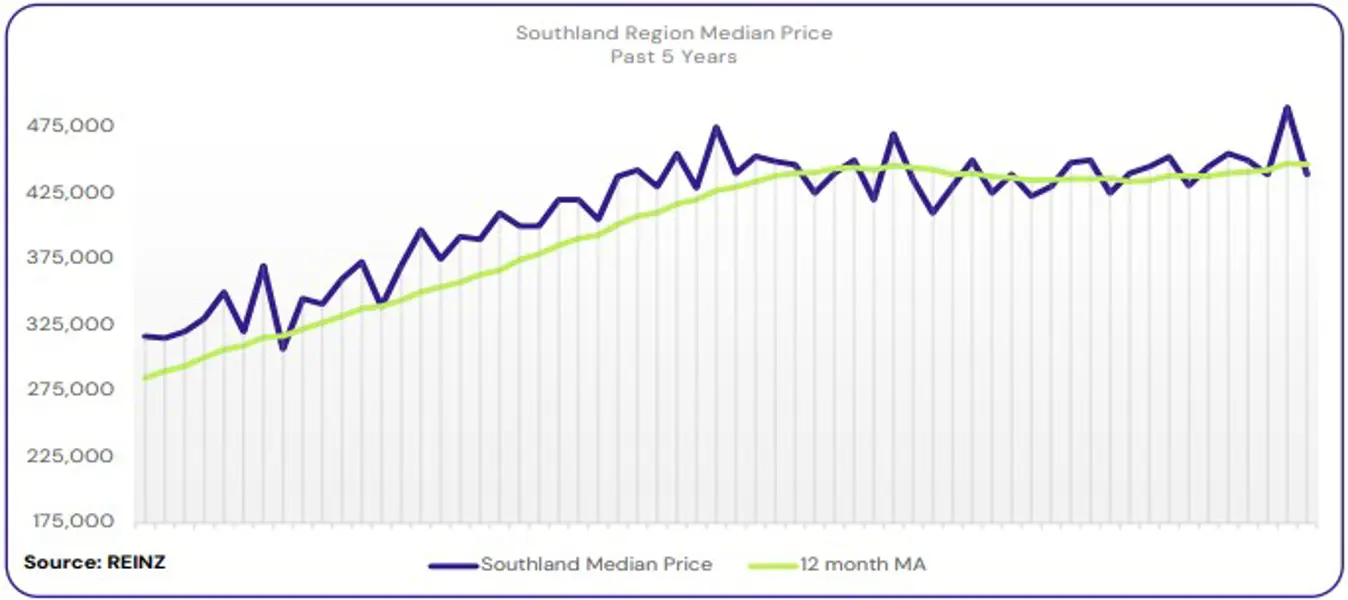

The HPI for New Zealand stood at 3,563 in August 2024, a 0.8% decrease from August 2023. There was no change compared to July 2024. The average annual growth in the New Zealand HPI over the past five years has been 5.0% per annum, and it is currently 16.7% below the market peak reached in 2021. Southland is the top-ranked region in August, with a +3.0% increase year-on-year.

Regional highlights:

- Northland had the most notable sales count percentage increase of 22.7% year-on-year, from 141 to 173 sales.

- Thirteen regions saw an increase in new listings year-on-year, with notable increases in Gisborne (+69.2%), Marlborough (+40.8%) and Manawatu-Whanganui (+39.8%).

- Six of the sixteen regions had a median price increase year-on-year, with Otago leading the way with a 6.7% increase to $640,000, followed closely by the West Coast with a 6.6% increase to $357,000.

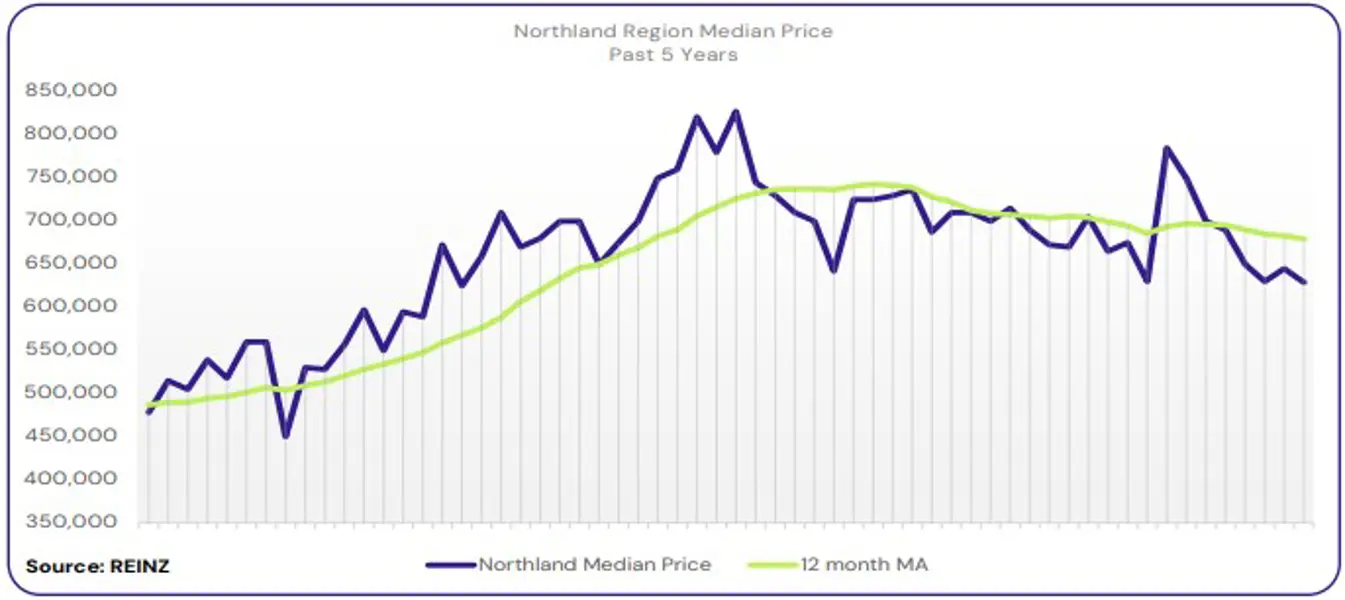

Regional Analysis - Northland

The median price for Northland decreased 6.1% year-on-year to $629,000.

“Owner-occupiers and first home buyers were the most active buyer groups in August, with reports of increased investor activity in Whangarei.

Most vendors are generally meeting market expectations; however, some are anticipating price increases due to lower interest rates. The number of attendees at open homes has increased, particularly for newer listings. Auction room attendance has increased, although buyer activity varied around the region.

Factors like a lack of buyer urgency, buyer delay in the market’s confidence, and accessing funds to purchase properties have influenced market sentiment. Local agents are cautiously optimistic the market will slowly improve and suggest that appraising properties accurately in a shifting market is critical for agents to understand.” (REINZ).

The current median Days to Sell of 71 days is much more than the 10-year average for August which is 55 days. There were 44 weeks of inventory in August 2024 which is 1 week less than the same time last year.

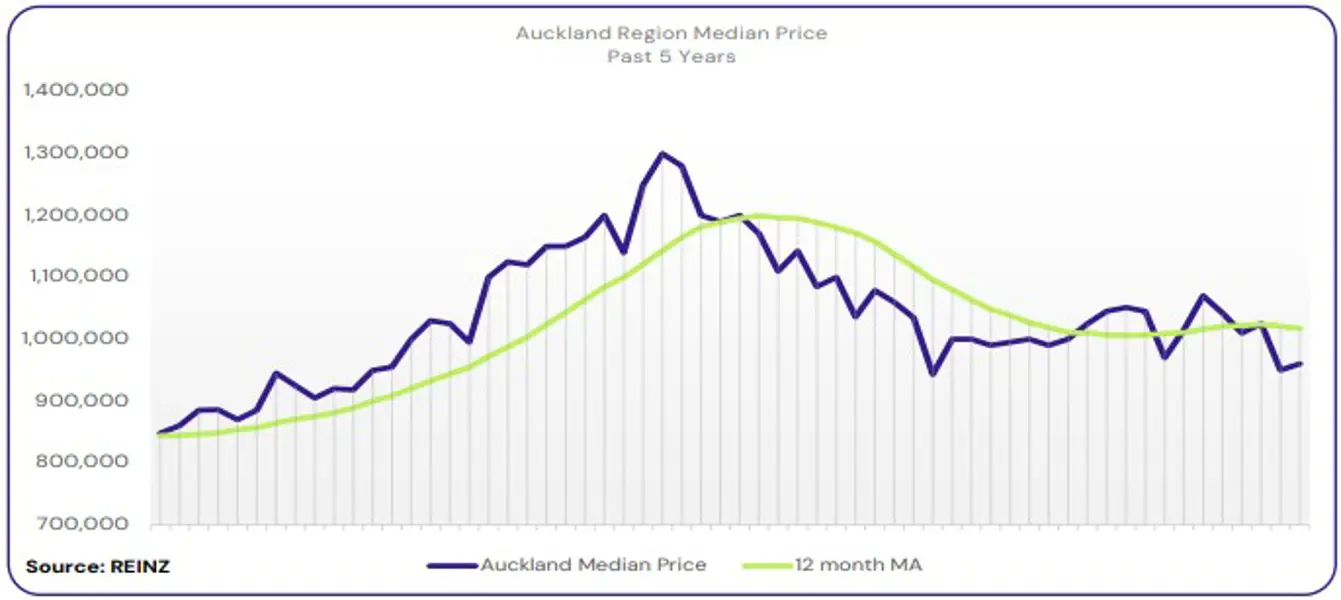

Regional Analysis - Auckland

The median price for Auckland decreased by 4.0% year-on-year to $960,000.

“First home buyers, owner-occupiers and investors were Auckland’s most active buyer groups this month. Vendor price expectations were realistic. However, some buyers seemed “optimistic” with their offers, displaying a new type of confidence as they were aware of the ample supply of properties on the market.

Attendance at open homes increased, with newer listings attracting good interest. Auction room activity and attendance picked up across the board. Market sentiment has been influenced by changes in OCR, lending criteria, a slight decrease in interest rates, and a rise in general confidence. Local agents predict no significant market changes until lending criteria loosens and interest rates fall further.” (REINZ).

The current median Days to Sell of 51 days is much more than the 10-year average for August which is 39 days. There were 29 weeks of inventory in August 2024 which is 4 weeks more than the same time last year.

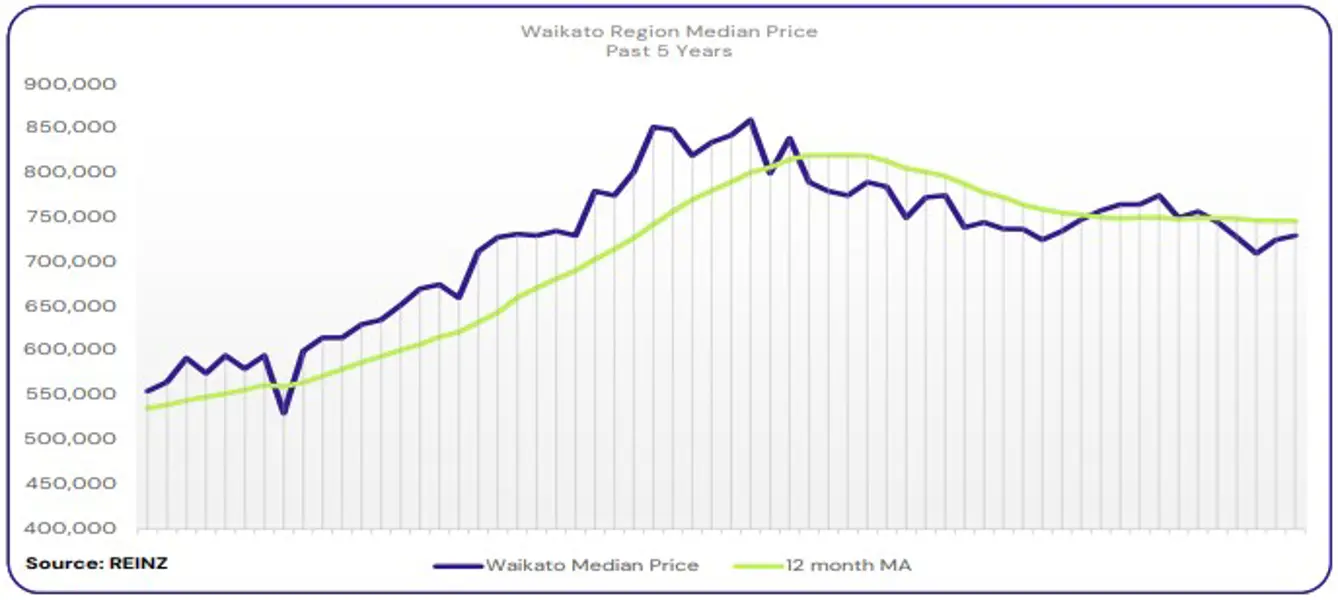

Regional Analysis - Waikato

Waikato’s median price decreased by 0.7% year-on-year to $730,000.

Investors, owner-occupiers and first home buyers were the most active buyer groups, with developer enquiries reported in Hamilton.

Some vendor price expectations proved realistic, but there were signs of other vendors holding firm to their higher, original expectations because they believed the market would rise. Attendance at open homes varied, with most properties= seeing good buyer groups. Auction activity increased, with more properties coming to market, more people in attendance, and increased sales activity in the auction room. Although sales activity was slower at the beginning of the month, the overall sales count increased by 2.9% year-on-year and 1.8% month-on-month.

Market sentiment was influenced by the OCR announcement, interest rates dropping, buyer confidence increasing, bank lending criteria, and the positivity around seasonal shifts. Local agents report that market activity has improved, people searching or selling are more optimistic and are anticipating a busy run to the end of the year.” (REINZ).

The current median Days to Sell of 56 days is much more than the 10-year average for August which is 40 days. There were 30 weeks of inventory in August 2024 which is 11 weeks more than the same time last year.

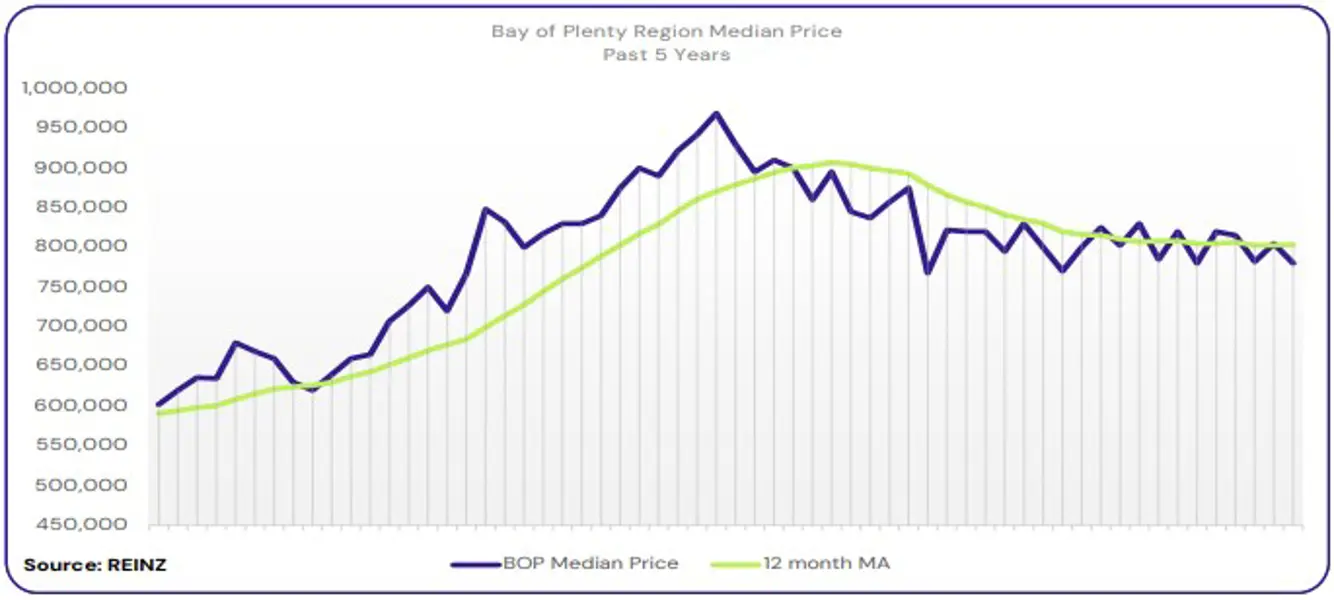

Regional Analysis - Bay of Plenty

The median price for Bay of Plenty increased by 1.3% year-on-year to $780,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with reports of lifestyle property buyers and investor enquiries increasing in Tauranga.

Most vendors were taking offers seriously and were willing to meet market expectations. Attendance at open homes increased in the last two weeks of August, with auction attendance and activity varied depending on the properties for sale.

Market sentiment was influenced by the decline in the OCR and the increase in listings, which led to more choices for buyers and declining interest rates. Local agents are cautiously optimistic that sales will increase moderately as warmer weather approaches.” (REINZ).

The current median Days to Sell of 58 days is much more than the 10-year average for August which is 44 days. There were 27 weeks of inventory in August 2024 which is 3 weeks more than the same time last year.

Regional Analysis - Gisborne

Gisborne’s median price decreased 4.6% year-on-year to $620,000.

“Owner-occupiers remained the most active buyer group in August. Vendor expectations were realistic, as the early spring activity brought positivity. Attendance at open homes increased due to decreases in interest rates. The latter part of August saw more activity and increased interest.

Local agents report that their sales counts have started to increase with positivity surrounding early spring activity. Market sentiment has shifted with more active buyers, giving vendors further confidence. The upcoming spring market is likely to bring new listings, and with that comes the challenge of selling the stock that has been on the market for a long period of time. Local salespeople remain hopeful that the positivity and confidence in the market will steadily increase sales counts over the coming months.” (REINZ).

The current median Days to Sell of 43 days is more than the 10-year average for August which is 36 days. There are 12 weeks of inventory in August 2024 which is 1 week more than last year.

Regional Analysis - Hawke's Bay

The median price for Hawkes Bay decreased by 4.2% year-on-year to $640,000.

“First home buyers and owner-occupiers were the most active buyer groups across the region, with no decline in either buyer pool.

Vendor expectations regarding asking prices were becoming more realistic. Attendance at open homes increased for properties at the lower end of the market and the well presented properties. Mortgage rate and insurance increases influenced market sentiment this month, slowing the market down. Local agents suggest that the upcoming months will be steady, with some buyers taking advantage of the affordability opportunity, while the total cost of ownership will remain challenging for others.” (REINZ).

The current median Days to Sell of 50 days is much more than the 10-year average for August which is 38 days. There were 23 weeks of inventory in August 2024 which is 6 weeks more than the same time last year.

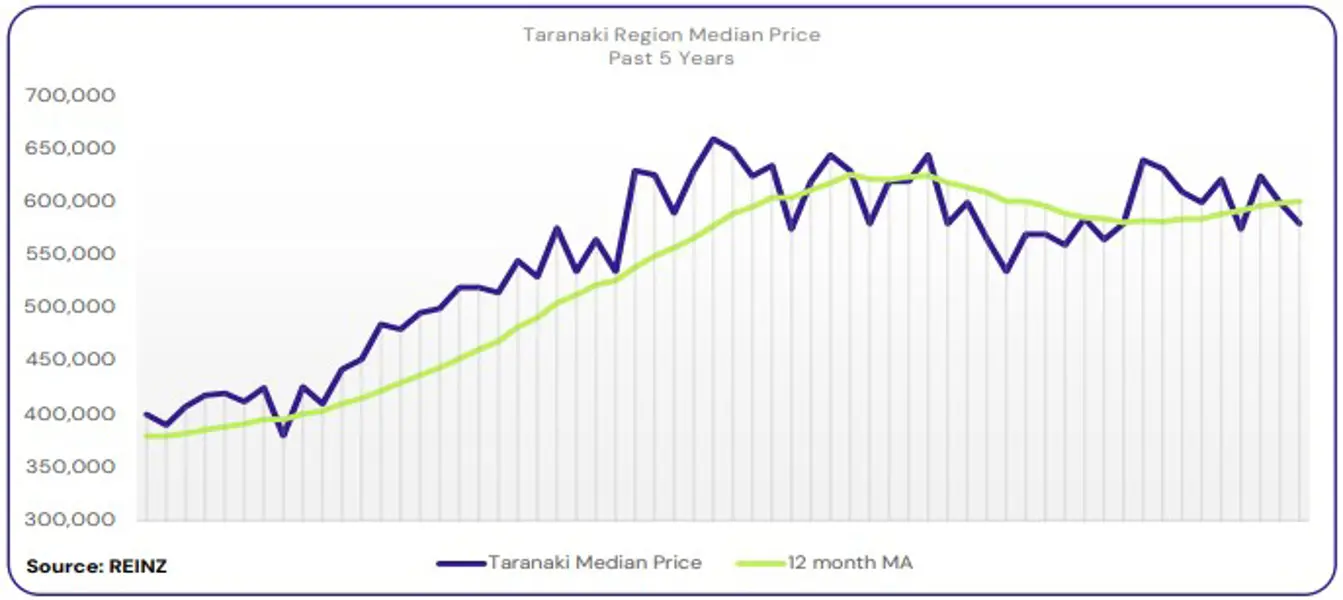

Regional Analysis - Taranaki

Taranaki’s median price increased 3.6% year-on-year to $580,000.

“Owner-occupiers and first home buyers were the most active buyer group across the region, with a shortage of buyers in the higher-priced brackets. Most vendor price expectations remain realistic; sales prices are beginning to increase slightly. Attendance at open homes was well-attended this month, as more new buyers were on the market.

The reduction in interest rates influenced market sentiment, positively affecting confidence in the Taranaki market. However, days to sell remained a concern for many vendors. The rise in first home buyers in the market creates an opportunity for agents to educate and assist this buyer pool. Local agents are cautiously optimistic that if interest rates continue to drop, sales volumes are expected to increase in the coming months.” (REINZ).

The current median Days to Sell of 42 days is more than the 10-year average for August which is 38 days. There were 22 weeks of inventory in August 2024 which is 1 week more than the same time last year.

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased by 1.8% year-on-year to $540,000.

“Owner-occupiers were the most active buyer group in August, with an increasing number of first home buyers beginning to re-enter the market. Local agents reported investors were still absent, with an increased number of investors selling their rental investments.

Vendors understood the importance of pricing their property to attract the right buyer and were open to listening to offers. Attendance was good at open homes for newer listings. Auction activity was limited due to a lack of cash buyers. Local salespeople suggest that selling properties via auction was a difficult month.

The decrease influenced market sentiment in interest rates, job security, and many listings available, but a limited number of motivated buyers and high prices remain concerns for buyers. Local agents are cautiously optimistic that the early signs of “green shoots” will continue throughout spring and into summer.” (REINZ).

The current median Days to Sell of 50 days is more than the 10-year average for August which is 38 days. There were 26 weeks of inventory in August 2024 which is 3 weeks more than the same time last year.

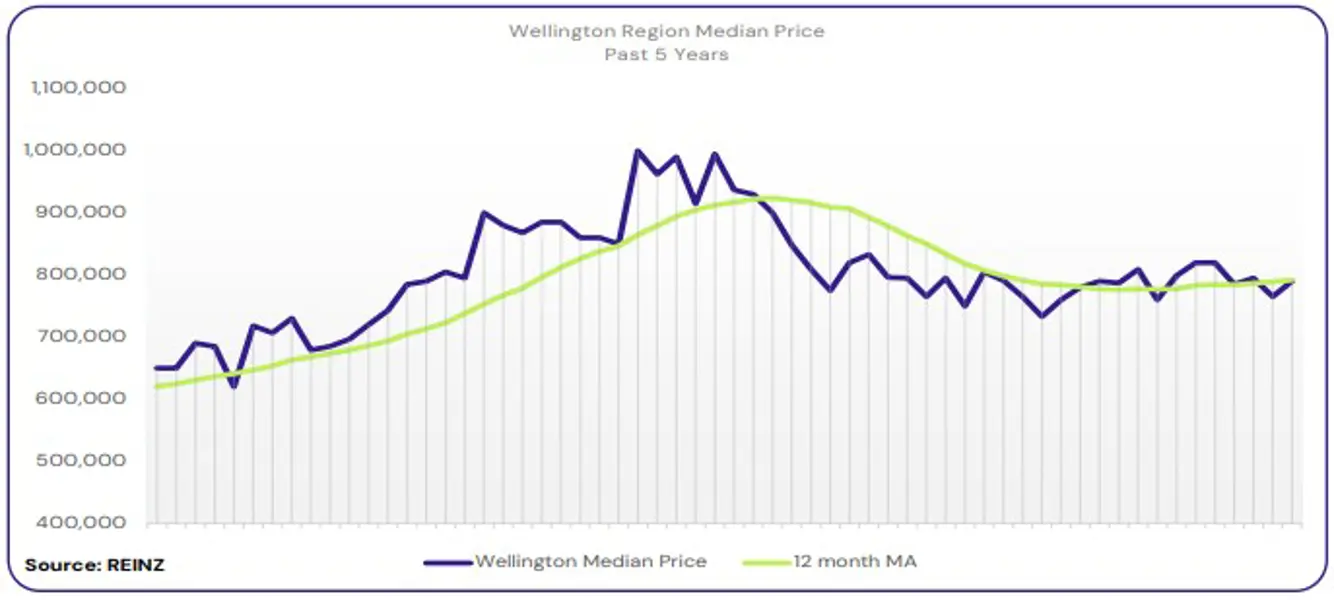

Regional Analysis - Wellington

Wellington’s median price increased by 3.9% year-on-year to $790,000.

“The most active buyer group in Wellington was first home buyers. Most vendors on the market were realistic in terms of asking prices. Attendance at open homes was quiet, with the same for activity and attendance at the auction rooms.

4.8% of all sales in August 2024 were sold by auction (26 auctions). Sales count increased by 5.4% year-on-year from 533 to 562. Median days to sell increased by 13 days year-on-year, from 37 to 50 days. Average listings increased by 3.5% compared to this time last year, from 461 to 477. Average inventory levels increased 55.6% year-on-year from 994 to 1,546.” (REINZ).

The current median Days to Sell of 50 days is much more than the 10-year average for August of 36 days. There were 14 weeks of inventory in August 2024 which is 3 weeks more than the same time last year.

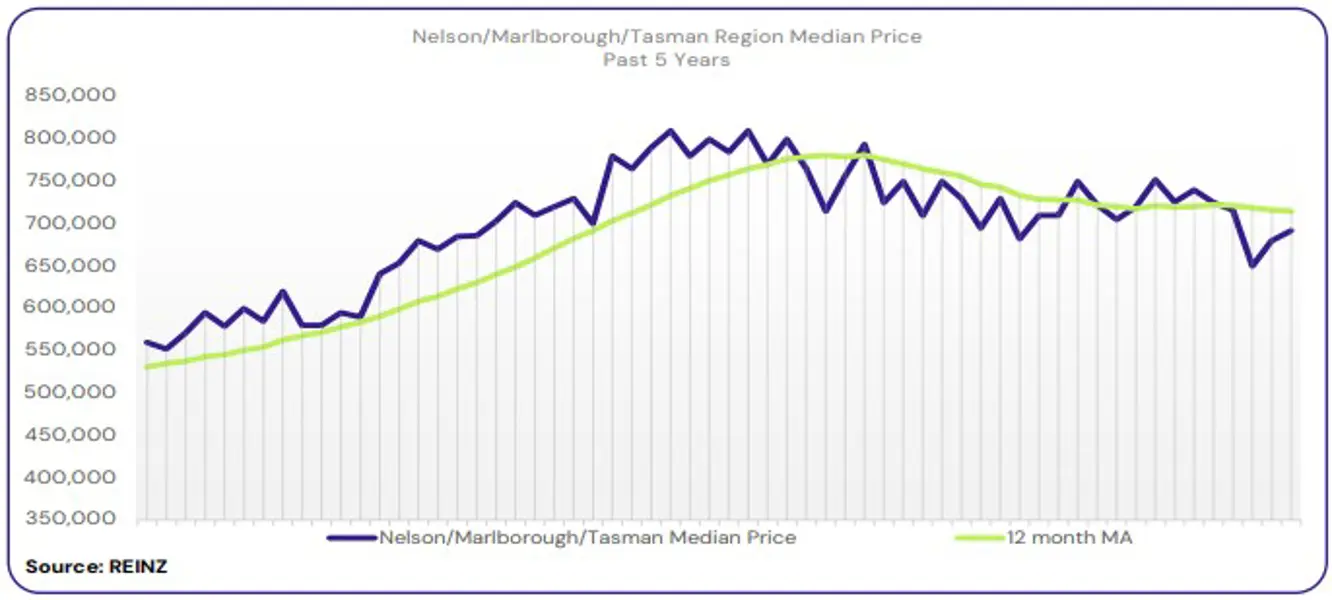

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased 0.3% year-on-year to $693,000. The median price for Marlborough decreased 3.8% year-on-year to $625,000. The median price for Tasman decreased 5.1% year-on-year to $745,000.

“Owner-occupiers and first home buyers were the most active buyer group, with investor activity reported in Nelson. Most vendors became realistic about pricing, although some found it difficult when offers didn’t reflect this. Attendance at newer listings’ open homes was well-attended, but it tended to drop after the campaign’s second week.

Market sentiment was influenced by bank activity regarding interest rates, job uncertainty, a lack of buyer urgency, and increased confidence. First home buyers were reported to have newfound confidence, with some having the opportunity to secure finance.

Local salespeople anticipate the usual spring market increase in the coming months. However, they remind both buyers and vendors that the market could fluctuate, and they must be mindful of that possibility.” (REINZ).

The current median Days to Sell of 49 days is much more than the 10-year average for August which is 39 days. There were 25 weeks of inventory in August 2024 which is 1 week more than the same time last year.

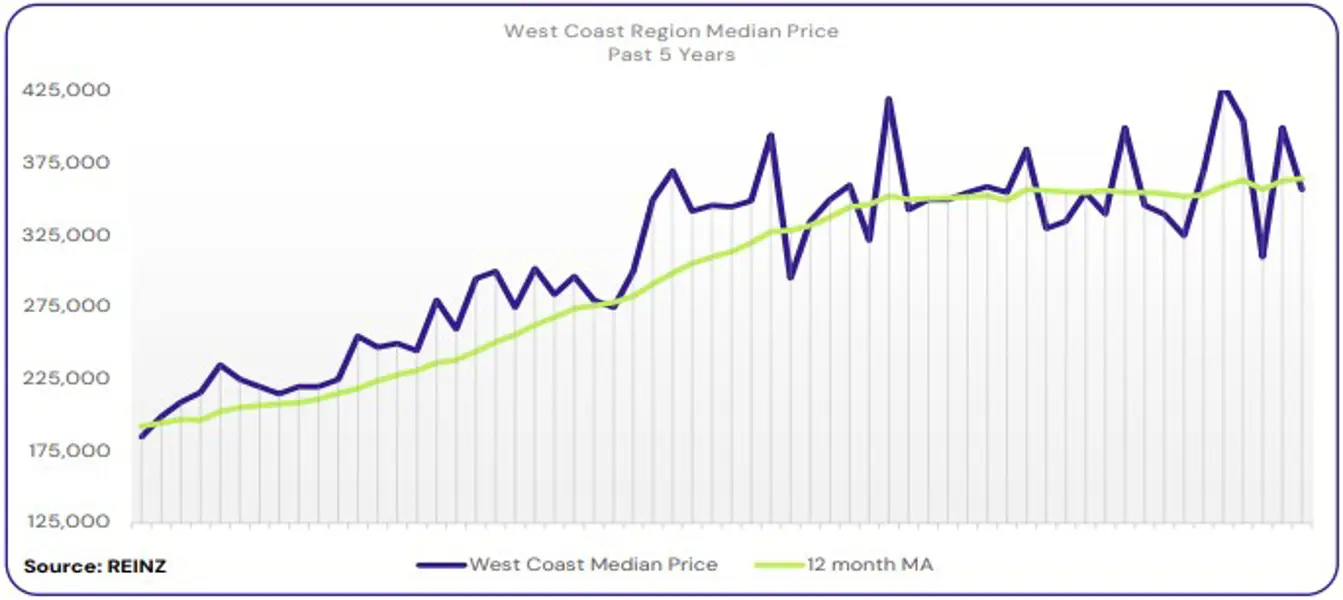

Regional Analysis - West Coast

West Coast’s median price increased by 6.6% year-on-year to $357,000.

“Investors were the most active buyer group, with first home buyer enquiries increasing. Most vendors were realistic with their price expectations and actively negotiated listing prices. However, keeping expectations realistic for some vendors remains challenging.

An average number attended open homes, as most buyers look around multiple properties. Market sentiment shifted positively, showing early signs of the usual spring activity and banks reducing interest rates. Local agents hope the market will remain steady over the coming months and expect further activity as interest rates drop.” (REINZ).

The current median Days to Sell of 37 days is much less than the 10-year average for August which is 68 days. There were 39 weeks of inventory in August 2024 which is 10 weeks more than the same time last year.

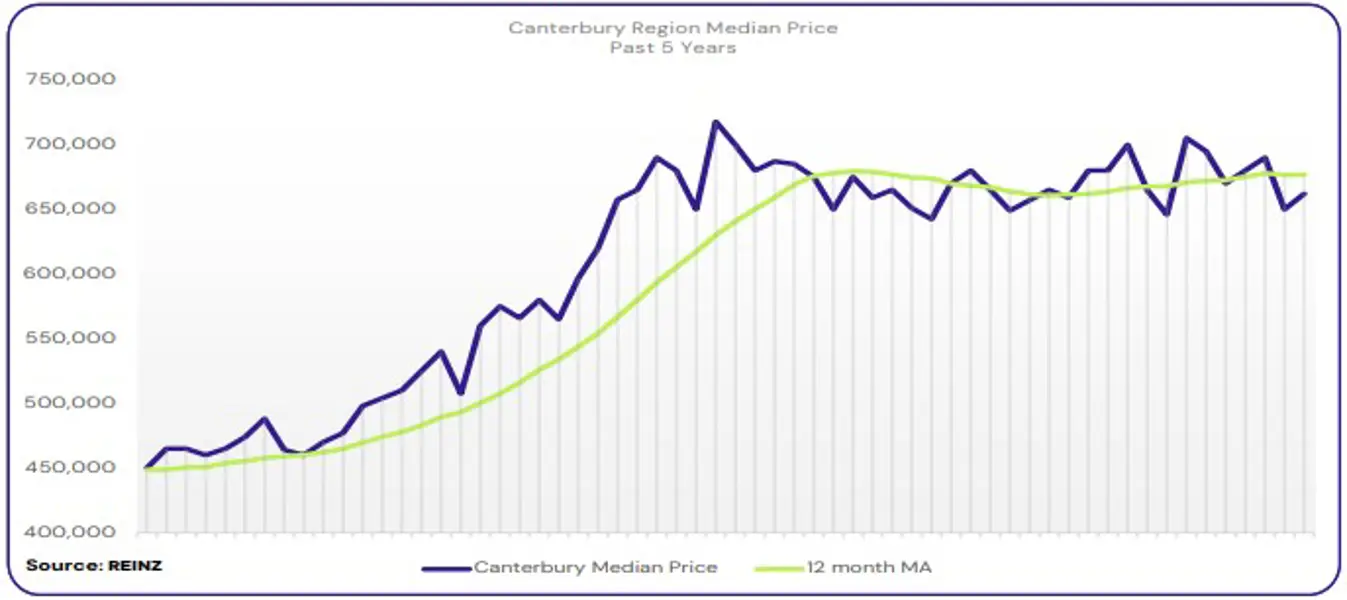

Regional Analysis - Canterbury

Canterbury’s median price increased 0.5% year-on-year to $662,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with early interest from investors. Most vendor expectations are realistic, although, with the decline in interest rates, some are hopeful of price increases. Attendance at open homes varied across the region, with newer listings attracting higher numbers. Auction room activity has picked up, both in attendance and clearance rates.

Market sentiment was influenced by factors such as decreased interest rates, early signs of spring-like activity, economic progress, and general optimism. Local salespeople report a positive shift, but that doesn’t mean a sudden change in the market, indicating it could take some time. As we head into spring, local agents remain hopeful the market will continue improving in the coming months and hopefully see further positivity, engagement and confidence.” (REINZ).

The current median Days to Sell of 41 days is more than the 10-year average for August which is 35 days. There were 16 weeks of inventory in August 2024 which is 1 week more than the same time last year.

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price increased by 2.7% year-on-year to $570,000.

First home buyers were the most active buyer group in Dunedin, with a slight increase in investor activity. Vendor expectations were stable and relatively realistic, considering the nature of the market. Attendance at open homes lifted by approximately 50%, a positive sign before entering the spring rush.

Auction room activity was low, as there were fewer cash buyers. This month, local salespeople noted that properties with price methods such as “by negotiation” and “deadline sale” were more favourable among buyers. Factors such as the lowering of interest rates and the potential for them to drop further influenced market sentiment. Local agents are cautiously optimistic that house prices will stay relatively the same and sales volumes will increase towards the end of the year.”

Queenstown Lakes

“Owner-occupiers and first home buyers were the most active buyer groups. Australian buyer enquiries were active, although other international enquiries were still quiet. Most vendors expected more than the market value of their property, and the lower-than-expected offers gave them a reality check. Attendance at open homes saw steady numbers, particularly for properties priced between $900K-$1.5m.

Auction room attendance was good, although there was a lack of active bidders due to issues surrounding the timing of securing finance approval. Factors like the OCR change and the decrease in interest rates influenced market sentiment. Local agents suggest that the market is improving and will hopefully continue to improve as we enter spring.” (REINZ).

The current median Days to Sell of 50 days is much more than the 10-year average for August which is 36 days. There were 18 weeks of inventory in August 2024 which is 1 week more than the same time last year.

Regional Analysis - Southland

The median price for Southland decreased by 2.0% year-on-year to $439,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with investors beginning to get out and about. Most vendors on the market are motivated to achieve a reasonable price for their properties.

The decline in interest rates, improved interest from buyers and vendors, stock selection, and early spring positivity influenced market sentiment, which saw a lift in buyer activity in open homes, auction rooms and the number of appraisals completed. Local salespeople are hopeful that interest rates will continue to fall, making buying more affordable for those searching, which could potentially lead to an increase in demand and prices.” (REINZ).

The current median Days to Sell of 37 days is more than the 10-year average for August which is 36 days. There were 19 weeks of inventory in August 2024 which is 2 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.