Property Market a Little Chilly Amid Economic Challenges - REINZ stats June 2024

Monday, 15 July 2024

The June 2024 data shows a decrease in sales and median prices nationwide while listings continue to rise.

REINZ Chief Executive Jen Baird says that the property market in June is reflecting the wider economic climate in New Zealand. New listings have risen, continuing a trend seen in 2024, yet this increase contrasts with a noticeable decline in buyer activity, reflected in lower national sales figures.

The total number of properties sold in New Zealand decreased by 25.6% year-on-year, from 5,854 to 4,356, and by 32.6% compared to May 2024, from 6,461 to 4,356. Northland saw the only increase in sales, up by 11.9% year-on-year. The most significant decreases year-on-year were West Coast (-51.2%), Tasman (-41.7%), Gisborne (-39.4%) and Auckland (-35.1%). All regions reported a decrease in sales compared to May 2024.

"The typical winter lull, compounded by current economic conditions, has contributed to lower levels of activity in the market. This sentiment is reinforced by seasonally adjusted figures, which reveal a national sales decrease of 11.1% compared to May 2024, reflecting a market performance below expected levels," says Baird.

Median prices for June were mixed, with six of the sixteen regions increasing year-on-year. Taranaki and Gisborne stood out, with Taranaki’s median price increasing by 10.7% year-on-year ($570,000 to $631,000) and Gisborne up by 7.0% ($575,000 to $615,000). Five regions saw an increase month-on-month (Taranaki +9.7% to $631,000; Gisborne +3.4% to $615,000; Auckland +2.7% to $1,048,000, Canterbury +1.5% to $690,000; Tasman +0.4% to $777,000).

The national median price decreased by 1.3% year-on-year, from $780,000 to $770,000, and saw no change compared with May 2024. For NZ, excluding Auckland, the median price was up slightly by 0.4% year-on-year, from $682,500 to $685,000, but decreased 0.6% compared to May 2024, from $689,000 to $685,000.

At the end of June, the national inventory level had increased 28.6% (+7,069) from 24,676 to 31,745 year-on-year and decreased 2.6% from 32,598 month-on-month. For New Zealand ex Auckland, inventory levels increased 25.1% (+3,929) year-on-year from 15,655 to 19,583 and decreased 3.2% compared to May 2024 (-647).

Nationally, listings increased by 25.5% year-on-year from 6,218 to 7,805. Twelve of the fifteen regions have seen a rise in new listings year-on-year, with significant increases in Wellington (+50.3%), Hawke’s Bay (+35.6%), Gisborne (+34.8%), Bay of Plenty and Canterbury (+33.6%), Auckland (+33.0%) and Otago (+23.4%).

“The increased number of listings coming to market continues the trend we have seen all year, with high levels of choice for buyers nationwide. The winter months do tend to see fewer people choosing to sell, and this year is no different. Yet, regardless of the economic conditions, people’s lives change, they grow families and retire and need to make a property decision alongside those changes.”

Nationally, median Days to Sell decreased by one day, from 48 to 47 days, compared to a year ago. For New Zealand, excluding Auckland, median Days to Sell decreased by two days year-on-year, from 49 to 47 days. In 11 of the 16 regions, median Days to Sell were lower compared with June 2023. Northland had the highest days to sell at 71 days compared to 69 in May 2024 and 56 compared to this time last year.

The HPI for New Zealand stood at 3,573 in June 2024, down 0.7% from May 2024 and up by 1.3% year-on-year. The average annual growth in the New Zealand HPI over the past five years has been 5.4% per annum, and it is currently 16.4% below the market peak reached in 2021.

“There was a notable decrease in buyer activity in June and a reduced sense of urgency. As more listings come to a well-stocked market, those who are in the position to buy are taking their time to carefully select their ideal home. While winter has set in, we have just seen a slight change in tone coming from the Reserve Bank suggesting that this cycle of interest rate pain may have an end in sight. This is a key factor in both buying and selling decisions but also has an impact on overall sentiment within the industry.” adds Baird.

Regional highlights

- Northland had the only increase in sales count, up by +11.9% year-on-year. No region saw an increase in sales compared to May 2024.

- Twelve of the sixteen regions have increased in new listings year-on-year, with notable increases in Wellington at +50.3%, Hawke’s Bay at +35.4%, and Gisborne at +34.8%.

- Six of the sixteen regions had year-on-year price increases, with Taranaki leading the way with a 10.7% increase ($570,000 to $615,000).

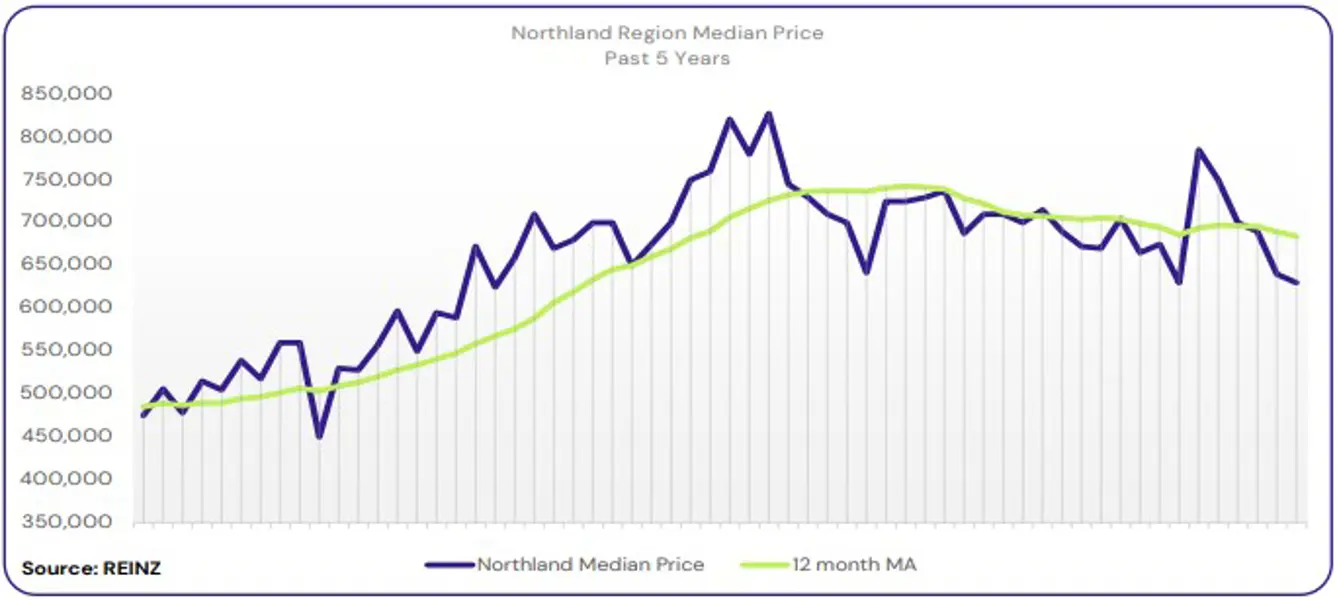

Regional Analysis - Northland

The median price for Northland decreased 8.7% year-on-year to $630,000.

“Owner occupiers and first-home buyers were the most active groups. Most vendors across the region meet market expectations, either listing properties at market price or dropping initial prices to get enquiries. There are slow increases in open home attendance numbers through new listings, but there’s been a decline in out-of-town visitors.

Local agents reported that some vendors were electing to take their properties off the market as winter is approaching. In Whangarei, more attendees have been seen in the auction room, and sales under the hammer for well-priced properties have improved.

Lack of out-of-town buyers and lack of buyer urgency influence market sentiment across the region. Local salespeople predict there will be lower listings as we enter the cooler months but remain cautiously optimistic this will pick back up in early spring.” (REINZ)

The current median Days to Sell of 71 days is much more than the 10-year average for June which is 55 days. There were 46 weeks of inventory in June 2024 which is the same as the same time last year.

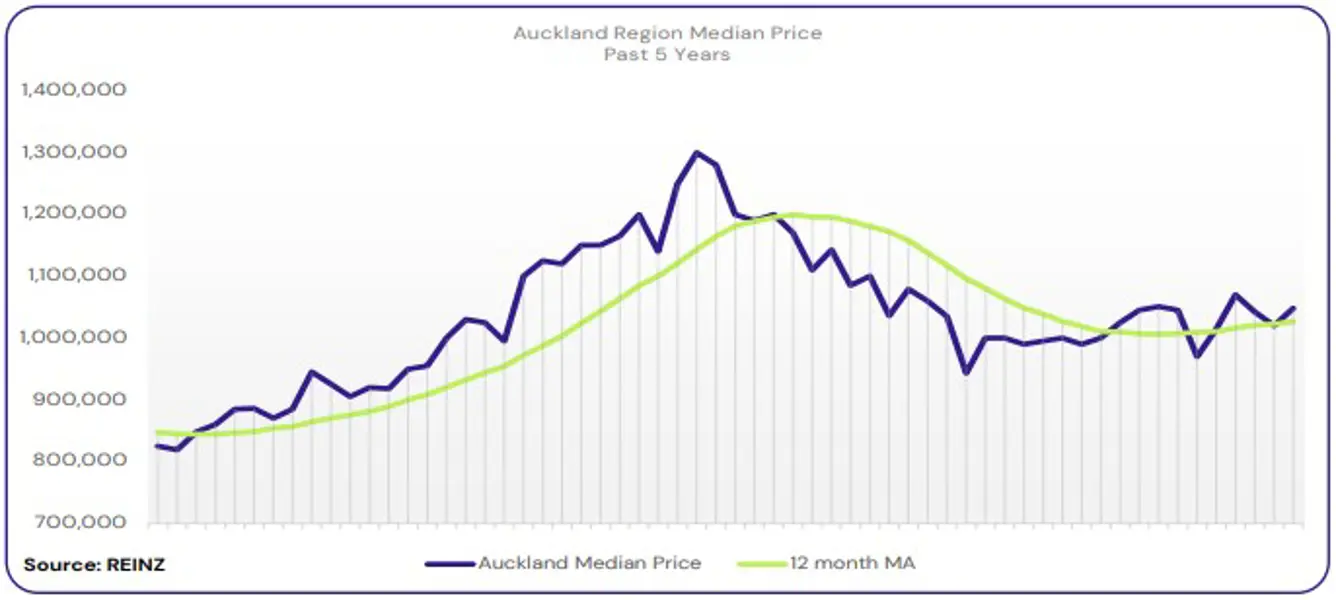

Regional Analysis - Auckland

The median price for Auckland increased 4.8% year-on-year to $1,048,000.

“First-home buyers, owner occupiers and investors were the most active buyer groups. However, local agents from Rodney have noted that there were no stand-out buyer groups in June.

Vendors understand the current tougher market and that it has shifted to a “buyer’s market”. However, some vendors still enter with higher price expectations. Open home attendance varied, with first-home buyers attending most but dropping off soon after. Auction activity remained light, with a mixture of clearance rates around the region.

Interest levels, bank lending criteria, the cost of living, lack of buyer confidence, and economic uncertainty remain factors influencing market sentiment. Local agents are cautiously optimistic that once interest rates decrease, market activity might pick up, but are suggesting that might not be until 2025.” (REINZ)

The current median Days to Sell of 47 days is more than the 10-year average for June which is 41 days. There were 33 weeks of inventory in June 2024 which is 6 weeks more than the same time last year.

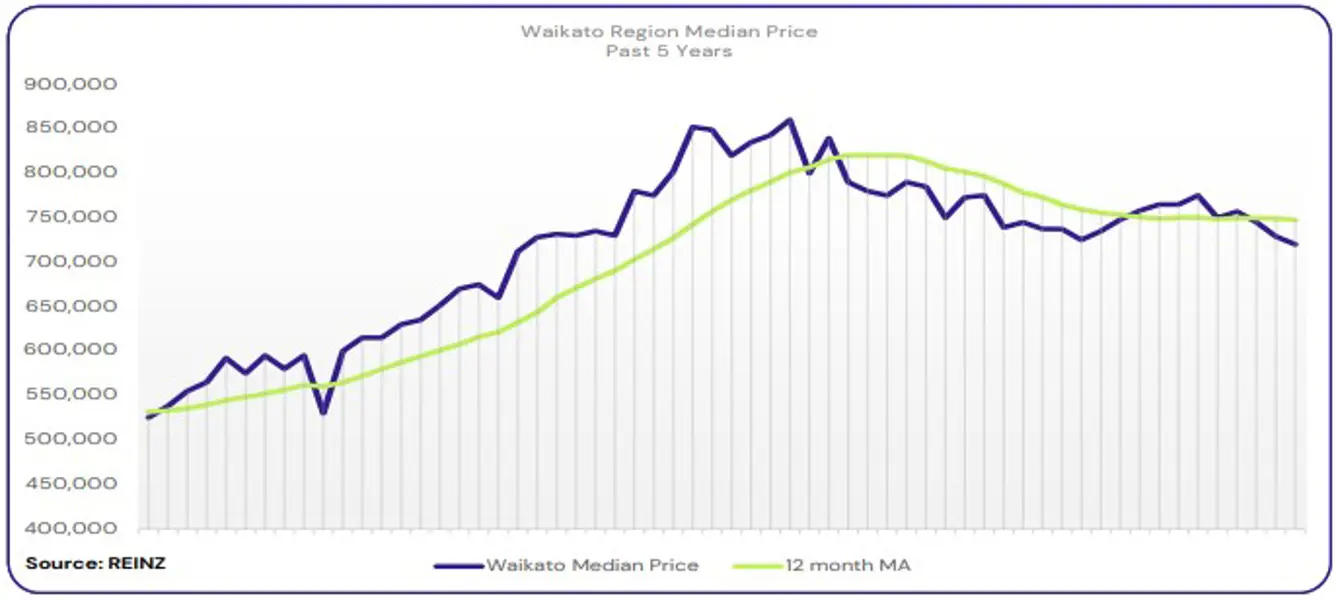

Regional Analysis - Waikato

Waikato’s median price decreased 2.3% year-on-year to $720,000.

“Owner occupiers and first-home buyers were the most active over June, with reports of investors showing an early interest in Hamilton.

Local salespeople said vendors entering the market were realistic with their price expectations. Open home attendance was light. Auction activity varied, with 50% of properties in Taupo seeing activity, while post-auction activity in Hamilton is higher.

Market sentiment was influenced by factors such as high interest rates, pressures from the cost of living, legislation changes, and challenging economic conditions. Predictions from local agents suggest the market will continue much of the same over the winter period, with an increase in activity later in the year and once interest rates drop.” (REINZ)

The current median Days to Sell of 55 days is much more than the 10-year average for June which is 44 days. There were 27 weeks of inventory in June 2024 which is 2 weeks more than the same time last year.

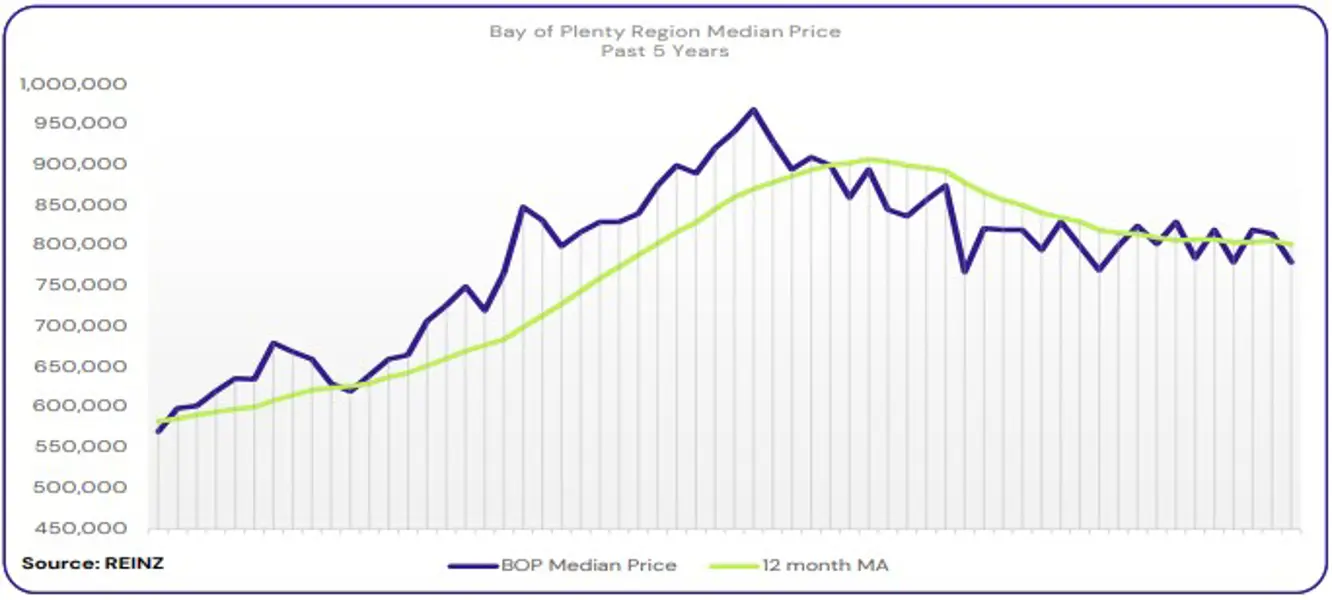

Regional Analysis - Bay of Plenty

The median price for Bay of Plenty decreased 6.0% year-on-year to $780,000.

“Owner occupiers and first-home buyers remained the most active buyer group. Most vendors are accepting of the current market expectations, with some vendors struggling with a potential financial loss. Open home attendance was steady, although quieter in the last weeks of June, with newer stock getting the most attendees.

Auction activity varied across the region, with properties positioned generally well to see outside of the auction room. Factors such as the general economic climate, job uncertainty, and the cost of living influenced market sentiment. Buyers’ lack of urgency was also a factor, with buyers opting to wait for the “right property.”

Local agents cautiously predict a similar situation over the coming months, with hopes for more positivity and confidence in spring.” (REINZ)

The current median Days to Sell of 59 days is much more than the 10-year average for June which is 48 days. There were 28 weeks of inventory in June 2024 which is 5 weeks more than the same time last year.

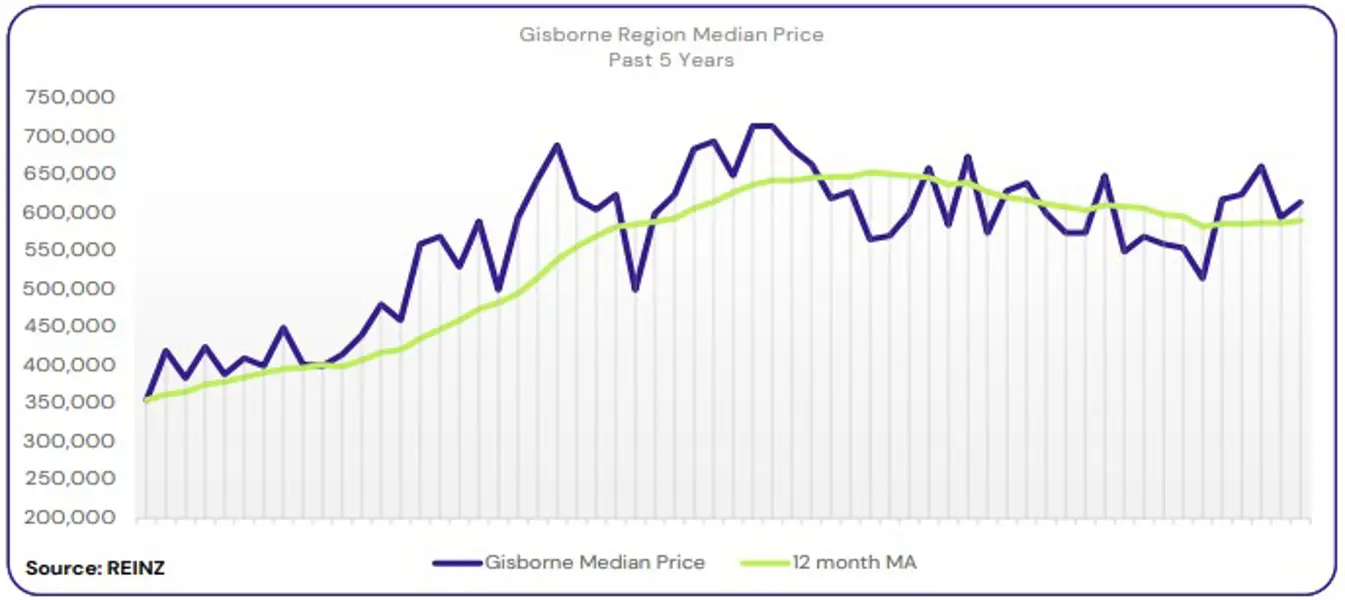

Regional Analysis - Gisborne

Gisborne’s median price has increased 7.0% year-on-year to $615,000.

“Owner occupiers were the most active buyer group this month, as there was an increase in cash buyers due to prior property sales. However, the upper end of the market saw a decline in transactions.

There was a positive shift with vendors entering the market with realistic expectations, and most are happy to meet the market. Open home attendance declined the last two months in June. Auction attendance had reduced slightly, although a stable clearance rate for properties selling under the hammer. Market sentiment was influenced by factors such as high interest rates. Local agents remain cautiously optimistic that the market will positively shift as winter ends and spring begins but spoke to the market remaining much of the same over the coming months.” (REINZ)

The current median Days to Sell of 49 days is more than the 10-year average for June which is 40 days. There are 7 weeks of inventory in June 2024 which is 10 weeks less than last year.

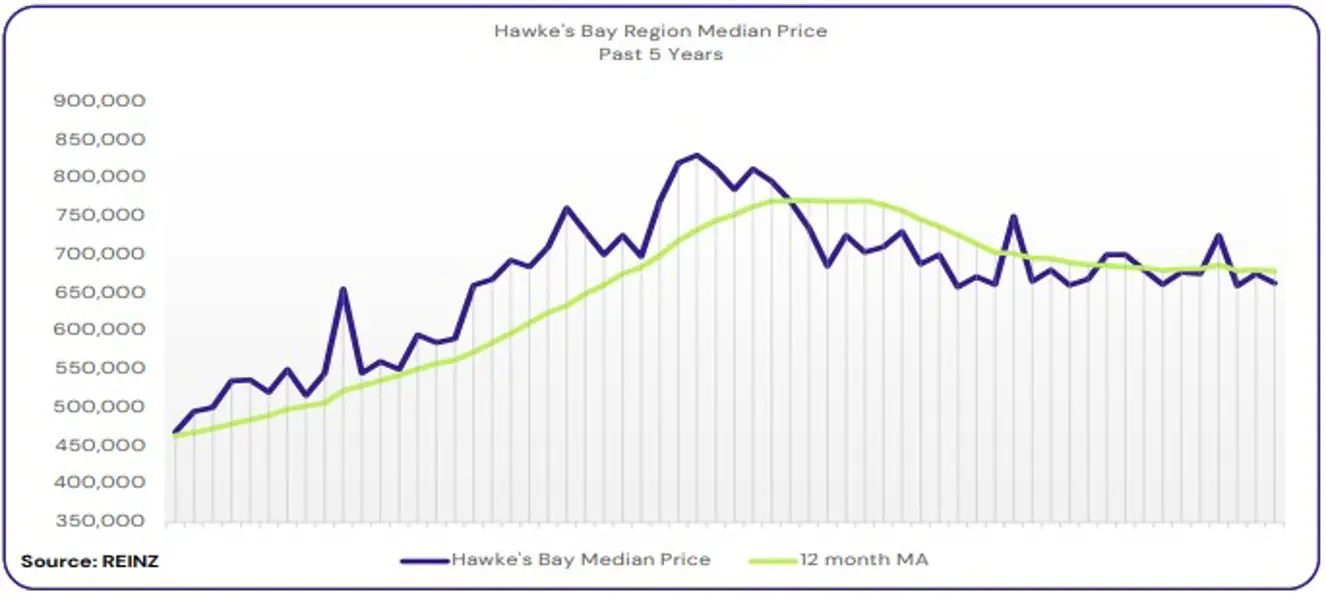

Regional Analysis - Hawke's Bay

The median price for Hawke’s Bay decreased 2.6% year-on-year to $662,500.

“Local agents report that there wasn’t a dominant buyer group in June, as activity was slow across the board. However, buyers looking for a “bargain” were prevalent.

Most vendors still hoped to get a premium price for their property. Although open home attendance was slightly lower, those who attended were serious buyers. Interest rates, the cost of living and employment insecurity were the main factors influencing market sentiment. Local agents remain hopeful that market sentiment and activity will increase later in the year.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for June which is 41 days. There were 22 weeks of inventory in June 2024 which is 5 weeks more than the same time last year.

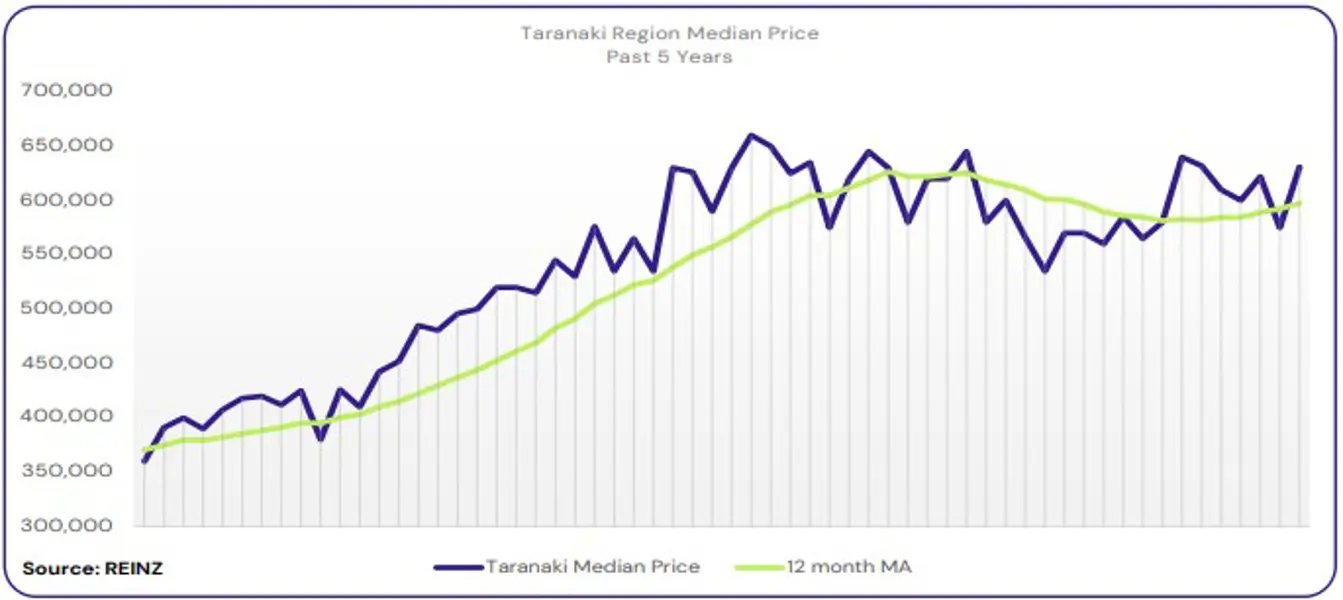

Regional Analysis - Taranaki

The median price for Taranaki increased 10.7% year-on-year to $631,000.

“The most active buyer group were first-home buyers, with reports of a shortage of buyers for higher-priced properties. Most vendors seem to be well-educated about market expectations in their area, and most vendor prices were realistic. However, open home attendance numbers were lower than usual for June, particularly with long weekends to start and end the month.

High interest rates and the cost of living remained the most significant factors that influenced market sentiment, with no notable shift from the last few months. Local agents are cautiously optimistic that once interest rates drop, there will be a notable shift in sales volumes across the region.” (REINZ)

The current median Days to Sell of 42 days is more than the 10-year average for June which is 41 days. There were 24 weeks of inventory in June 2024 which is 1 week less than the same time last year.

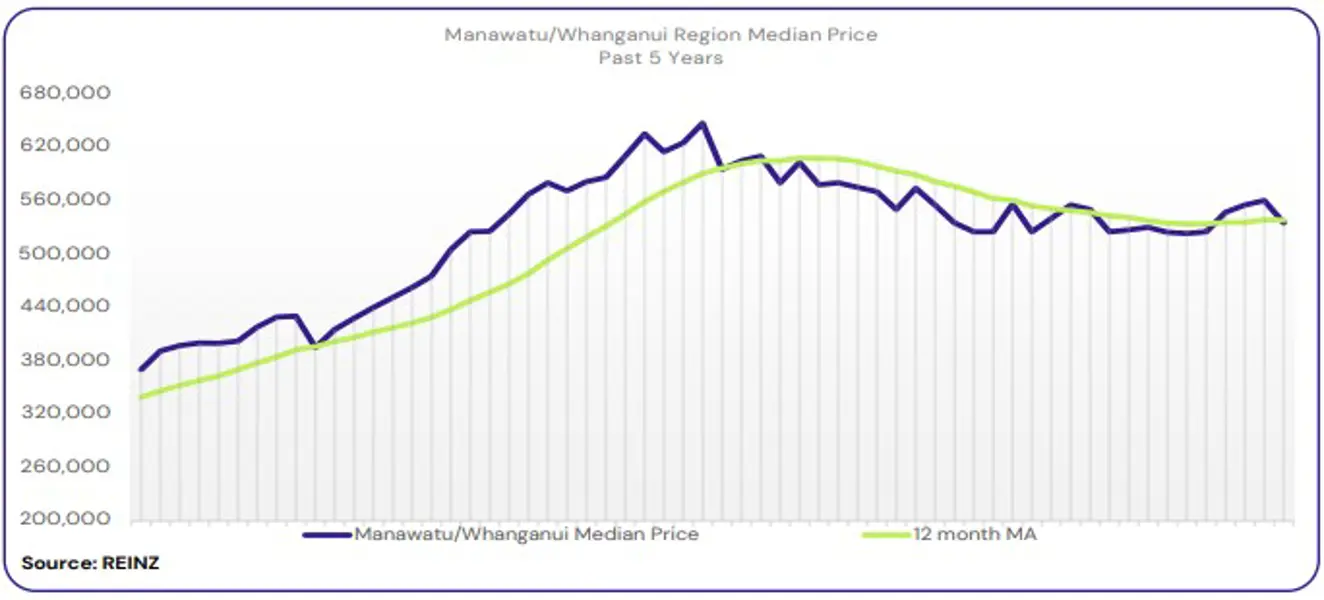

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased 0.9% year-on-year to $535,000.

“Owner occupiers were the most active buyer group, with few first-home buyers entering the market. Investors were still absent across the region.

Most vendors have come to terms with it now being a “buyer’s market” and have adjusted their price expectations accordingly. New listings attracted reasonable numbers at open homes, but attendance declined the longer the property was on the market. Little activity and attendance were noted at auctions.

Market sentiment was influenced by interest rates, job security, complex bank lending criteria, current economic challenges, and the lack of uncertainty and confidence in general. Local agents predict no substantial change in market conditions over the coming months, with challenges facing both vendors and buyers.” (REINZ)

The current median Days to Sell of 51 days is more than the 10-year average for June which is 41 days. There were 24 weeks of inventory in June 2024 which is 1 week more than the same time last year.

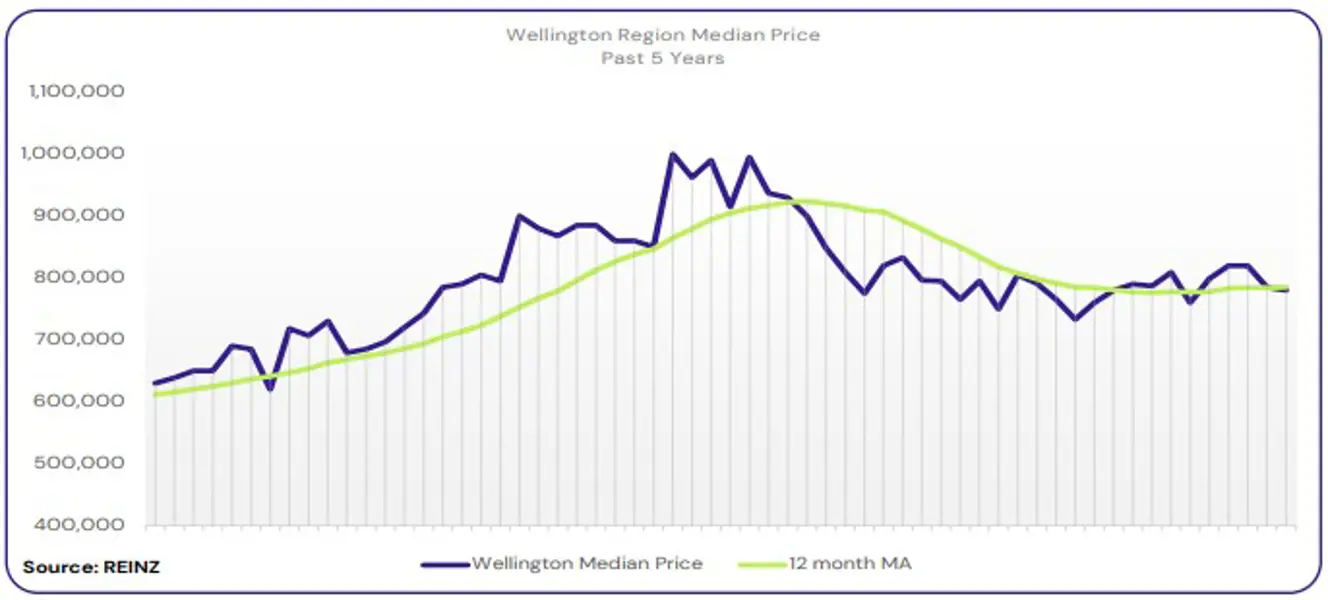

Regional Analysis - Wellington

The median price for Wellington increased 2.0% year-on-year to $780,000.

“Wellington’s average sales count decreased 21.5% year-on-year from 605 to 475. The median days to sell decreased by 2 days year-on-year from 51 to 49 days. 4.0% of all sales in June 2024 were sold by auction (19 auctions).

Average inventory increased 49.8% from 1,184 to 1,773 year-on-year. Weeks inventory increased 50% year-on-year from 10 to 15 weeks. Average listings increased 50.3% year-on-year from 354 to 532 listings.” (REINZ)

The current median Days to Sell of 49 days is more than the 10-year average for June of 39 days. There were 15 weeks of inventory in June 2024 which is 5 weeks more than the same time last year.

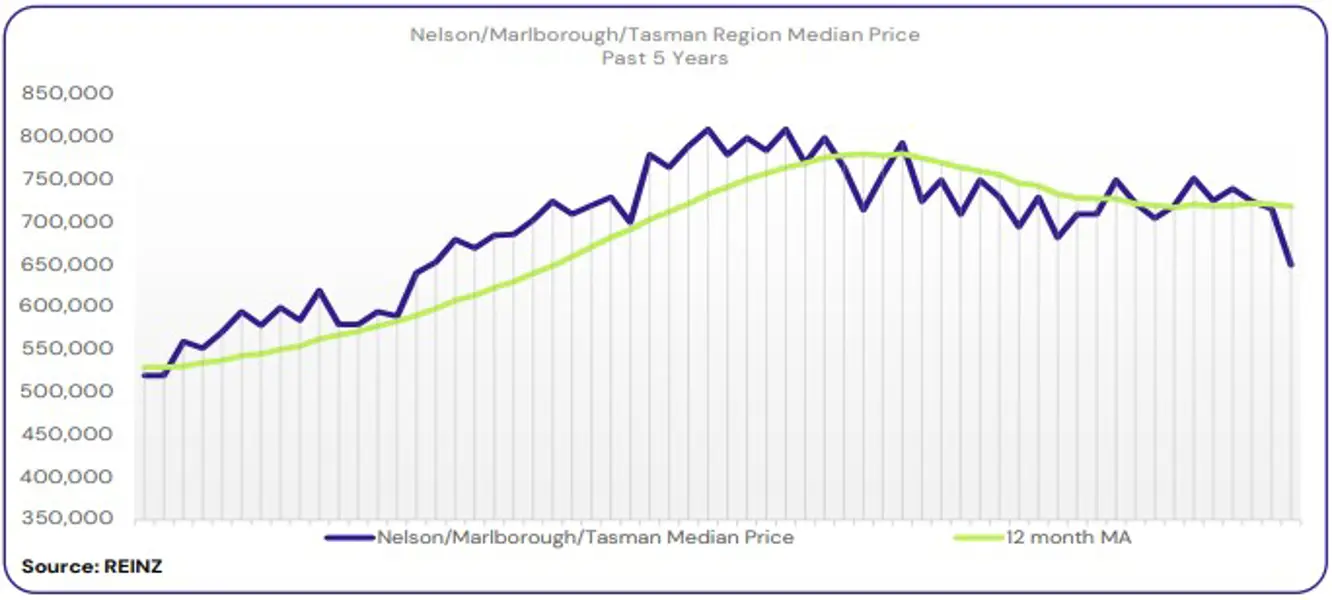

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson was the same as that for June 2023, at $650,000. The median price for Marlborough decreased 3.9% year-onyear to $620,000. The median price for Tasman decreased 2.9% year-on-year to $777,000.

“There was an even spread of buyers across the region for June 2024, with no stand-out buyer group. Some vendors continue to want the best price outcome, and those who are well-educated on market expectations and price their properties at the current market value are seeing more activity. Open home attendance remained steady but tended to drop away quickly. New listings received higher attendance numbers. There was a low success rate in auction rooms across Marlborough.

Market sentiment was influenced by positive/negative media coverage of what’s happening in the market, entering the winter period, a delayed process for pre-approvals, increased stock levels and the cost of living. Local agents are cautiously optimistic that once winter leads into spring, there will be more activity in the property market.” (REINZ)

The current median Days to Sell of 50 days is much more than the 10-year average for June which is 39 days. There were 26 weeks of inventory in June 2024 which is 2 weeks more than the same time last year.

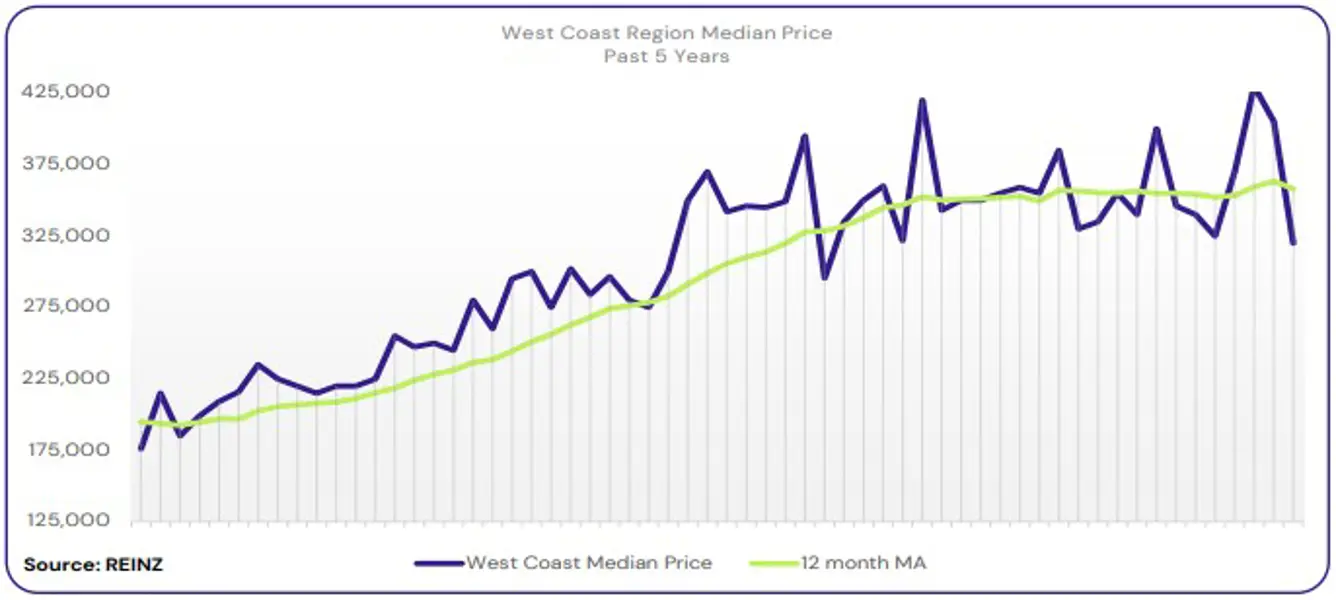

Regional Analysis - West Coast

West Coast’s median price decreased 16.9% year-on-year to $320,000.

“First-home buyers, owner occupiers, investors and overseas buyers have all been present over June, with no decline in a particular buyer group.

Vendor expectations have been realistic, and local agents report that this is because of the media coverage around asking prices. Open home attendance saw steady numbers across the region. Factors such as the cost of living, interest rates and job uncertainty remain the main factors influencing market sentiment. Local agents cautiously predict that the momentum will continue over the coming cooler months.” (REINZ)

The current median Days to Sell of 46 days is much less than the 10-year average for June which is 63 days. There were 25 weeks of inventory in June 2024 which is 16 weeks less than the same time last year.

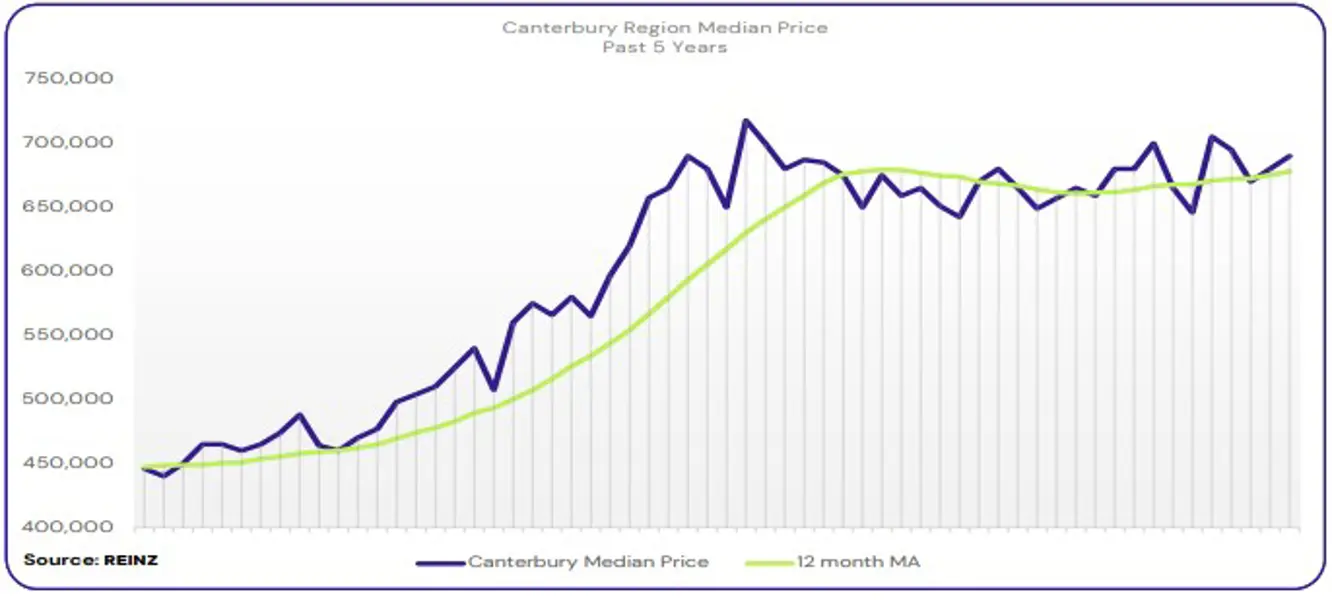

Regional Analysis - Canterbury

The median price for Canterbury increased 5.0% year-on-year to $690,000.

“There was an even spread of buyers across the region. First home buyers were the most active in Timaru. Most vendor expectations are realistic and in line with current market conditions, with few still hoping for a high sale price. Open home attendance has been steady, with higher attendance for newer listings. Auction clearance rates in Christchurch have been average, while Timaru saw better auction room activity and more cash buyers.

The media, cost of living, FOMO among some buyers, high interest rates, increased stock levels and lack of buyer urgency influenced market sentiment. Local agents are cautiously hopeful that spring will bring positivity and an increased number of listings on the market, which might bring out more buyers.” (REINZ)

The current median Days to Sell of 37 days is the same as the 10-year average for June which is 37 days. There were 15 weeks of inventory in June 2024 which is 1 week less than the same time last year.

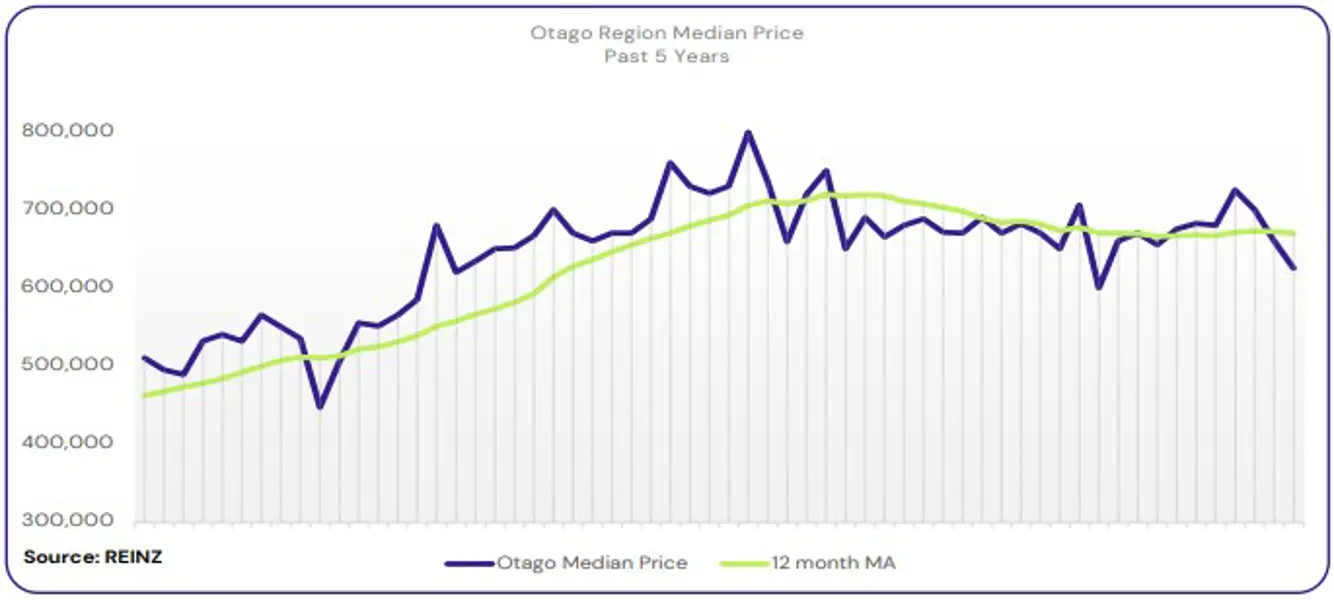

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price has decreased 1.0% year-on-year to $579,000.

All buyer types except investors were seen across the region in June, with a slight decline in first-home buyers. Most vendors have come to terms with current market conditions and their lowered price expectations. Open home attendance was good, with numbers higher than expected for a few weeks after the property was first listed.

Market sentiment was influenced by high interest rates, the cost of living and a lack of confidence and urgency among buyers. Local agents report that the main concern for some buyers remains how long it will be until there is relief from high interest rates.

Local agents remain cautiously optimistic that once we are through the remaining winter months, market sentiment, overall confidence and motivation will increase towards the end of the year and into next year.”

Queenstown Lakes

“First-home buyers were the most active buyer group in the region for May. Investors have adopted the ‘wait and see’ approach. There were reports of a decline in the buyer pool for higher-end properties, which is reflected in the low attendance at open homes for such properties. Properties marketed by asking price, auction, price by negotiation and deadline sale are the most popular properties in this region.

Motivated vendors are prepared to listen to market feedback and adjust their expectations. However, some vendors are not prepared to adjust to meet market expectations in the auction room. Local agents report that high interest rates, the lack of buyer urgency, the condition of finance and job security continue to impact market sentiment.” (REINZ)

The current median Days to Sell of 44 days is more than the 10-year average for June which is 40 days. There were 22 weeks of inventory in June 2024 which is 7 weeks more than the same time last year.

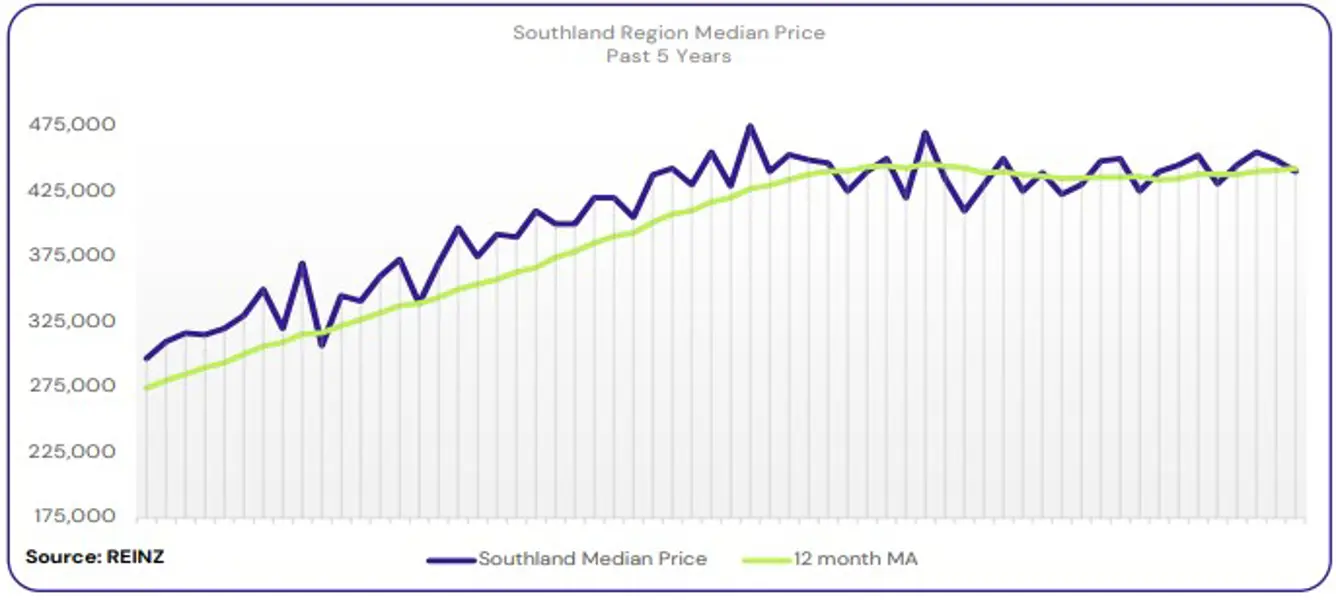

Regional Analysis - Southland

The median price for Southland increased 4.1% year-on-year to $440,000.

“The median sales count for Southland decreased 33.3%, from 141 in June 2023 to 94 properties sold in June 2024. Average inventory levels increased 20.5% from 451 to 543 year-on-year, with weeks inventory up 12.5% from 16 to 18 weeks year-on-year.

Average listings increase 33.6% year-on-year from 122 to 163. Median days to sell increased by 2 days year-on-year from 36 to 38. 4.3% of all sales in June were auctions (4 auctions).” (REINZ)

The current median Days to Sell of 38 days is more than the 10-year average for June which is 36 days. There were 18 weeks of inventory in June 2024 which is 2 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.