July brought a new wave of buyer activity - REINZ stats July 2024

Wednesday, 21 August 2024

The July 2024 figures shows signs of positivity with increases in sales numbers and listing volumes.

REINZ Chief Executive Jen Baird said July brought a new wave of buyer activity not typically seen in late winter. While listings continue to increase, the rise in sales volumes has seen the total number of properties for sale in New Zealand fall compared to last month. However, median prices have decreased by 2.2% nationally compared to a year ago, indicating that houses sold at a lower price in July.

The total number of properties sold in New Zealand increased by 14.5% year-on-year, from 5,070 to 5,806, and by 19.7% compared to June 2024, from 4,851 to 5,806. Thirteen regions saw an increase in sales for July 2024. The most significant increases were in Gisborne (+53.6%), Otago (+45.7%), Marlborough (+42.9%) and Southland (+38.8%). Compared to June 2024, only one region saw a decrease in sales volume, Nelson (-21.2%).

“Although we have not yet reached the spring season, we are observing early signs of growth in the market not typically associated with this time of year. This can be seen through the seasonally adjusted data, which indicates an increase of 5.4% in national sales compared to last year, which reflects a market performing above anticipated levels," says Baird.

Fourteen of the fifteen regions have seen a rise in new listings year-on-year, with Wellington (+55.0%), Gisborne (+50.0%) and Southland (+36.9%) leading the way. The only region to see a decrease in new listings year-on-year was Taranaki (-4.8%).

Seven of the sixteen regions had a median price increase year-on-year. West Coast and Tasman stood out, with West Coast’s median price increasing by 21.2% year-on-year ($330,000 to $400,000), and Tasman saw a 10.6% increase ($710,000 to $785,000). Seven regions saw an increase month-on-month (Waikato +3.4% to $725,000, Bay of Plenty +2.0% to $800,000, Tasman +8.7% to $785,000, Nelson +1.4%to $657,000, West Coast +25.0% to $400,000, Otago +6.4% to $665,000 and Southland +9.9% to $482,500).

The national median price decreased by 2.2% year-on-year, from $770,000 to $753,000, and decreased by the same amount month-on-month. For NZ, excluding Auckland, the median price decreased 1.5% year-on-year from $680,000 to $670,000. Month-on-month, the median price also decreased by 1.5%.

“There has been downward pressure on prices in most parts of the country this year and sales volumes have been lower than average as the cost of living, concerns around job security and interest rates challenge many people in New Zealand. However, it seems this sentiment is beginning to change. The slight decline in interest rates in July, and a belief that there are more to come, appears to have encouraged buyer activity, as reflected in the increase in sales,” comments Baird.

“The recent 25 basis point reduction in the OCR, and the strong signals of more reductions to come, will bring relief to households and will provide some confidence to buyers to act soon,” adds Baird.

Nationally, median Days to Sell increased by one day, from 48 to 49 days, compared to a year ago. For New Zealand, excluding Auckland, median Days to Sell had no change year-on-year (49 days). Eight regions had fewer Days to Sell in July 2024 than in July 2023. Manawatu/Whanganui had the highest median Days to Sell at 63 days, a one-day increase compared to a year ago.

The HPI for New Zealand stood at 3,563 in July 2024, a 0.2% increase from July 2023 and down by 0.3% compared to June 2024. The average annual growth in the New Zealand HPI over the past five years has been 5.2% per annum, and it is currently 16.7% below the market peak reached in 2021. Otago is the top-ranked HPI year-on-year movement this month, reaching a new peak at 4,187.

“In July, we saw an increase in sales across the country compared to last year and June 2024. As more listings hit the well-supplied market, buyers are slower to make decisions, extending the average Days to Sell. Despite ongoing economic challenges, early signs suggest potential improvement, indicating favourable conditions in the residential property landscape might be on the horizon.” adds Baird.

Regional highlights:

- Gisborne had the highest increase in sales count, up by 53.6% year-on-year and a 115.0% increase compared to June 2024.

- Fourteen regions have increased in new listings year-on-year, with notable increases in Wellington at +55.0%, Gisborne at +50.0% and Southland +36.9%.

- Seven of the sixteen regions had year-on-year price increases, with West Coast leading the way with a 21.2% increase ($330,000 to $400,000).

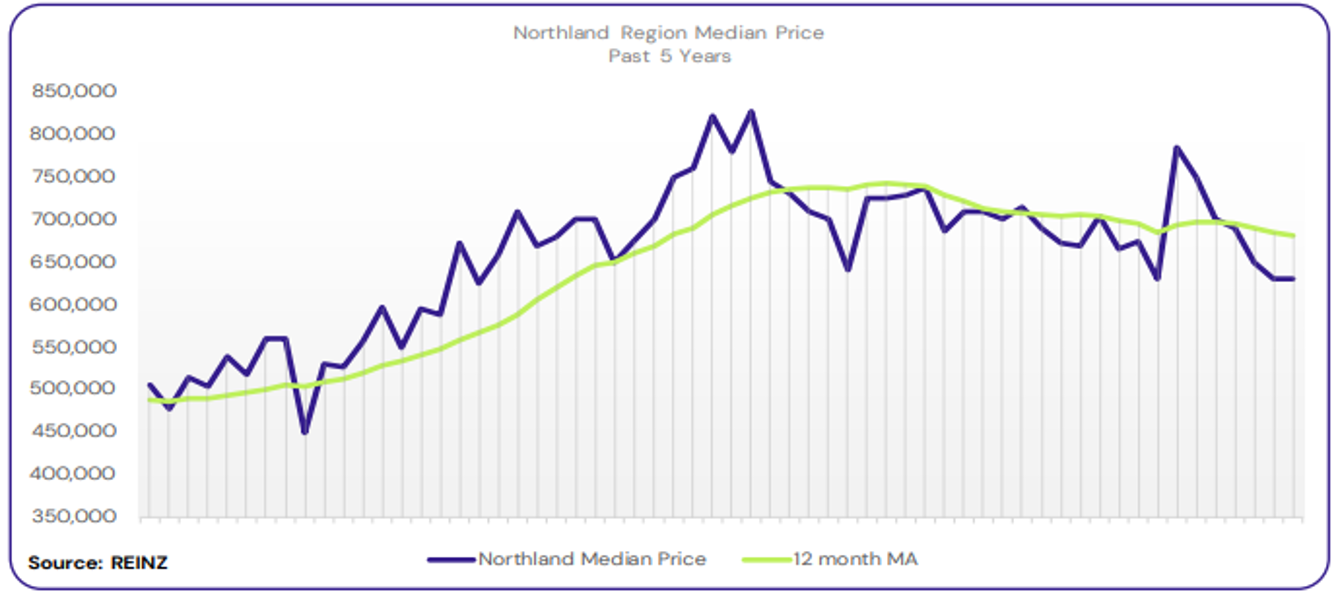

Regional Analysis - Northland

The median price for Northland decreased 6.3% year-on-year to $630,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with reports of fewer lifestyle and investment buyers.

Most vendors are listening and adjusting prices to meet market expectations, with some choosing to remove their properties in anticipation of a lift later this year. Open home attendance varied, with good numbers reported at new listings in Whangarei, whereas private viewings are popular elsewhere.

Low attendance was recorded at some auctions. However, negotiations in the auction room produced good results. As vendors began to accept the current market, confidence among vendors and buyers slowly increased. Local agents report that interest rates and lending criteria didn’t hold buyers back in July and are hopeful for a further lift in confidence towards the end of the year.” (REINZ).

The current median Days to Sell of 65 days is much more than the 10-year average for July which is 53 days. There were 47 weeks of inventory in July 2024 which is 1 week more than the same time last year.

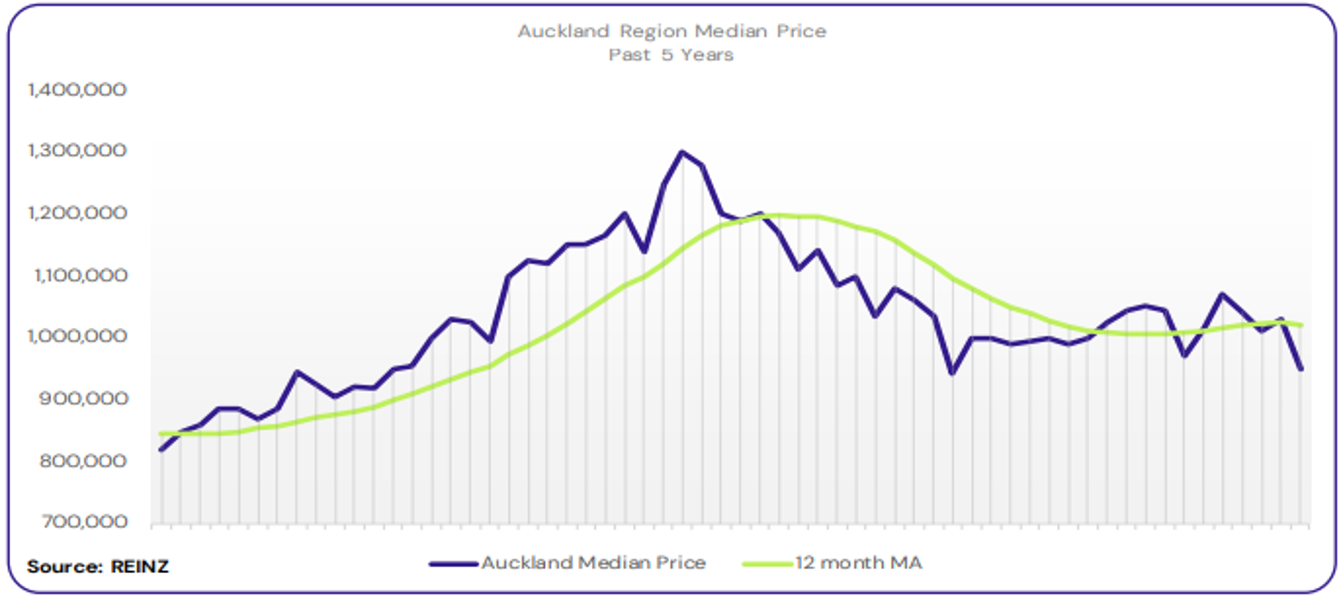

Regional Analysis - Auckland

The median price for Auckland decreased 4.0% year-on-year to $950,000.

“First home buyers, owner-occupiers and investors were the most active buyer groups across the region, with Rodney reporting no active buyer group.

Vendor expectations were mixed. Some were reluctant to accept lower prices, while others listened and were willing to meet market expectations. Attendance at open homes varied, with new listings seeing the highest numbers.

The auction clearance rate and attendance held steady, with a decline in lifestyle auctions. Interest rates, a lack of buyer urgency, bank lending criteria, and high stock levels influenced market sentiment. Local agents are cautiously optimistic that spring will bring positivity, and as interest rates fall, there may be further confidence.” (REINZ).

The current median Days to Sell of 48 days is more than the 10-year average for July which is 39 days. There were 40 weeks of inventory in July 2024 which is 19 weeks more than the same time last year.

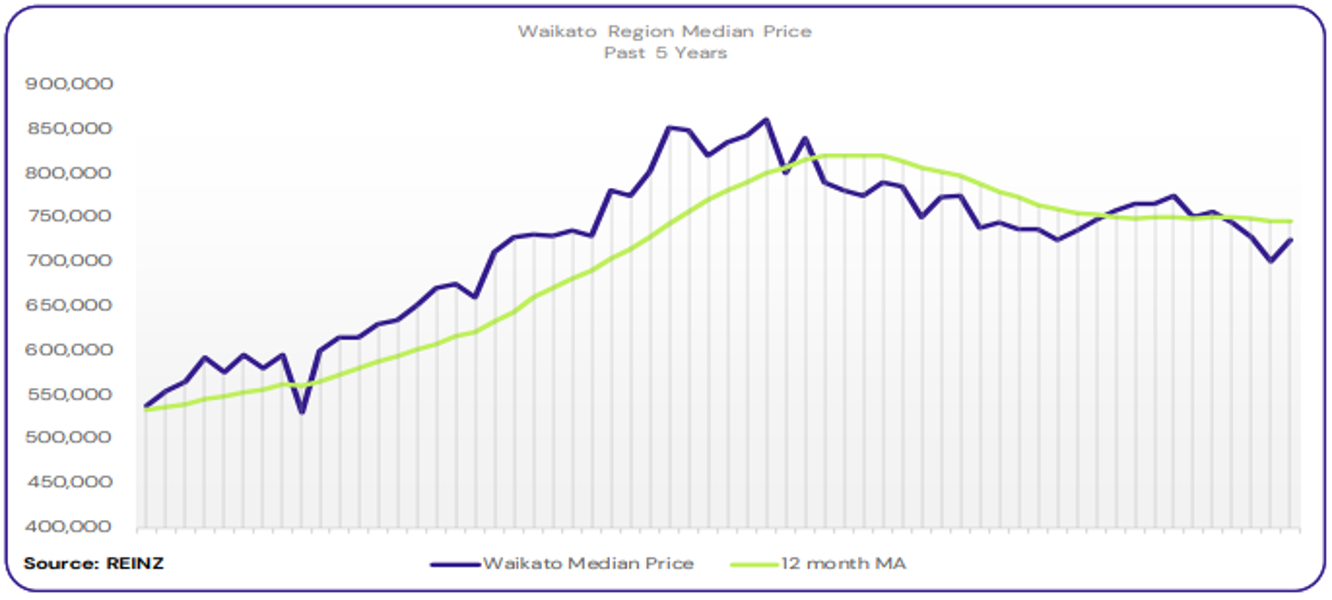

Regional Analysis - Waikato

Waikato’s median price was the same as July 2023 at $725,000.

“First home buyers and owner-occupiers were the most active buyer groups, with an increase in initial enquiries from investors and developers. The lifestyle buyer groups have declined, which is usual for this time of year. Most vendor expectations aligned with market conditions, but those who purchased their property 1-2 years ago expected a higher price. There were reports of good attendance at open homes with a range of buyers, but this is not reflected in the Thames-Coromandel market, where open home attendance has been quiet. Auction listings and attendance levels increased. However, most conversions happened post-auction. Sales count varied across the region, with local salespeople hoping for an increase as we head out of winter.

Current economic conditions, interest rates, lack of confidence in the market, the shift in tax changes and lack of buyer urgency influenced market sentiment. Local agents predict spring will bring an influx of new listings and might remain strong until the end of 2024.” (REINZ).

The current median Days to Sell of 58 days is much more than the 10-year average for July which is 41 days. There were 32 weeks of inventory in July 2024 which is 11 weeks more than the same time last year.

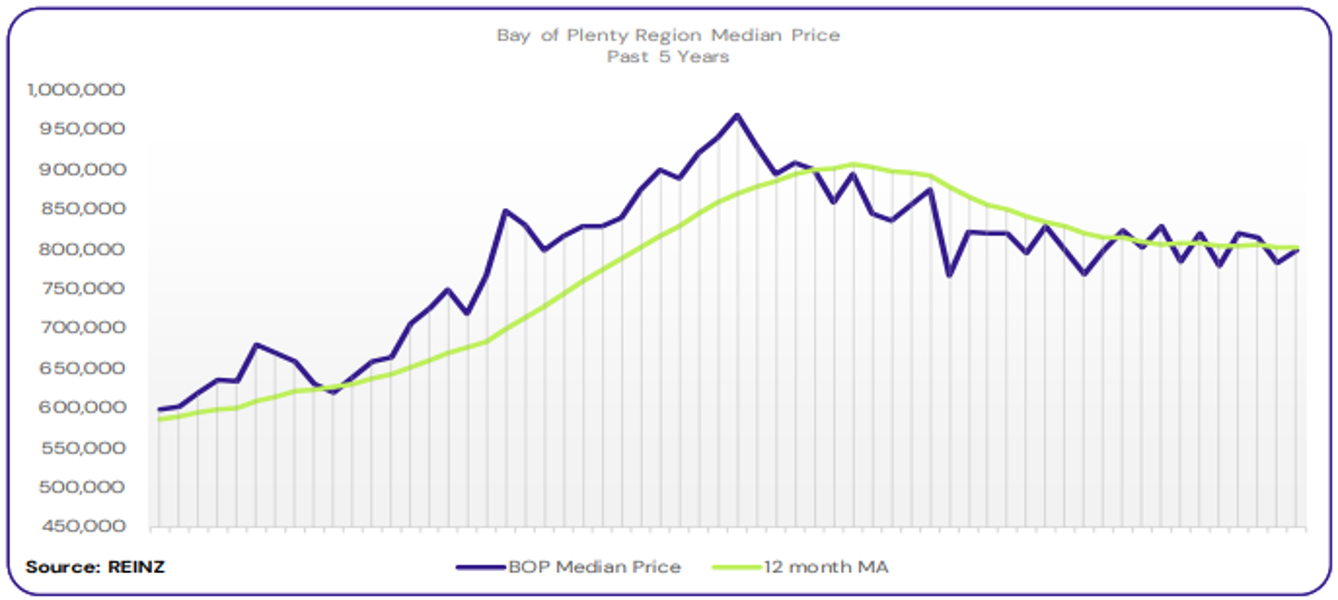

Regional Analysis - Bay of Plenty

The median price for Bay of Plenty was the same as July 2023 at $800,000.

“First home buyers and local buyers were the most active buyer groups in July, which local agents suspect is due to increased properties in the lower-priced brackets. Investors, developers, and owner-occupiers were less active.

Vendors were generally more accepting of market conditions, with those who bought at the market’s peak still holding on to higher expectations. Attendance at open homes varied; some saw steady attendance with quality buyers, while others saw a decline in numbers as buyers waited for the right property.

A good number of properties chose to sell by auction. However, most activity was seen outside of the auction room. Market sentiment improved with positive talk around interest rates, although some buyers wait for interest rates to drop further before committing. Local agents are cautiously optimistic that there will be an influx of listings as we move into spring and that the market will track upward and steadily as we head into 2025.” (REINZ).

The current median Days to Sell of 52 days is more than the 10-year average for July which is 45 days. There were 31 weeks of inventory in July 2024 which is 10 weeks more than the same time last year.

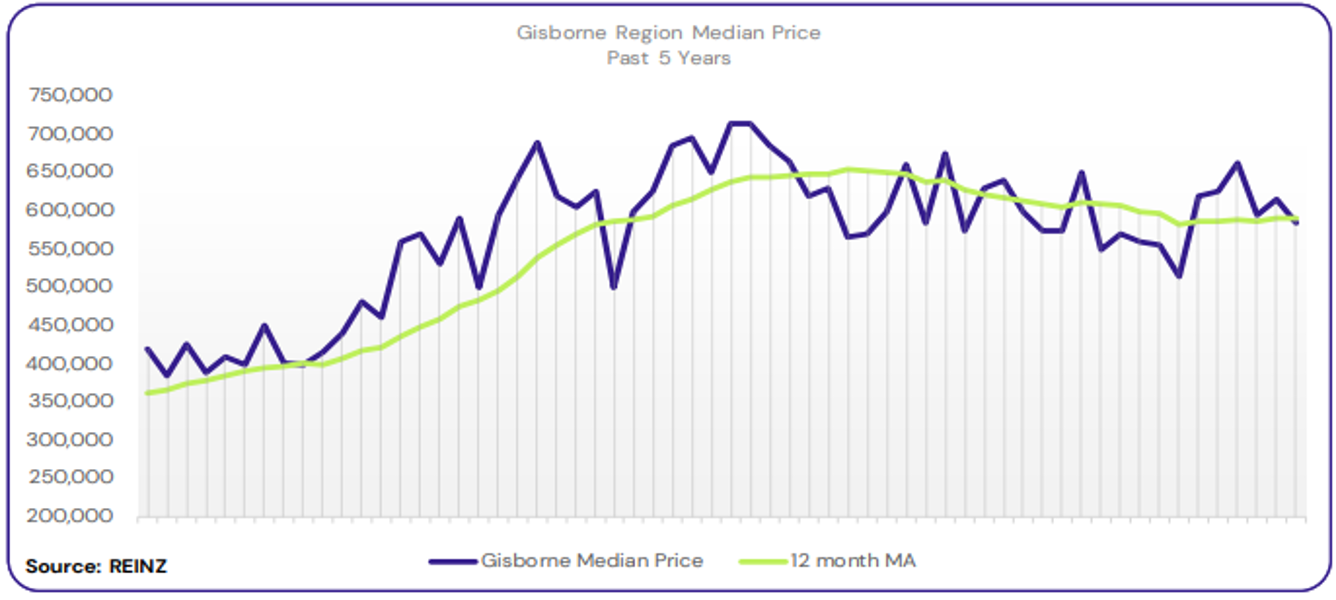

Regional Analysis - Gisborne

Gisborne’s median price increased 1.7% year-on-year to $585,000.

“Owner-occupiers were the most active buyer group in July. Local agents reported that as prices have seemed to settle in the region, owner-occupiers are taking opportunities to upsize.

Vendor expectations were stable. As properties were priced correctly within market expectations, the number of multiple offers received increased. Open home attendance increased in the second half of July as new stock increased in conjunction with increased positivity around lowered interest rates.

Auction attendance was good, and active bidders remained stable. Clearance rates were ahead of any other method of sale. The optimism surrounding interest rates influenced market sentiment, and local agents are cautiously hopeful that there will be further market confidence in the lead-up to spring.” (REINZ).

The current median Days to Sell of 45 days is more than the 10-year average for July which is 40 days. There are 23 weeks of inventory in July 2024 which is 13 weeks more than last year.

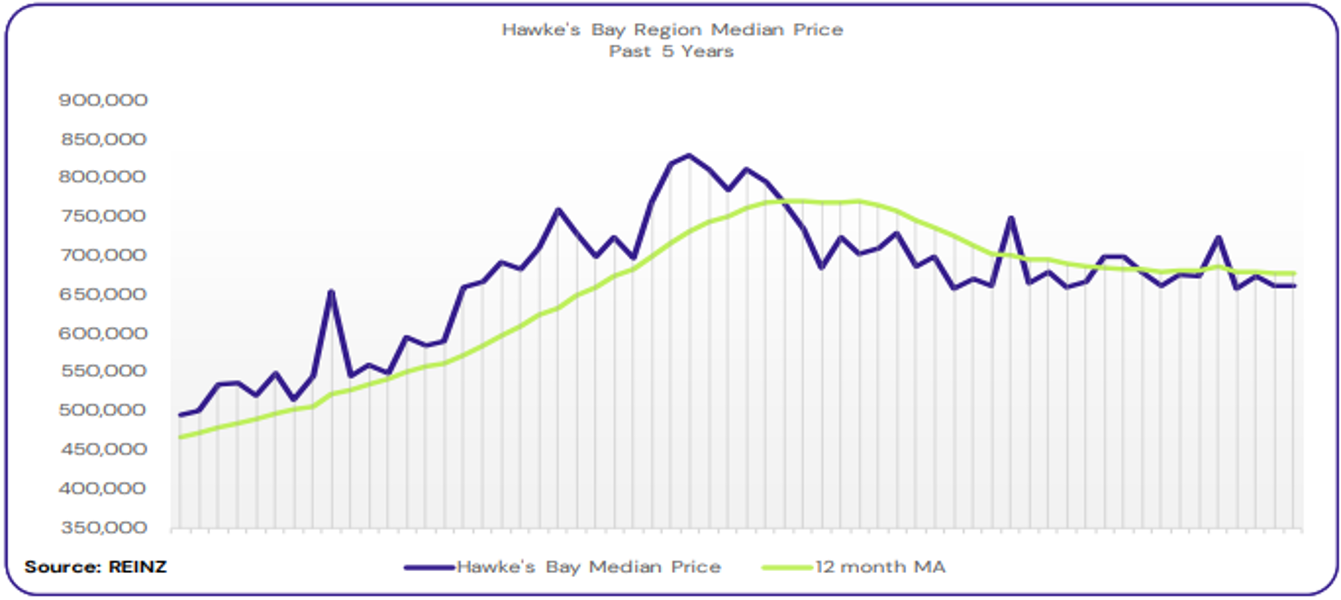

Regional Analysis - Hawke's Bay

The median price for Hawke's Bay increased 0.4% year-on-year to $662,500.

“Owner-occupiers were July’s most prominent buyer group, with reports of a slight decline in first home buyers. Vendors were reluctant to lower their asking price to meet market expectations, standing by their original expectations. Open homes saw low attendance, but those who attended were quality buyers.

Market sentiment was influenced by buyers’ lack of urgency, interest rates, increased property rates, insurance, and other general cost increases. There have also been reports of an increased number of withdrawn listings in the region for this time of year.

Local agents remain cautiously optimistic that the number of sales may increase when interest rates decrease potentially later in the year.” (REINZ).

The current median Days to Sell of 59 days is much more than the 10-year average for July which is 39 days. There were 21 weeks of inventory in July 2024 which is 6 weeks more than the same time last year.

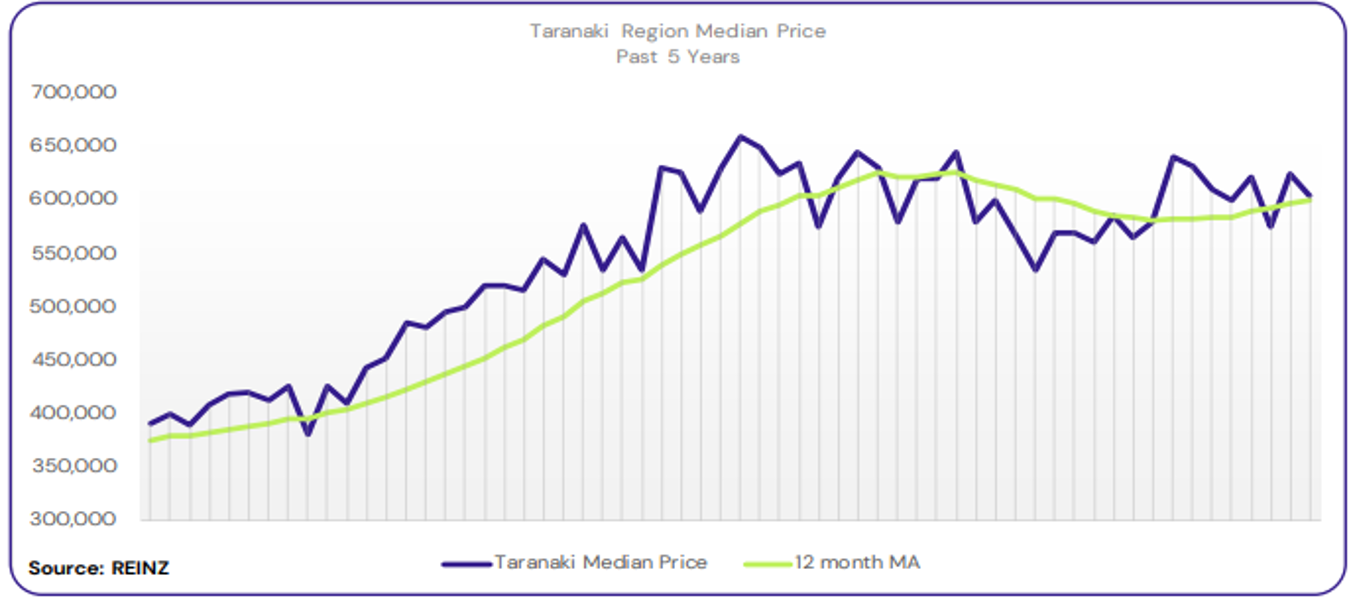

Regional Analysis - Taranaki

The median price for Taranaki increased 6.1% year-on-year to $605,000.

“Owner-occupiers were the most active buyer group in the Taranaki region. First home buyers were active in lower-priced listings. There was no particular decline in one buyer group, but there are still reports of a shortage of buyers in the higher-priced brackets.

Vendor expectations remained realistic on their pricing. Open homes were well-attended in July despite the winter weather. Interest rates, the increased cost of living, and a lack of buyer urgency influenced market sentiment. Local salespeople note a positive shift in activity in their region and remain hopeful that once interest rates are reduced, the number of sales across the region will increase as we see the end of 2024.” (REINZ).

The current median Days to Sell of 57 days is much more than the 10-year average for July which is 38 days. There were 25 weeks of inventory in July 2024 which is 2 weeks more than the same time last year.

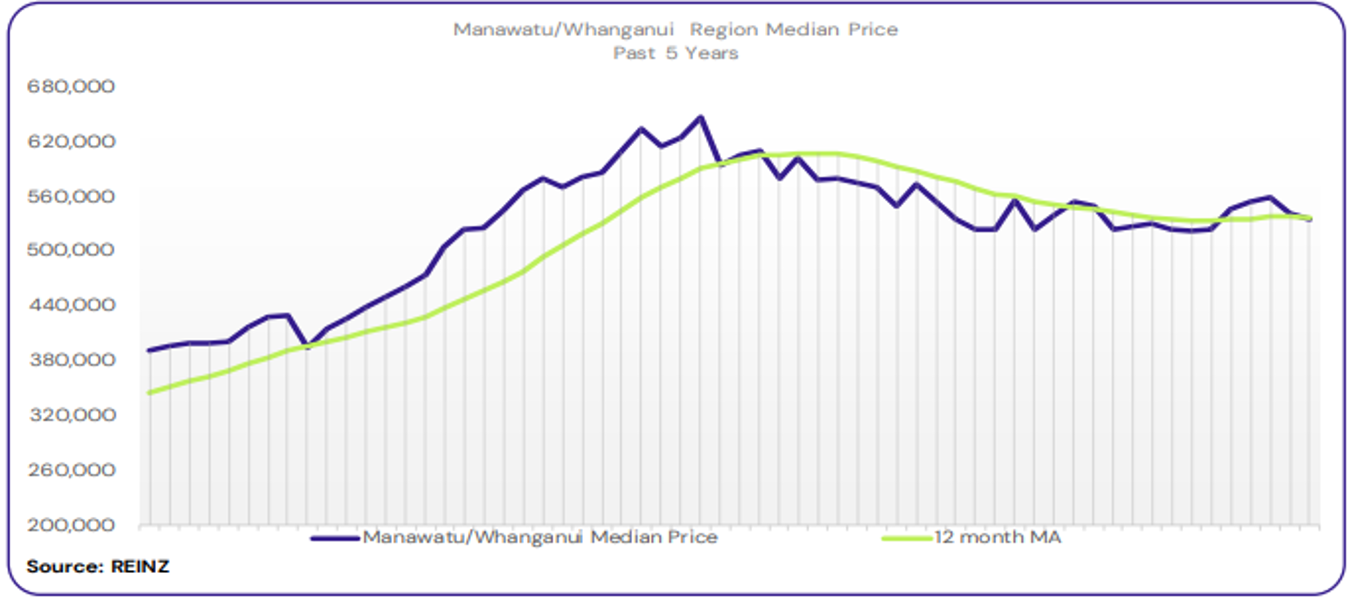

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased 3.6% year-on-year to $535,000.

“Owner-occupiers were the most active buyer group, with few first home buyers. Investor enquiries declined. Vendors knew that price expectations were lower than in previous years, and if they wanted to sell, they were required to meet market conditions. Attendance at open homes was quiet, with good attendance at new listings. Attendance at auction rooms followed a similar trend, with a decline in interest and a lack of cash buyers.

High interest rates, property prices, and bank lending criteria influenced market sentiment. Local agents predict a similar market until the end of 2024 and are cautiously optimistic that 2025 will bring positivity.” (REINZ).

The current median Days to Sell of 63 days is much more than the 10-year average for July which is 42 days. There were 29 weeks of inventory in July 2024 which is 10 weeks more than the same time last year.

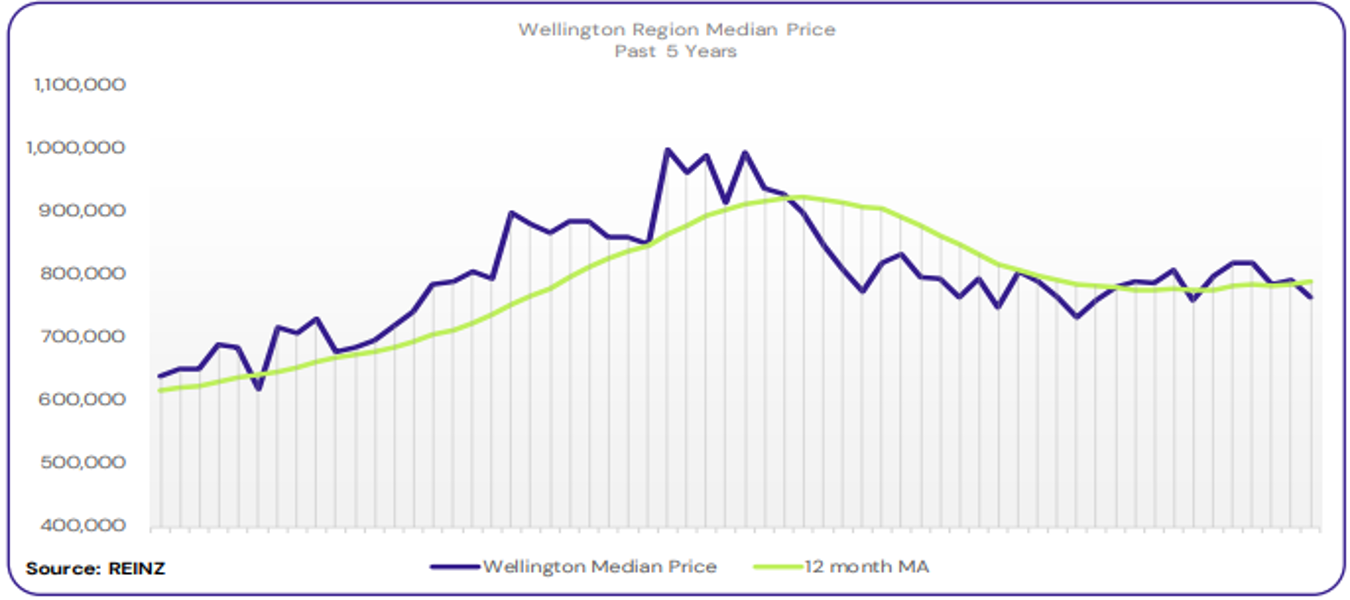

Regional Analysis - Wellington

The median price for Wellington increased 4.4% year-on-year to $765,000.

“First home buyers were the most active buyer group in July. Vendor price expectations were realistic, and those coming to market were serious and well aware of today’s market. However, attendance at open homes was very quiet.

Seasonal changes, job security, winter weather, and general negativity about current market conditions influenced market sentiment. Local salespeople report that buyers secured preapprovals even if they weren’t actively placing offers. Local agents remain cautiously hopeful that the coming months will bring a more settled market.” (REINZ).

The current median Days to Sell of 46 days is more than the 10-year average for July of 39 days. There were 17 weeks of inventory in July 2024 which is 8 weeks more than the same time last year.

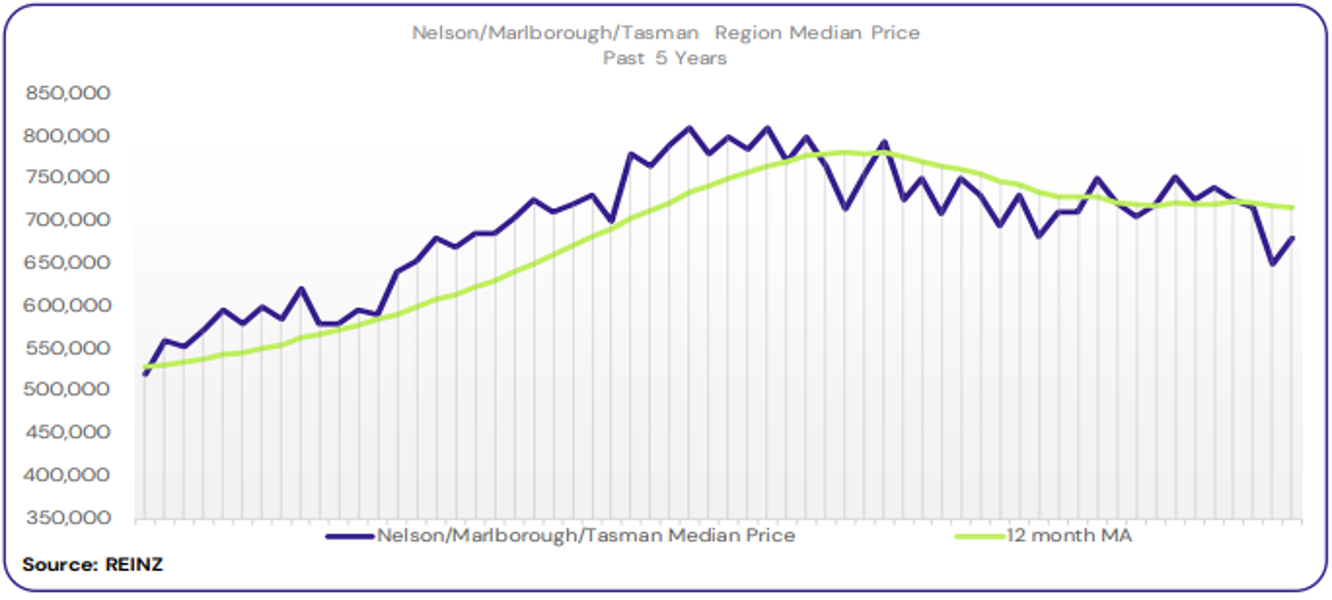

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased 7.5% year-on-year to $657,000. The median price for Marlborough decreased 14.3% year-on-year to $580,000. The median price for Tasman increased 10.6% year-on-year to $785,000.

“Owner-occupiers and first home buyers were the most active buyer groups—reports of investors showing some interest in Nelson.

Most vendors have adjusted their price expectations, while others have found it difficult to understand market conditions. Open home attendance for new listings was busier than listings that have been on the market for a while. Current economic conditions, personal finances, employment concerns, a lack of buyer urgency, and interest rates influenced market sentiment.

Local agents predict that spring will bring new activity. They are hopeful those vendors waiting for the ‘right time’ to come will do so then and are cautiously optimistic that there might be a positive outlook if money lending criteria ease.” (REINZ).

The current median Days to Sell of 48 days is more than the 10-year average for July which is 38 days. There were 32 weeks of inventory in July 2024 which is 8 weeks more than the same time last year.

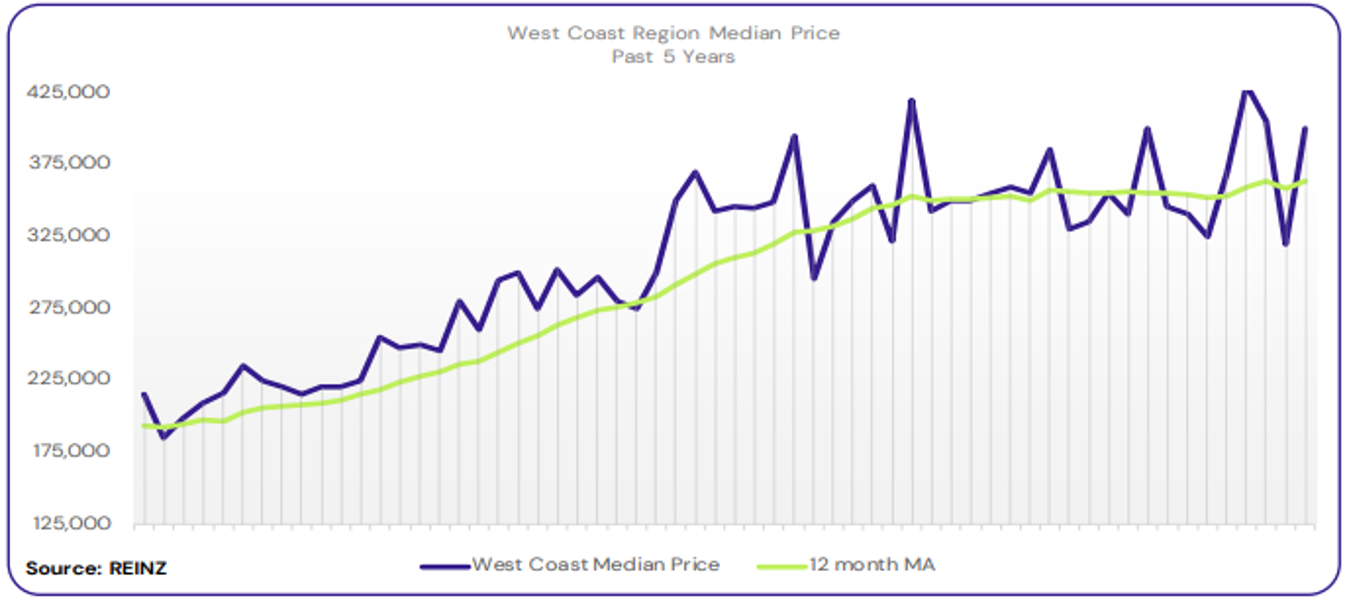

Regional Analysis - West Coast

West Coast’s median price increased 21.2% year-on-year to $400,000.

“A mix of owner-occupiers and first home buyers were the most active buyer group across the region, with no decline in buyer pool.

Vendors have been listing their properties at appraisal pricing and are now aware that pricing is key to good engagement at open homes and potential buyers. Good attendance at open homes, with those attending to get a feel for the market and what is on offer.

Interest rates, media coverage and vendor confidence influenced market sentiment. Local agents report that as job vacancies begin to be advertised in the coming months, it will bring positivity to the residential property market and rental sector.” (REINZ).

The current median Days to Sell of 41 days is much less than the 10-year average for July which is 80 days. There were 55 weeks of inventory in July 2024 which is 21 weeks more than the same time last year.

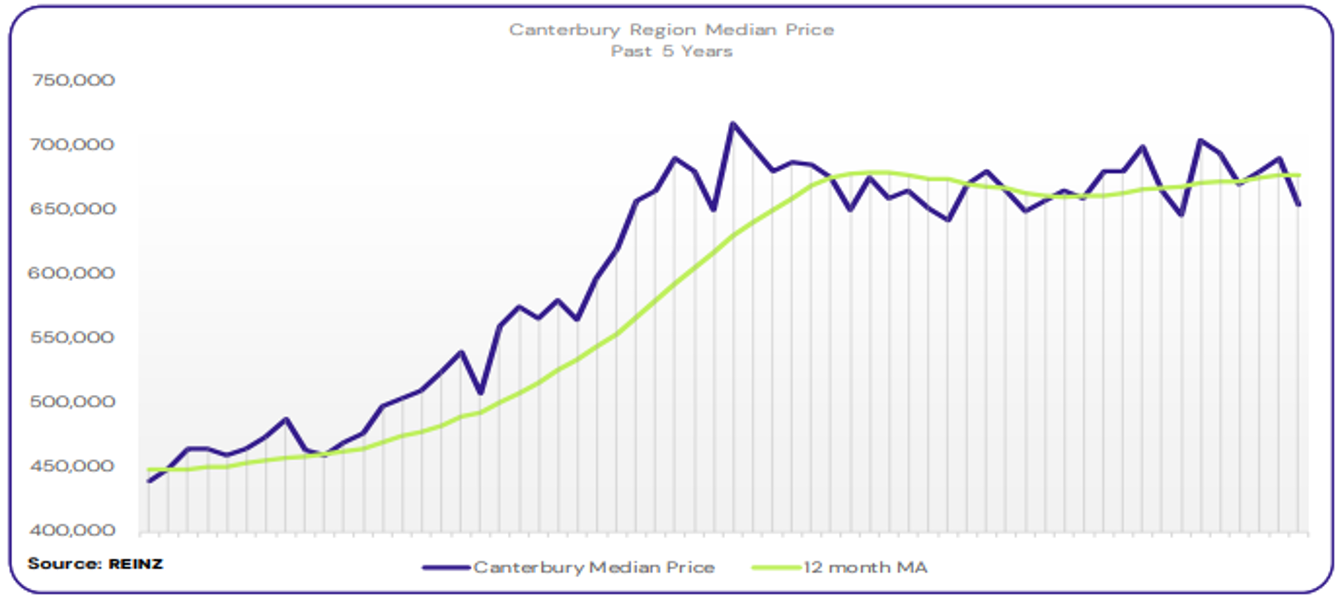

Regional Analysis - Canterbury

The median price for Canterbury decreased 1.7% year-on-year to $654,000.

“First home buyers and owner-occupiers were the most active buyer groups, although there were reports of fewer owner-occupiers transacting in Timaru. Vendors were accepting of current market expectations. Open home attendance was steady, with more attendees recorded for newer listings and lower-priced properties. Auction clearance rates were good, with multiple bidders at most auctions.

Factors such as media commentary on market sentiment, the mood shift around interest rates, the cost of living and the number of listings available influenced market sentiment. Local agents cautiously predict the remainder of the winter market will be steady and have a slightly more positive outlook as spring arrives. They are hopeful that an increase in listings will be brought to market in the coming months.” (REINZ).

The current median Days to Sell of 40 days is more than the 10-year average for July which is 36 days. There were 19 weeks of inventory in July 2024 which is 5 weeks more than the same time last year.

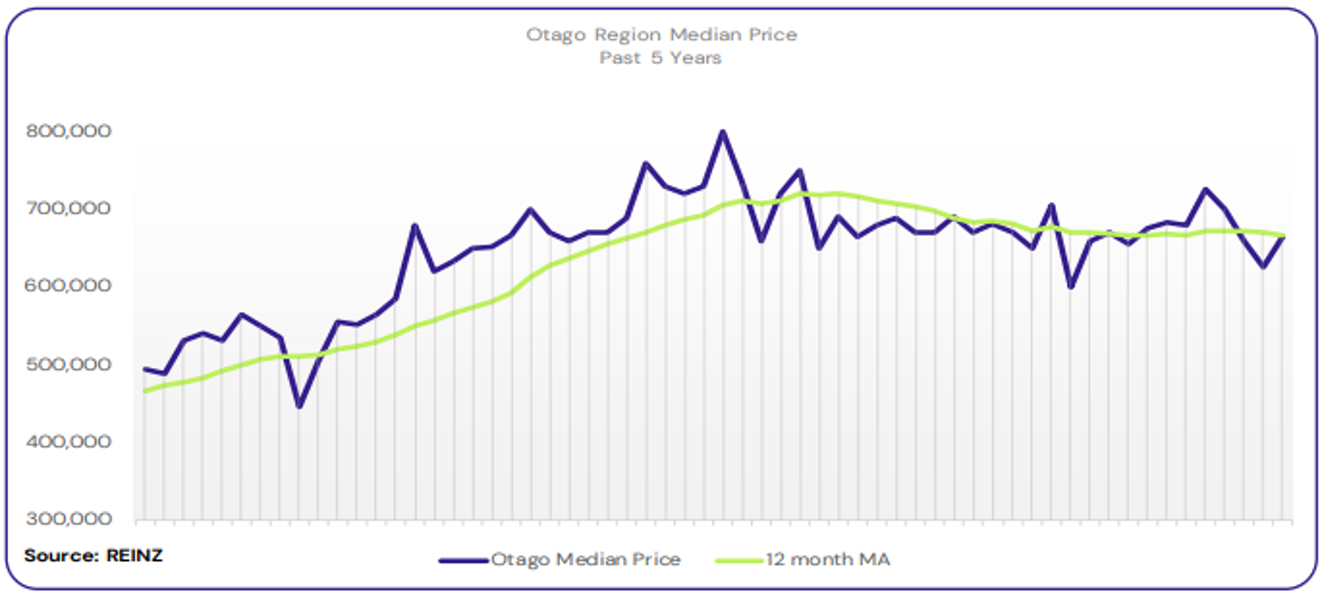

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price has decreased 8.7% year-on-year to $575,000.

Owner-occupiers were the most active buyer group, with those who required downsizing the most common. Local agents report that first home buyers and investors were held back from buying in July.

Vendor expectations exceeded the asking price, but they are willing to readjust and reduce when indicated. Open home attendance for new listings was good but decreased after week two. Some properties are sold by auction, but this is not the region’s most popular method of sale.

Factors such as interest rates and the cost of living influenced market sentiment. Local agents are predicting that spring will bring an increase in stock numbers. However, they state that this increase might be from those under financial pressure.”

Queenstown Lakes

“The most active buyer groups were first home buyers and investors, with reports of enquiries from Australia on the rise. While the buyer pool did not decline, enquiries in properties over $2.5m showed little activity. Vendors were optimistic with their expectations, still wanting more than market estimates, but once offers were received, they were prepared to listen. Attendance at open homes was steady.

Factors such as interest rates, increased stock levels, and the cost of living influenced market sentiment in July. Local agents are encouraged to keep their vendors and potential buyers well-informed and cautiously predict more activity and confidence in 2025.” (REINZ).

The current median Days to Sell of 47 days is more than the 10-year average for July which is 37 days. There were 21 weeks of inventory in July 2024 which is 5 weeks more than the same time last year.

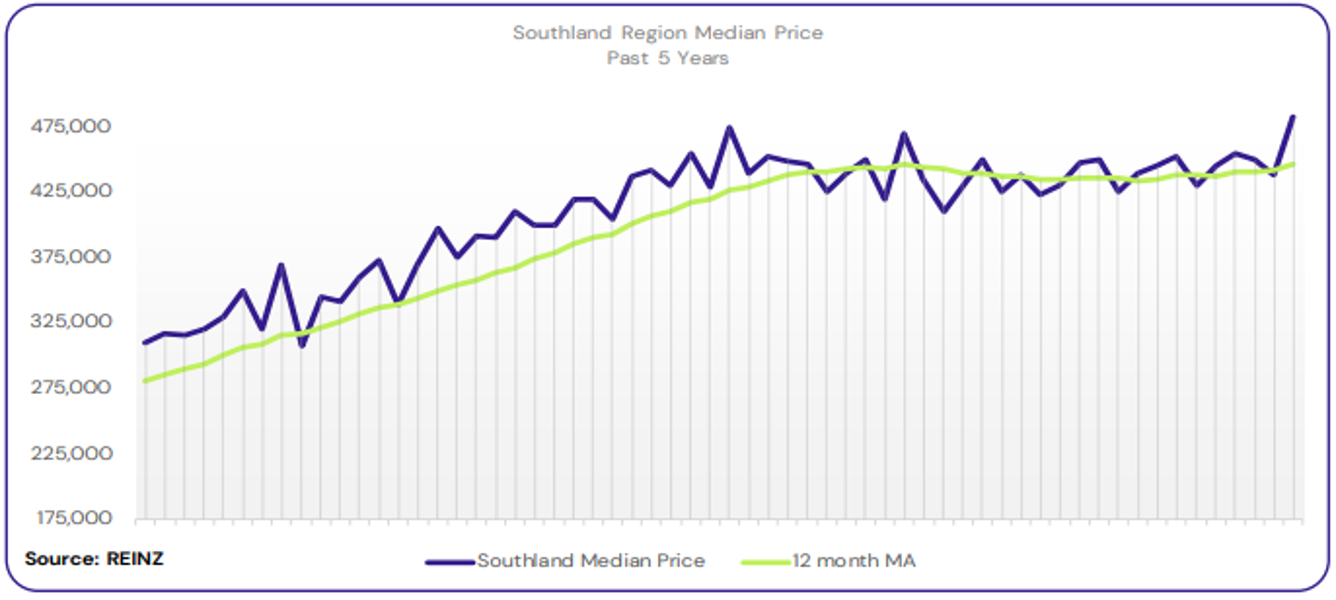

Regional Analysis - Southland

The median price for Southland increased 12.2% year-on-year to $482,500.

“First home buyers and property investors were Southland’s most active buyer group in July. Fewer buyers were viewing high-priced properties, which local salespeople suggest is because of school holidays and seasonal and economic factors. Vendors have been more accepting of the lower-priced offers.

Open home attendance has been good at the properties placed $550K and under. Properties selling by auction have increased, with good results under the hammer, particularly in the lifestyle market.

Current economic conditions, job uncertainty, interest rates, and a limited stock market have influenced market sentiment. Local agents cautiously predict improved activity and a change in interest rate outlook over the next few months. (REINZ).

The current median Days to Sell of 47 days is much more than the 10-year average for July which is 37 days. There were 26 weeks of inventory in July 2024 which is 10 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.